what is Upside Tasuki gap?

upside tasuki gap forex market mein bullish pattern he samjha jata hey jo keh forex mein ten candle stick or reversal difference par moshtamel hota hey aik gap or aik reversal candle stick pattern hota hey aik gap bearish candle stick mein tasuki gap par moshtamel hote hey or forex market mein upper hesay par moshtmel hote hey

yeh candle stick pattern khordah trader ko batata hey keh forex market mein bullish ka trend jare rahay ga yeh khordah trader profit ko zyada say zyada hasell karmay ke koshesh kartay hein or zyada long trading position par kaim rehtay hein

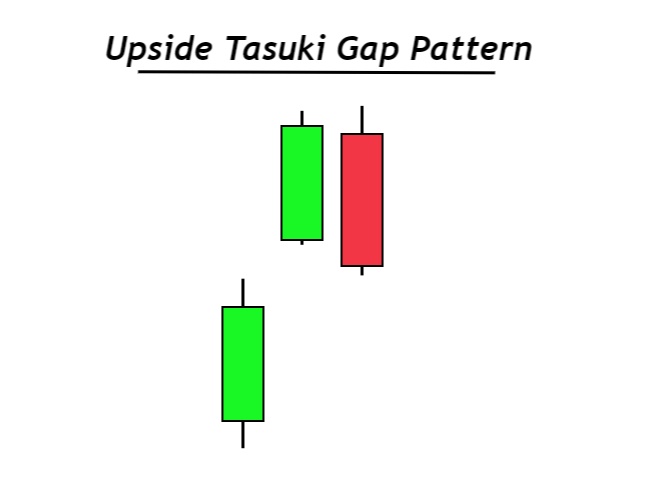

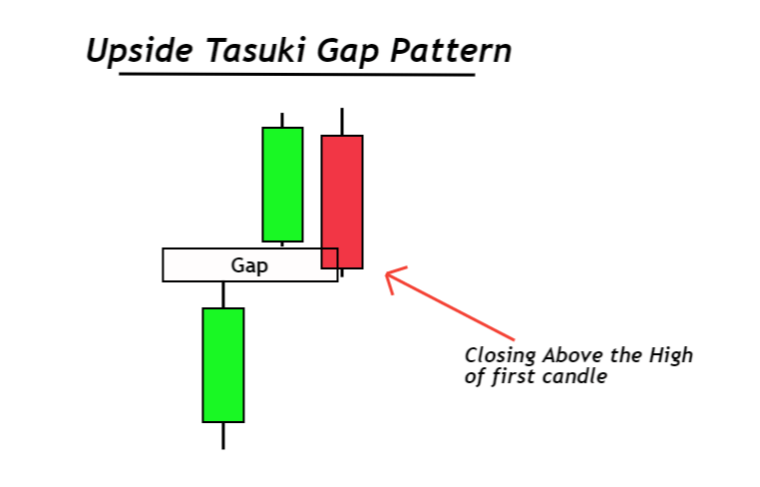

identification of upside tasuki gap

pehle candle stick aik important bullish candle stick ho ge jo keh forex market mein buyer ke zabardast raftar or forex market kay bullish pattern ko wazah karte hey

dsree candle stick pehle candle stick ke range kay opar ho ge upside kay gap kay sath open ho ge es ke closing price zyada ho ge candle stick ka size chota ho ga

tesaree candle stick pechle candle stick bearish ho ge or es ka size candle stick kay andar open hona chihay pehle candle stick ko close price say opar close hona chihay

How to trade with upside tasuki Gap

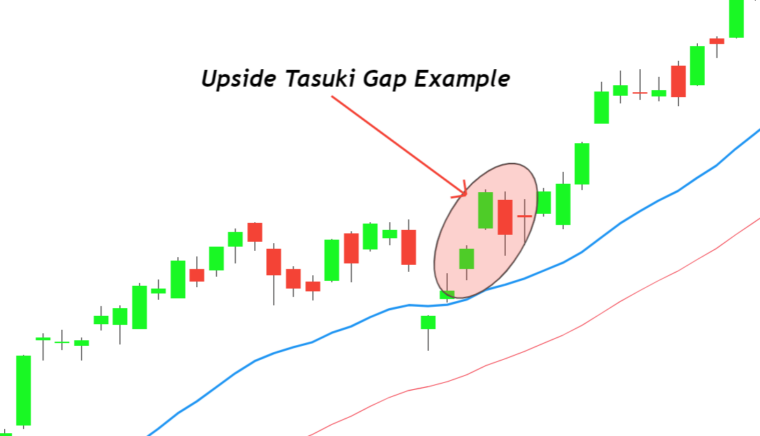

yeh forex market mein aik trend continuation candle stick pattern hota hey jes ko dosray technial analysis tool r price kay sungom ko sath lay kar estamal kartay hein

simple EMA Trading Strategy

chart par EMA 21 or EMA 38 ko darj karen or phir trend ke confirmation karen ager candle stick chalte hove average line kay opar bante hey to price mein bullish aay ge up trend ka order open karen jab forex mein aik buy entry open ho jay ge to moving aberage say nechay stp loss lagay ga trade ko s time tak rokay rakhen jab tak moving average cross over ke movement bearish direction mein na ho jay

Conclusion

Tasuki candlestick pattern basic tor par chart or stock market mein estamal hota hey engulfing candle stick ya pin bar candlestick important chart pattern hotay hein yeh forex market mein hamesha kay ley safaresh ke jate hey keh pin bar candle stick pattern ko samjhen or dosray technical tools ko bhe shamel kar kay trading karen

upside tasuki gap forex market mein bullish pattern he samjha jata hey jo keh forex mein ten candle stick or reversal difference par moshtamel hota hey aik gap or aik reversal candle stick pattern hota hey aik gap bearish candle stick mein tasuki gap par moshtamel hote hey or forex market mein upper hesay par moshtmel hote hey

yeh candle stick pattern khordah trader ko batata hey keh forex market mein bullish ka trend jare rahay ga yeh khordah trader profit ko zyada say zyada hasell karmay ke koshesh kartay hein or zyada long trading position par kaim rehtay hein

identification of upside tasuki gap

pehle candle stick aik important bullish candle stick ho ge jo keh forex market mein buyer ke zabardast raftar or forex market kay bullish pattern ko wazah karte hey

dsree candle stick pehle candle stick ke range kay opar ho ge upside kay gap kay sath open ho ge es ke closing price zyada ho ge candle stick ka size chota ho ga

tesaree candle stick pechle candle stick bearish ho ge or es ka size candle stick kay andar open hona chihay pehle candle stick ko close price say opar close hona chihay

How to trade with upside tasuki Gap

yeh forex market mein aik trend continuation candle stick pattern hota hey jes ko dosray technial analysis tool r price kay sungom ko sath lay kar estamal kartay hein

simple EMA Trading Strategy

chart par EMA 21 or EMA 38 ko darj karen or phir trend ke confirmation karen ager candle stick chalte hove average line kay opar bante hey to price mein bullish aay ge up trend ka order open karen jab forex mein aik buy entry open ho jay ge to moving aberage say nechay stp loss lagay ga trade ko s time tak rokay rakhen jab tak moving average cross over ke movement bearish direction mein na ho jay

Conclusion

Tasuki candlestick pattern basic tor par chart or stock market mein estamal hota hey engulfing candle stick ya pin bar candlestick important chart pattern hotay hein yeh forex market mein hamesha kay ley safaresh ke jate hey keh pin bar candle stick pattern ko samjhen or dosray technical tools ko bhe shamel kar kay trading karen

تبصرہ

Расширенный режим Обычный режим