Assalamu Alaikum!

dear senior and junior members agar aap Forex trading market mein technical analysis ki base per trade karte hain to ismein aapko bahut achcha munafa mil sakta hai aur aap ek acchi trading position mein a sakte hain iske liye aapko market mein available multiple candlesticks aur candlestick pattern ko acchi tarah study karna hota hai kyunki Jab aap Kisi candle stick pattern ko acchi tarah study kar lete hain aur usko apni decision making per apply karte hain to aapko ismein bahut achcha munafa mil sakta hai aaj main aapko ek bahut hi important aur familiar candle stick pattern jisko aap bullish kickar candle stick pattern ke naam se jante Hain uski tafseel batane ja raha hun.

Bullish Kicker Candlestick

Jab aap market mein candlestick pattern ko focus kar rahe hote hain aur daily basis per apne analysis complete kar rahe hote hain to aapko is candlestick pattern ko acchi tarah samajhna hota hai basically Jab aap market mein ek aisi situation dekhte hain ki Jab market mein bearish trend valid hota hai aur last candlestick bear is close hoti hai lekin Jab market open hoti hai to usmein aapko use candlestick mein gap ke sath opening milati hai to isko aap bullish kickar candlest pattern ke naam se jante Hain.

Recognition

Dear jab Forex trading market mein prices bottom level par hoti hai aur aisi condition mein Jab last candlestick ki closing full bear is trend mein hoti hai lekin Jab market open hoti hai to market last candle ko completely cover karke aur upar se open hoti hai aur last candle ka completely gap hota hai to is candlestick pattern ko aap market mein easily identify aur recognize kar sakte hain.

Gear Changing Pattern

Already main aapko jo details Bata chuka hun usmein aapko clearli yah idea Mil jata hai ki is candle stick pattern ke bad market mein totally unexpected movement hoti hai aur totally reversal trend maintain ho jata hai is candlestick pattern ko aap market mein gear changing candlestick pattern ke naam se bhi jante Hain kyunki iske bad market mein totally movement hi change Ho jaati hai.

Stop Loss Calculation

Risk management ke rules and regulations ke mutabik apni working karna aapke liye most important factor hota hai kyunki jab tak aap risk management ke rules and regulations ke mutabik apni working nahin karenge to aap kabhi bhi successful trading nahin kar sakte isliye aapko hamesha trade entry lete hue uski condition ke mutabik usmein risk management ke rules ke mutabik apni working karna hoti hai Jab aap is candlestick pattern ke mutabik apni trading karte hain to ismein aapko hamesha lowest point per apna stop loss ki value select karna hoti hai.

Estimated Target

Forex trading market mein Jab aap Kisi point per entry dete Hain to ismein aapko hamesha apna estimated target jarur select karna chahie kyunki Jab aap apna estimated target select kar lete hain to uske bad aap market mein ek acchi earning hasil kar sakte hain aapka estimated target different scenario ki base per totally different ho sakta hai.

Bullish Kicker Overview

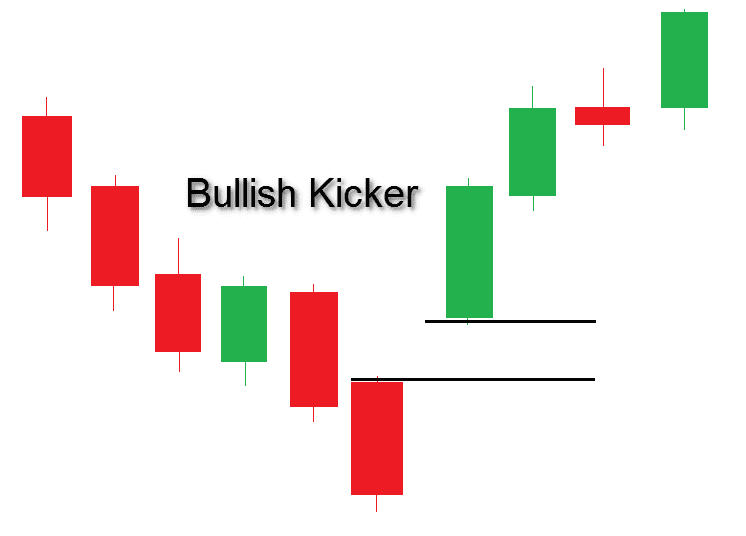

Above mentioned candlestick pattern ko further explain karne ke liye main aapko iska chart share karne ja raha hun jismein aap isko easily identify kar sakte hain aur ismein aap iski base per is it decision making kar sakte hain aur ismein different important factors ko aasani ke sath find out kar sakte hain kyunki Jab aap market mein apni patterns ko completely focus karte hain aur ismein aap according tu rules and regulations apni working karte Hain to aap ek acchi position mein kar sakte hain.

Chart Explanation

Jab aap apni learning ko complete kar dete Hain to aisi condition mein aapko hamesha bahut jyada fayda mil sakta hai aur aap isko aasani se samajh sakte hain isliye main aapke sath iski image share karne ja raha hun jo aapko explain kar sakta hun.

dear senior and junior members agar aap Forex trading market mein technical analysis ki base per trade karte hain to ismein aapko bahut achcha munafa mil sakta hai aur aap ek acchi trading position mein a sakte hain iske liye aapko market mein available multiple candlesticks aur candlestick pattern ko acchi tarah study karna hota hai kyunki Jab aap Kisi candle stick pattern ko acchi tarah study kar lete hain aur usko apni decision making per apply karte hain to aapko ismein bahut achcha munafa mil sakta hai aaj main aapko ek bahut hi important aur familiar candle stick pattern jisko aap bullish kickar candle stick pattern ke naam se jante Hain uski tafseel batane ja raha hun.

Bullish Kicker Candlestick

Jab aap market mein candlestick pattern ko focus kar rahe hote hain aur daily basis per apne analysis complete kar rahe hote hain to aapko is candlestick pattern ko acchi tarah samajhna hota hai basically Jab aap market mein ek aisi situation dekhte hain ki Jab market mein bearish trend valid hota hai aur last candlestick bear is close hoti hai lekin Jab market open hoti hai to usmein aapko use candlestick mein gap ke sath opening milati hai to isko aap bullish kickar candlest pattern ke naam se jante Hain.

Recognition

Dear jab Forex trading market mein prices bottom level par hoti hai aur aisi condition mein Jab last candlestick ki closing full bear is trend mein hoti hai lekin Jab market open hoti hai to market last candle ko completely cover karke aur upar se open hoti hai aur last candle ka completely gap hota hai to is candlestick pattern ko aap market mein easily identify aur recognize kar sakte hain.

Gear Changing Pattern

Already main aapko jo details Bata chuka hun usmein aapko clearli yah idea Mil jata hai ki is candle stick pattern ke bad market mein totally unexpected movement hoti hai aur totally reversal trend maintain ho jata hai is candlestick pattern ko aap market mein gear changing candlestick pattern ke naam se bhi jante Hain kyunki iske bad market mein totally movement hi change Ho jaati hai.

Stop Loss Calculation

Risk management ke rules and regulations ke mutabik apni working karna aapke liye most important factor hota hai kyunki jab tak aap risk management ke rules and regulations ke mutabik apni working nahin karenge to aap kabhi bhi successful trading nahin kar sakte isliye aapko hamesha trade entry lete hue uski condition ke mutabik usmein risk management ke rules ke mutabik apni working karna hoti hai Jab aap is candlestick pattern ke mutabik apni trading karte hain to ismein aapko hamesha lowest point per apna stop loss ki value select karna hoti hai.

Estimated Target

Forex trading market mein Jab aap Kisi point per entry dete Hain to ismein aapko hamesha apna estimated target jarur select karna chahie kyunki Jab aap apna estimated target select kar lete hain to uske bad aap market mein ek acchi earning hasil kar sakte hain aapka estimated target different scenario ki base per totally different ho sakta hai.

Bullish Kicker Overview

Above mentioned candlestick pattern ko further explain karne ke liye main aapko iska chart share karne ja raha hun jismein aap isko easily identify kar sakte hain aur ismein aap iski base per is it decision making kar sakte hain aur ismein different important factors ko aasani ke sath find out kar sakte hain kyunki Jab aap market mein apni patterns ko completely focus karte hain aur ismein aap according tu rules and regulations apni working karte Hain to aap ek acchi position mein kar sakte hain.

Chart Explanation

Jab aap apni learning ko complete kar dete Hain to aisi condition mein aapko hamesha bahut jyada fayda mil sakta hai aur aap isko aasani se samajh sakte hain isliye main aapke sath iski image share karne ja raha hun jo aapko explain kar sakta hun.

تبصرہ

Расширенный режим Обычный режим