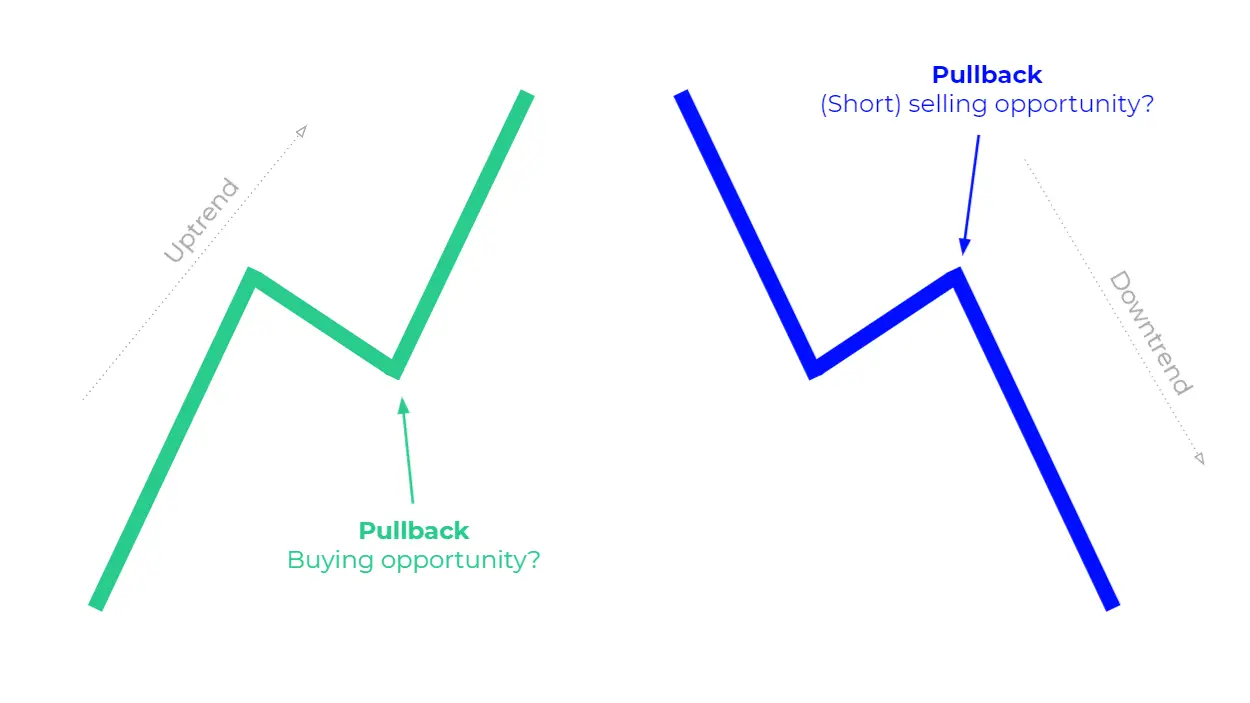

Jab stock market mein kisi stak ya commodity ki qeemat ruk jati hai ya simt ko revers karti hai to usay pull back kaha jata hai. yeh doosri soorat mein oopar ki taraf barhti hui asasa ki qeemat ka aik mukhtasir ulat hai. ulat pullat ke bar aks, jis ke nateejay mein qeemat mein ziyada dairpa kami waqay hoti hai, pull back aik mukhtasir muddat tak rehta hai .

Pull back traders kisi barray, oopar ki taraf rujhan ke tanazur mein is ki qeemat mein mukhtasir tor par kami ke baad kisi stak ya commodity ko kharidne ki koshish karte hain. tijarat karne ke liye, market ko do simtao mein se aik mein harkat karni chahiye : oopar ya neechay. tijarat ke rujhan ke baghair zawaal se munafe haasil karna namumkin hai .

How Does Pullback Trading Work?

Pull backs mukhtalif wajohaat ki binaa par ho sakta hai. murawaja brand aur market ke jazbaat ke nateejay mein, ziyada tar aykoytiz jin ki ost tareekh oopar ki taraf barhti hai qeemat mein kami dekhi jati hai. jab koi dhoka dahi ya posheeda dewalia pan ka inkishaaf hota hai, ya jab aamdani mein musalsal nuqsaan ki khabrain aam hojati hain, to bohat se sarmaya car is brand mein –apne hasas beech dete hain. nateejay ke tor par, brand ke stock ki qeemat gir jati hai. ashya ki market mein is terhan ke waqeat aam hain, khaas tor par sonay aur tail ki qeematon mein .

Stock market ka pull back kisi asasay ki aam tor par oopar ki taraf barhti hui qeemat mein aik lmhati kami hai. zehen mein rakho ke mukhtasir hona chahiye ؛ agar yeh theek honay ke baghair girta rahay to yeh ulat ho jata hai .

Kam kharidne aur ziyada farokht karne ke bunyadi tijarti maqsad ko haasil karne ke liye mandi faida mand hai. pull backs ko kamyabi se tijarat karne ke liye, aap ko pehlay stock ya commodity ko' ڈپ' ke douran khareedna hoga aur phir usay' bherne' ke douran farokht karna hoga. nateejay ke tor par, yahan tak ke mubtadi bhi aasani se pull back trading hikmat e amli bana satke hain aur is par amal daraamad kar satke hain .

Nateejay ke tor par, pull backs taajiron ko aykoyti kharidne ke mawaqay faraham karte hain jin ki qader mein ab bhi izafah ho raha hai. misaal ke tor par, agar koi tajir amazon ya apple ke hasas ko un ki barhti hui qeematon ki wajah se kharidne se qassar hai, to pull back trading qeemat mein kami ki bunyaad par kharidne ka aik munafe bakhash mauqa maloom ho sakti hai .

Writers ki yeh report is baat par roshni daalti hai ke kis terhan aalmi aykoyti marketon mein 2021 ke awail mein record buland rujhan ke baad kami dekhnay mein aayi kyunkay sarmaya karon ne take company ke stock ko khatam kar diya. mazeed bar-aan, yeh mutalea 10 sala trisri pedawar ki naqal o harkat ko wazeh karta hai, jis mein co ke nateejay mein wapsi hui

Recognizing Forex Pullbacks

Forex pull backs ki shanakht karne ke aasaan tareen tareeqon mein se aik trained lines par nazar rakhna hai. jab kisi currency ki qeemat lagataar teen baar chart par aik hi line ko uboor karti hai to aik trained line banti hai. woh forex trained lines ka aik na guzeer hissa hain .

Agar qeemat baar baar chart par aik hi line par lautade hai, to aik trained line hoti hai. aur woh market mein daakhil honay ke liye un qeematon mein kami ka faida utha satke hain, is yaqeen ke sath ke qeematein aakhir kaar dobarah barheen gi .

Is tijarti hikmat e amli ka sab se bara nuqsaan mandi ke gayab honay ka imkaan hai. dosray lafzon mein, aik noaamoz ya impulse tridr stock ko farokht kar sakta hai is se pehlay ke woh –apne oopar ki taraf rujhan ko dobarah shuru kere. inhen aisay waqeat mein paisay khonay ke khatray ka saamna karna parta hai .

Is qisam ki tijarat ke liye do bunyadi tknikin hain : jarehana aur qadamat pasand. jarehana hikmat e amli is waqt tijarat mein daakhil hoti hai jab qeemat kami ke ilaqay mein wapas ajati hai. aam tor par, yeh nuqta islahi lehar ke ekhtataam ko zahir karta hai. nateejay ke tor par, is hikmat e amli mein behtareen inaam / khatray ka tanasub hoga. yeh aik tajir ko is qabil banata hai ke woh market mein sab se ziyada faida mand qeemat par daakhil ho sakay .

Doosri taraf, mohtaat tareeqa market mein sirf is waqt shaamil hota hai jab stock ya ijnaas ki qeemat –apne rujhan ko barqarar rakhti hai aur aik nai nichli satah par pahonch jati hai. qadamat pasand tajir market ki raftaar ki pairwi karta hai. nateejay ke tor par, is taknik ka mumkina khatrah / inaam ka tanasub kam hai .

Reversal vs. Pullback

Pehli nazar mein, dono aik chart par aik jaisay dikhayi day satke hain. taham, dono ke darmiyan kaafi farq hai. ulat jana kisi asasay ke majmoi rujhan mein tabdeeli hai. nateejay ke tor par, agar stock ki qeemat pehlay oopar ki taraf barh rahi thi, to aik ulat pullat aik naye neechay ke rujhan ke aaghaz ki tajweez kere ga. aik pull back, jaisa ke pehlay kaha gaya hai, mehez aik barray rujhan ka aik earzi ulat hai. nateejay ke tor par, woh earzi hain, jabkay ulat mustaqil hain .

har tajir ka maqsad pull backs ko pehchanana hai jo behtar entry points faraham karte hain. taham, inhen rujhan ke ulat phair mein phansnay se bachna chahiye. sayaq o Sabaq aur qeemat ki karwai do bunyadi isharay hain jo pull back se ulat jane mein farq karne mein madad kar satke hain. qeemat ki harkat ko samajhney ke liye, aik tajir ko pehlay yeh faisla karna chahiye ke aaya mojooda asasa ki qadren rujhan ke aaghaz, darmiyani ya ekhtataam ki numaindagi karti hain .

kisi ke paas market ke baray mein aik taweel mudti nazriya hona chahiye, is baat ka taayun karte hue ke kisi rujhan ke aaghaz mein kya sun-hwa aur yeh kahan ja raha hai. yeh kisi ko market mein honay wali ahem paish ki passion goi karne ke qabil banata hai jis ke nateejay mein jari rujhan ko tabdeel kya ja sakta hai

Pull back traders kisi barray, oopar ki taraf rujhan ke tanazur mein is ki qeemat mein mukhtasir tor par kami ke baad kisi stak ya commodity ko kharidne ki koshish karte hain. tijarat karne ke liye, market ko do simtao mein se aik mein harkat karni chahiye : oopar ya neechay. tijarat ke rujhan ke baghair zawaal se munafe haasil karna namumkin hai .

How Does Pullback Trading Work?

Pull backs mukhtalif wajohaat ki binaa par ho sakta hai. murawaja brand aur market ke jazbaat ke nateejay mein, ziyada tar aykoytiz jin ki ost tareekh oopar ki taraf barhti hai qeemat mein kami dekhi jati hai. jab koi dhoka dahi ya posheeda dewalia pan ka inkishaaf hota hai, ya jab aamdani mein musalsal nuqsaan ki khabrain aam hojati hain, to bohat se sarmaya car is brand mein –apne hasas beech dete hain. nateejay ke tor par, brand ke stock ki qeemat gir jati hai. ashya ki market mein is terhan ke waqeat aam hain, khaas tor par sonay aur tail ki qeematon mein .

Stock market ka pull back kisi asasay ki aam tor par oopar ki taraf barhti hui qeemat mein aik lmhati kami hai. zehen mein rakho ke mukhtasir hona chahiye ؛ agar yeh theek honay ke baghair girta rahay to yeh ulat ho jata hai .

Kam kharidne aur ziyada farokht karne ke bunyadi tijarti maqsad ko haasil karne ke liye mandi faida mand hai. pull backs ko kamyabi se tijarat karne ke liye, aap ko pehlay stock ya commodity ko' ڈپ' ke douran khareedna hoga aur phir usay' bherne' ke douran farokht karna hoga. nateejay ke tor par, yahan tak ke mubtadi bhi aasani se pull back trading hikmat e amli bana satke hain aur is par amal daraamad kar satke hain .

Nateejay ke tor par, pull backs taajiron ko aykoyti kharidne ke mawaqay faraham karte hain jin ki qader mein ab bhi izafah ho raha hai. misaal ke tor par, agar koi tajir amazon ya apple ke hasas ko un ki barhti hui qeematon ki wajah se kharidne se qassar hai, to pull back trading qeemat mein kami ki bunyaad par kharidne ka aik munafe bakhash mauqa maloom ho sakti hai .

Writers ki yeh report is baat par roshni daalti hai ke kis terhan aalmi aykoyti marketon mein 2021 ke awail mein record buland rujhan ke baad kami dekhnay mein aayi kyunkay sarmaya karon ne take company ke stock ko khatam kar diya. mazeed bar-aan, yeh mutalea 10 sala trisri pedawar ki naqal o harkat ko wazeh karta hai, jis mein co ke nateejay mein wapsi hui

Recognizing Forex Pullbacks

Forex pull backs ki shanakht karne ke aasaan tareen tareeqon mein se aik trained lines par nazar rakhna hai. jab kisi currency ki qeemat lagataar teen baar chart par aik hi line ko uboor karti hai to aik trained line banti hai. woh forex trained lines ka aik na guzeer hissa hain .

Agar qeemat baar baar chart par aik hi line par lautade hai, to aik trained line hoti hai. aur woh market mein daakhil honay ke liye un qeematon mein kami ka faida utha satke hain, is yaqeen ke sath ke qeematein aakhir kaar dobarah barheen gi .

Is tijarti hikmat e amli ka sab se bara nuqsaan mandi ke gayab honay ka imkaan hai. dosray lafzon mein, aik noaamoz ya impulse tridr stock ko farokht kar sakta hai is se pehlay ke woh –apne oopar ki taraf rujhan ko dobarah shuru kere. inhen aisay waqeat mein paisay khonay ke khatray ka saamna karna parta hai .

Is qisam ki tijarat ke liye do bunyadi tknikin hain : jarehana aur qadamat pasand. jarehana hikmat e amli is waqt tijarat mein daakhil hoti hai jab qeemat kami ke ilaqay mein wapas ajati hai. aam tor par, yeh nuqta islahi lehar ke ekhtataam ko zahir karta hai. nateejay ke tor par, is hikmat e amli mein behtareen inaam / khatray ka tanasub hoga. yeh aik tajir ko is qabil banata hai ke woh market mein sab se ziyada faida mand qeemat par daakhil ho sakay .

Doosri taraf, mohtaat tareeqa market mein sirf is waqt shaamil hota hai jab stock ya ijnaas ki qeemat –apne rujhan ko barqarar rakhti hai aur aik nai nichli satah par pahonch jati hai. qadamat pasand tajir market ki raftaar ki pairwi karta hai. nateejay ke tor par, is taknik ka mumkina khatrah / inaam ka tanasub kam hai .

Reversal vs. Pullback

Pehli nazar mein, dono aik chart par aik jaisay dikhayi day satke hain. taham, dono ke darmiyan kaafi farq hai. ulat jana kisi asasay ke majmoi rujhan mein tabdeeli hai. nateejay ke tor par, agar stock ki qeemat pehlay oopar ki taraf barh rahi thi, to aik ulat pullat aik naye neechay ke rujhan ke aaghaz ki tajweez kere ga. aik pull back, jaisa ke pehlay kaha gaya hai, mehez aik barray rujhan ka aik earzi ulat hai. nateejay ke tor par, woh earzi hain, jabkay ulat mustaqil hain .

har tajir ka maqsad pull backs ko pehchanana hai jo behtar entry points faraham karte hain. taham, inhen rujhan ke ulat phair mein phansnay se bachna chahiye. sayaq o Sabaq aur qeemat ki karwai do bunyadi isharay hain jo pull back se ulat jane mein farq karne mein madad kar satke hain. qeemat ki harkat ko samajhney ke liye, aik tajir ko pehlay yeh faisla karna chahiye ke aaya mojooda asasa ki qadren rujhan ke aaghaz, darmiyani ya ekhtataam ki numaindagi karti hain .

kisi ke paas market ke baray mein aik taweel mudti nazriya hona chahiye, is baat ka taayun karte hue ke kisi rujhan ke aaghaz mein kya sun-hwa aur yeh kahan ja raha hai. yeh kisi ko market mein honay wali ahem paish ki passion goi karne ke qabil banata hai jis ke nateejay mein jari rujhan ko tabdeel kya ja sakta hai

Pullback ka ek tareeqa hai trendline analysis. Trendlines ko draw karke traders trend ke direction ko identify karte hain. Jab price trendline se thori der ke liye bahar nikalta hai aur phir wapas andar aata hai, tab traders ko pullback ka signal milta hai. Trendline pullback trading strategy mein traders trendline ke near buy ya sell karte hain aur price wapas trend ke saath move karte hue unko profit milta hai. Dusri technique Fibonacci retracements ka istemal karna hai. Fibonacci levels ek series hain jinhe traders price retracement ke liye use karte hain. Pullback mein traders Fibonacci retracement tool ka istemal karke recent trend ke high aur low points ke beech price ka retracement level calculate karte hain. Fibonacci levels 23.6%, 38.2%, 50%, 61.8% aur 78.6% hote hain. Jab price kisi Fibonacci level par reverse karta hai aur trend ke saath move karta hai, tab traders ko pullback trading opportunities milte hain. Pullback trading strategy mein risk management ka mahatva hai. Traders stop-loss orders ka istemal karke apne trades ko protect karte hain. Stop-loss level woh price level hota hai jahan traders trade ko exit karne ke liye set karte hain agar price unki expectations ke against move karta hai. Risk-reward ratio bhi important hota hai jahan traders profit target aur stop-loss level ke beech balance rakhte hain.

Pullback ka ek tareeqa hai trendline analysis. Trendlines ko draw karke traders trend ke direction ko identify karte hain. Jab price trendline se thori der ke liye bahar nikalta hai aur phir wapas andar aata hai, tab traders ko pullback ka signal milta hai. Trendline pullback trading strategy mein traders trendline ke near buy ya sell karte hain aur price wapas trend ke saath move karte hue unko profit milta hai. Dusri technique Fibonacci retracements ka istemal karna hai. Fibonacci levels ek series hain jinhe traders price retracement ke liye use karte hain. Pullback mein traders Fibonacci retracement tool ka istemal karke recent trend ke high aur low points ke beech price ka retracement level calculate karte hain. Fibonacci levels 23.6%, 38.2%, 50%, 61.8% aur 78.6% hote hain. Jab price kisi Fibonacci level par reverse karta hai aur trend ke saath move karta hai, tab traders ko pullback trading opportunities milte hain. Pullback trading strategy mein risk management ka mahatva hai. Traders stop-loss orders ka istemal karke apne trades ko protect karte hain. Stop-loss level woh price level hota hai jahan traders trade ko exit karne ke liye set karte hain agar price unki expectations ke against move karta hai. Risk-reward ratio bhi important hota hai jahan traders profit target aur stop-loss level ke beech balance rakhte hain.  Pullback trading ka ek main faida ye hai ke traders ko better entry points milte hain. Trend ke saath trade karte waqt pullback ki wajah se traders ko trend direction mein entry karne ka mouqa milta hai. Isse unko potential higher profits aur lower risk hota hai. Lekin pullback trading mein ek challenge bhi hota hai, aur wo hai false pullbacks ya fake-outs. Jab price temporary retracement karta hai, lekin phir wapas trend ke against move karta hai, tab ye false pullback consider kiya jata hai. Isliye traders ko pullback confirmation ke liye aur additional technical analysis ke liye trade entries par dhyan dena chahiye. Pullback trading strategy mein patience aur discipline bahut zaruri hai. Traders ko trend direction ke saath move karne ke liye pullback ka wait karna hota hai. Pullbacks market volatility aur price fluctuations ke karan hote hain, isliye traders ko apne trading plan par focus rakhna chahiye aur emotional decisions se bache rehna chahiye.

Pullback trading ka ek main faida ye hai ke traders ko better entry points milte hain. Trend ke saath trade karte waqt pullback ki wajah se traders ko trend direction mein entry karne ka mouqa milta hai. Isse unko potential higher profits aur lower risk hota hai. Lekin pullback trading mein ek challenge bhi hota hai, aur wo hai false pullbacks ya fake-outs. Jab price temporary retracement karta hai, lekin phir wapas trend ke against move karta hai, tab ye false pullback consider kiya jata hai. Isliye traders ko pullback confirmation ke liye aur additional technical analysis ke liye trade entries par dhyan dena chahiye. Pullback trading strategy mein patience aur discipline bahut zaruri hai. Traders ko trend direction ke saath move karne ke liye pullback ka wait karna hota hai. Pullbacks market volatility aur price fluctuations ke karan hote hain, isliye traders ko apne trading plan par focus rakhna chahiye aur emotional decisions se bache rehna chahiye.

تبصرہ

Расширенный режим Обычный режим