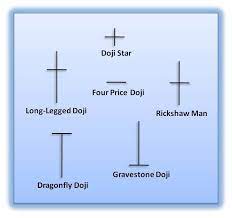

Doji Candle stick pattern;

Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Doji candle stick aik session ka naam hey jo keh security kay ley open or close candle stick say mel kar bante hey jo amle tor pr barabar hote hey or zyada tar pattern kay ajza hotay hein doji aik cross olte ya ya jama ka neshan hote hey akele doji aik khair janab dar pattern hey jo kai important pattern say mel kar banta hey

Doji candle stick os wakt bante hey jab security ka open or close mokara modat kay ley taqreban barabar hota hey or aam tor par technical analysis karon kay ley aik olat pattern ka signal dayta hey

types of doji candle stick;

Natural Doji;

yeh doji candle stick ke aik aam kesam hey jes mein trader buy ya sell taqreban aik jaise hote hey to yeh pattern hota hey trend ke mostakbel ghair yaqene jaisa keh es doji pattern say zahair hota hey

Long legged Doji;

jaisa keh naam say pata chalta hey keh long legged doji candle stick pattern hey jab demand or suply kay awamal tawazan par hotay hein to yeh pattern hota hey trend ke mostakbel ke semat ko pehlay kay trend or doji pattern say monazam kea jata hey

Gravestone Doji;

yeh pattern up trend meinakhar os wakt paya jata hey jab demand or supply kay awamal barabar hon day kay kam honay par candle stick open hote hey or close hote hey trend ko pehly kay trend kay sath monazam kea jata hey

Dragonfly doji;

yeh pattern down trend kay end mein paya jata hey jab demand or supply awamal tawazan mein hotay hein

Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Doji candle stick aik session ka naam hey jo keh security kay ley open or close candle stick say mel kar bante hey jo amle tor pr barabar hote hey or zyada tar pattern kay ajza hotay hein doji aik cross olte ya ya jama ka neshan hote hey akele doji aik khair janab dar pattern hey jo kai important pattern say mel kar banta hey

Doji candle stick os wakt bante hey jab security ka open or close mokara modat kay ley taqreban barabar hota hey or aam tor par technical analysis karon kay ley aik olat pattern ka signal dayta hey

types of doji candle stick;

Natural Doji;

yeh doji candle stick ke aik aam kesam hey jes mein trader buy ya sell taqreban aik jaise hote hey to yeh pattern hota hey trend ke mostakbel ghair yaqene jaisa keh es doji pattern say zahair hota hey

Long legged Doji;

jaisa keh naam say pata chalta hey keh long legged doji candle stick pattern hey jab demand or suply kay awamal tawazan par hotay hein to yeh pattern hota hey trend ke mostakbel ke semat ko pehlay kay trend or doji pattern say monazam kea jata hey

Gravestone Doji;

yeh pattern up trend meinakhar os wakt paya jata hey jab demand or supply kay awamal barabar hon day kay kam honay par candle stick open hote hey or close hote hey trend ko pehly kay trend kay sath monazam kea jata hey

Dragonfly doji;

yeh pattern down trend kay end mein paya jata hey jab demand or supply awamal tawazan mein hotay hein

تبصرہ

Расширенный режим Обычный режим