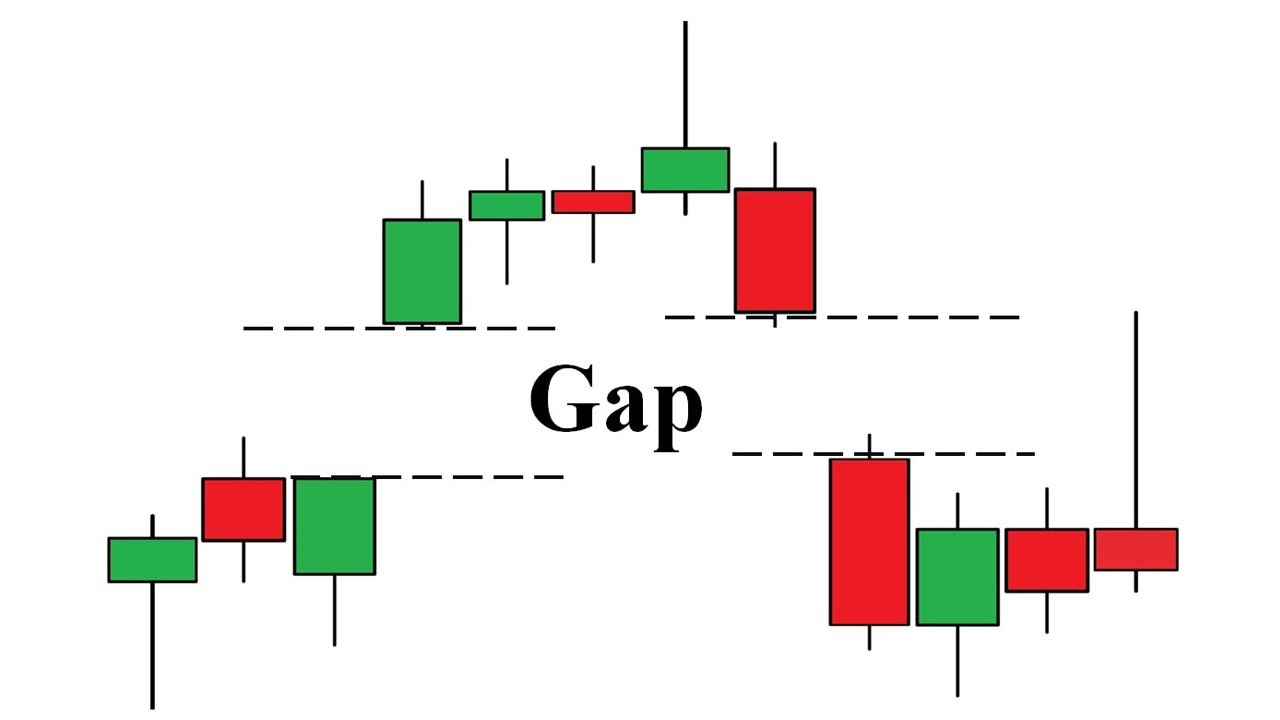

un khaali jaghon se faida uthany ke bohat se tareeqay hain, chand hikmat amlyon ke sath jo doosron ke muqablay mein ziyada maqbool hain. kuch tajir is waqt khareedain ge jab aglay tijarti din mein bunyadi ya takneeki awamil farq ke haq mein hon ge. misaal ke tor par, woh chand ghanton ke baad aik stock khareedain ge jab misbet aamdani ki report jari ki jaye gi, aglay tijarti din mein farq ki umeed mein. tajir qeematon ki naqal o harkat ke aaghaz mein intehai maya ya ghair maya pozishnon mein khareed o farokht bhi kar satke hain, achi bharai aur musalsal rujhan ki umeed mein. misaal ke tor par, woh currency khareed satke hain jab yeh kam likoyditi par bohat taizi se barh rahi ho aur is mein koi khaas muzahmat nah ho. aik baar jab aala ya kam nuqta ka taayun ho jata hai ( aksar takneeki tajzia ki doosri shaklon ke zariye ) kuch tajir mukhalif simt mein khalaa ko khatam kar dete hain. misaal ke tor par, agar stak kuch qiyaas aarai par mabni report par barh jata hai, to tajurbah car tajir stak ko kam kar ke is farq ko khatam kar satke hain. aakhir mein, tajir is waqt khareed satke hain jab khala ko pur karne ke baad qeemat ki satah paishgi himayat tak pahonch jaye. is hikmat e amli ki aik misaal zail mein bayan ki gayi hai. yahan woh ahem cheeze hain jo aap trading gaps ke douran yaad rakhna chahain ge : aik baar jab stock ne khalaa ko pur karna shuru kar diya to, yeh Shaz o nadir hi ruke ga, kyunkay aksar koi fori madad ya muzahmat nahi hoti hai. thakan ke farq aur tasalsul ke farq se qeemat do mukhtalif simtao mein bherne ki pishin goi ki jati hai — is baat ko yakeeni banayen ke aap jis farq ko khailnay ja rahay hain is ki sahih darja bandi karen. khorda sarmaya car woh hain jo aam tor par ghair maqool josh o kharosh ka muzahira karte hain. taham, idaara jati sarmaya car –apne port follows ki madad ke liye sath day satke hain, lehaza is isharay ka istemaal karte waqt mohtaat rahen aur position lainay se pehlay qeemat ke totnay ka intzaar karen

Runway or Measuring Gap

aik bhagnay wala farq, aam tor par charts par dekha jata hai, is waqt hota hai jab tijarti sargarmi tarteeb waar qeemat points ko chore deti hai, jo aam tor par sarmaya karon ki shadeed dilchaspi se chalti hai. dosray lafzon mein, koi tijarat nahi thi, jis ki tareef security mein malkiat ke tabadlay ke tor par ki gayi thi, qeemat ke is maqam ke darmiyan jahan se bhagnay wala farq shuru sun-hwa aur jahan khatam sun-hwa .

Runway or Measuring Gap

aik bhagnay wala farq, aam tor par charts par dekha jata hai, is waqt hota hai jab tijarti sargarmi tarteeb waar qeemat points ko chore deti hai, jo aam tor par sarmaya karon ki shadeed dilchaspi se chalti hai. dosray lafzon mein, koi tijarat nahi thi, jis ki tareef security mein malkiat ke tabadlay ke tor par ki gayi thi, qeemat ke is maqam ke darmiyan jahan se bhagnay wala farq shuru sun-hwa aur jahan khatam sun-hwa .

تبصرہ

Расширенный режим Обычный режим