Description.

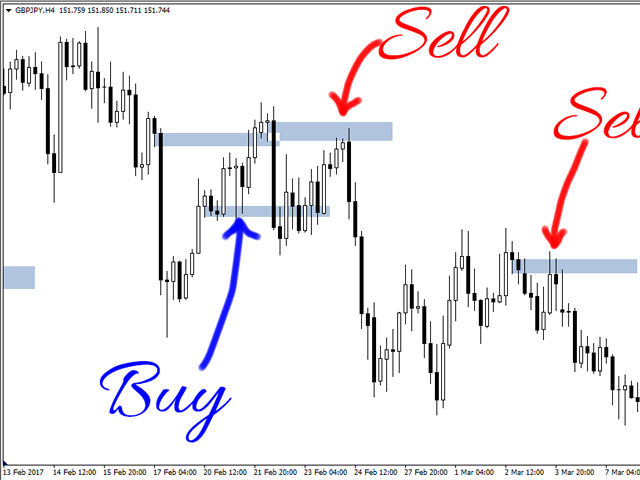

Dear friends market kisi bhi direction main movement ker chuki hoti hai tou usky bahd market price correction kerti hai aur wahan per market agar kuch time ky liay stay kerti hai tou market kuch stay kerny ky bahd again same direction main movement start ker leti hai tou aesy time per market main same order main trade continue kerna hoti hai.

Trading at Order block Strategy.

Dear friends Jo trader market k against trade karny k bary ma sochta hai uska account he hamesa wash ho jata hai. So same trend ma b trader ko market ki retracement ka wait karna chahe. Retracement k bad agr market same direction ma move karti hai jesa pehle kar rahi thi to trader ko us side par trade open kar leni chahe aur Order block strategy k lae trader ko pehle market ka trend find karna chahe. Jb trader ko market ka trend pata chal jae to isko ese side par trade ko open karny k bary ma zehan banana chahe.

Observation of Market Indicators.

Dear friends profitable trading karne ke liye market trading chart ky ndicators ko dekhna hoga aur technical analysis ko follow karna hoga kyunki jab tak aap technical analysis ko follow nahi karenge indicators to nahin dekhenge candlestick patterns ko dekhne ke bad apni trade nahin lagaenge to aap kabhi bhi kamyab nahin ho sakte isiliye agar aap kamyab hona chahte Hain to uske liye aapko proper market analysis ko follow karna hoga aur uske bad hi trade karni hogi tab hi aap acche se accha profit hasil ho sakta hea.

How to understand Order Block trading Strategy.

Dear friends order block trading strategies ke bare mein complete analysis karte hain to use Waqt aap is kajariya se market Mein best result bhi Hasil kar lete hain market traders ke liye order block ke acchi money aur acchi earning Hasil karna possible Nahin Hota traders market Mein is order block trading strategies ko different type ke time frame mein se best time frame ko select Karke acchi Tarah Se samajh sakte hain aur market ki movement aur uski direction ko acchi Tarah Se identify kar sakty hean.

Dear friends market kisi bhi direction main movement ker chuki hoti hai tou usky bahd market price correction kerti hai aur wahan per market agar kuch time ky liay stay kerti hai tou market kuch stay kerny ky bahd again same direction main movement start ker leti hai tou aesy time per market main same order main trade continue kerna hoti hai.

Trading at Order block Strategy.

Dear friends Jo trader market k against trade karny k bary ma sochta hai uska account he hamesa wash ho jata hai. So same trend ma b trader ko market ki retracement ka wait karna chahe. Retracement k bad agr market same direction ma move karti hai jesa pehle kar rahi thi to trader ko us side par trade open kar leni chahe aur Order block strategy k lae trader ko pehle market ka trend find karna chahe. Jb trader ko market ka trend pata chal jae to isko ese side par trade ko open karny k bary ma zehan banana chahe.

Observation of Market Indicators.

Dear friends profitable trading karne ke liye market trading chart ky ndicators ko dekhna hoga aur technical analysis ko follow karna hoga kyunki jab tak aap technical analysis ko follow nahi karenge indicators to nahin dekhenge candlestick patterns ko dekhne ke bad apni trade nahin lagaenge to aap kabhi bhi kamyab nahin ho sakte isiliye agar aap kamyab hona chahte Hain to uske liye aapko proper market analysis ko follow karna hoga aur uske bad hi trade karni hogi tab hi aap acche se accha profit hasil ho sakta hea.

How to understand Order Block trading Strategy.

Dear friends order block trading strategies ke bare mein complete analysis karte hain to use Waqt aap is kajariya se market Mein best result bhi Hasil kar lete hain market traders ke liye order block ke acchi money aur acchi earning Hasil karna possible Nahin Hota traders market Mein is order block trading strategies ko different type ke time frame mein se best time frame ko select Karke acchi Tarah Se samajh sakte hain aur market ki movement aur uski direction ko acchi Tarah Se identify kar sakty hean.

تبصرہ

Расширенный режим Обычный режим