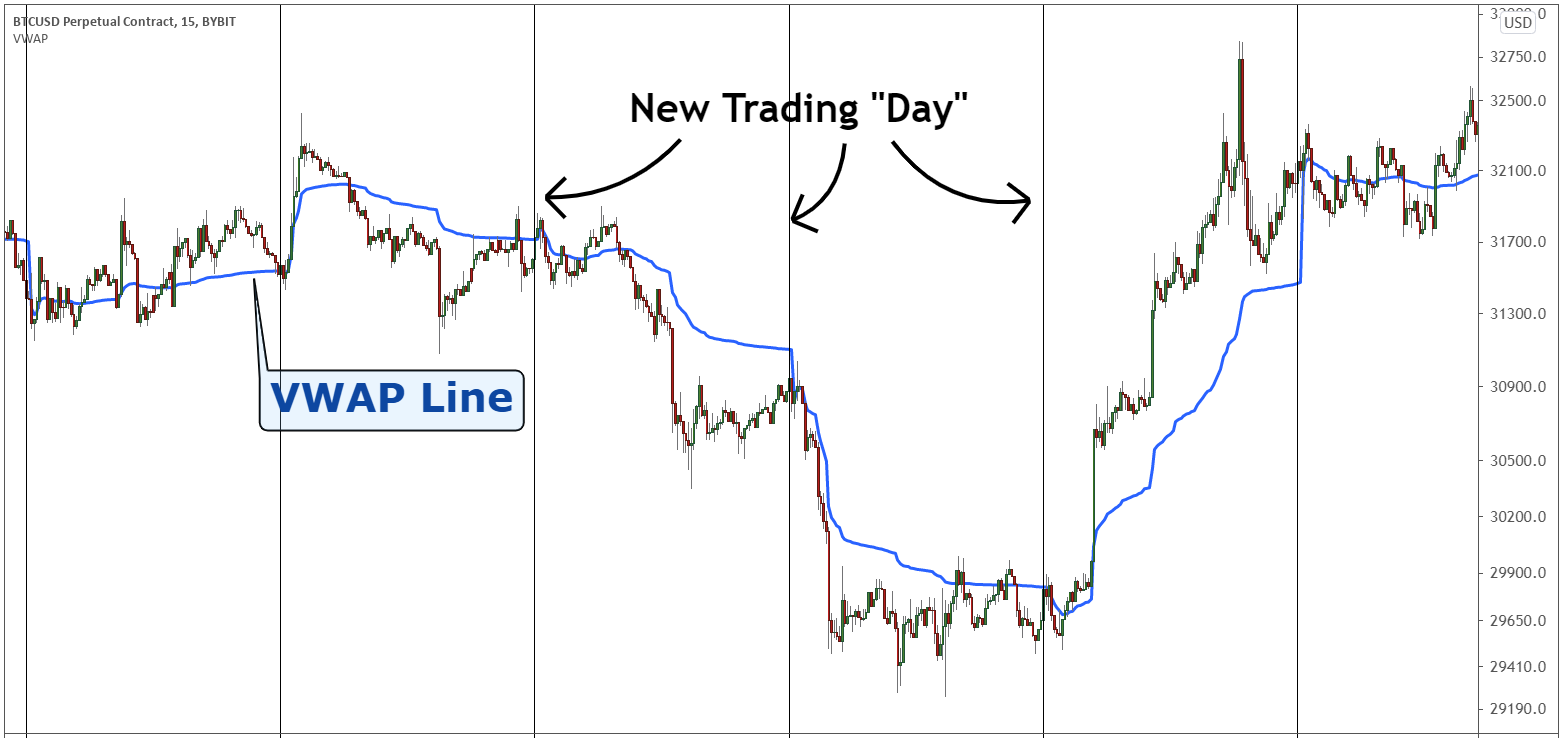

Dear friend Forex Mein Ek term v w a p use Hoti Hai Jo Ek powerful indicator Hai Jiske actual meaning hai volume vate average pric isase Hamen yah Pata Chalta Hai Ki market ki value kis Taraf ja rahi hai Taki Ham Usi hisab se trade Laga Saken Agar market ki value up and down ho rahi hai To Ham use hisab se apni trader lagaenge Jab Ke vi w a p se average kam Mein Pata Chal jata hai aur isase Hamen yah bhi Pata Chalta Hai Ki Jo broker hai vah kahan per trader Lagana chahta hai aur Market kitne lakh de sakti hai aur Kitna profit Dega kis Parv per Karke Hamen trade Lagani chahie

Definition

Definition ki baat ki Jaaye to Iske real chart Mein effectiveness ya execution ki To ismein Ham koi bhi player select karne ke bad Uske chart ko properli observe karne ke candle ki madad se trend Mein ine 40 ko aasani se calculate karne ke bad Apne trade execute kar sakte hain

VWAP ki working strategy

Iski working strategy bahut simple hai aap chart mein aasani se isko draw kar sakte hain ismein Dekhen ki aap vartically ismein price ko show Karen aur original ya horizontally Iske volume ko up and down dekh sakte hain agar aap samajhte hain next move predicted kar sakte hain to iski men vajah yah bhi ho sakti hai ki aapki Jo VW a bhi effectiveness kahan tak ja rahi hai

Effects of strategic

V w strategy useful hone ke sath technical strategy hai Jisko learn karna bahut jaruri hai Aur Is per price action Hamare Liye ise Hamen price ki breakdown hone ka andaza ho sakta hai price action strateg ke liye Hamen chart Mein sport and distance level ko bhi mind Mein Rakhna hoga aur isase Hamen Kafi help mil sakti hai Kafi help mil sakti hai Jab market retest per Aati Hai To is trade Lagani Hai Kyunki hamare pass tab mauka hota hai ki Jab Ham market ki resho Ko Dekhkar

Definition

Definition ki baat ki Jaaye to Iske real chart Mein effectiveness ya execution ki To ismein Ham koi bhi player select karne ke bad Uske chart ko properli observe karne ke candle ki madad se trend Mein ine 40 ko aasani se calculate karne ke bad Apne trade execute kar sakte hain

VWAP ki working strategy

Iski working strategy bahut simple hai aap chart mein aasani se isko draw kar sakte hain ismein Dekhen ki aap vartically ismein price ko show Karen aur original ya horizontally Iske volume ko up and down dekh sakte hain agar aap samajhte hain next move predicted kar sakte hain to iski men vajah yah bhi ho sakti hai ki aapki Jo VW a bhi effectiveness kahan tak ja rahi hai

Effects of strategic

V w strategy useful hone ke sath technical strategy hai Jisko learn karna bahut jaruri hai Aur Is per price action Hamare Liye ise Hamen price ki breakdown hone ka andaza ho sakta hai price action strateg ke liye Hamen chart Mein sport and distance level ko bhi mind Mein Rakhna hoga aur isase Hamen Kafi help mil sakti hai Kafi help mil sakti hai Jab market retest per Aati Hai To is trade Lagani Hai Kyunki hamare pass tab mauka hota hai ki Jab Ham market ki resho Ko Dekhkar

تبصرہ

Расширенный режим Обычный режим