Bollinger Bands

Description

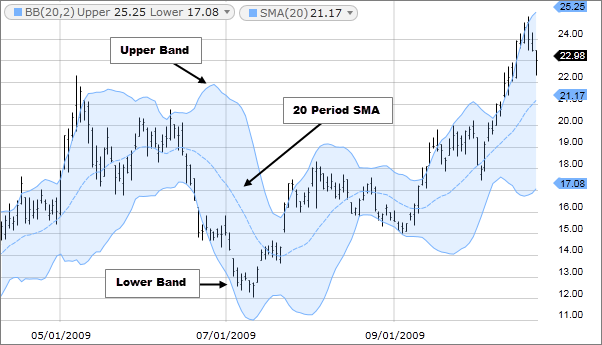

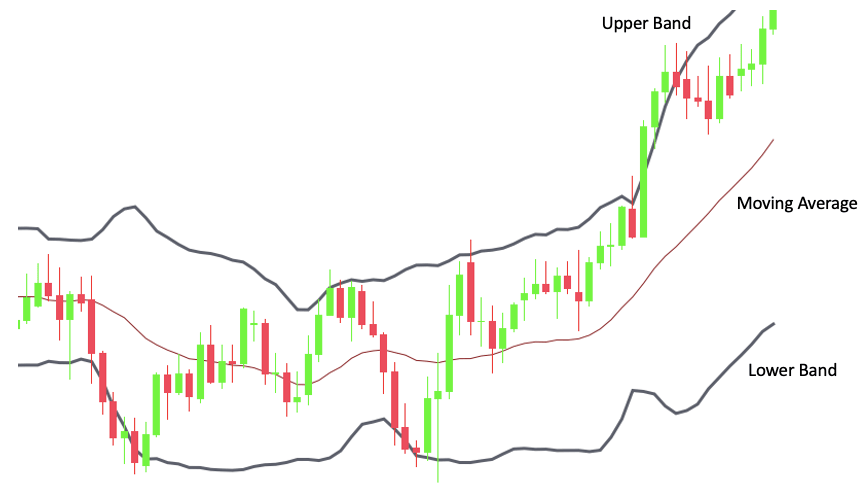

Bollinger baind qeemat ke lifafay ki aik qisam hai jo jaan Bollinger Opens ne aik nai window mein tayyar ki hai. qeemat ke lifafay oopri aur nichli qeemat ki had ki sthon ki wazahat karte hain. Bollinger bindz woh lifafay hain jo qeemat ki aik saada harkat pazeeri ost se oopar aur neechay mayaari inhiraf ki satah par banaye gaye hain. chunkay bindz ka faasla mayaari inhiraf par mabni hai, is liye woh bunyadi qeemat mein utaar charhao ke jhoolon ko adjust karte hain .Bollinger bindz 2 Parameters muddat aur mayaari inhiraf, stddev istemaal karte hain. pehlay se tay shuda eqdaar muddat ke liye 20 aur mayaari inhiraf ke liye 2 hain, halaank aap majmoay ko apni marzi ke mutabiq bana satke hain . Bollinger baind is baat ka taayun karne mein madad karte hain ke aaya qeematein nisbatan ziyada hain ya kam. woh joron mein istemaal hotay hain, oopri aur nichale dono Bands aur aik mutharrak ost ke sath mil kar. mazeed yeh ke baind ki jori khud istemaal karne ka iradah nahi hai. dosray isharay ke sath diye gaye ishaaron ki tasdeeq ke liye jore ka istemaal karen .

How this indicator works

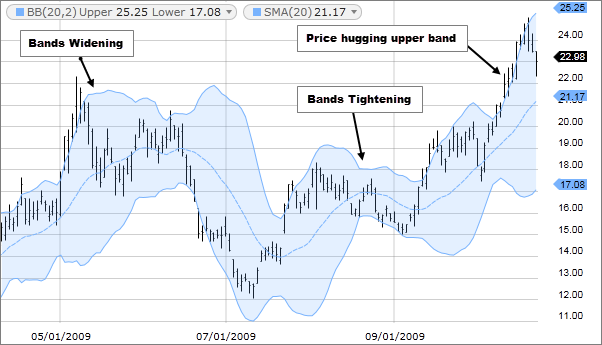

jab kam utaar charhao ke douran baind sakht ho jatay hain, to yeh qeematon mein taizi se kisi bhi simt mein muntaqil honay ka imkaan berhata hai. yeh aik rujhan saaz iqdaam shuru kar sakta hai. mukhalif simt mein ghalat iqdaam par nigah rakhen jo munasib rujhan shuru honay se pehlay hi ulat jaye .jab bindz ghair mamooli barri miqdaar se allag ho jatay hain to utaar charhao barh jata hai aur koi bhi mojooda rujhan khatam ho sakta hai .qeematon ka rujhan baind ke lifafay ke andar uchalnay ka hota hai, aik baind ko chone ke baad dosray baind mein muntaqil hota hai. aap mumkina munafe ke ahdaaf ki shanakht mein madad ke liye un jhoolon ka istemaal kar satke hain. misaal ke tor par, agar qeemat nichale baind se bouncing hai aur phir chalti ost se oopar jati hai, to oopri baind phir munafe ka hadaf ban jata hai .qeemat mazboot rujhanaat ke douran taweel arsay tak baind lifafay se tajawaz kar sakti hai ya gilaay laga sakti hai. momentum Oscillator ke sath Diversion par, aap yeh taayun karne ke liye izafi tehqeeq karna chahain ge ke aaya izafi munafe lena aap ke liye munasib hai .jab qeemat baind se bahar ho jati hai to aik mazboot rujhan ke tasalsul ki tawaqqa ki ja sakti hai. taham, agar qeematein fori tor par wapas baind ke andar chali jati hain, to tajweez kardah taaqat ko mustard kar diya jata hai .

Calculation

sab se pehlay, aik saada harkat pazeeri ost ka hisaab lagayen. agla, saada moving average ke barabar adwaar ki tadaad mein mayaari inhiraf ka hisaab lagayen. oopri baind ke liye, mayaari inhiraf ko mutharrak ost mein shaamil karen. nichale baind ke liye, mayaari inhiraf ko mutharrak ost se ghatain .

Typical values used:

Short term: 10 day moving average, bands at 1.5 standard deviations. (1.5 times the standard dev. +/- the SMA)

Medium term: 20 day moving average, bands at 2 standard deviations.

Long term: 50 day moving average, bands at 2.5 standard deviations.

Description

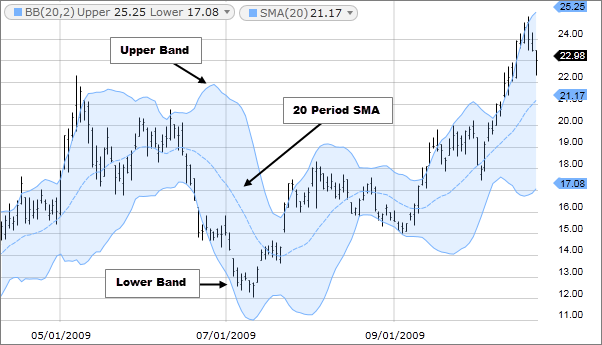

Bollinger baind qeemat ke lifafay ki aik qisam hai jo jaan Bollinger Opens ne aik nai window mein tayyar ki hai. qeemat ke lifafay oopri aur nichli qeemat ki had ki sthon ki wazahat karte hain. Bollinger bindz woh lifafay hain jo qeemat ki aik saada harkat pazeeri ost se oopar aur neechay mayaari inhiraf ki satah par banaye gaye hain. chunkay bindz ka faasla mayaari inhiraf par mabni hai, is liye woh bunyadi qeemat mein utaar charhao ke jhoolon ko adjust karte hain .Bollinger bindz 2 Parameters muddat aur mayaari inhiraf, stddev istemaal karte hain. pehlay se tay shuda eqdaar muddat ke liye 20 aur mayaari inhiraf ke liye 2 hain, halaank aap majmoay ko apni marzi ke mutabiq bana satke hain . Bollinger baind is baat ka taayun karne mein madad karte hain ke aaya qeematein nisbatan ziyada hain ya kam. woh joron mein istemaal hotay hain, oopri aur nichale dono Bands aur aik mutharrak ost ke sath mil kar. mazeed yeh ke baind ki jori khud istemaal karne ka iradah nahi hai. dosray isharay ke sath diye gaye ishaaron ki tasdeeq ke liye jore ka istemaal karen .

How this indicator works

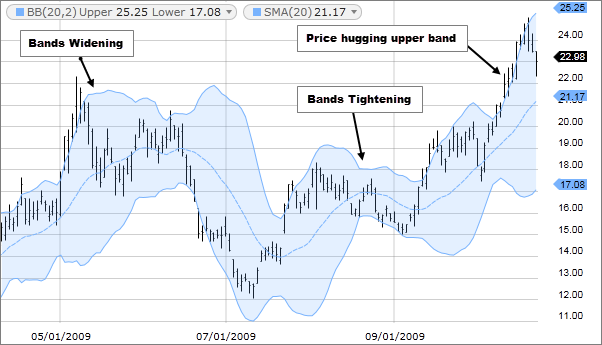

jab kam utaar charhao ke douran baind sakht ho jatay hain, to yeh qeematon mein taizi se kisi bhi simt mein muntaqil honay ka imkaan berhata hai. yeh aik rujhan saaz iqdaam shuru kar sakta hai. mukhalif simt mein ghalat iqdaam par nigah rakhen jo munasib rujhan shuru honay se pehlay hi ulat jaye .jab bindz ghair mamooli barri miqdaar se allag ho jatay hain to utaar charhao barh jata hai aur koi bhi mojooda rujhan khatam ho sakta hai .qeematon ka rujhan baind ke lifafay ke andar uchalnay ka hota hai, aik baind ko chone ke baad dosray baind mein muntaqil hota hai. aap mumkina munafe ke ahdaaf ki shanakht mein madad ke liye un jhoolon ka istemaal kar satke hain. misaal ke tor par, agar qeemat nichale baind se bouncing hai aur phir chalti ost se oopar jati hai, to oopri baind phir munafe ka hadaf ban jata hai .qeemat mazboot rujhanaat ke douran taweel arsay tak baind lifafay se tajawaz kar sakti hai ya gilaay laga sakti hai. momentum Oscillator ke sath Diversion par, aap yeh taayun karne ke liye izafi tehqeeq karna chahain ge ke aaya izafi munafe lena aap ke liye munasib hai .jab qeemat baind se bahar ho jati hai to aik mazboot rujhan ke tasalsul ki tawaqqa ki ja sakti hai. taham, agar qeematein fori tor par wapas baind ke andar chali jati hain, to tajweez kardah taaqat ko mustard kar diya jata hai .

Calculation

sab se pehlay, aik saada harkat pazeeri ost ka hisaab lagayen. agla, saada moving average ke barabar adwaar ki tadaad mein mayaari inhiraf ka hisaab lagayen. oopri baind ke liye, mayaari inhiraf ko mutharrak ost mein shaamil karen. nichale baind ke liye, mayaari inhiraf ko mutharrak ost se ghatain .

Typical values used:

Short term: 10 day moving average, bands at 1.5 standard deviations. (1.5 times the standard dev. +/- the SMA)

Medium term: 20 day moving average, bands at 2 standard deviations.

Long term: 50 day moving average, bands at 2.5 standard deviations.

Bollinger Bands ke kuch faidey hain jaise ke yeh traders ko market trends ko identify karne mein help karta hai. Yeh indicator price reversals aur breakouts ko bhi detect karta hai. Bollinger Bands ki madad se traders trading range ko identify kar sakte hain, jo trading ke liye aik important factor hai. Lekin Bollinger Bands ke kuch nuqsan bhi hain. Jab market volatile hota hai, to upper aur lower bands kafi wide ho jatey hain, aur yeh indicator price movements ko correctly interpret karna mushkil ho jata hai. Iske sath hi, Bollinger Bands ka use market trends aur price movements ko identify karne ke liye hota hai, lekin iska koi guarantee nahin hai ke market ki direction kya hogi. Bollinger Bands ka use karne ke liye traders ko iske sahi istemal ki training leni chahiye. Yeh indicator keval aik tool hai aur traders ko market analysis ke liye multiple tools ka use karna chahiye. Bollinger Bands ko aik confirmatory tool ke taur par use karna behtar hai, jabke traders ko apni trading decisions ko aur market ko analyze karne ke liye multiple sources se information collect karna chahiye. Bollinger Bands ka istemal market trends aur price volatility ko samajhne aur trading decisions lena ke liye kiya jata hai.

Bollinger Bands ke kuch faidey hain jaise ke yeh traders ko market trends ko identify karne mein help karta hai. Yeh indicator price reversals aur breakouts ko bhi detect karta hai. Bollinger Bands ki madad se traders trading range ko identify kar sakte hain, jo trading ke liye aik important factor hai. Lekin Bollinger Bands ke kuch nuqsan bhi hain. Jab market volatile hota hai, to upper aur lower bands kafi wide ho jatey hain, aur yeh indicator price movements ko correctly interpret karna mushkil ho jata hai. Iske sath hi, Bollinger Bands ka use market trends aur price movements ko identify karne ke liye hota hai, lekin iska koi guarantee nahin hai ke market ki direction kya hogi. Bollinger Bands ka use karne ke liye traders ko iske sahi istemal ki training leni chahiye. Yeh indicator keval aik tool hai aur traders ko market analysis ke liye multiple tools ka use karna chahiye. Bollinger Bands ko aik confirmatory tool ke taur par use karna behtar hai, jabke traders ko apni trading decisions ko aur market ko analyze karne ke liye multiple sources se information collect karna chahiye. Bollinger Bands ka istemal market trends aur price volatility ko samajhne aur trading decisions lena ke liye kiya jata hai.  Bollinger Bands indicator ko use karne ke liye traders ko kuch basic steps follow karne hote hain:

Bollinger Bands indicator ko use karne ke liye traders ko kuch basic steps follow karne hote hain:

تبصرہ

Расширенный режим Обычный режим