Average True Range

Description

average true range ( atr ) makhsoos muddat ke douran haqeeqi range ki ost hai. atr qeematon ki naqal o harkat mein kisi bhi farq ko mad e nazar rakhtay hue utaar charhao ki pemaiesh karta hai. aam tor par, ae tea are ka hisaab 14 adwaar par mabni hota hai, jo intra day, rozana, hafta waar ya mahana ho sakta hai. haliya utaar charhao ki pemaiesh karne ke liye, aik mukhtasir ost istemaal karen, jaisay ke 2 se 10 adwaar. taweel mudti utaar charhao ke liye, 20 se 50 adwaar istemaal karen .

How this indicator works

Description

average true range ( atr ) makhsoos muddat ke douran haqeeqi range ki ost hai. atr qeematon ki naqal o harkat mein kisi bhi farq ko mad e nazar rakhtay hue utaar charhao ki pemaiesh karta hai. aam tor par, ae tea are ka hisaab 14 adwaar par mabni hota hai, jo intra day, rozana, hafta waar ya mahana ho sakta hai. haliya utaar charhao ki pemaiesh karne ke liye, aik mukhtasir ost istemaal karen, jaisay ke 2 se 10 adwaar. taweel mudti utaar charhao ke liye, 20 se 50 adwaar istemaal karen .

How this indicator works

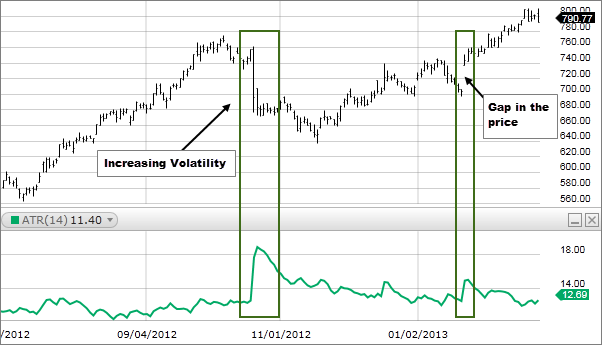

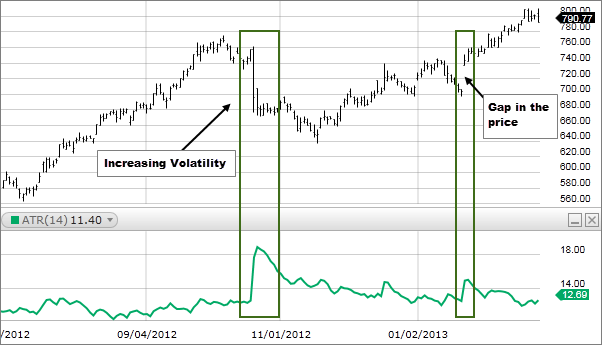

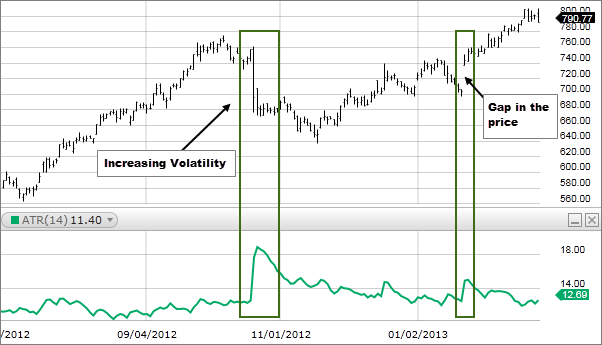

- atr ki tosee market mein barhatay hue utaar charhao ki nishandahi karti hai, har baar ki range bherne ke sath. atr mein izafay ke sath qeemat mein tabdeeli is iqdaam ke peechay taaqat ki nishandahi kere gi. atr Directional nahi hai is liye phialta sun-hwa atr farokht ke dabao ya kharidari ke dabao ki nishandahi kar sakta hai.

aala atr qadren aam tor par taiz paish qadmi ya kami ke nateejay mein hoti hain aur un ke taweel muddat tak barqarar rehne ka imkaan nahi hota hai .kam atr qader choti ranges ( khamosh din ) ke sath adwaar ki aik series ki nishandahi karti hai. yeh kam atr qadren tosee shuda side ways price action ke douran payi jati hain, is terhan kam utaar charhao.

kam atr qadron ki taweel muddat aik mazbooti ke ilaqay aur tasalsul ki harkat ya ulat jane ke imkaan ki nishandahi kar sakti hai .atr stops ya entry Triggers ke liye bohat mufeed hai, jo utaar charhao mein tabdeelion ka ishara deta hai. jabkay muqarara dollar point ya feesad stop utaar charhao ki ijazat nahi den ge, ae tea are stop qeemat ki taiz raftaar harkato ya istehkaam walay ilaqon ke mutabiq ho jaye ga, jo dono simtao mein qeemat ki ghair mamooli harkat ko mutharrak kar sakta hai. qeematon ki un ghair mamooli harkato ko pakarney ke liye atr ka multiple istemaal karen, jaisay 1. 5 x atr .

Calculation

ATR = (Previous ATR * (n - 1) + TR) / n

Where:

ATR = Average True Range

n = number of periods or bars

TR = True Range

The True Range for today is the greatest of the following:

- Today's high minus today's low

- The absolute value of today's high minus yesterday's close

- The absolute value of today's low minus yesterday's close

:max_bytes(150000):strip_icc()/Average-True-Range-FINAL-90c6d31cebf640b8bfb618a280b842be.jpg)

Kam ARC value Chhoti range quiet days ke sath period Ek series ki indicate karti hai yah Low art value extended sideway price action ke dauran Pai Jaati Hain Is Tarah Low volatility LOW ART value ki prolonged period Ek consolidation area aur continuation ki move ya reversal ke imkan ki indicate karti hai ART stop ya entry ke liye bahut useful hai Jo volatility Mein change ka signaling Deti Hai Jab ke kuch dollar point ya percentage stop volatiliy Ke allow Nahin Denge price ARTStop price ki Tez reftaar moves ya consolidation wale area ke mutabik ho jaega Jo donon direction Mein prices ki abnormal move ko Trigger kar sakta hai price ine abnormal moves ko pakrane ke liye ART Ka multiple istemal Karen

Kam ARC value Chhoti range quiet days ke sath period Ek series ki indicate karti hai yah Low art value extended sideway price action ke dauran Pai Jaati Hain Is Tarah Low volatility LOW ART value ki prolonged period Ek consolidation area aur continuation ki move ya reversal ke imkan ki indicate karti hai ART stop ya entry ke liye bahut useful hai Jo volatility Mein change ka signaling Deti Hai Jab ke kuch dollar point ya percentage stop volatiliy Ke allow Nahin Denge price ARTStop price ki Tez reftaar moves ya consolidation wale area ke mutabik ho jaega Jo donon direction Mein prices ki abnormal move ko Trigger kar sakta hai price ine abnormal moves ko pakrane ke liye ART Ka multiple istemal Karen

تبصرہ

Расширенный режим Обычный режим