Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members jab hum analysis ko study kar rahy hoty hain to candlesticks ky bary mn knowledge hasil karna bht important hota hai. Aj hum Harami Candlestick Pattern ky bary mn bat Karen gy. Lafz Harami Japanese zaban ka lafz hai jis ky meaning pregnant ky hain. Harami Candles ka format aesy hi hota hai jaisy 1 pregnant woman apny baby ko carry kiye huay ho. Harami Candlestick pattern double pattern sy ban’ny wali candlesticks hain. First candle barhi hoti hai like a women or second candle choti hoti hai like a baby. Harami Candlestick reversal signal provide karti hain. Harami Candlesticks 2 types ki hoti hain.

1. Bullish Harami Candlestick Pattern

2. Bearish Harami Candlestick Pattern

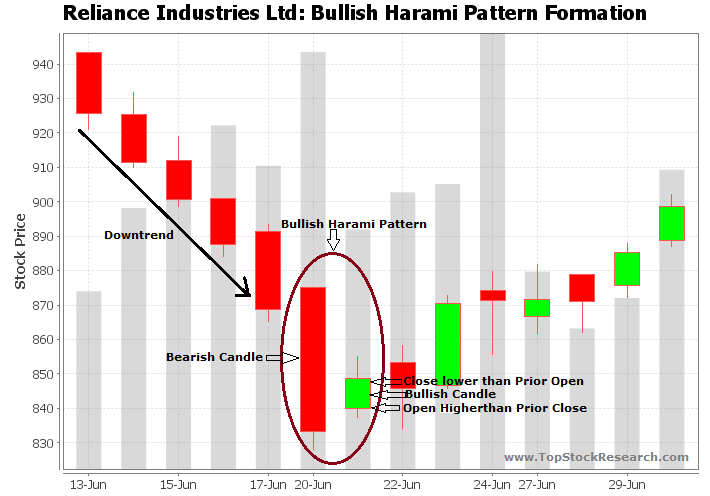

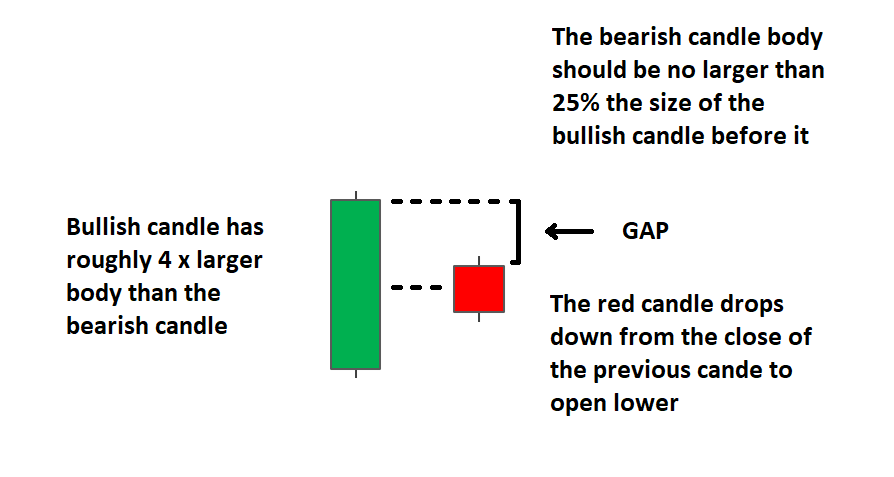

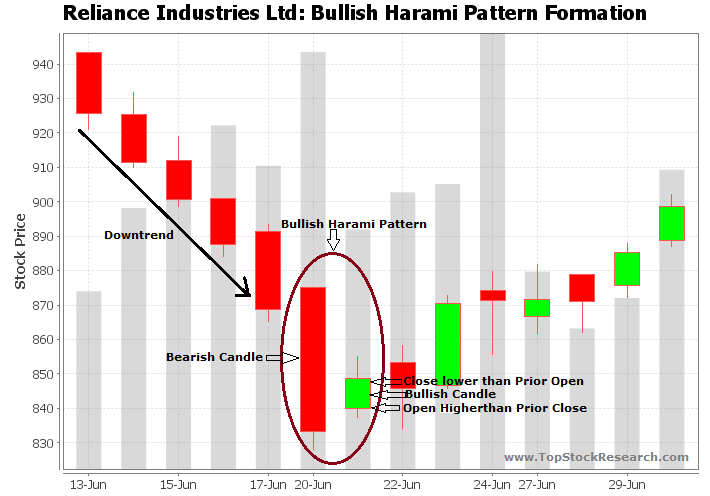

1. Bullish Harami Candlestick Pattern:

Bullish Harami Candlestick bullish reversal ka signal deti hai. Bullish Harami Candlestick Pattern 1 long down ky baad ban’ny wala pattern hai. Yeh pattern 2 candles sy mil kar banta hai. First candle barhi hoti hai or bearish hoti hai. Next candle bullish hoti hai jis ka size chota hai. Candles ky dono taraf chota sa shadow hota hai.

Agar iss tarah ki candles 1 down trend k baad banain to iss ko technical analysis ky rules ky mutabiq bullish consider kiya jata hai. Yani ky Bullish Harami Candlestick Pattern 1 bullish reversal pattern hai.

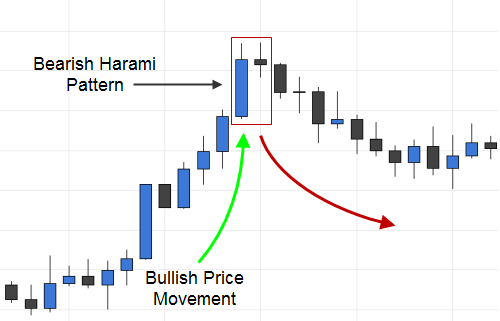

2. Beariah Harami Candlestick Pattern:

Beariah Harami Candlestick beariah reversal ka signal deti hai. Beariah Harami Candlestick Pattern 1 long up ky baad ban’ny wala pattern hai. Yeh pattern 2 candles sy mil kar banta hai. First candle barhi hoti hai or bullish hoti hai. Next candle bearish hoti hai jis ka size chota hai. Candles ky dono taraf chota sa shadow hota hai.

Agar iss tarah ki candles 1 up trend k baad banain to iss ko technical analysis ky rules ky mutabiq bearish consider kiya jata hai. Yani ky Bearish Harami Candlestick Pattern 1 bearish reversal pattern hai.

Dear forex member umeed karta hun aap sab khairiyat se honge dear members jab hum analysis ko study kar rahy hoty hain to candlesticks ky bary mn knowledge hasil karna bht important hota hai. Aj hum Harami Candlestick Pattern ky bary mn bat Karen gy. Lafz Harami Japanese zaban ka lafz hai jis ky meaning pregnant ky hain. Harami Candles ka format aesy hi hota hai jaisy 1 pregnant woman apny baby ko carry kiye huay ho. Harami Candlestick pattern double pattern sy ban’ny wali candlesticks hain. First candle barhi hoti hai like a women or second candle choti hoti hai like a baby. Harami Candlestick reversal signal provide karti hain. Harami Candlesticks 2 types ki hoti hain.

1. Bullish Harami Candlestick Pattern

2. Bearish Harami Candlestick Pattern

1. Bullish Harami Candlestick Pattern:

Bullish Harami Candlestick bullish reversal ka signal deti hai. Bullish Harami Candlestick Pattern 1 long down ky baad ban’ny wala pattern hai. Yeh pattern 2 candles sy mil kar banta hai. First candle barhi hoti hai or bearish hoti hai. Next candle bullish hoti hai jis ka size chota hai. Candles ky dono taraf chota sa shadow hota hai.

Agar iss tarah ki candles 1 down trend k baad banain to iss ko technical analysis ky rules ky mutabiq bullish consider kiya jata hai. Yani ky Bullish Harami Candlestick Pattern 1 bullish reversal pattern hai.

2. Beariah Harami Candlestick Pattern:

Beariah Harami Candlestick beariah reversal ka signal deti hai. Beariah Harami Candlestick Pattern 1 long up ky baad ban’ny wala pattern hai. Yeh pattern 2 candles sy mil kar banta hai. First candle barhi hoti hai or bullish hoti hai. Next candle bearish hoti hai jis ka size chota hai. Candles ky dono taraf chota sa shadow hota hai.

Agar iss tarah ki candles 1 up trend k baad banain to iss ko technical analysis ky rules ky mutabiq bearish consider kiya jata hai. Yani ky Bearish Harami Candlestick Pattern 1 bearish reversal pattern hai.

تبصرہ

Расширенный режим Обычный режим