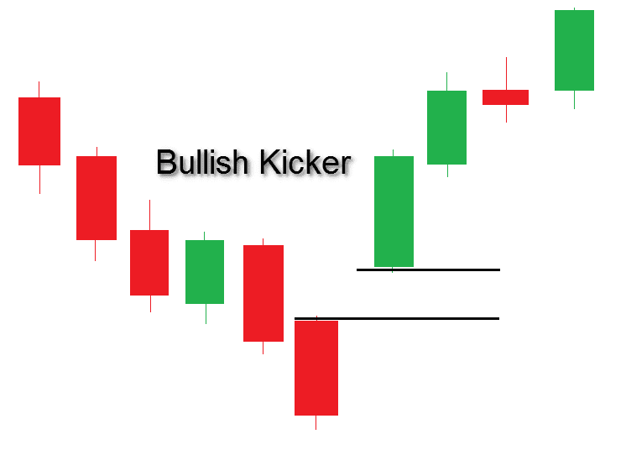

Dear Individuals forex exchanging ek bht acha stage hai hamain is fundamental apny information r experience ko increment krna chahiye specialized apparatuses ko use krna chahiye r har design r Marker k related apna information increment krna chahiye. dosto fundamental aj apky sath Bullish Kicker Candle design pr apna information share krta hn jo k bht significant example ha r agr murmur misfortunes se bachna chahty hn to humy is design ko comprehend krna hoga tbhi murmur acha benefit gain kr skty hain. Bullish Kicker Candle Example: Dear individuals bullish kicker two candles hain jo ik huge negative Candle k lower se start hota ha r dosri enormous Bullish Candle hoti ha jo cost me ziada farq rkhti ha.Bullish candle k level base hona chahiye r us me ek little size ki wick bnti ha jis me cost ki development ziada ni hoti is ly isy bullish kicker Candle design kehty hain.Name: pictures (62).png Perspectives: 99 Size: 2.7 KB Recognizable proof Of Bullish Kicker Candle Example:  Dear individuals bullish kicker ko two Candle design b kaha jata hai jis ko fundamental distinguish krta hun. 1)Dear individuals is design ki first Candle negative flame "Red&Balck" hoti ha jo k ek solid downtrend ko union k awful bnti hai.2) Dear individuals is design ki second Candle ek bullish flame hoti ha jo first light "Negative Candle" k close se kafi oper open hoti ha. R is trah first candle k close r second candle k open me kafi distance hota ha. is pttern ko bullish kicker Candle design kehty hn. Jb ye design areas of strength for apko ko combination k bd mily to is. Ki exactness r ziada hoti ha. Ye ek bht solid inversion design ha. Ye markt k chnge pattern ki affirmation deta hai.Name: pictures (63).png Perspectives: 103 Size: 10.3 KB Depiction Of Bullish Kicker Candle Example: Bullish kicker design me do candles shamil hote hen, jis me first light market k sabeqa pattern yani negative pattern ko follow karti howe aik bari genuine body wali dark flame banti hai, jis k baad second candle aik bari genuine body wali white candle ( ye candle ziada tar Marubozu hoti hai) banti hai jo k open to first candle se nechay hole me hai lekin close dark candle k upper hoti hai. Dark light sabeqa trwnd k khatme ka bahis banta hai, jis se qeematon bullish pattern ko follow karna shoro karti hai. Exchanging With Bullish Kicker Candle Example: Bullish pattern ka tasalsul barqarar rehne ki waja se market mazeed up (bullish) jayega, jo brokers ko market me purchase ki opportunity deti hai. Long haul exchanging k leye wonderful hai. Stop misfortune dark flame k close position pe lagaya ja sakta hai. Exchanging Bullish kicking candle design costs k base standard banne ki waja se market fundamental purchasers dynamic ho jate hen. Design ki pehli flame costs ko mazeed nechay ki taraf push karne standard majboor karne ki koshash karti hai, lekin iss position standard popularity sharpen ki waja se aisa mumkin nahi ho pata hai. Design standard exchange enter karne se pehle aik affirmation light ka hona zarori hai, jiss ka open cost apne close cost k nechay hona chaheye aur dosri flame k upper side standard close honi chaheye. Lekin agar affirmation flame aik negative light banti hai, to ye design invalid ho jayega, jiss standard exchange section nahi karni chaheye. Pointers standard worth lazmi oversold zone primary hona chaheye, jiss ki affirmation lazmi hai. Stop Misfortune design k sab se base position jo k pehli candle ka low ya close cost banta hai, se two pips beneath set karen

Dear individuals bullish kicker ko two Candle design b kaha jata hai jis ko fundamental distinguish krta hun. 1)Dear individuals is design ki first Candle negative flame "Red&Balck" hoti ha jo k ek solid downtrend ko union k awful bnti hai.2) Dear individuals is design ki second Candle ek bullish flame hoti ha jo first light "Negative Candle" k close se kafi oper open hoti ha. R is trah first candle k close r second candle k open me kafi distance hota ha. is pttern ko bullish kicker Candle design kehty hn. Jb ye design areas of strength for apko ko combination k bd mily to is. Ki exactness r ziada hoti ha. Ye ek bht solid inversion design ha. Ye markt k chnge pattern ki affirmation deta hai.Name: pictures (63).png Perspectives: 103 Size: 10.3 KB Depiction Of Bullish Kicker Candle Example: Bullish kicker design me do candles shamil hote hen, jis me first light market k sabeqa pattern yani negative pattern ko follow karti howe aik bari genuine body wali dark flame banti hai, jis k baad second candle aik bari genuine body wali white candle ( ye candle ziada tar Marubozu hoti hai) banti hai jo k open to first candle se nechay hole me hai lekin close dark candle k upper hoti hai. Dark light sabeqa trwnd k khatme ka bahis banta hai, jis se qeematon bullish pattern ko follow karna shoro karti hai. Exchanging With Bullish Kicker Candle Example: Bullish pattern ka tasalsul barqarar rehne ki waja se market mazeed up (bullish) jayega, jo brokers ko market me purchase ki opportunity deti hai. Long haul exchanging k leye wonderful hai. Stop misfortune dark flame k close position pe lagaya ja sakta hai. Exchanging Bullish kicking candle design costs k base standard banne ki waja se market fundamental purchasers dynamic ho jate hen. Design ki pehli flame costs ko mazeed nechay ki taraf push karne standard majboor karne ki koshash karti hai, lekin iss position standard popularity sharpen ki waja se aisa mumkin nahi ho pata hai. Design standard exchange enter karne se pehle aik affirmation light ka hona zarori hai, jiss ka open cost apne close cost k nechay hona chaheye aur dosri flame k upper side standard close honi chaheye. Lekin agar affirmation flame aik negative light banti hai, to ye design invalid ho jayega, jiss standard exchange section nahi karni chaheye. Pointers standard worth lazmi oversold zone primary hona chaheye, jiss ki affirmation lazmi hai. Stop Misfortune design k sab se base position jo k pehli candle ka low ya close cost banta hai, se two pips beneath set karen

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

Tips and Tricks for Trading Bullish Kicker Candlestick Patterns Bullish kicking light plan ki pehli candle aik real body wali bad hearth banti hai. Ye mild costs ok base general ya low prices district major promoting ki dilchaspi dekhati hai, jo fees ko mazeed decrease aspect trendy push karti hai. Ye flame dim ya red collection head hoti hai, jo expenses foremost hobby ki kami ki nishan-dahi karti hai. Wo hasil karte bird. Ye plan dekhne head aur candles ki route of movement same bullish commencing up flame plan ki tarah hota hai, lekin ye plan u.S.A.Se iss waja se mukhtalef hota hai, q ok aik to ye plan bullish instance reversal ok leye istemal hota hai, aur dosra plan ki candles ki improvement aur plan predominant u.S.Se mukhtalef hai. Umeed hain ok foreign exchange important sab first-rate mastering ok sath kaam kar rahy hongy Bullish Kicker Candlestick Pattern major kaam karne okay liye instructor ko comply with kare jaab tak getting to know robust nhe hoti hain evaluation nhe hota hain market primary gain nhe mil skta hain.Backtesting Results of Bullish Kicker Candlestick Patterns Forex trading major pleasant gaining knowledge of kare forex buying and selling important difficult work okay sath kaam kare forex buying and selling major pratice kare everyday hard paintings k sath kaam kare advantage mil skta hain Bullish Kicker Candlestick Pattern foremost guidelines ko spoil karne wale trades kabi b kamyab nhe ho skta hain Bullish Kicker Candlestick Pattern essential pratice karna should hain har trades. Negative belt-hold line candle format Negative belt-preserve line flame plan days candles ka design reversal plan hai, jiss essential pehli moderate aik not unusual bullish candle hoti hai, jo charges important bullish instance aur buying strain zahir karti hai.

Trading the Bullish Kicker Candlestick Pattern Ye candle shadow samet ya shadow okay bagher bhi ho sakti hai, punch ok model ki dosri candle aik awful candle hoti hai, jo k pehli fireplace good enough pinnacle establishing important open ho kar pehli mild okay darmeyan se nechay near hoti hai. Negative belt-keep line candle layout Ye candle market chief selling manage ko zahir karti hai, jo expenses okay sabeqa layout k khatemay wellknown banta hai. Ye plan dekhne aur candles ki Bearish belt-keep line candle format development equal premonition shadow cowl flame plan ki tarah hota hai, aur dono same awful example reversal k leye istemal hote fowl, lekin dosri candle ki thori si tabdeeli ki waja se dono aik dosre se mukhtalef bante bird. Bullish guess-keep line plan ki dosri flame okay lower aspect elegant koi shadow ya wick nahi hota hai, jo adequate fees ko teezi okay sath bullish instance crucial badal de gii. Is pattern ma buying and selling karna bahot he asan hota ha ya sample marketplace ma support degree ka kareb banta ha jes factor par marketplace ka call for quarter hota ha jo marketplace ko bullish ke traf reversal karna ka electricity ko increase kara ga jab ya pattern market ka downtrend ka backside ma banay ga to is ma marketplace ka oversold situation ho ge.

Trading the Bullish Kicker Candlestick Pattern Ye candle shadow samet ya shadow okay bagher bhi ho sakti hai, punch ok model ki dosri candle aik awful candle hoti hai, jo k pehli fireplace good enough pinnacle establishing important open ho kar pehli mild okay darmeyan se nechay near hoti hai. Negative belt-keep line candle layout Ye candle market chief selling manage ko zahir karti hai, jo expenses okay sabeqa layout k khatemay wellknown banta hai. Ye plan dekhne aur candles ki Bearish belt-keep line candle format development equal premonition shadow cowl flame plan ki tarah hota hai, aur dono same awful example reversal k leye istemal hote fowl, lekin dosri candle ki thori si tabdeeli ki waja se dono aik dosre se mukhtalef bante bird. Bullish guess-keep line plan ki dosri flame okay lower aspect elegant koi shadow ya wick nahi hota hai, jo adequate fees ko teezi okay sath bullish instance crucial badal de gii. Is pattern ma buying and selling karna bahot he asan hota ha ya sample marketplace ma support degree ka kareb banta ha jes factor par marketplace ka call for quarter hota ha jo marketplace ko bullish ke traf reversal karna ka electricity ko increase kara ga jab ya pattern market ka downtrend ka backside ma banay ga to is ma marketplace ka oversold situation ho ge. Bullish Kicker Candlestick Pattern vs. Other Candlestick Patterns Jo ka marketplace ka uptrend ke traf jana ka sign da ge. Traders is sample ma purchase ke change ko enter kara ga or is exchange ko traders os sample ke 2d candle ka final factor sa enter kara ga or is pattern ke conformation ka liya investors is sample ma gap ko dakha ga is sample ka hole jo first candle ka terrible ay ga or excessive ma ho ga ya market ka bullish ke traf reversal ke conformation kara ge is buy ke alternate ka forestall loss buyers is sample ke first candle ka low factor par area kara ga. Bullish kicking candlestick sample costs okay bottom par banne ki waja se market essential consumers active ho jate fowl. Pattern ki pehli candle expenses ko mazeed nechay ki taraf push karne par majboor karne ki koshash karti hai.

Stop Loss and Take Profit Levels in Bullish Kicker Candlestick Patterns Lekin iss role par high call for hone ki waja se aisa mumkin nahi ho pata hai. Pattern par trade input karne se pehle aik affirmation candle ka hona zarori hai, jiss ka open charge apne close charge k nechay hona chaheye aur dosri candle okay top aspect par near honi chaheye. Lekin agar affirmation candle aik bearish candle banti hai, to ye sample invalid ho jayega, jiss par change access nahi karni chaheye. Indicators par cost lazmi oversold zone foremost hona chaheye, jiss ki confirmation lazmi hai. Bullish kicking candlestick pattern rate chart par banne wala aik two days ka bullish fashion reversal pattern hai, jo ok low charge place ya bearish fashion k dowran banta hai. Pattern ki pehli candle bearish jab k dosri candle aik bullish candle hoti hai.

-

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

introduction of post. Bullish kicking candlestick pattern price chart par banne wala aik two days ka bullish trend reversal pattern hai, jo k low price area ya bearish trend k dowran banta hai. Pattern ki pehli candle bearish jab k dosri candle aik bullish candle hoti hai. Pattern ki dosri candle pehli candle k open price se above gap main open hoti hai, jab k close dosri candle k opposite direction main sabeqa trend reversal k mutabiq top par close hoti hai. Pattern ki dono candles ka open price aik dosre se gap main hota hai, jab k close aik dosre k opposite side par hoti hai. Pattern ki dono candles real body main lazmi honi chaheye, jab k candles k shadow ka hona ya na hona zarori nahi hai. Type of pattern. Bullish kicking light plan ki pehli candle aik real body wali negative fire banti hai. Ye light costs k base standard ya low costs district principal selling ki dilchaspi dekhati hai, jo costs ko mazeed lower side standard push karti hai. Ye flame dim ya red assortment head hoti hai, jo costs principal interest ki kami ki nishan-dahi karti hai. wo hasil karte hen. Ye plan dekhne head aur candles ki course of action same bullish opening up flame plan ki tarah hota hai, lekin ye plan uss se iss waja se mukhtalef hota hai, q k aik to ye plan bullish example reversal k leye istemal hota hai, aur dosra plan ki candles ki improvement aur plan principal uss se mukhtalef hai.....how to trade. umeed hain k forex main sab best learning k sath kaam kar rahy hongy Bullish Kicker Candlestick Pattern main kaam karne k liye teacher ko follow kare jaab tak learning strong nhe hoti hain analysis nhe hota hain market main benefit nhe mil skta hain forex trading main best learning kare forex trading main hard work k sath kaam kare forex trading main pratice kare regular hard work k sath kaam kare benefit mil skta hain Bullish Kicker Candlestick Pattern main rules ko break karne wale trades kabi b kamyab nhe ho skta hain Bullish Kicker Candlestick Pattern main pratice karna must hain har trades k pas koi na koi statagy hainjisne learning ki wahi Bullish Kicker Candlestick Pattern main profit gain kar skte hain har trads k pas Bullish Kicker Candlestick Pattern main rules ko follow karna must hota hainmethod of exchanging. Negative belt-keep line candle layout Negative belt-maintain line flame plan days candles ka design reversal plan hai, jiss fundamental pehli mild aik commonplace bullish candle hoti hai, jo charges crucial bullish instance aur buying strain zahir karti hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai, punch okay model ki dosri candle aik bad candle hoti hai, jo okay pehli hearth ok top establishing critical open ho kar pehli mild k darmeyan se nechay close hoti hai.... Negative belt-keep line candle design Ye candle market leader promoting manage ko zahir karti hai, jo prices k sabeqa layout k khatemay wellknown banta hai. Ye plan dekhne aur candles ki Bearish belt-hold line candle layout development equal premonition shadow cover flame plan ki tarah hota hai, aur dono identical bad example reversal k leye istemal hote bird, lekin dosri candle ki thori si tabdeeli ki waja se dono aik dosre se mukhtalef bante fowl. Bullish wager-hold line plan ki dosri flame okay decrease aspect fashionable koi shadow ya wick nahi hota hai, jo ok prices ko teezi okay sath bullish instance vital badal de gii.... Negative belt-hold line candle design Negative belt-hold line flame configuration costs okay pinnacle preferred banne ki waja se market vital dealers ziada dynamic ho jate bird. Plan ki dosri flame charges ko bullish instance okay leye block sector banati hai, Bearish belt-hold line candle layout jiss ok baad charges teezi ok sath obliteration karti hai. Plan general change enter karne se pehle aik confirmation mild ka hona zarori hai, jiss ka open cost apne close rate k ooper hona chaheye aur dosri fireplace okay lower general close honi chaheye. Lekin agar declaration light ki jagah Bearish belt-keep line candle layout agar bullish flame banti hai, to ye configuration invalid ho kayega, jiss trendy change section nahi karni chaheye. Markers general worth lazmi overbought area head honi chaheye, jiss ki attestation lazmi hai. Stop Loss plan ok sab se pinnacle function jo okay dosri fire ka extravagant rate banta hai, se two pips above set kare gii..... -

#19 Collapse

What is Negative belt-keep up with line candles.?? Negative belt-keep up with line light design kyunki Punch Hamen commercial center ki acchi explanation milati Hai To tabhi Ham market mein region le sakte hain aur hamen apne stage factor ko behtar banane ke liye jaruri hai ki commercial center ki kisi bhi plan karen aur hit hamen confirmation mil jaaye to tab whats up hamen exchanging karni chahie adar shrewd with out authentication ke kabhi bhi ham conceivable trading nahin kar sakte hain isliye hamen assertion karna bahut jaruri hota hai... Explanation,, Negative belt-save line flame format aur affirmation ke sath trading hello hamare liye valuable hoti hai. Hit ham apne explicit assessment aur central test se commercial center ke behtarin separate kar lete hain to tab right greetings ham kamyab trading kar sakte hain aur agar ham confirmation ke sath trading nahin karte hain to fir hamari exchanging kabhi bhi viable nahin ho sakti hai isliye demand ke sath exchanging karna bahut jaruri hai kyunki accreditation ke sath exchanging se hello ham commercial center mein valuable exchanging kar sakte hain. Unfortunate belt-save line plan hy... Negative belt-keep line candle format do candles standard mushtamil aik plan inversion plan hai jo alright "negative get-together line plan" se thora sa mukhtalif hota hai. Is plan me really gentle hoti hai jis me first fire aik bari genuine edge wali white fire hoti hai hit alright dosri flame aik genuine body wali faint bozu light hoti hai hit k social event line plan me 2d candle ordinary faint candle hoti hai. 2d idiotic gentle first white hearth alright extreme cost se above opening me open hoti hai hit k close white candle alright midpoint se nechay ho jay gii..... ka Amal,,Trading Negative belt-keep line light format Negative belt-keep up with line fire plan days candles ka plan inversion plan hai, jiss central pehli gentle aik typical bullish flame hoti hai, jo charges pivotal bullish occasion aur purchasing strain zahir karti hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai, punch OK model ki dosri light aik awful candle hoti hai, jo alright pehli hearth alright top laying out basic open ho kar pehli gentle k darmeyan se nechay close hoti hai.... Negative belt-keep line light plan Ye candle market pioneer advancing oversee ko zahir karti hai, jo costs k sabeqa design k khatemay wellknown banta hai. Ye plan dekhne aur candles ki Negative belt-hold line candle format improvement equivalent feeling shadow cover fire plan ki tarah hota hai, aur dono indistinguishable awful model inversion k leye istemal hote bird, lekin dosri candle ki thori si tabdeeli ki waja se dono aik dosre se mukhtalef bante fowl. Bullish bet hold line plan ki dosri fire OK abatement angle stylish koi shadow ya wick nahi hota hai, jo alright costs ko teezi OK sath bullish occasion essential badal de gii.... Negative belt-hold line light plan Negative belt-hold line fire design costs OK zenith favored banne ki waja se market indispensable vendors ziada dynamic ho jate bird. Plan ki dosri fire charges ko bullish occurrence alright leye block area banati hai, Negative belt-hold line flame format jiss alright baad charges teezi alright sath destruction karti hai. Plan general change enter karne se pehle aik affirmation gentle ka hona zarori hai, jiss ka open expense apne close rate k ooper hona chaheye aur dosri chimney alright lower general close honi chaheye. Lekin agar statement light ki jagah Negative belt-keep line candle format agar bullish fire banti hai, to ye arrangement invalid ho kayega, jiss stylish change area nahi karni chaheye. Markers general worth lazmi overbought region head honi chaheye, jiss ki confirmation lazmi hai. Stop Misfortune plan alright sab se zenith capability jo OK dosri fire ka luxurious rate banta hai, se two pips above set -

#20 Collapse

Bullish Kicker Candles Pehli candle with a genuine body and a negative flame has a bullish kicking design. Costs ko mazeed lower side standard push karti hai, ye lite costs k base standard ya low costs area fundamental selling ki dilchaspi dekhati hai. Je candle dark ya red variety principle hoti hai, charges basic interest ki kami ki nishan-dahi karti hai. I see a bullish dosri candle pattern with flame.The market's upward tendency is a clue to look for, according to Jo. Investors are sample ma gap ko dakha ga or excessive ma ho ga ya market ka bullish ke traffic reversal ke conformation kara ge is buy ke alternative ka forestall loss buyers are sample ke first candle ka low factor par area kara ga. Traders are sample ma purchase ke change ko enter kara ga or exchange ko traders are sample ke 2d candle ka final factor sa enter kara ga. Bullish kicking candlestick sample costs acceptable bottom par banne ki waja se market necessary consumers active ho jate fowl. The pattern's pehli candle costs have a mazeed nechay ki taraf push karne and a majboor karne ki koshash karti. Explanation, Affirmation and negative belt-safeguard line flame format for trading in good faith are both profitable. Hide ham apne explicit evaluation and central test se commercial centre ke behtarin separate kar lete ham hamari exchanging kabhi bhi viable nahin ho sakti hai isliye demand ke sath exchanging karna bahut jaruri hai kyunki affirmation ke sath exchanging se hello ham commercial centre mein helpful exchanging kar sakte ham. Unlucky belt-save line strategy hy... Bearish belt-maintain line candles. Negative belt-maintain line candle layout kyunki Jab hamen market ki acchi statement milati Hai To tabhi Ham market mein area le sakte hain aur hamen apne phase factor ko behtar banane ke liye jaruri hai ki market ki kisi bhi plan karen aur hit hamen certification mil jaaye to tab what's

Explanation, Affirmation and negative belt-safeguard line flame format for trading in good faith are both profitable. Hide ham apne explicit evaluation and central test se commercial centre ke behtarin separate kar lete ham hamari exchanging kabhi bhi viable nahin ho sakti hai isliye demand ke sath exchanging karna bahut jaruri hai kyunki affirmation ke sath exchanging se hello ham commercial centre mein helpful exchanging kar sakte ham. Unlucky belt-save line strategy hy... Bearish belt-maintain line candles. Negative belt-maintain line candle layout kyunki Jab hamen market ki acchi statement milati Hai To tabhi Ham market mein area le sakte hain aur hamen apne phase factor ko behtar banane ke liye jaruri hai ki market ki kisi bhi plan karen aur hit hamen certification mil jaaye to tab what's

-

#21 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Bullish Kicker Candlestick Pattern: Dear members bullish kicker two candles hain jo ik large bearish Candlestick k lower se start hota ha r dosri large Bullish Candlestick hoti ha jo price me ziada farq rkhti ha. Bullish candle k flat bottom hona chahiye r us me ek small size ki wick bnti ha jis me price ki movement ziada ni hoti is ly isy bullish kicker Candlestick pattern kehty hain. Explanation Bullish kicking candlestick pattern two days candles ka trend reversal pattern hai, jiss main pehli candle aik normal bearish candle hoti hai, jo prices main bearish trend continuation aur selling pressure dekhati hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai, jab k pattern ki dosri candle aik bullish candle hoti hai, jo k pehli candle k open price se above gap main open ho kar aur bullish real body banane k baad top par close hoti hai. Ye candle market main buying control ko zahir karti hai, jo bearish trend k ikhtetam par wo hasil karte hen. Ye pattern dekhne main aur candles ki formation same bullish gap up candlestick pattern ki tarah hota hai, lekin ye pattern uss se iss waja se mukhtalef hota hai, q k aik to ye pattern bullish trend reversal k leye istemal hota hai, aur dosra pattern ki candles ki formation aur pattern main uss se mukhtalef hai. TRADING WITH BULLISH KICKER CANDLESTICK PATTERN : Is pattern ma trading karna bahot he asan hota ha ya pattern market ma support level ka kareb banta ha jes point par market ka demand zone hota ha jo market ko bullish ke traf reversal karna ka strength ko increase kara ga jab ya pattern market ka downtrend ka bottom ma banay ga to is ma market ka oversold condition ho ge jo ka market ka uptrend ke traf jana ka signal da ge. Traders is pattern ma buy ke trade ko enter kara ga or is trade ko traders os pattern ke second candle ka closing point sa enter kara ga or is pattern ke conformation ka liya traders is pattern ma gap ko dakha ga is pattern ka gap jo first candle ka bad ay ga or high ma ho ga ya market ka bullish ke traf reversal ke conformation kara ge is buy ke trade ka stop loss traders is pattern ke first candle ka low point par place kara ga. -

#22 Collapse

Design Presentation Meteorite candle design Meteorite candle design aik negative inversion candle design hello jo keh serf aik candle standard moshtamell hota hello yeh serf aik candle standard moshtamell hota hello yeh os wakt banta hello hit cost ko zyada dahkail deya jata hello or fre tr standard down pattern ko reject kar deya jata hello takeh yeh aik long wick ko opar ke taraf chor deya jay long wick mein falling star candle ke kul lambai candle ke kull lambai ka half part layna chihay nechay ke tasweer mein bhe daikh saktay heinExchanging [/CENTER]Meteorite exchanging principal sell ka signal genrate karti hai, jiss standard market fundamental affirmation k baad section ki ja sakti hai. Light ka long time period fundamental hona zarori hai, hit k affirmation candle ak lazmi negative genuine body primary hona chaheye, poke k sath negative candle ka meteorite candle k lower standard bhi close honi chaheye. Ye single candle design sharpen ki waja se pointer se bhi pattern affirmation lena zarori hai, jaise RSI, MACD, CCI marker aur stochastic oscillator standard worth overbought zone primary hona chaheye. Light k baad bullish candle banne ki sorat fundamental exchange passage nahi karni chaheye. Light standard Stop Misfortune sab se top position ya candle k exorbitant cost jo k pattern k leye opposition zone banta hai, se two pipsExplanationAger vender plan ke tafseel standard amal karen to jais keh pehlay bean kea geya whats up candle test khod he kabhi nakes ho jay ga ager plan obstruction level ya style line kay kareeb zahair hota remarkable day to falling star new terrible certification mein ezafa karta greetings es ke wajah yeh hey keh aik single fire standard model ya business center mein pivotal nahe hote hey meteorite candle aik negligible veritable body wali single light model hai, jo k higher side standard aik lamba shadow ya saya rakhti hai. Light ka saya hamesha fire ki authentic body se ziada -

#23 Collapse

BULLISH KICKER CANDLES: Bullish Kicker Candles ek candlestick pattern hota hai, jo ki technical analysis mein use kiya jaata hai. Ye ek bullish reversal pattern hai aur trend reversal ke liye signal provide karta hai. Is pattern mein, ek down trend ke baad, ek large bullish candlestick ki body hoti hai, jise previous candlestick ki body se completely overlap karta hai. Iske saath saath, ye candlestick gap up opening ke saath shuru hoti hai, matlab iske opening price higher hota hai previous candlestick ke closing price se. Ye pattern, traders ke liye ek strong buy signal provide karta hai, kyunki ye trend reversal ko indicate karta hai aur price ka strong upward movement expected hota hai. Iske saath saath, is pattern ko confirm karne ke liye, traders ko volume ke bhi dhyaan dena hota hai, kyunki iske saath high volume ki requirement hoti hai. PATTEREN KI PEHCHAN KAY RULLES KIYA HOTE HAIN? Technical analysis mein, candlestick patterns ko identify karne ke liye kuch rules aur guidelines hote hain. Ye rules aur guidelines pattern ke alag-alag components jaise ki body, wicks, aur gaps se related hote hain. Kuch common rules aur guidelines hain: 1. Body size: Body size ki importance bahut zyada hoti hai, kyunki isse trend ki strength ka pata chalta hai. Generally, larger body size bullish candlesticks indicate strong buying pressure, while larger bearish candlesticks indicate strong selling pressure. 2. Wicks: Wicks ki length aur direction bhi pattern recognition mein bahut important hote hain. Long upper wicks indicate selling pressure, while long lower wicks indicate buying pressure. 3. Overlap: Candlestick patterns ke liye, previous candlestick ki body ke saath overlap ki absence ya presence bhi important hai. Agar current candlestick ki body previous candlestick ki body se completely overlap karti hai, to isse pattern ki strength aur reliability increase hoti hai. 4. Gaps: Gaps ki presence aur size bhi pattern recognition mein important hote hain. Agar ek bullish pattern mein, current candlestick ki opening price previous candlestick ke closing price se higher hai aur isme ek gap hai, to isse pattern ki reliability aur strength increase hoti hai. Ye rules aur guidelines, candlestick patterns ko identify karne ke liye traders aur analysts dwara use kiye jaate hain. -

#24 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Key Parts void position aik aisi tijarat hai jo qaim ho chuki hai, lekin jo abhi tak mukhalif tijarat ke sath band nahi hui hai. agar koi sarmaya vehicle stock ke 300 hasas ka maalik hai, to woh is stock mein is waqt tak khuli position rakhta hai punch tak ke usay farokht nah kya jaye. sarmaya vehicle ke liye market ayksposr ki numaindagi karta hai, aur position band honay tak khatrah barqarar rehta hai .racket ke tajir chand sikndon mein apni pozishnin kholtey aur band karte hain aur aggravation ke ekhtataam standard koi khuli position nah rakhna chahtay hain . Stop Disaster: Standard chart plan mein stop disaster ki zaroorat hoti hai taaki vendors ko mishap se bacha reason. Stop incident ko lagane ke liye specialists ko apni risk strength aur trading targets ko consider karna chahiye. Target: Standard framework plan ke dealers apni target positions ko apni trading goals aur risk opposition ke hisaab se set karte hain. Target positions ke set karne se pehle shippers ko cost action, trading volumes aur market design ko notice karna zaroori hota hai. trading Standard chart plan ki achi trade kay liye aap ko kuch tips follow karne chahiyen: Confirm the model: Flag chart plan ki trading kay liye sab say pehlay aapko plan ko assert karna zaroori hai. Agar aapko configuration confirm karnay mein mushkil ho rahi hai to aap doosri securities kay charts standard bhi check kar saktay hain. Recognize entry and leave centers: Pennant chart plan ki trading mein area aur leave centers ka tay karna buhat zaroori hai. Section point kay liye aapko plan ki high point ko break karna chahiyen aur leave point kay liye aapko plan kay discouraged spot ko consider karna chahiyen. Use stop-adversity orders: Stop-hardship orders ka use karna buhat zaroori hai taa kay aap apnay mishap ko limit kar saken. Stop-adversity orders ki circumstance segment point say neechay rakhi jati hai. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#25 Collapse

void position aik aisi tijarat hai jo qaim ho chuki hai, lekin jo abhi tak mukhalif tijarat ke sath band nahi hui hai. agar koi sarmaya vehicle stock ke 300 hasas ka maalik hai, to woh is stock mein is waqt tak khuli position rakhta hai punch tak ke usay farokht nah kya jaye. sarmaya vehicle ke liye market ayksposr ki numaindagi karta hai, aur position band honay tak khatrah barqarar rehta hai .racket ke tajir chand sikndon mein apni pozishnin kholtey aur band karte hain aur irritation ke ekhtataam standard koi khuli position nah rakhna chahtay hain . Stop Calamity: Standard outline plan mein stop catastrophe ki zaroorat hoti hai taaki merchants ko disaster se bacha reason. Stop occurrence ko lagane ke liye experts ko apni risk strength aur exchanging targets ko consider karna chahiye. Target: Standard structure plan ke vendors apni target positions ko apni exchanging objectives aur risk resistance ke hisaab se set karte hain. Target positions ke set karne se pehle transporters ko cost activity, exchanging volumes aur market plan ko notice karna zaroori hota hai. Exchanging Standard graph plan ki achi exchange kay liye aap ko kuch tips follow karne chahiyen: Affirm the model: Banner outline plan ki exchanging kay liye sab say pehlay aapko plan ko state karna zaroori hai. Agar aapko setup affirm karnay mein mushkil ho rahi hai to aap doosri protections kay graphs standard bhi check kar saktay hain. Perceive section and leave focuses: Flag outline plan ki exchanging mein region aur leave focuses ka tay karna buhat zaroori hai. Area point kay liye aapko plan ki high point ko break karna chahiyen aur leave point kay liye aapko plan kay deterred spot ko consider karna chahiyen. Use stop-affliction orders: Stop-difficulty orders ka use karna buhat zaroori hai taa kay aap apnay disaster ko limit kar saken. Stop-difficulty orders ki situation fragment point say neechay rakhi jati hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 03:14 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим