AOA

INTRODUCTION

Friends kya haal hai aapke ummid karta hun aap sab khairiyat se honge Jahan rahen Khush rahen aur mahfuz Rahe jab bhi Ham Apne trade open karna chahte hain to sabse pahle Ham trading chart ko read karne ki koshish karte hain Jahan per different trading chart bante rahte hain un main se ek V pattern bhi hai jo market mein bahut zeji ke sath banta Hai jiski vajah se market mein bahut jyada violation Hoti Hai V pattern ko market mein maloom karna thora difficult hota hai jaise hi yah ban jata hai tab hi hamen iska pata chal jata Hai V pettern market Taz selling aur buying ki vajah se banta Hai kyunki yah pattern V shape ka hota Hai ISI vajah se is pattern ko V pattern bhi kaha jata hai V pattern ko do types hote hain kyunki yah ya to market ke top per banta hai ya fir market ke sabse bottom position per banta hai V pattern ke type Ham niche discuss karte Hain

BULLISH V TOP PATTERN

Bullish V top jisko bullish Skype pattern bhi kaha jata Hai prices ke sabse highest price mein banti Hai jab bhi market mein ek normal bullish trend per prices move kar rahi hoti hai aur is dauran achanak se Koi Bari news ya Central Bank se Koi beyan jari hone se market volitilety kar ka shikar ho jaati Hai jisse bullish trend achanak bearish trend mein change ho jata hai

BEARISH V BOTTOM PATTERN

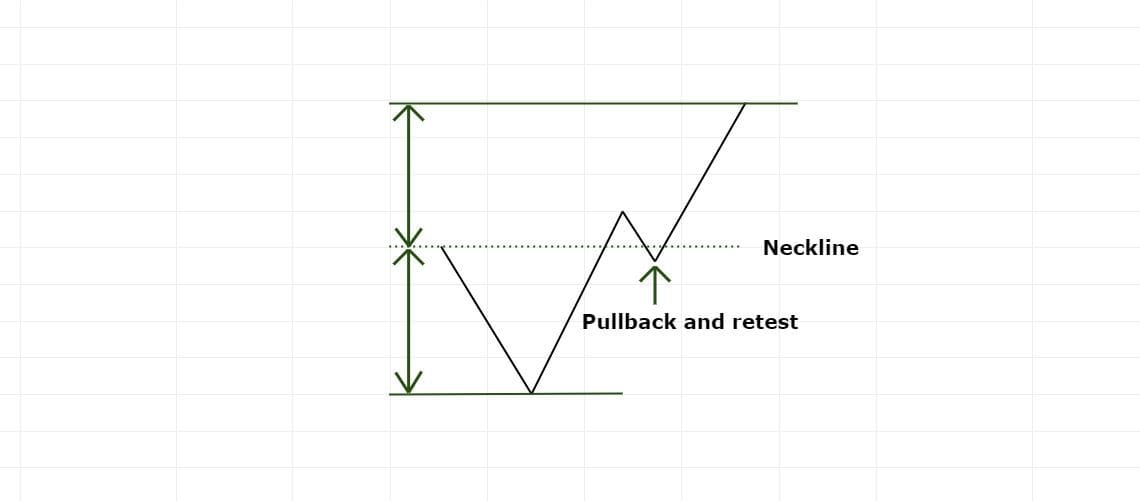

Bearish V pattern market ke bottom mein use waqt banta Hai jab prices ek bearish trend mein move kar rahi hoti hai aur suddenly economics news ki vajah se market mein volitilrty paida ho jaati Hai aur prices achanak bullish trend mein change ho jaati Hai or bearish V pattern ko bearish spike pattern bhi kaha jata hai

SL &TP USE ON V PATTERN

V pattern market mein prices ke achanak changing Hoti Hai is dauran ham market ki Psychology itni jyada aasani se nahin samajh paate Hain V pattern banne se yah to trader ko achanak Bara fayda hasil ho jata hai ya loss ho Lekin kyunki prices pahle trend ke hisab mein movement kar rahi Hoti Hai Is vajah se jyadatar loss bhi hota Hai V pattern ke loss se bachne ke liye traders ko Apne trade ke sath stop loss ki position lazmi set karna chahie isase kam loss kam ho jata hai agar AP Tp set karte Hain to Aapka profit bhi mahfuz ho jata hai aur aap market se bahar nikal aate Hain

INTRODUCTION

Friends kya haal hai aapke ummid karta hun aap sab khairiyat se honge Jahan rahen Khush rahen aur mahfuz Rahe jab bhi Ham Apne trade open karna chahte hain to sabse pahle Ham trading chart ko read karne ki koshish karte hain Jahan per different trading chart bante rahte hain un main se ek V pattern bhi hai jo market mein bahut zeji ke sath banta Hai jiski vajah se market mein bahut jyada violation Hoti Hai V pattern ko market mein maloom karna thora difficult hota hai jaise hi yah ban jata hai tab hi hamen iska pata chal jata Hai V pettern market Taz selling aur buying ki vajah se banta Hai kyunki yah pattern V shape ka hota Hai ISI vajah se is pattern ko V pattern bhi kaha jata hai V pattern ko do types hote hain kyunki yah ya to market ke top per banta hai ya fir market ke sabse bottom position per banta hai V pattern ke type Ham niche discuss karte Hain

BULLISH V TOP PATTERN

Bullish V top jisko bullish Skype pattern bhi kaha jata Hai prices ke sabse highest price mein banti Hai jab bhi market mein ek normal bullish trend per prices move kar rahi hoti hai aur is dauran achanak se Koi Bari news ya Central Bank se Koi beyan jari hone se market volitilety kar ka shikar ho jaati Hai jisse bullish trend achanak bearish trend mein change ho jata hai

BEARISH V BOTTOM PATTERN

Bearish V pattern market ke bottom mein use waqt banta Hai jab prices ek bearish trend mein move kar rahi hoti hai aur suddenly economics news ki vajah se market mein volitilrty paida ho jaati Hai aur prices achanak bullish trend mein change ho jaati Hai or bearish V pattern ko bearish spike pattern bhi kaha jata hai

SL &TP USE ON V PATTERN

V pattern market mein prices ke achanak changing Hoti Hai is dauran ham market ki Psychology itni jyada aasani se nahin samajh paate Hain V pattern banne se yah to trader ko achanak Bara fayda hasil ho jata hai ya loss ho Lekin kyunki prices pahle trend ke hisab mein movement kar rahi Hoti Hai Is vajah se jyadatar loss bhi hota Hai V pattern ke loss se bachne ke liye traders ko Apne trade ke sath stop loss ki position lazmi set karna chahie isase kam loss kam ho jata hai agar AP Tp set karte Hain to Aapka profit bhi mahfuz ho jata hai aur aap market se bahar nikal aate Hain

V pattern ki formation mein kuch stages hote hain. Pehle stage mein price ka downtrend hota hai aur sellers dominate karte hain. Jab price ne bottom level tak pohanchta hai, wahan se buyers active hojate hain aur price ko support dete hain. Is stage mein, price ki movement typically sideways hoti hai aur volume bhi kam hojati hai. Dusra stage, jab price ne bottom level ko paar kar liya hai, uske baad sudden reversal aur price ka tezi se upar ki taraf jaana shuru hojata hai. Yeh stage V pattern ka central point hota hai, jahan se traders ko bullish trend ki chance hoti hai. Is stage mein volume bhi barhne lagta hai, kyunki traders aur investors V pattern ki formation par focus karte hain. Price ka rapid upward movement traders ko yeh indication deta hai ke trend reversal hone ki chance hai.

V pattern ki formation mein kuch stages hote hain. Pehle stage mein price ka downtrend hota hai aur sellers dominate karte hain. Jab price ne bottom level tak pohanchta hai, wahan se buyers active hojate hain aur price ko support dete hain. Is stage mein, price ki movement typically sideways hoti hai aur volume bhi kam hojati hai. Dusra stage, jab price ne bottom level ko paar kar liya hai, uske baad sudden reversal aur price ka tezi se upar ki taraf jaana shuru hojata hai. Yeh stage V pattern ka central point hota hai, jahan se traders ko bullish trend ki chance hoti hai. Is stage mein volume bhi barhne lagta hai, kyunki traders aur investors V pattern ki formation par focus karte hain. Price ka rapid upward movement traders ko yeh indication deta hai ke trend reversal hone ki chance hai.  Teesra stage jab price ne bearish trend ko break karke upar ki taraf jaana shuru kar diya hai, toh V pattern complete samjha jata hai. Price ne previous resistance levels ko paar kar liya hota hai, jiski wajah se bullish trend ka confirmation hota hai. Traders is stage mein bullish sentiment ke saath price ko aur upar lejane ki koshish karte hain. V pattern ki successful trading ke liye, kuch important factors hain jo traders ko samajhne chahiye. Pehle toh volume ki analysis zaroori hai, kyunki jab price V pattern ki formation mein hota hai, toh volume barhne lagta hai. Volume ki ziyada barhti hai yeh indicate karta hai ke traders aur investors active ho rahe hain aur price ko upar lejane ki koshish kar rahe hain. Iske saath hi, price movement ko confirm karne ke liye moving averages aur other technical indicators ka istemal bhi kiya ja sakta hai. V pattern ka istemal short-term aur long-term trading strategies mein kiya ja sakta hai. Short-term traders typically is pattern ka istemal karte hain jab price bottom level ko paar karne ke baad tezi se upar ki taraf badhne lagta hai. Woh short positions ko close karke long positions enter karte hain, hoping for a bullish reversal. Long-term traders, on the other hand, is pattern ki formation ka intezaar karte hain aur jab price ne V pattern complete kar liya hai, toh woh long positions enter karte hain.

Teesra stage jab price ne bearish trend ko break karke upar ki taraf jaana shuru kar diya hai, toh V pattern complete samjha jata hai. Price ne previous resistance levels ko paar kar liya hota hai, jiski wajah se bullish trend ka confirmation hota hai. Traders is stage mein bullish sentiment ke saath price ko aur upar lejane ki koshish karte hain. V pattern ki successful trading ke liye, kuch important factors hain jo traders ko samajhne chahiye. Pehle toh volume ki analysis zaroori hai, kyunki jab price V pattern ki formation mein hota hai, toh volume barhne lagta hai. Volume ki ziyada barhti hai yeh indicate karta hai ke traders aur investors active ho rahe hain aur price ko upar lejane ki koshish kar rahe hain. Iske saath hi, price movement ko confirm karne ke liye moving averages aur other technical indicators ka istemal bhi kiya ja sakta hai. V pattern ka istemal short-term aur long-term trading strategies mein kiya ja sakta hai. Short-term traders typically is pattern ka istemal karte hain jab price bottom level ko paar karne ke baad tezi se upar ki taraf badhne lagta hai. Woh short positions ko close karke long positions enter karte hain, hoping for a bullish reversal. Long-term traders, on the other hand, is pattern ki formation ka intezaar karte hain aur jab price ne V pattern complete kar liya hai, toh woh long positions enter karte hain.

تبصرہ

Расширенный режим Обычный режим