Assalamu alaikum dear forex friend kaise hain aap sab ummid hai khairiyat se honge dear jab Ham for ex trading business mein kam karte Hain to hamen candlesticks pattern ke bare mein complete information aur knowledge hi market ko acche tarike se analysis karne mein madad deta hai isiliye candlestick pattern ke bare mein knowledge aur information hasil karte rahana chahie dear aaj Ham jis pattern ke bare mein baat karenge vah hai "Long-legged Doji Candlestick Pattern".

Long-legged Doji Candlestick Pattern:

Dear friends Japanese candlestick bar chart ki nisbat bahut jyada popular hai kyunki yah candles bar chat ki se jyada information deti Hain kyunki main ek time frame ke open, close, high, low prices ko hi dikhata hai jabke candles Kisi bhi chij ki open, close,high, low, bullish, bearish or neutral values ki bhi Nishan dahi karti hai.

Isiliye candles stick patterns ki information ko jyada reliable Kiya jata hai aur inke sharir kiye jaane wale analysis jyada strong hote hain long legged do ji bhi ek single candle hoti hai jo ki women ek neutral candle ke taur per najar aati hai yah candle without real body mein Hoti hai jiska uper aur lower side per long equal length ki wick hoti hai.

Formation of Candle:

Dear long leg doji candle aamtaur per prices mein jyadatar dekhe jaate Hain kyunki yah ek neutral candle hoti hai isiliye yah candle ek hi waqt mein market mein buyers aur sellers ki ek jitni tadad ko jahir karti hai jo price ko ek khas position per constant rakhti hai candles ki formation kuchh is Tarah se Hoti hai.

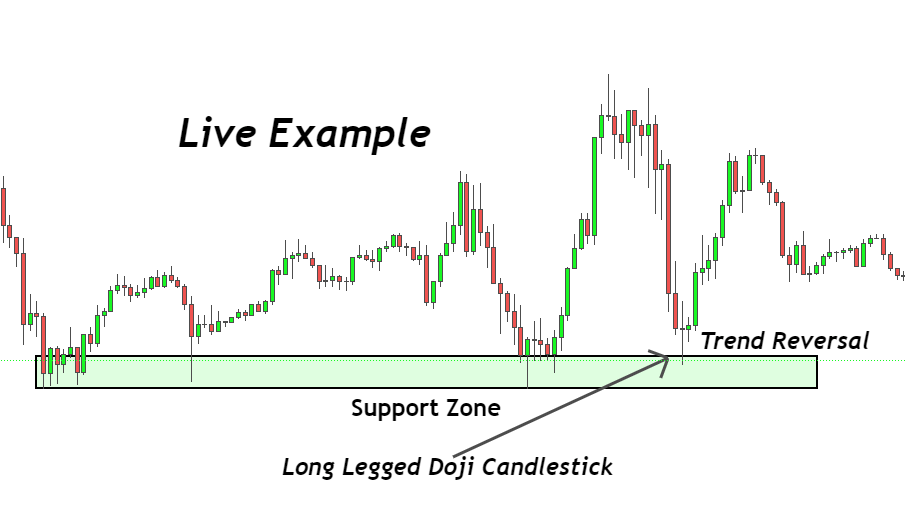

Dear long legged dodgy candlestick price ke darmiyan mein jyadatar neutral hoti hai aur iske bottom or top price per trend reversal ki salahiyat maujud Hoti hai yah candle ek real body ke bagair banne wali candle Hoti hai kyunki yah candle single hone ki vajah se police aur bearish donon Tarah ka kam kar sakti hai candle ke upper aur lower side per Shadow hota hai jo ki donon side per size mein equal hota hai.

Explanation:

Dear friends long length do ji cantastic ek real body ke bagair candle hoti hai aur iske upper aur lower side per equal length key with ya Shadow hota hai yah candle aur bearish dono taraf ka kam kar sakti hai kyunki yah candle ke open or close price ke upper aur lower side per equally long Shadow deti hai jab ke stock ki price per selected time frame ke mutabik pahle ek side per se jyada pressure per jata hai aur FIR bad mein dusri taraf se sem pressure padta hai to use surat mein yah candle banti najar aati hai Lekin wires aur salary market mein barabar pressure ki vajah se candle ke donon taraf Shadow Ban jaate Hain jabki uski real body Nahin ban paati long let lo ji candle dekhne mein sem small doji candle ki Tarah hoti hai lekin iske Apar aur lower side ka shadow bahut jyada hota hai jisse yah candle ke darmiyan mein bahut jyada Fark rakhti hai.

Trading strategy of Long-legged Doji Candlestick:

Dear forex friends long legged do ji cantastic egg single pattern hone ki wajah se traders ko jyada acche signals nahi de sakti aur sideway Market mein tujhe neutral candle hoti hai yah candle price ke top ya bottom mein thodi bahut karamat ho sakti hai lekin uske liye bhi confirmation Nahin de sakti isiliye candle ki trading se pahle market mein long term ki time frame select karna ke bad price ke top ya bottom position ko dekh lena chahie kyunki uske bad indicator jaise CCI indicator aur oscillator per value dekh Lene se overbought aur oversold zone mein hona chahie.

Stop loss:

Dear friends Long-legged Doji candlestick pattern ke mutabik jab aap kaam kar rahe hote hain to aapko chahiye ki aap stop loss ko candles ke bottom your top prices K2 pics below your above he set kare tabhi aapko market se achcha profit hasil ho sakta hai.

Long-legged Doji Candlestick Pattern:

Dear friends Japanese candlestick bar chart ki nisbat bahut jyada popular hai kyunki yah candles bar chat ki se jyada information deti Hain kyunki main ek time frame ke open, close, high, low prices ko hi dikhata hai jabke candles Kisi bhi chij ki open, close,high, low, bullish, bearish or neutral values ki bhi Nishan dahi karti hai.

Isiliye candles stick patterns ki information ko jyada reliable Kiya jata hai aur inke sharir kiye jaane wale analysis jyada strong hote hain long legged do ji bhi ek single candle hoti hai jo ki women ek neutral candle ke taur per najar aati hai yah candle without real body mein Hoti hai jiska uper aur lower side per long equal length ki wick hoti hai.

Formation of Candle:

Dear long leg doji candle aamtaur per prices mein jyadatar dekhe jaate Hain kyunki yah ek neutral candle hoti hai isiliye yah candle ek hi waqt mein market mein buyers aur sellers ki ek jitni tadad ko jahir karti hai jo price ko ek khas position per constant rakhti hai candles ki formation kuchh is Tarah se Hoti hai.

Dear long legged dodgy candlestick price ke darmiyan mein jyadatar neutral hoti hai aur iske bottom or top price per trend reversal ki salahiyat maujud Hoti hai yah candle ek real body ke bagair banne wali candle Hoti hai kyunki yah candle single hone ki vajah se police aur bearish donon Tarah ka kam kar sakti hai candle ke upper aur lower side per Shadow hota hai jo ki donon side per size mein equal hota hai.

Explanation:

Dear friends long length do ji cantastic ek real body ke bagair candle hoti hai aur iske upper aur lower side per equal length key with ya Shadow hota hai yah candle aur bearish dono taraf ka kam kar sakti hai kyunki yah candle ke open or close price ke upper aur lower side per equally long Shadow deti hai jab ke stock ki price per selected time frame ke mutabik pahle ek side per se jyada pressure per jata hai aur FIR bad mein dusri taraf se sem pressure padta hai to use surat mein yah candle banti najar aati hai Lekin wires aur salary market mein barabar pressure ki vajah se candle ke donon taraf Shadow Ban jaate Hain jabki uski real body Nahin ban paati long let lo ji candle dekhne mein sem small doji candle ki Tarah hoti hai lekin iske Apar aur lower side ka shadow bahut jyada hota hai jisse yah candle ke darmiyan mein bahut jyada Fark rakhti hai.

Trading strategy of Long-legged Doji Candlestick:

Dear forex friends long legged do ji cantastic egg single pattern hone ki wajah se traders ko jyada acche signals nahi de sakti aur sideway Market mein tujhe neutral candle hoti hai yah candle price ke top ya bottom mein thodi bahut karamat ho sakti hai lekin uske liye bhi confirmation Nahin de sakti isiliye candle ki trading se pahle market mein long term ki time frame select karna ke bad price ke top ya bottom position ko dekh lena chahie kyunki uske bad indicator jaise CCI indicator aur oscillator per value dekh Lene se overbought aur oversold zone mein hona chahie.

Stop loss:

Dear friends Long-legged Doji candlestick pattern ke mutabik jab aap kaam kar rahe hote hain to aapko chahiye ki aap stop loss ko candles ke bottom your top prices K2 pics below your above he set kare tabhi aapko market se achcha profit hasil ho sakta hai.

Long-legged Doji pattern ki formation mein kuch important points hain

Long-legged Doji pattern ki formation mein kuch important points hain

تبصرہ

Расширенный режим Обычный режим