Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members ap na Market k related 2 bhot important terms per bhot acha knowledge share kia ha. Man b is important topic per apka sa apna knowledge share kerta hon, umeed ha k is sa traders ko acha faida hasil hoga.

Bullish Market:

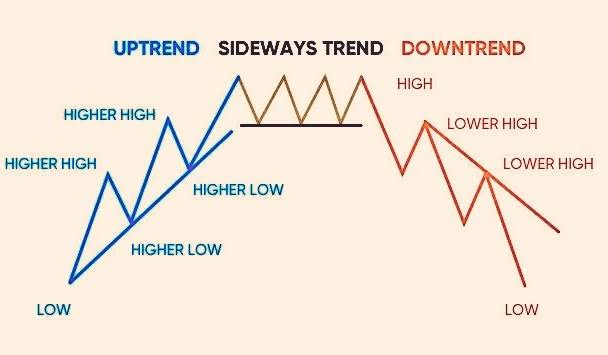

Dear trading k liye zarori ha k trader ko pata ho k market price increase ker rahe ha ya fall ker rahe ha. Ta k trader sell ya buy ker k market sa benefit uthae. Is liye market price k ander increase aur decrease ka andaza sirf aur sirf past prices sa lagaya ja sakta ha. Ager market prices past prices k motabiq increase hoi han to isko market term man "BULLISH Market" kehta han. Bullish market man Buyers ka pressure zayada strong hota ha, seller kafi koshish kerta han k market ko sell ker k nicha laya jae lakin market man buyers itna zayada aur strong hota han k jitna b unit sellers sell kerta han usi waqt buy ker leta han aur is terha market price "Higher High" bana k tazi sa oper jati ha. Is condition man trader ko hamasha "Buy ki Opportunity" ko dakhna chaheye. Bullish market man demand zayada aur supply ki shortage hoti ha.

Bullish market man market prices ki direction ko "Bullish Trend" kehta han.

Bearish Market:

Dear ager market prices past ki prices k motabiq decrease ker rahe han to market term man isko "BEARISH MARKET" kehta han. Bearish market man "Sellers ka pressure" zayada hota ha aur wo her level per sell kerta jata ha lakin buyer itna strong nahe hota k sara unit buy ker sakan aur is terha market prices "Lower Low" lagati ha aur market prices tazi k sath nicha ki taraf shoot ( fall) kerti han. Is situation man trader ko "Sell ki Opportunity" ko dakhna chaheye. Bearish market man Demand man kami aur supply zayada hoti ha.

Bearish market man Market prices ki direction ko "Bearish Trend" kehta han.

History of Bullish and Bearish:

"Bullish" ka word "BULLS" sa liya gya ha. Ager ham dakhen to "Bulls" apna shikar ko head nicha ker k oper ki taraf throw kerta ha aur similarly market prices man b jab increase ata ha to price oper jati han to is liye market price k increase ko Bullish word sa zaher kerta han.

"Bearish" ka word "Bear" sa liya gya ha. Q k Bear apna shikar ko oper sa nich ki taraf hit kerta ha, similarly bearish market man prices fall kerti ha. Is waja sa market prices man fall ko Bearish k word sa zaher kia jata ha. Is liye forex market man traders commonly bull aur bear ka words use ker k market ko explain kerta han.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members ap na Market k related 2 bhot important terms per bhot acha knowledge share kia ha. Man b is important topic per apka sa apna knowledge share kerta hon, umeed ha k is sa traders ko acha faida hasil hoga.

Bullish Market:

Dear trading k liye zarori ha k trader ko pata ho k market price increase ker rahe ha ya fall ker rahe ha. Ta k trader sell ya buy ker k market sa benefit uthae. Is liye market price k ander increase aur decrease ka andaza sirf aur sirf past prices sa lagaya ja sakta ha. Ager market prices past prices k motabiq increase hoi han to isko market term man "BULLISH Market" kehta han. Bullish market man Buyers ka pressure zayada strong hota ha, seller kafi koshish kerta han k market ko sell ker k nicha laya jae lakin market man buyers itna zayada aur strong hota han k jitna b unit sellers sell kerta han usi waqt buy ker leta han aur is terha market price "Higher High" bana k tazi sa oper jati ha. Is condition man trader ko hamasha "Buy ki Opportunity" ko dakhna chaheye. Bullish market man demand zayada aur supply ki shortage hoti ha.

Bullish market man market prices ki direction ko "Bullish Trend" kehta han.

Bearish Market:

Dear ager market prices past ki prices k motabiq decrease ker rahe han to market term man isko "BEARISH MARKET" kehta han. Bearish market man "Sellers ka pressure" zayada hota ha aur wo her level per sell kerta jata ha lakin buyer itna strong nahe hota k sara unit buy ker sakan aur is terha market prices "Lower Low" lagati ha aur market prices tazi k sath nicha ki taraf shoot ( fall) kerti han. Is situation man trader ko "Sell ki Opportunity" ko dakhna chaheye. Bearish market man Demand man kami aur supply zayada hoti ha.

Bearish market man Market prices ki direction ko "Bearish Trend" kehta han.

History of Bullish and Bearish:

"Bullish" ka word "BULLS" sa liya gya ha. Ager ham dakhen to "Bulls" apna shikar ko head nicha ker k oper ki taraf throw kerta ha aur similarly market prices man b jab increase ata ha to price oper jati han to is liye market price k increase ko Bullish word sa zaher kerta han.

"Bearish" ka word "Bear" sa liya gya ha. Q k Bear apna shikar ko oper sa nich ki taraf hit kerta ha, similarly bearish market man prices fall kerti ha. Is waja sa market prices man fall ko Bearish k word sa zaher kia jata ha. Is liye forex market man traders commonly bull aur bear ka words use ker k market ko explain kerta han.

تبصرہ

Расширенный режим Обычный режим