INTRODUCTION:

Dear forex members ummid karta hun ki aap sab khairiyat se honge aur Forex se daily ke message per aur Forex se daily ke message per acchi earning kar rahe honge.. dear Forex members for access rescue business hai jismein hamen profit kiske sath sath loss dear Forex members for access rescue business hai jismein hamen profit kiske sath sath loss bhi slow se bachne ke liye important hai ki Ham Forex ke bare mein knowledge aur experience hasil Karen Taki hamara jyada loss na slow se bachne ke liye important hai ki Ham Forex ke bare mein knowledge aur experience hasil Karen Taki hamara jyada loss na ho. For extra bahut sare patient we use hote hain jinki help se have successful studying kar sakte hain.

UPSIDE TASUKI CANDLESTCICK PATTERN:

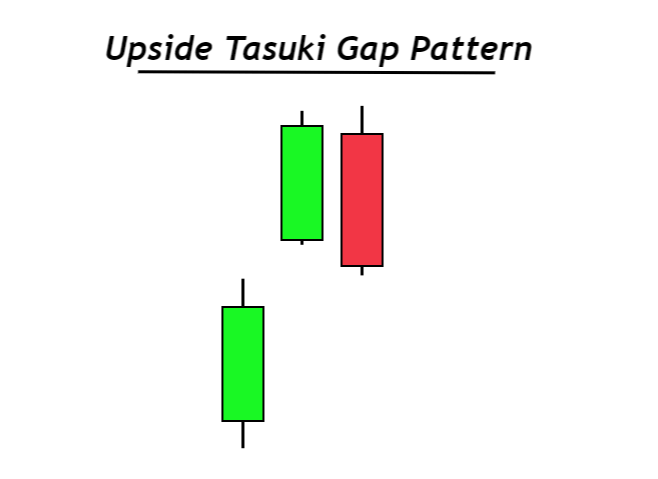

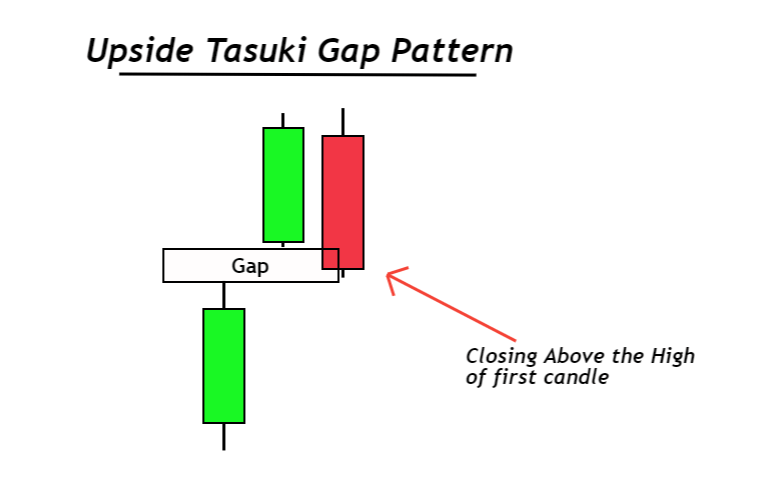

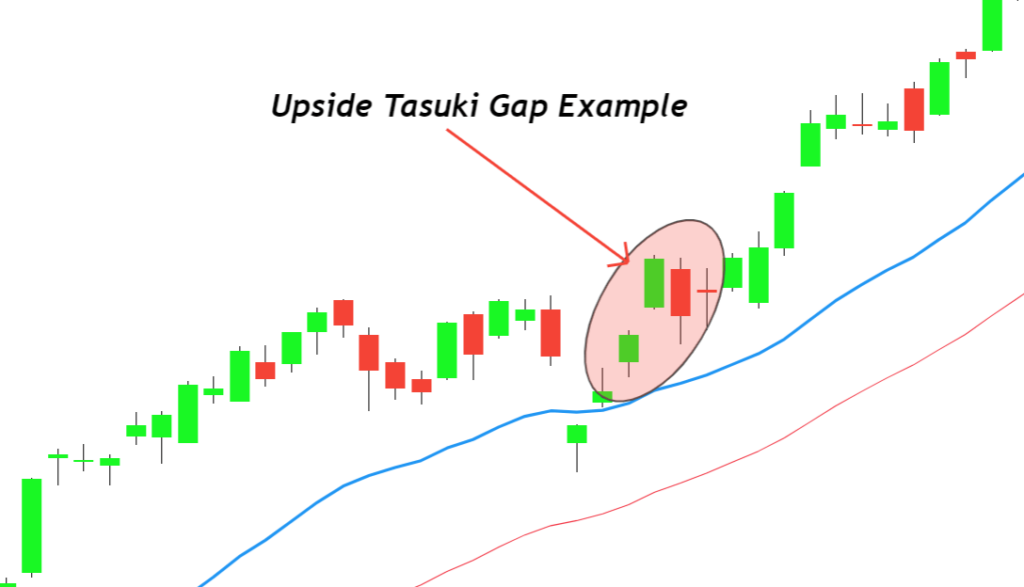

Dear forex members upside Tasuki Candlestcick pattern teen candles for mustameez ek majbut trend continuation pattern hai. Jo crisis ki high level ya police train mein banta hai Jo crisis ki high level ya police train mein banta hai. Upside the sowki gap gastric pattern mein teen candle shamil hoti hain yah hamen market ke train ke bare mein indicate Karti Hain jismein Upside the sowki gap gastric pattern mein teen candle shamil hoti hain yah hamen market ke train ke bare mein indicate Karti Hain jismein pahle Peri channel white kendal hoti hai jo ki market mein current police strength ko ke bare mein batati hai aur hamen market ke positive signal ke bare mein batati hai aur hamen market ke positive signal deti.

IDENTIFICATION OF UPSIDE TASUKI GAP CANDLESTCICK PATTERN:

Dear forex members upside Tasuki Candlestcick pattern teen ke Dal ka ek police continuation pattern hai jismein pahle 2 ke 10 word ya green color ki hoti hain aur yah donon police hoti hain jabki dosti ke andar black ya red color ki hoti hai aur yah candle Barish hoti hai pattern mein shamil pahle do kenal police banne ka matlab yah hota hai ki market off side jayegi aur abhi tak yah extra indication hota hai yah Nahin ismein Kisi bhi kism ki gunjaish Nahin Hoti ki market niche ki taraf fall karegi. Iski vajah se yah donon ke distrong real body mein banne ke साथ-साथ ek dusre se gap mein bhi banti Hain jiski TC ki nal dusri candle aur gap mein close hone ka matlab yah hota hai ki market apna current ko hi follow karegi yah Nahin Veri strain ko koshish nakam banaa chuki Hogi.

USE OF UPSIDE TASUKI GAP CANDLESTCICK PATTERN:

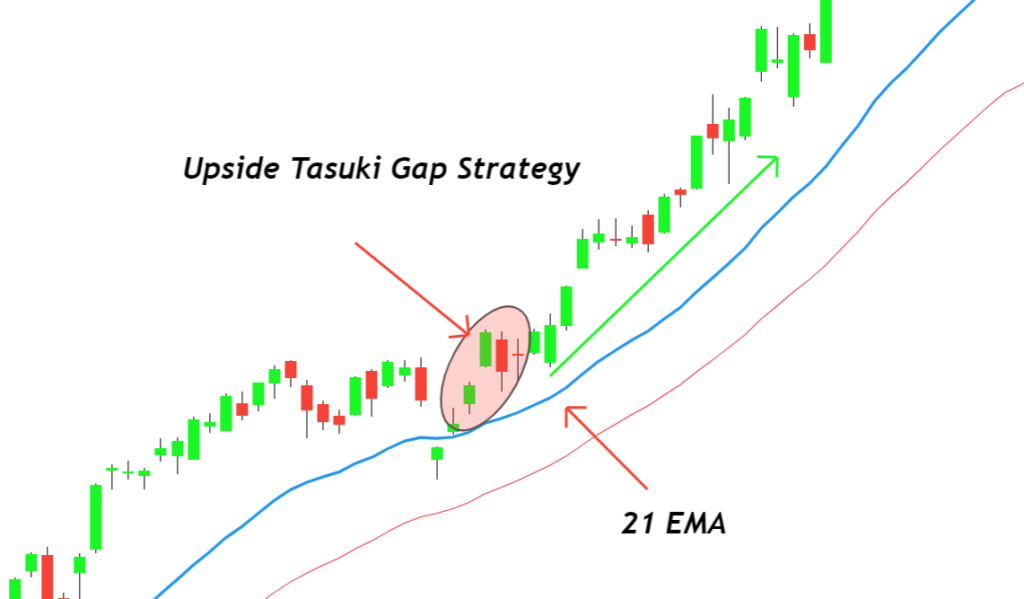

Dear forex members upside the soake get a stick pattern mare hit my bike hoti hai patron for trading karne se pehle hame marge information hai jo ke exhaust signal conservation candle plus candle charge topar close hone chahiye. Is Tarah se hamen market mein ek positive signal Mil Jata hai jiske bad trader is per Karke apni position ko majbut banaa dete Hain lekin petrol jyada strong hona jaruri Nahin Hota is vajah se hamen pattern per sabse kam position ya pahle kinnar ke lower per top loss ka ilaaj mein istemal karna chahie.

STOP LOSS AND TAKE PROFIT:

Dear forex members Kisi bhi setting karne se pahle hamen chahie ki Ham is per stop loss aur take profit ka last mein use Karen isase yah hota hai ki hamari trade bi safe rahti hai aur hamara account bhi wash hone se bacha rahata hai kyunki jis prices per Ham staff Los lagate Hain vahan per platform kar khud bahut close ho jaati hai aur hamen market ko बार-बार dekhna Nahin padta Is Tarah hamara time bhi West hone se bacha rahata hai isliye important hai ki Ham stop loss aur take profit ka last mein use Karen.

تبصرہ

Расширенный режим Обычный режим