What is bullish candle stick pattern;

Aslam u alaikum,

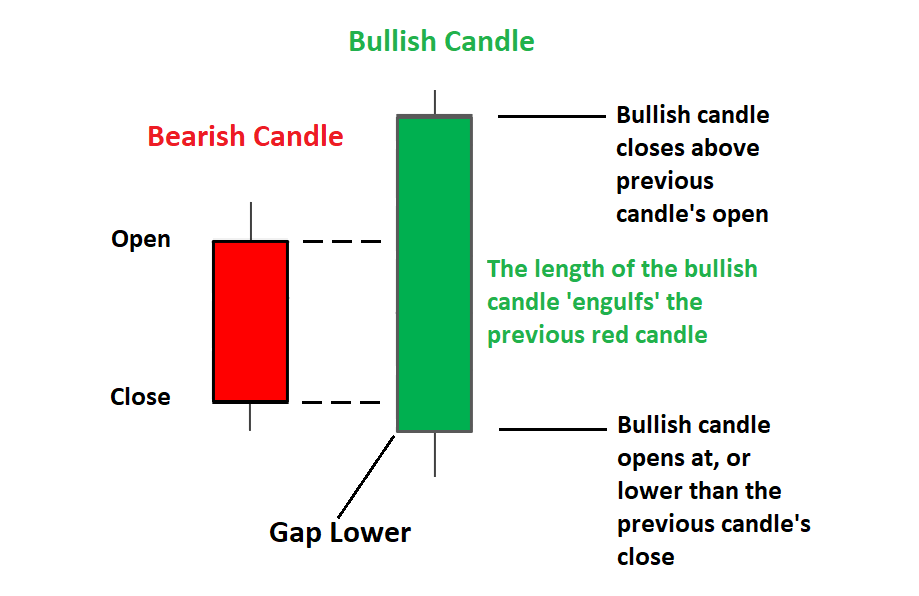

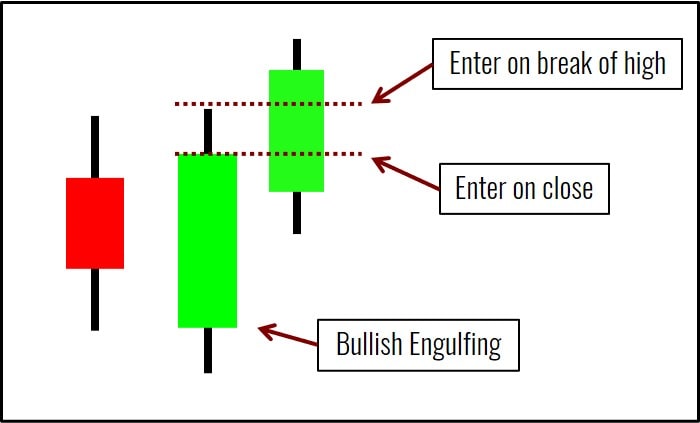

Dear forex member umeed karta hun aap sab khairiyat se honge dear members bullish candle stick pattern trader ko inform karta hey keh price mein kame kay bad ezafay ka trend banta hey yeh reversal pattern ka eshara dayta hey keh bulls market par over aa rahay hein or yahan tak keh prices ko mazeed barha rahay hein long position ko open karnay kay bad neshan zad kartay hein

bullish market pattern 2 mokhtalef candle stick mein say aik hey jesay ap strategies ka estamal kar kay dosray stocks or dosray pairs par estamal kar saktay hein technical analysis kar hum bullish candle stick sahe idea laga saktay hein

understanding bullish candle stick pattern;Stock market trader kay darmeyan aik larai hey jo long position khol kar ya apnay asasay buy kar kay bears apnay asserts ko sell kartay hein market movement ko navigate karnay kay ley ap ko yeh jananay ke zaroorat hey keh es wakt kes ke bala daste hey jab trader trading decision lay rahay hon to ap bullish market low honay par bhe ni choren gay to ap ko bohut bore tarah market mein phans saktay hein

Trader bullish market ko identify kar kay apnay technical analysis eham hesa bananay kay ley bullish candle stick par focus kar saktay trading en pattern ka estamal aam tor par en forex strategies ka estamal kea jata hey takeh yeh fore indicate kar saken keh market asal condition kea hey ya asal movement kahan pe hey

Technical analysis strategy;

Bullish candle stick pattern technical analysis ka aik important part hey woh aam tor par volume ko indicate karnay kay ley estamal kea jata hey jaisay RSI hey jo keh aik trend ke rakat ko indicate karta hey aik bullish pattern trader ko yeh indicate kar sakta hey keh last price mein kame kay doran market mein ezafay ka trend start honay walla hey

har roz ke daily ke candle stick price kay adad o shomar ko indicate karte hey or es mein opening price ya closing price zyada hey aik he formula har time frame chart par lago hota hey jaisa keh ap ko pata ho ga trader 1 minut kay chart say lay kar monthly candle stick kay chart ko estamal kar sakta hey bullish candle stick pattern mazeed confirm technical analysis say he confirm kar saktay hein

Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members bullish candle stick pattern trader ko inform karta hey keh price mein kame kay bad ezafay ka trend banta hey yeh reversal pattern ka eshara dayta hey keh bulls market par over aa rahay hein or yahan tak keh prices ko mazeed barha rahay hein long position ko open karnay kay bad neshan zad kartay hein

bullish market pattern 2 mokhtalef candle stick mein say aik hey jesay ap strategies ka estamal kar kay dosray stocks or dosray pairs par estamal kar saktay hein technical analysis kar hum bullish candle stick sahe idea laga saktay hein

understanding bullish candle stick pattern;Stock market trader kay darmeyan aik larai hey jo long position khol kar ya apnay asasay buy kar kay bears apnay asserts ko sell kartay hein market movement ko navigate karnay kay ley ap ko yeh jananay ke zaroorat hey keh es wakt kes ke bala daste hey jab trader trading decision lay rahay hon to ap bullish market low honay par bhe ni choren gay to ap ko bohut bore tarah market mein phans saktay hein

Trader bullish market ko identify kar kay apnay technical analysis eham hesa bananay kay ley bullish candle stick par focus kar saktay trading en pattern ka estamal aam tor par en forex strategies ka estamal kea jata hey takeh yeh fore indicate kar saken keh market asal condition kea hey ya asal movement kahan pe hey

Technical analysis strategy;

Bullish candle stick pattern technical analysis ka aik important part hey woh aam tor par volume ko indicate karnay kay ley estamal kea jata hey jaisay RSI hey jo keh aik trend ke rakat ko indicate karta hey aik bullish pattern trader ko yeh indicate kar sakta hey keh last price mein kame kay doran market mein ezafay ka trend start honay walla hey

har roz ke daily ke candle stick price kay adad o shomar ko indicate karte hey or es mein opening price ya closing price zyada hey aik he formula har time frame chart par lago hota hey jaisa keh ap ko pata ho ga trader 1 minut kay chart say lay kar monthly candle stick kay chart ko estamal kar sakta hey bullish candle stick pattern mazeed confirm technical analysis say he confirm kar saktay hein

تبصرہ

Расширенный режим Обычный режим