Dear members, Forex trading market main trade lagany say pehly Kisi bi pair ka volume spread analysis krna zarori hota hai. Qk Jis pair ka spread zayda hota hai to os main jab ap trade krty hain to ap ki trade zayda loss me open hoti hai. Aj ki hamri post, main ap is volume spread analysis ki complete information share krna chata hoon.

Introduction of Volume Spread Analysis:

Dear forum members, Forex trading market main Jab ap market ka equilibrium daikhny ki koshish krty hain, to is main sab say famous technique ko Volume spread Analysis kaha jata hai. Dear forum members, ager ap market mein volume spread analysis karna chahte hain, tu is main ap ko below mentioned point ko focus krna chaiy qk yah bahut hi important role play krty Hain.

Bulls Pressure in Forex trading market:

Jab ap Forex trading market main momentum find out krna chaty hain, tu is main aapko bulls pressure bahut zyda help provide krta hai, kunk jab ap ko market mein buyers pressure zyda milta hai, tu Market ka volume spread analysis find out karna aasan hota hai. Asi condition main prices upward movement krti hain.

Sellers Pressure in Forex trading market:

Forex trading market me jab sellers pressure zyda hota hai, us time market k downtrend me jany k chances hoty hain. Asi condition me aap market ka volume spread easily find kr sakhty Hain. Market Kay equilibrium or volume ko find out kar Kay decision making process complete krna aasan ho sakhta hai.

Importance:

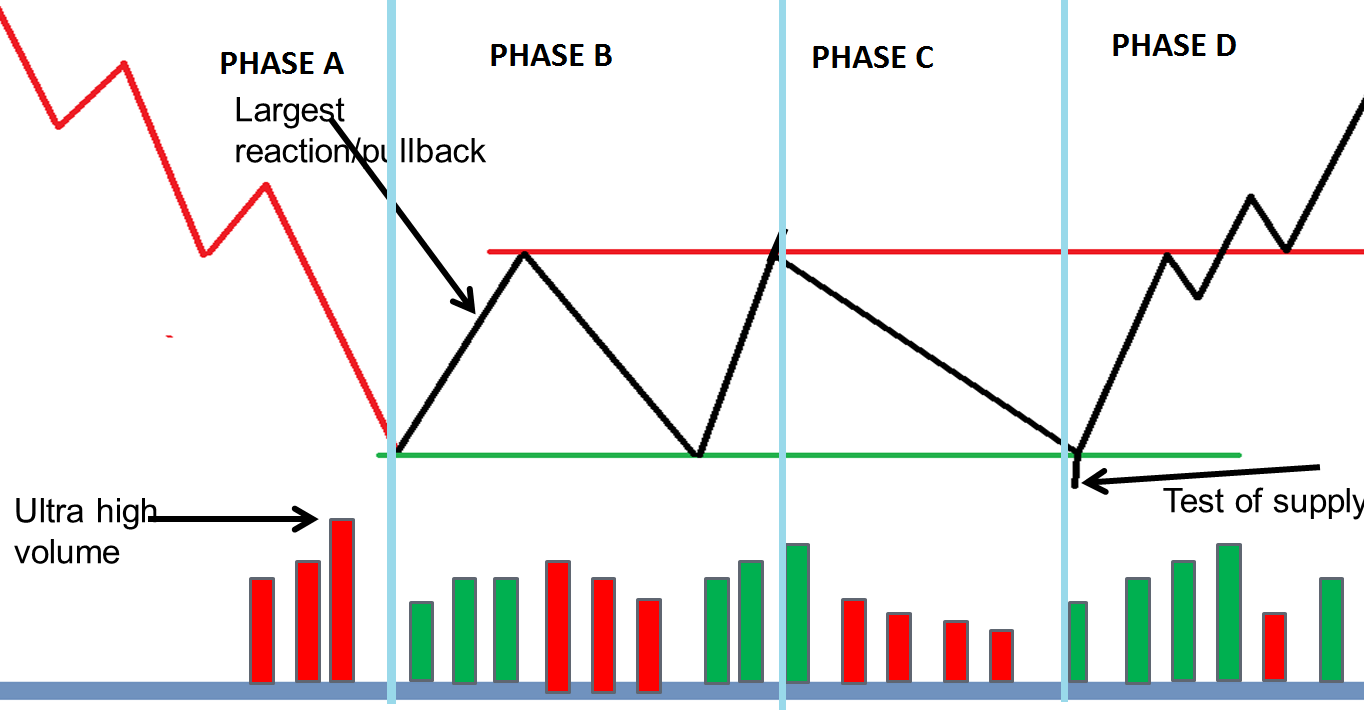

Forex trading market mein trade lagany say pehly volume spread ko analyse krna bahut jyada zarori hai, kunk jab aap market ka momentum find out karna chahty Hain, or market Kay next swing sa related apni learning ko increase karna chahte hain, tu ismien aapko definitely maximum advantages available ho sakte hain. Volume spread analysis, market me demand aur supply ko show krta hai.

Introduction of Volume Spread Analysis:

Dear forum members, Forex trading market main Jab ap market ka equilibrium daikhny ki koshish krty hain, to is main sab say famous technique ko Volume spread Analysis kaha jata hai. Dear forum members, ager ap market mein volume spread analysis karna chahte hain, tu is main ap ko below mentioned point ko focus krna chaiy qk yah bahut hi important role play krty Hain.

Bulls Pressure in Forex trading market:

Jab ap Forex trading market main momentum find out krna chaty hain, tu is main aapko bulls pressure bahut zyda help provide krta hai, kunk jab ap ko market mein buyers pressure zyda milta hai, tu Market ka volume spread analysis find out karna aasan hota hai. Asi condition main prices upward movement krti hain.

Sellers Pressure in Forex trading market:

Forex trading market me jab sellers pressure zyda hota hai, us time market k downtrend me jany k chances hoty hain. Asi condition me aap market ka volume spread easily find kr sakhty Hain. Market Kay equilibrium or volume ko find out kar Kay decision making process complete krna aasan ho sakhta hai.

Importance:

Forex trading market mein trade lagany say pehly volume spread ko analyse krna bahut jyada zarori hai, kunk jab aap market ka momentum find out karna chahty Hain, or market Kay next swing sa related apni learning ko increase karna chahte hain, tu ismien aapko definitely maximum advantages available ho sakte hain. Volume spread analysis, market me demand aur supply ko show krta hai.

تبصرہ

Расширенный режим Обычный режим