Asslam O Alaikum!

Dear members, Aaj hum jis topic ko discuss kr rhy hain wo hai Martingle strategy. Is k bary mai information share krty hain.

Introduction.

Financial markets mein busy honay ke hawalay se logon ki dilchaspi pichlle saloon mein musalsal barh rahi hai . Is ki wajah ziyada tar woh fawaid hain jo woh is se haasil kar satke thay . Financial markets mein traders ko jo fawaid pasand hain un mein se aik yeh hai ke woh kisi bhi hikmat e amli ko baghair kisi had ke istemaal kar satke hain . Is jagah ke tajir aisi hikmat e amli bananay ke ahal hain jinhein woh tijarat mein istemaal kar satke hain . Traders wahan mojood hazaron hikmat amlyon mein se bhi intikhab kar satke hain . Is ke ilawa , sab se aam hikmat e amli jin ke baray mein tajir jantay hain woh hain beijing , price action , scalping , trendd following , aur bohat kuch . Trend ki pairwi karne wali hikmat amlyon mein , tajir rujhan ke ravayye ke lehaaz se mukhtasir ya taweel tijarat mein daakhil hotay hain . Dosri taraf , hedging strategies ko aam tor par ya to do baahum munsalik ya ghair marboot kholnay mein shaamil hoti hain jabkay is baat ko yakeeni banatay hue ke un ki tijarat ko mehfooz rakha jaye .

Importance of Martingle strategy.

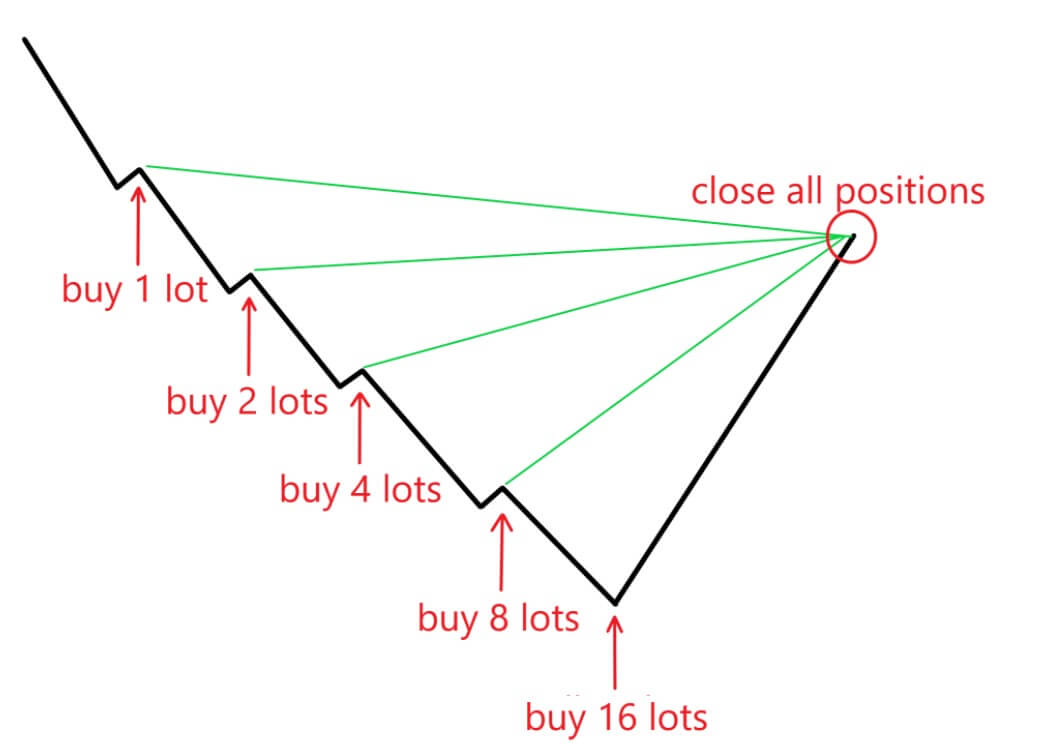

Martingale strategy ki bhot importance hai or khas tor par ye loss ko deal karny ma bhot help karti hai . Trader jb loss ko recover karny k lae trade size ko double kar lety hain to asa karny sy trader ko agr kamyabi ho jae to wo apna loss recover karny ma kamyab ho jaty hain . But trader agr ye strategy use karny ma market k achy analysis hasil na kar saky to enka account he wash ho jata hai .

Advantages of Martingle strategy.

Martingle Strategy kay bht faidy hen jin sy advantage utthna hai to serf aik pattern ki knowledge sy asa possible ni ho ga es k lae apko forex ki complete knowledge chahe hoti hai jo us trader ko he melti hai jo market ma acha time spend karta hai . Jo trader ye sochta hai k usko time b invest na karna pary or wo forex sy benefit b hasil kar ley to asa possible ni hota . is k lae struggle karna hoti hai . Jo jetni mehnat karta hai wo etny time ma esko learn karny ma kamyab ho jata hai .

Dear members, Aaj hum jis topic ko discuss kr rhy hain wo hai Martingle strategy. Is k bary mai information share krty hain.

Introduction.

Financial markets mein busy honay ke hawalay se logon ki dilchaspi pichlle saloon mein musalsal barh rahi hai . Is ki wajah ziyada tar woh fawaid hain jo woh is se haasil kar satke thay . Financial markets mein traders ko jo fawaid pasand hain un mein se aik yeh hai ke woh kisi bhi hikmat e amli ko baghair kisi had ke istemaal kar satke hain . Is jagah ke tajir aisi hikmat e amli bananay ke ahal hain jinhein woh tijarat mein istemaal kar satke hain . Traders wahan mojood hazaron hikmat amlyon mein se bhi intikhab kar satke hain . Is ke ilawa , sab se aam hikmat e amli jin ke baray mein tajir jantay hain woh hain beijing , price action , scalping , trendd following , aur bohat kuch . Trend ki pairwi karne wali hikmat amlyon mein , tajir rujhan ke ravayye ke lehaaz se mukhtasir ya taweel tijarat mein daakhil hotay hain . Dosri taraf , hedging strategies ko aam tor par ya to do baahum munsalik ya ghair marboot kholnay mein shaamil hoti hain jabkay is baat ko yakeeni banatay hue ke un ki tijarat ko mehfooz rakha jaye .

Importance of Martingle strategy.

Martingale strategy ki bhot importance hai or khas tor par ye loss ko deal karny ma bhot help karti hai . Trader jb loss ko recover karny k lae trade size ko double kar lety hain to asa karny sy trader ko agr kamyabi ho jae to wo apna loss recover karny ma kamyab ho jaty hain . But trader agr ye strategy use karny ma market k achy analysis hasil na kar saky to enka account he wash ho jata hai .

Advantages of Martingle strategy.

Martingle Strategy kay bht faidy hen jin sy advantage utthna hai to serf aik pattern ki knowledge sy asa possible ni ho ga es k lae apko forex ki complete knowledge chahe hoti hai jo us trader ko he melti hai jo market ma acha time spend karta hai . Jo trader ye sochta hai k usko time b invest na karna pary or wo forex sy benefit b hasil kar ley to asa possible ni hota . is k lae struggle karna hoti hai . Jo jetni mehnat karta hai wo etny time ma esko learn karny ma kamyab ho jata hai .

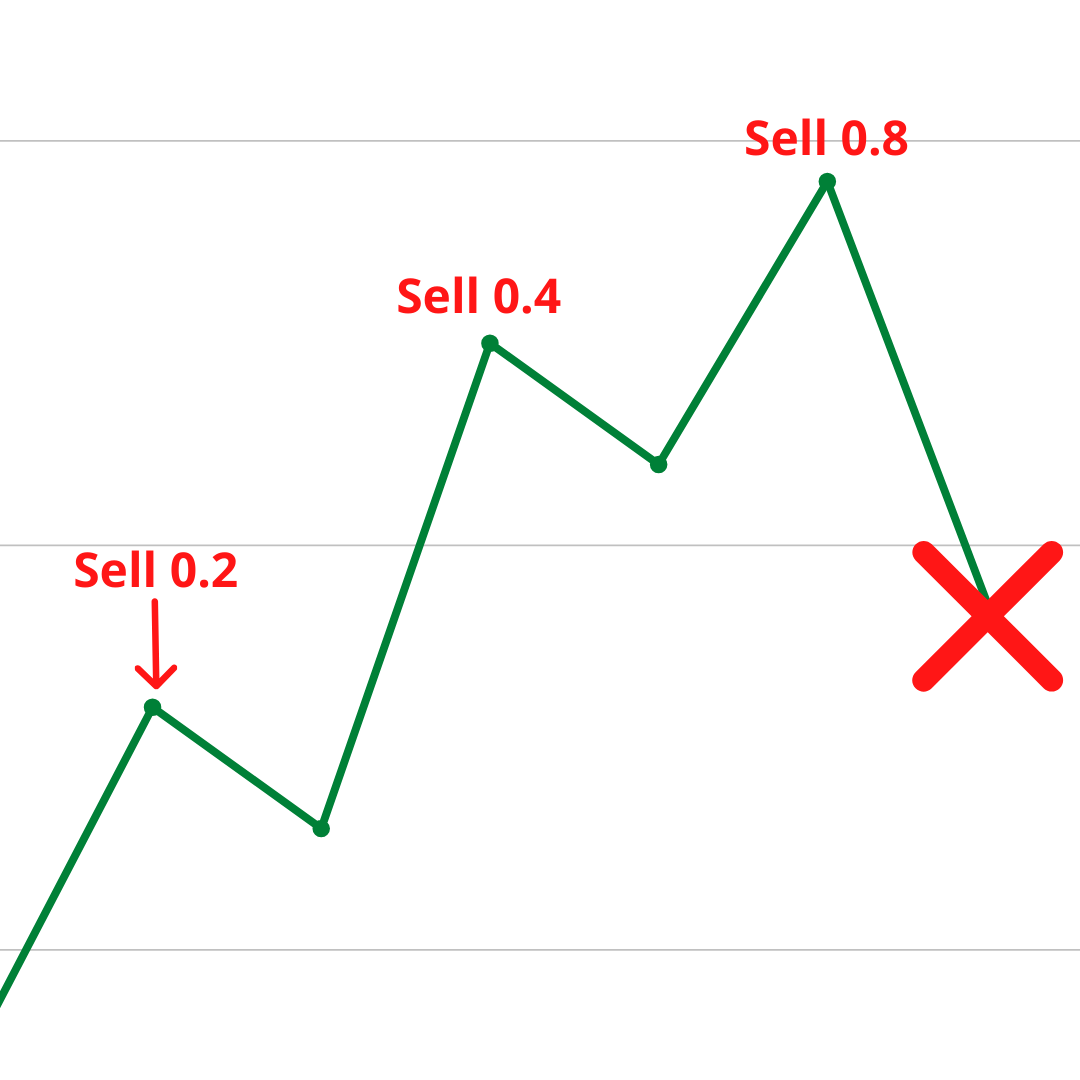

Is strategy ko use karne ke liye trader ko market ko carefully monitor karna hota hai aur usko apni trade ko manage karne ke liye technical analysis ki zaroorat hoti hai. Iske sath sath, trader ko apni emotions ko control karna bhi zaroori hai, taaki woh apni trade ko strategically manage kar sake. Martingale strategy ka istamal sirf experienced traders ke liye suitable hai, jo market ko achhi tarah se samajhte hain aur uske risks aur rewards ko bhi samajhte hain. Is strategy ka istamal karte hue trader ko apni risk management ke liye kuch rules set karna zaroori hai, jaise ke apni trade ko stop loss ke sath lagana aur apni position size ko bhi monitor karna. Martingale strategy ke istamal se, trader ki position size kuch had tak barhti rahti hai aur woh apni losses ko recover karne ke liye zyada capital bhi istamal karta hai. Lekin, jab woh market mein long time tak loss mein hota hai to uski financial condition kharab ho sakti hai. Iske alawa, Martingale strategy ke kuch drawbacks bhi hote hain, jaise ke iske istamal se trader ki financial condition unstable ho sakti hai, aur iski wajah se woh apni mental health ko bhi kharaab kar sakta hai. Iske sath sath, is strategy ko use karte hue trader ko market ke unpredictable nature ko bhi samajhna zaroori hai, aur iski wajah se woh apni trade ko manage karne ke liye flexible hona chahiye.

Is strategy ko use karne ke liye trader ko market ko carefully monitor karna hota hai aur usko apni trade ko manage karne ke liye technical analysis ki zaroorat hoti hai. Iske sath sath, trader ko apni emotions ko control karna bhi zaroori hai, taaki woh apni trade ko strategically manage kar sake. Martingale strategy ka istamal sirf experienced traders ke liye suitable hai, jo market ko achhi tarah se samajhte hain aur uske risks aur rewards ko bhi samajhte hain. Is strategy ka istamal karte hue trader ko apni risk management ke liye kuch rules set karna zaroori hai, jaise ke apni trade ko stop loss ke sath lagana aur apni position size ko bhi monitor karna. Martingale strategy ke istamal se, trader ki position size kuch had tak barhti rahti hai aur woh apni losses ko recover karne ke liye zyada capital bhi istamal karta hai. Lekin, jab woh market mein long time tak loss mein hota hai to uski financial condition kharab ho sakti hai. Iske alawa, Martingale strategy ke kuch drawbacks bhi hote hain, jaise ke iske istamal se trader ki financial condition unstable ho sakti hai, aur iski wajah se woh apni mental health ko bhi kharaab kar sakta hai. Iske sath sath, is strategy ko use karte hue trader ko market ke unpredictable nature ko bhi samajhna zaroori hai, aur iski wajah se woh apni trade ko manage karne ke liye flexible hona chahiye.  In sab challenges ke sath sath Martingale strategy ka istamal traders ke liye profitable bhi ho sakta hai, lekin yeh unke liye suitable hai jo high risk ko tolerate kar sakte hain aur market ko achhi tarah se samajhte hain. Iske alawa, Martingale strategy ke sath sath kuch traders multiple time frame analysis ka istamal bhi karte hain, taaki woh apni trade ko manage karne ke liye achhi tarah se prepare ho sake. Is strategy ke istamal se trader ko apni risk management ke liye kuch rules set karna zaroori hai, jaise ke apni trade ko stop loss ke sath lagana aur apni position size ko bhi monitor karna. Iske alawa, trader ko market ko closely monitor karna chahiye, taaki woh market ke unpredictable nature ko samajh sake aur uske sath sath apni trade ko manage kar sake. Martingale strategy ka istamal karne se pehle trader ko iske advantages aur disadvantages ke bare mein puri tarah se samajhna chahiye. Iske alawa, woh apni trading plan ko bhi carefully design karna chahiye, taaki woh apni position size ko strategically double kar sake jab woh loss mein hota hai. Lekin, is strategy ke sath sath trader ko apni mental health ko bhi focus karna chahiye, aur iski wajah se woh apni trading ko emotional level par na le jaaye. Martingale strategy ka istamal sirf experienced traders ke liye suitable hai, jo market ko achhi tarah se samajhte hain aur uske risks aur rewards ko bhi samajhte hain. Iske alawa, Martingale strategy ke sath sath kuch traders multiple time frame analysis ka istamal bhi karte hain, taaki woh apni trade ko manage karne ke liye achhi tarah se prepare ho sake.

In sab challenges ke sath sath Martingale strategy ka istamal traders ke liye profitable bhi ho sakta hai, lekin yeh unke liye suitable hai jo high risk ko tolerate kar sakte hain aur market ko achhi tarah se samajhte hain. Iske alawa, Martingale strategy ke sath sath kuch traders multiple time frame analysis ka istamal bhi karte hain, taaki woh apni trade ko manage karne ke liye achhi tarah se prepare ho sake. Is strategy ke istamal se trader ko apni risk management ke liye kuch rules set karna zaroori hai, jaise ke apni trade ko stop loss ke sath lagana aur apni position size ko bhi monitor karna. Iske alawa, trader ko market ko closely monitor karna chahiye, taaki woh market ke unpredictable nature ko samajh sake aur uske sath sath apni trade ko manage kar sake. Martingale strategy ka istamal karne se pehle trader ko iske advantages aur disadvantages ke bare mein puri tarah se samajhna chahiye. Iske alawa, woh apni trading plan ko bhi carefully design karna chahiye, taaki woh apni position size ko strategically double kar sake jab woh loss mein hota hai. Lekin, is strategy ke sath sath trader ko apni mental health ko bhi focus karna chahiye, aur iski wajah se woh apni trading ko emotional level par na le jaaye. Martingale strategy ka istamal sirf experienced traders ke liye suitable hai, jo market ko achhi tarah se samajhte hain aur uske risks aur rewards ko bhi samajhte hain. Iske alawa, Martingale strategy ke sath sath kuch traders multiple time frame analysis ka istamal bhi karte hain, taaki woh apni trade ko manage karne ke liye achhi tarah se prepare ho sake.

تبصرہ

Расширенный режим Обычный режим