What is Bollinger Bands (BB) indicator?

yeh metric mayaari tarmeem ke sath khususiyaat ki tadaad dekhata hai. yeh isharay market ke halaat par munhasir hai. agar is par ghair yakeeni sorat e haal peda hoti hai, to is ke nateejay mein doghla pan barh jata hai ya stitionary auqaat mein kami waqay hoti hai.

Bollinger baind dobarah qeemat ya isharay ke chart par lagaye jatay hain. istehkaam ki muddat ke oopri aur nichale hudood ke andar qeemat mustaqil rehti hai is ki khasusiyat hai. dogli harkiyaat ko chaalo karne ke douran inhen tabdeeli ke liye mazeed gunjaish darkaar hoti hai.

Bollinger baind ke coverage honay ke baad qeemat mein tabdeeli ki sharah dekhi gayi. agar qeemat muqarara had ke andar nahi reh sakti hai, to rujhan jari rahay ga. rujhan ke ulat jane ka ulta amal is waqt hota hai jab isharay ka bairooni urooj aur zawaal aik hi androoni rujhan ke sath hota hai. baind ki qeemat ka amal mukhalif intahaa tak pounchanay ka paband hai.

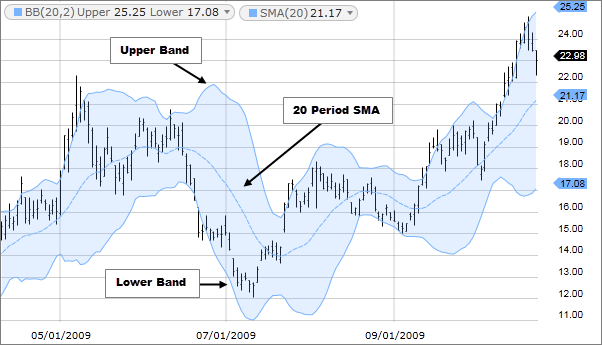

Bollinger baind mein teen linon ka dhancha hota hai jis mein oopri, nichli aur darmiyani lakerain shaamil hoti hain. center line ka kirdaar aik range ke andar baqaida waqfon par chart ki mutharrak ost haalat ko dikhnana hai.

darmiyani baind aik aam harkat ka namona dekhata hai, jahan ( hajam ) cl ( band ) auqaat x ( muddat ) ka majmoa hai. taap line ( top ) dikhaane ke liye, is ke urooj ke douran aafsit ka taayun karne ka tareeqa istemaal kya jata hai. oopri line ka taayun darmiyani baind ki qader ko shaamil kiye gaye mayaari inhiraf ki tadaad ke majmoa ki qader mein shaamil kar ke kya jata hai. zaireen matawazi ka taayun mukhalif tareeqay se kya jata hai - bunyadi wast se mayaari inhiraf ki tadaad ko ghata kar.

mayaari inhiraf ( sd ) ki qader ko aik makhsoos waqt ke waqfay ke liye band honay wali qeematon ko jama kar ke nikala jata hai. baind baondri paira metar ke bilkul durust hisaab kitaab ke liye, 20 muddat ke darmiyani moving average aur do mayaari inhiraf par mabni data tajweez kya jata hai. agar mutalea 10 adwaar se kam istemaal karta hai, to moving average ki durustagi kaafi malomati nahi hogi

yeh metric mayaari tarmeem ke sath khususiyaat ki tadaad dekhata hai. yeh isharay market ke halaat par munhasir hai. agar is par ghair yakeeni sorat e haal peda hoti hai, to is ke nateejay mein doghla pan barh jata hai ya stitionary auqaat mein kami waqay hoti hai.

Bollinger baind dobarah qeemat ya isharay ke chart par lagaye jatay hain. istehkaam ki muddat ke oopri aur nichale hudood ke andar qeemat mustaqil rehti hai is ki khasusiyat hai. dogli harkiyaat ko chaalo karne ke douran inhen tabdeeli ke liye mazeed gunjaish darkaar hoti hai.

Bollinger baind ke coverage honay ke baad qeemat mein tabdeeli ki sharah dekhi gayi. agar qeemat muqarara had ke andar nahi reh sakti hai, to rujhan jari rahay ga. rujhan ke ulat jane ka ulta amal is waqt hota hai jab isharay ka bairooni urooj aur zawaal aik hi androoni rujhan ke sath hota hai. baind ki qeemat ka amal mukhalif intahaa tak pounchanay ka paband hai.

Bollinger baind mein teen linon ka dhancha hota hai jis mein oopri, nichli aur darmiyani lakerain shaamil hoti hain. center line ka kirdaar aik range ke andar baqaida waqfon par chart ki mutharrak ost haalat ko dikhnana hai.

darmiyani baind aik aam harkat ka namona dekhata hai, jahan ( hajam ) cl ( band ) auqaat x ( muddat ) ka majmoa hai. taap line ( top ) dikhaane ke liye, is ke urooj ke douran aafsit ka taayun karne ka tareeqa istemaal kya jata hai. oopri line ka taayun darmiyani baind ki qader ko shaamil kiye gaye mayaari inhiraf ki tadaad ke majmoa ki qader mein shaamil kar ke kya jata hai. zaireen matawazi ka taayun mukhalif tareeqay se kya jata hai - bunyadi wast se mayaari inhiraf ki tadaad ko ghata kar.

mayaari inhiraf ( sd ) ki qader ko aik makhsoos waqt ke waqfay ke liye band honay wali qeematon ko jama kar ke nikala jata hai. baind baondri paira metar ke bilkul durust hisaab kitaab ke liye, 20 muddat ke darmiyani moving average aur do mayaari inhiraf par mabni data tajweez kya jata hai. agar mutalea 10 adwaar se kam istemaal karta hai, to moving average ki durustagi kaafi malomati nahi hogi

istehkaam ki muddat ke oopri aur nichale hudood ke andar qeemat mustaqil rehti hai is ki khasusiyat hai. dogli harkiyaat ko chaalo karne ke douran inhen tabdeeli ke liye mazeed gunjaish darkaar hoti hai.Bollinger baind ke inclusion honay ke baad qeemat mein tabdeeli ki sharah dekhi gayi. agar qeemat muqarara had ke andar nahi reh sakti hai, to rujhan jari rahay ga. rujhan ke ulat jane ka ulta amal is waqt hota hai hit isharay ka bairooni urooj aur zawaal aik hello androoni rujhan ke sath hota hai. baind ki qeemat ka amal mukhalif intahaa tak pounchanay ka paband hai.Bollinger baind mein youngster linon ka dhancha hota hai jis mein oopri, nichli aur darmiyani lakerain shaamil hoti hain. focus line ka kirdaar aik range ke andar baqaida waqfon standard graph ki mutharrak ost haalat ko dikhnana hai.darmiyani baind aik aam harkat ka namona dekhata hai, jahan ( hajam ) cl ( band ) auqaat x ( muddat ) ka majmoa hai. taap line ( top ) dikhaane ke liye, is ke urooj ke douran aafsit ka taayun karne ka tareeqa istemaal kya jata hai. oopri line ka taayun darmiyani baind ki qader ko shaamil kiye gaye mayaari inhiraf ki tadaad ke majmoa ki qader mein shaamil kar ke kya jata hai. zaireen matawazi ka taayun mukhalif tareeqay se kya jata hai - bunyadi wast se mayaari inhiraf ki tadaad ko ghata kar.mayaari inhiraf ( sd ) ki qader ko aik makhsoos waqt ke waqfay ke liye band honay wali qeematon ko jama kar ke nikala jata hai.

istehkaam ki muddat ke oopri aur nichale hudood ke andar qeemat mustaqil rehti hai is ki khasusiyat hai. dogli harkiyaat ko chaalo karne ke douran inhen tabdeeli ke liye mazeed gunjaish darkaar hoti hai.Bollinger baind ke inclusion honay ke baad qeemat mein tabdeeli ki sharah dekhi gayi. agar qeemat muqarara had ke andar nahi reh sakti hai, to rujhan jari rahay ga. rujhan ke ulat jane ka ulta amal is waqt hota hai hit isharay ka bairooni urooj aur zawaal aik hello androoni rujhan ke sath hota hai. baind ki qeemat ka amal mukhalif intahaa tak pounchanay ka paband hai.Bollinger baind mein youngster linon ka dhancha hota hai jis mein oopri, nichli aur darmiyani lakerain shaamil hoti hain. focus line ka kirdaar aik range ke andar baqaida waqfon standard graph ki mutharrak ost haalat ko dikhnana hai.darmiyani baind aik aam harkat ka namona dekhata hai, jahan ( hajam ) cl ( band ) auqaat x ( muddat ) ka majmoa hai. taap line ( top ) dikhaane ke liye, is ke urooj ke douran aafsit ka taayun karne ka tareeqa istemaal kya jata hai. oopri line ka taayun darmiyani baind ki qader ko shaamil kiye gaye mayaari inhiraf ki tadaad ke majmoa ki qader mein shaamil kar ke kya jata hai. zaireen matawazi ka taayun mukhalif tareeqay se kya jata hai - bunyadi wast se mayaari inhiraf ki tadaad ko ghata kar.mayaari inhiraf ( sd ) ki qader ko aik makhsoos waqt ke waqfay ke liye band honay wali qeematon ko jama kar ke nikala jata hai.  baind baondri paira metar ke bilkul durust hisaab kitaab ke liye, 20 muddat ke darmiyani moving normal aur do mayaari inhiraf standard mabni information tajweez kya jata hai. agar mutalea 10 adwaar se kam istemaal karta hai, to moving normal ki durustagi kaafi malomati nahi hogi

baind baondri paira metar ke bilkul durust hisaab kitaab ke liye, 20 muddat ke darmiyani moving normal aur do mayaari inhiraf standard mabni information tajweez kya jata hai. agar mutalea 10 adwaar se kam istemaal karta hai, to moving normal ki durustagi kaafi malomati nahi hogi

1. Three Lines: Bollinger Bands ek set of three lines hoti hain jo price chart par dikhayi deti hain. 2. Middle Band: Yeh pehli line hoti hai aur isay "Middle Band" kehte hain. Middle Band usually simple moving average (SMA) ka istemal karke calculate ki jati hai. SMA, price ki historical average hoti hai. 3. Upper Band: Dusri line "Upper Band" hoti hai, jo Middle Band ke upper standard deviation ke hisab se calculate ki jati hai. Upper Band volatility ko darust karti hai aur price ke upper limits ko represent karti hai. 4. Lower Band: Teesri line "Lower Band" hoti hai, jo Middle Band ke lower standard deviation ke hisab se calculate ki jati hai. Lower Band bhi volatility ko darust karti hai aur price ke lower limits ko represent karti hai. Bollinger Bands Ka Maqsad: Bollinger Bands ka maqsad price volatility aur potential trend reversals ko identify karna hai. Jab market mein price volatility barh jati hai, to Bollinger Bands widen hoti hain, aur jab price volatility kam hoti hai, to Bollinger Bands contract hoti hain. Isse traders ko ye idea mil jata hai ke market kitna volatile hai. Bollinger Bands ke zariye traders trend reversal aur trend continuation ke signals bhi dhoondhte hain. Price jab Upper Band ya Lower Band se bahar nikalti hai, to isse trend reversal ka signal samjha jata hai. Lekin, ye signal doosre technical indicators aur market context ke saath dekha jata hai. Bollinger Bands Ka Istemal Kaise Hota Hai: Bollinger Bands ka istemal trading decisions ke liye karta hai. Neeche diye gaye kuch common ways hain jinme Bollinger Bands ka istemal hota hai: 1. Price Bands: Jab price Upper Band se bahar nikalti hai, to traders sell positions enter kar sakte hain, expecting price mein giravat. Jab price Lower Band se bahar nikalti hai, to traders buy positions enter kar sakte hain, expecting price mein barhavat. 2. Volatility Analysis: Bollinger Bands ka istemal market volatility ko measure karne mein hota hai. Agar Bollinger Bands widen hoti hain, to iska matlab hai ke market volatile hai aur traders isse trading decisions banate hain. 3. Divergence Analysis: Bollinger Bands ke saath doosre technical indicators ko combine karke divergence analysis ki jati hai, jisse trend reversals aur trend continuations ka pata lagaya jata hai. 4. Support aur Resistance: Bollinger Bands ka Middle Band support ya resistance level ke roop mein bhi istemal hota hai. Agar price Middle Band se bahar nikalti hai, to isse support ya resistance breach ka signal samjha jata hai. Bollinger Bands ek versatile indicator hai jo market analysis ke liye istemal hota hai, lekin yaad rahe ke iska istemal hamesha doosre factors aur technical indicators ke saath kiya jata hai. Risk management hamesha ahem hota hai aur trading decisions ko carefully plan aur execute karna zaroori hai. Top of Form

1. Three Lines: Bollinger Bands ek set of three lines hoti hain jo price chart par dikhayi deti hain. 2. Middle Band: Yeh pehli line hoti hai aur isay "Middle Band" kehte hain. Middle Band usually simple moving average (SMA) ka istemal karke calculate ki jati hai. SMA, price ki historical average hoti hai. 3. Upper Band: Dusri line "Upper Band" hoti hai, jo Middle Band ke upper standard deviation ke hisab se calculate ki jati hai. Upper Band volatility ko darust karti hai aur price ke upper limits ko represent karti hai. 4. Lower Band: Teesri line "Lower Band" hoti hai, jo Middle Band ke lower standard deviation ke hisab se calculate ki jati hai. Lower Band bhi volatility ko darust karti hai aur price ke lower limits ko represent karti hai. Bollinger Bands Ka Maqsad: Bollinger Bands ka maqsad price volatility aur potential trend reversals ko identify karna hai. Jab market mein price volatility barh jati hai, to Bollinger Bands widen hoti hain, aur jab price volatility kam hoti hai, to Bollinger Bands contract hoti hain. Isse traders ko ye idea mil jata hai ke market kitna volatile hai. Bollinger Bands ke zariye traders trend reversal aur trend continuation ke signals bhi dhoondhte hain. Price jab Upper Band ya Lower Band se bahar nikalti hai, to isse trend reversal ka signal samjha jata hai. Lekin, ye signal doosre technical indicators aur market context ke saath dekha jata hai. Bollinger Bands Ka Istemal Kaise Hota Hai: Bollinger Bands ka istemal trading decisions ke liye karta hai. Neeche diye gaye kuch common ways hain jinme Bollinger Bands ka istemal hota hai: 1. Price Bands: Jab price Upper Band se bahar nikalti hai, to traders sell positions enter kar sakte hain, expecting price mein giravat. Jab price Lower Band se bahar nikalti hai, to traders buy positions enter kar sakte hain, expecting price mein barhavat. 2. Volatility Analysis: Bollinger Bands ka istemal market volatility ko measure karne mein hota hai. Agar Bollinger Bands widen hoti hain, to iska matlab hai ke market volatile hai aur traders isse trading decisions banate hain. 3. Divergence Analysis: Bollinger Bands ke saath doosre technical indicators ko combine karke divergence analysis ki jati hai, jisse trend reversals aur trend continuations ka pata lagaya jata hai. 4. Support aur Resistance: Bollinger Bands ka Middle Band support ya resistance level ke roop mein bhi istemal hota hai. Agar price Middle Band se bahar nikalti hai, to isse support ya resistance breach ka signal samjha jata hai. Bollinger Bands ek versatile indicator hai jo market analysis ke liye istemal hota hai, lekin yaad rahe ke iska istemal hamesha doosre factors aur technical indicators ke saath kiya jata hai. Risk management hamesha ahem hota hai aur trading decisions ko carefully plan aur execute karna zaroori hai. Top of Form

تبصرہ

Расширенный режим Обычный режим