Introduction

Kya हाल-चाल haiAssalam alaikum dear members!umeed karta hn ap sb khiar khairiat se hn gy or apka last trading week bahut acha gaya ho ga. or dua ha k apka next trading week bhi profit se bhrpor ho.

dear members aj ki post main hum Non form payroll ki news py trading karny ki strategy ko study karen gy or hum ye b dekhen gy k NFP ka data kahan se lia jaye or esy kesy analyse kia jy or eska market py kia impact ho skta ha.

What is non form payroll?

Dear members Non Form Payroll united states ki economy ki strength main aik key role play karta ha.ye united states main total number of paid workers , less farm employes, government employes or private employes , ko show karta ha.

NFP forex main baki tmam news se zada bari movement ki wja banti ha.esi lye bht bari tadad main traders esko watch or analyse kr k market ki direction ka andaza lgaty hain or trade karty hain.

NFP k lye technical analysis kia ja skta ha srf 5 or 15 min k chart main.

Analysing NFP data:

Dear members baki tmam economic data ki trha NFP ko bhi analyse karny k 3 treeky hain jo k nechy bayan kye gay hain.

1) payroll ki higher figure US ki economy k lye positive sign hota ha.q k zada emplyement economy main zada contribute krta ha or economy ko healthy bnata ha.

Estrha traders analyse karty hain k USD string ho ga or es k against pairs weak hn gy or esi k mutabiq trade ki jati ha.

2) NFP k sth sth agr unemployement calims main bhi koe change ho to market main mix result ho skta ha .

es lye traders dono ko dkhty hain or agr 1 chz positive ho or dosri negative ho to jska data zada strong ho us k lehaz se market main trade ki jati ha.

3) or agr NFP ka data less ho to ye US economy k lye negative hota ha q k km log employed hoty hain kr estrha economy main zada contribution ni hota or economy weak hoti ha.

es halat main USD ko weak expect kia jata ha or opposite pairs ko strong or esi lehaz se trade ki jati ha.

Trading news release:

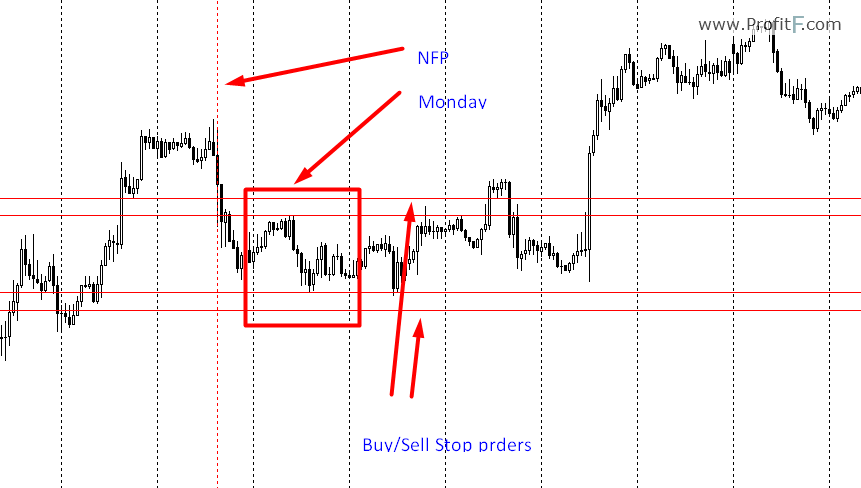

Dear members news release ko trade karna profitable hota ha laikin utna hi risk hota ha q k news k release hony k bad kafi zada manipulation bhi hoti ha market main.

Es doran apko news release hony k bad 15 se 30 minute wait karna chahye ta k manipulation khtm ho or market ka structure clear ho phr trade len.

Trading news release:

Dear members news release ko trade karna profitable hota ha laikin utna hi risk hota ha q k news k release hony k bad kafi zada manipulation bhi hoti ha market main.

Es doran apko news release hony k bad 15 se 30 minute wait karna chahye ta k manipulation khtm ho or market ka structure clear ho phr trade len.

Name: 5D3BA111-C4CE-4D6B-8C31-5904E73CE908.png Views: 9 Size: 22.6 KB

Trading after effect news:

dear members news k release hony k ghnty tk market main manipulation jari rhti ha or lambi lambi candles banti hain laikin agr ap asl mainNFP ko trade karna chahty hain to apko aik ghnty ya km se km adhy ghnty ki candle k close hony ka wait karna chahye q jb candle close ho ge tb tk market manipulation bhi end ho jygi or market ka longterm trend b samny aa jayga to ap market main achi position le skty hain.

or estrha ap long term k lye acha profit gain kar skty hain.

Kya हाल-चाल haiAssalam alaikum dear members!umeed karta hn ap sb khiar khairiat se hn gy or apka last trading week bahut acha gaya ho ga. or dua ha k apka next trading week bhi profit se bhrpor ho.

dear members aj ki post main hum Non form payroll ki news py trading karny ki strategy ko study karen gy or hum ye b dekhen gy k NFP ka data kahan se lia jaye or esy kesy analyse kia jy or eska market py kia impact ho skta ha.

What is non form payroll?

Dear members Non Form Payroll united states ki economy ki strength main aik key role play karta ha.ye united states main total number of paid workers , less farm employes, government employes or private employes , ko show karta ha.

NFP forex main baki tmam news se zada bari movement ki wja banti ha.esi lye bht bari tadad main traders esko watch or analyse kr k market ki direction ka andaza lgaty hain or trade karty hain.

NFP k lye technical analysis kia ja skta ha srf 5 or 15 min k chart main.

Analysing NFP data:

Dear members baki tmam economic data ki trha NFP ko bhi analyse karny k 3 treeky hain jo k nechy bayan kye gay hain.

1) payroll ki higher figure US ki economy k lye positive sign hota ha.q k zada emplyement economy main zada contribute krta ha or economy ko healthy bnata ha.

Estrha traders analyse karty hain k USD string ho ga or es k against pairs weak hn gy or esi k mutabiq trade ki jati ha.

2) NFP k sth sth agr unemployement calims main bhi koe change ho to market main mix result ho skta ha .

es lye traders dono ko dkhty hain or agr 1 chz positive ho or dosri negative ho to jska data zada strong ho us k lehaz se market main trade ki jati ha.

3) or agr NFP ka data less ho to ye US economy k lye negative hota ha q k km log employed hoty hain kr estrha economy main zada contribution ni hota or economy weak hoti ha.

es halat main USD ko weak expect kia jata ha or opposite pairs ko strong or esi lehaz se trade ki jati ha.

Trading news release:

Dear members news release ko trade karna profitable hota ha laikin utna hi risk hota ha q k news k release hony k bad kafi zada manipulation bhi hoti ha market main.

Es doran apko news release hony k bad 15 se 30 minute wait karna chahye ta k manipulation khtm ho or market ka structure clear ho phr trade len.

Trading news release:

Dear members news release ko trade karna profitable hota ha laikin utna hi risk hota ha q k news k release hony k bad kafi zada manipulation bhi hoti ha market main.

Es doran apko news release hony k bad 15 se 30 minute wait karna chahye ta k manipulation khtm ho or market ka structure clear ho phr trade len.

Name: 5D3BA111-C4CE-4D6B-8C31-5904E73CE908.png Views: 9 Size: 22.6 KB

Trading after effect news:

dear members news k release hony k ghnty tk market main manipulation jari rhti ha or lambi lambi candles banti hain laikin agr ap asl mainNFP ko trade karna chahty hain to apko aik ghnty ya km se km adhy ghnty ki candle k close hony ka wait karna chahye q jb candle close ho ge tb tk market manipulation bhi end ho jygi or market ka longterm trend b samny aa jayga to ap market main achi position le skty hain.

or estrha ap long term k lye acha profit gain kar skty hain.

تبصرہ

Расширенный режим Обычный режим