Oscillator as Trading Indicator:-

Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Agar ham forex market main trading ky liay achy indicators ko use kerna chahty hain tou stochastic oscillator bahot hi acha forex trading indicator hai jis ko agar ham continue folllow kerty huey apni trading kerty hain tou hamain maximum trades main profit hasil hota hai jab ky agar hamain loss hona shoru hota hai tou same time per stochastic oscillator ki movement ki direction bhi change hona shoru ho jati hai aur ham bary loss sy bach sakty hain ky agar ham kisi aik direction main stochastic oscillator ki direction ky mutabiq trade open kerty hain lekin kuch time ky bad hi oscillator apni direction ko change kerna shoru ker deta hai to hamain bhi apni trade close ker ky new movement direction ky mutabiq trade open ker leni chahiay is wajah se k bahot jald hamara previos loss recover bhi ho jata hai aur hamain profit bhi hasil hona shoru ho jata hai.

Slow stochastic entry signal:-

jab stochastic line cross hote hein to raftar momentum hote hey aik trader os trend ka signal layta hey jab blue line red line ko cross kar jate hey short term trend ka pata stochastic nay lagya tahum trader signal ko behtar bananay kay tareekay tallash kartay rehtay hein takeh onhen strong banya ja sakay.

Which indicator is best for intraday trading?

Best Intraday indicators are:-

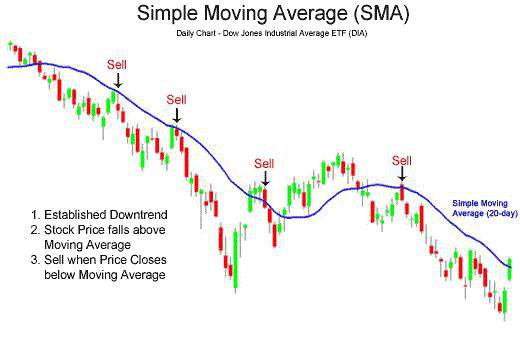

1. Moving Average ko intraday trading kelye frequently use kay jata hay.

2. Bollinger Bands ko market men volatility ki neshan dahi karnay kelye use kia jata hay.

3. Commodity Channel Index.

4. Stochastic Oscillator.

Dear friends agar mazkora indicator ko achi tara say samjh lia jaye to umeed hay kay forex say acha munfa earn kia ja sakta hay ais lye hamen fully knowledge hasil kar kay trade karni chaye.

Stochastic Oscillator ki setting:-

Agar ham stochastic oscillator ki default setting ky mutabiq isko follow kerna shoru ker dety hain tou is sy hamain market ko samajhny main kuch mushkil ho sakti hai kyun ky jo ranges hamain default setting main milti hain unky mutabiq market bahot kam hi retracement leti hai lekin agar ham oscillator ki setting minimum risk ko set ker ky ker lety hain jesy ky agar ham iski setting ko 90 and 10 per set ker dety hain tou wahan per jab market ponch jati hai tou bahot zyada chances hoty hain ky market retracement leti hai ham same time per reverse order main trade open ker lety hain tou hamain profit hasil ho sakta hai kyun ky is range sy market further movement bahot hi kam kerti hai lekin so hamain default setting ki bajaey apni minimum risk ky mutabiq setting ker ky trade open and continue kerni chahiay.is se hame bahut faida hota hai aur hame acha profit milta hai aur bahut km loss hota hai.

Stochastic Divergence:-

Jab market stochastic ky mutabiq apni maximum ranges ko touch kerny sy pehly diverge hoti hai tou aesi divergence per trade open kerna risky hota hai lekin jab market maximum ranges ko cross kerny ky bahd jab divergence leti hai tou aesy time per bahot zyada chances hoty hain ky hamari open ki jany wali trade main hamain loss nehi hota aesa possible hai ky kuch time ky liay hamari open trade main hamain profit na ho kyun ky market kabhi kabhi maximum ranges per ja ker stay kerti hai aesy time per hamain divergence ka wait kerna chahiay ky jab market divergence leti hai tou hamain phi apni trade enter ker leni chahiay ta k hame iska acha faida mil saky aur hum bahut zyada kamyab hojaye thanks.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Agar ham forex market main trading ky liay achy indicators ko use kerna chahty hain tou stochastic oscillator bahot hi acha forex trading indicator hai jis ko agar ham continue folllow kerty huey apni trading kerty hain tou hamain maximum trades main profit hasil hota hai jab ky agar hamain loss hona shoru hota hai tou same time per stochastic oscillator ki movement ki direction bhi change hona shoru ho jati hai aur ham bary loss sy bach sakty hain ky agar ham kisi aik direction main stochastic oscillator ki direction ky mutabiq trade open kerty hain lekin kuch time ky bad hi oscillator apni direction ko change kerna shoru ker deta hai to hamain bhi apni trade close ker ky new movement direction ky mutabiq trade open ker leni chahiay is wajah se k bahot jald hamara previos loss recover bhi ho jata hai aur hamain profit bhi hasil hona shoru ho jata hai.

Slow stochastic entry signal:-

jab stochastic line cross hote hein to raftar momentum hote hey aik trader os trend ka signal layta hey jab blue line red line ko cross kar jate hey short term trend ka pata stochastic nay lagya tahum trader signal ko behtar bananay kay tareekay tallash kartay rehtay hein takeh onhen strong banya ja sakay.

Which indicator is best for intraday trading?

Best Intraday indicators are:-

1. Moving Average ko intraday trading kelye frequently use kay jata hay.

2. Bollinger Bands ko market men volatility ki neshan dahi karnay kelye use kia jata hay.

3. Commodity Channel Index.

4. Stochastic Oscillator.

Dear friends agar mazkora indicator ko achi tara say samjh lia jaye to umeed hay kay forex say acha munfa earn kia ja sakta hay ais lye hamen fully knowledge hasil kar kay trade karni chaye.

Stochastic Oscillator ki setting:-

Agar ham stochastic oscillator ki default setting ky mutabiq isko follow kerna shoru ker dety hain tou is sy hamain market ko samajhny main kuch mushkil ho sakti hai kyun ky jo ranges hamain default setting main milti hain unky mutabiq market bahot kam hi retracement leti hai lekin agar ham oscillator ki setting minimum risk ko set ker ky ker lety hain jesy ky agar ham iski setting ko 90 and 10 per set ker dety hain tou wahan per jab market ponch jati hai tou bahot zyada chances hoty hain ky market retracement leti hai ham same time per reverse order main trade open ker lety hain tou hamain profit hasil ho sakta hai kyun ky is range sy market further movement bahot hi kam kerti hai lekin so hamain default setting ki bajaey apni minimum risk ky mutabiq setting ker ky trade open and continue kerni chahiay.is se hame bahut faida hota hai aur hame acha profit milta hai aur bahut km loss hota hai.

Stochastic Divergence:-

Jab market stochastic ky mutabiq apni maximum ranges ko touch kerny sy pehly diverge hoti hai tou aesi divergence per trade open kerna risky hota hai lekin jab market maximum ranges ko cross kerny ky bahd jab divergence leti hai tou aesy time per bahot zyada chances hoty hain ky hamari open ki jany wali trade main hamain loss nehi hota aesa possible hai ky kuch time ky liay hamari open trade main hamain profit na ho kyun ky market kabhi kabhi maximum ranges per ja ker stay kerti hai aesy time per hamain divergence ka wait kerna chahiay ky jab market divergence leti hai tou hamain phi apni trade enter ker leni chahiay ta k hame iska acha faida mil saky aur hum bahut zyada kamyab hojaye thanks.

تبصرہ

Расширенный режим Обычный режим