Asslam O Alaikum!

Dear members, Aaj hum jis topic ko discuss karain gy wo hai tasuki Gap up, is k bary mai information share krty hain r knowledge increase krty hain.

Introduction.

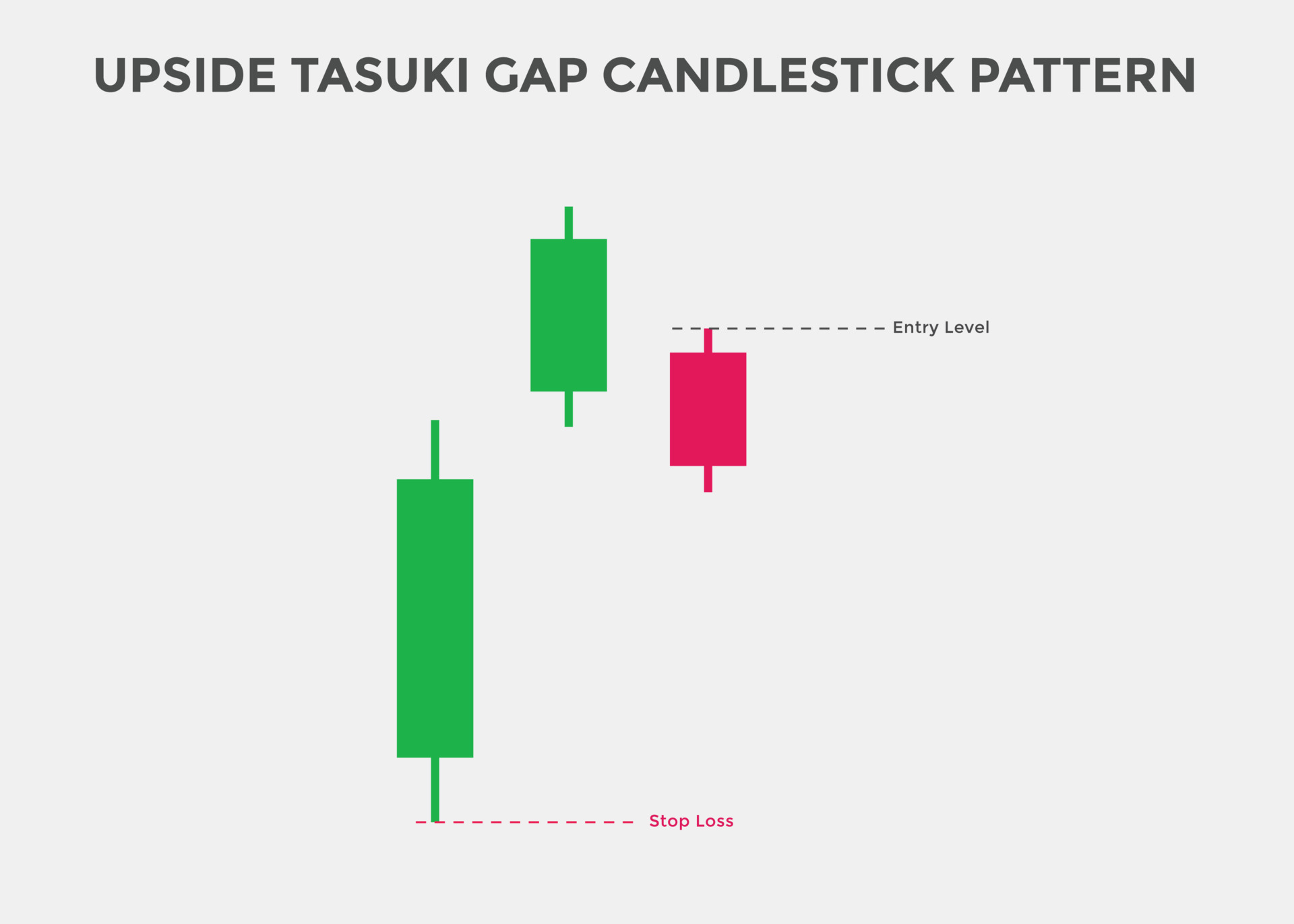

Upside Tasuki gap candlestick pattern teen candles par mushtamil aik bullish trend continuation pattern hai . Ye pattern same " Bullish side by side white lines " pattern jaisa hi hai , lekin difference sirf 3rd candle ki color ka hai . Upside Tasuki gap me 3rd candle bearish hoti hai , jab k " Bullish side by side white lines " me 3rd candle same bullish trend ki hi hoti hai , baqi dono pattern bullish trend continuation ka kaam karti hai . Ye pattern ya to qeematon k darmeyan me aur ya bullish trend me banta hai .

Identification of candlestick.

1. Upside Tasuki gap candlestick pattern ziada tar bullish trend ya qeematon k darmeyan me banta hai q k ye aik trend continuation pattern hai .

2. Pattern me shamil 1st candle bullish ya white hpti hai .

3. Pattern ki 2nd candle bhi bullish candle hoti hai , jo k 1st candle se above gap me open aur close hoti hai .

4. Pattern me shamil 3rd candle aik bearish candle hoti hai , jo k same 2nd candle k parallel me banti hai .

5. Pattern ki 2nd aur 3rd candle 1st candle se above gap me open aur close hoti hai .

Trading of Tasuki.

Upside Tasuki gap candlestick pattern trend continuation ka kaam karti hai , is waja se agar ye pattern qeematon k darmeyan me banta hai , to ye k muasar hone k asarat ziada hotw hen . Bullish trend me banne k baad pattern ki confirmation hona zarori hai , is waja se 3rd bearish trend k baad 4th candle ka intezar karna chaheye . Agar pattern k baad 4th candle aik bullish candle banti hai to ye market me buy ki entry ki position hogi . Stop loss k leye pattern k sab se lower area yani 1st candle k open position ko select karen .

Dear members, Aaj hum jis topic ko discuss karain gy wo hai tasuki Gap up, is k bary mai information share krty hain r knowledge increase krty hain.

Introduction.

Upside Tasuki gap candlestick pattern teen candles par mushtamil aik bullish trend continuation pattern hai . Ye pattern same " Bullish side by side white lines " pattern jaisa hi hai , lekin difference sirf 3rd candle ki color ka hai . Upside Tasuki gap me 3rd candle bearish hoti hai , jab k " Bullish side by side white lines " me 3rd candle same bullish trend ki hi hoti hai , baqi dono pattern bullish trend continuation ka kaam karti hai . Ye pattern ya to qeematon k darmeyan me aur ya bullish trend me banta hai .

Identification of candlestick.

1. Upside Tasuki gap candlestick pattern ziada tar bullish trend ya qeematon k darmeyan me banta hai q k ye aik trend continuation pattern hai .

2. Pattern me shamil 1st candle bullish ya white hpti hai .

3. Pattern ki 2nd candle bhi bullish candle hoti hai , jo k 1st candle se above gap me open aur close hoti hai .

4. Pattern me shamil 3rd candle aik bearish candle hoti hai , jo k same 2nd candle k parallel me banti hai .

5. Pattern ki 2nd aur 3rd candle 1st candle se above gap me open aur close hoti hai .

Trading of Tasuki.

Upside Tasuki gap candlestick pattern trend continuation ka kaam karti hai , is waja se agar ye pattern qeematon k darmeyan me banta hai , to ye k muasar hone k asarat ziada hotw hen . Bullish trend me banne k baad pattern ki confirmation hona zarori hai , is waja se 3rd bearish trend k baad 4th candle ka intezar karna chaheye . Agar pattern k baad 4th candle aik bullish candle banti hai to ye market me buy ki entry ki position hogi . Stop loss k leye pattern k sab se lower area yani 1st candle k open position ko select karen .

تبصرہ

Расширенный режим Обычный режим