INTRODUCTION:

Assalamu Alaikum dear Forex member kaise hain aap sab log ummid karta hun ki aap sab theek Honge aur forex market Mein Achcha work out kar rahe Honge dear members Forex risky business hai Humne usko properly utilise karne ke liye Apne knowledge aur experience ko Jyada Se Jyada increase karna hoga tabhi Ham ismein kamyabi Hasil kar sakte hain agar aap Forex trading se acchi running Hasil karna chahte hain to aapko chahie ke Forex trading ke rules and regulations ko follow Karen aur ismein apne learning skills ko improve Karen tabhi aap ismein kamyabi Hasil kar sakte hain jaise kya Sab Jante Hain Ki jab tak Ham taknik strong analysis nahin kar lete tab tak Forex trade Mein Kabhi Bhi successful Nahin ho sakte To Hamen chahie agar aap Forex trading Mein successful Hona Chahte Hain To aapko chahie ke trade din se pahle aap strong aur technical analysis Karen aur uske bad hi trade entry Karen use otherwise aapko trading Mein trade active Nahin Karni chahie usse aapko big loss ho sakta hai aur aapka account Vas ho sakta hai to isliye aapko strong analysis karne ke bad hi trade active Karni chahie tabhi aap ismein kamyabi Hasil kar sakte hain main aaj aapke sath Ek important hai indicator detail se discuss karta hun jo ki Arun indicator hai...

WHAT IS AROON OSCILLATOR:

dear members forex market mein yah Ek Aisa indicator hai jo ke market ki trend aur pair aur commodities ki price form inform karne ke liye use Kiya jata hai Iske साथ-साथ yah trend ki strength ko bhi mayor karne ke liye use Kiya jata hai indicator high aur Lo Ki Darmiyan mein time information karta hai jo ki strong ab friend Ki Surat Mein yah new high ko show karta hai iske sath yah Lo se share karta hai yah indicator signal Deta Hai Jab Is Tarah hota hai tab bhi signal deta hai isliye isko Auron indicator oscillator Kaha jata hai ...

TRADING STRATEGY WITH OSCILLATOR:

dear members for X market mein yah oscillator moving every se difference Mein Sel aur boy ki indication Hasil Karke trade open karna Hota Hai yah FIR humko bhi indicator jo ki moving average best hote hain unke Sath milakar use karne se hi acchi indication Hasil hoti hai aur ham is per trade open kar lete hain jisse Hamari trade Mein profit wasil hone ke chances increase Ho Jaate Hain lihaza Hamen pahle yah Pata Hona chahie ki yah oscillator ko delete Kis Tarah karna hai aur best trading ke liye indication Kis Tarah Hasil karni hai ki Ham is per trade open Karen aur successful trade ho isliye is oscillator ko negative ya positive zero ki taraf se hundred ki taraf Jata Hai To yah is Baat ke Ishara hota hai k ab price uptrwnd jany wli ha..

WORKING FOE AROON OSCILLATOR:

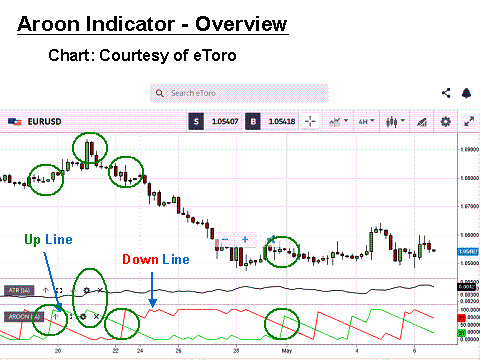

dear member forex market Mein yah accelerator indicator tarikh ke 25 period ko use karte hue kaam karta hai aur yah batata hai Ke Kitni period high aur Lo the in 25 period Mein Se Jab Arun up Arun down se upar ho to yah police behaviour show karta hai aur jab Arun down Arun ab se upar Hai To yah Don World Signal show karta hai Jab donon line Mein cross over hota hai to yah trend change Hone Ko show karta hai UP Board down line zero se hundred Ke Darmiyan Mein Chalti rahti Hain oscillator high aur Lo Ke Darmiyan mein time inform karta hai aur strong ab friend Ki Surat Mein yah new high ko show karta hai iske sath yah strong down trend ko new Lo se share karta hai...

Assalamu Alaikum dear Forex member kaise hain aap sab log ummid karta hun ki aap sab theek Honge aur forex market Mein Achcha work out kar rahe Honge dear members Forex risky business hai Humne usko properly utilise karne ke liye Apne knowledge aur experience ko Jyada Se Jyada increase karna hoga tabhi Ham ismein kamyabi Hasil kar sakte hain agar aap Forex trading se acchi running Hasil karna chahte hain to aapko chahie ke Forex trading ke rules and regulations ko follow Karen aur ismein apne learning skills ko improve Karen tabhi aap ismein kamyabi Hasil kar sakte hain jaise kya Sab Jante Hain Ki jab tak Ham taknik strong analysis nahin kar lete tab tak Forex trade Mein Kabhi Bhi successful Nahin ho sakte To Hamen chahie agar aap Forex trading Mein successful Hona Chahte Hain To aapko chahie ke trade din se pahle aap strong aur technical analysis Karen aur uske bad hi trade entry Karen use otherwise aapko trading Mein trade active Nahin Karni chahie usse aapko big loss ho sakta hai aur aapka account Vas ho sakta hai to isliye aapko strong analysis karne ke bad hi trade active Karni chahie tabhi aap ismein kamyabi Hasil kar sakte hain main aaj aapke sath Ek important hai indicator detail se discuss karta hun jo ki Arun indicator hai...

WHAT IS AROON OSCILLATOR:

dear members forex market mein yah Ek Aisa indicator hai jo ke market ki trend aur pair aur commodities ki price form inform karne ke liye use Kiya jata hai Iske साथ-साथ yah trend ki strength ko bhi mayor karne ke liye use Kiya jata hai indicator high aur Lo Ki Darmiyan mein time information karta hai jo ki strong ab friend Ki Surat Mein yah new high ko show karta hai iske sath yah Lo se share karta hai yah indicator signal Deta Hai Jab Is Tarah hota hai tab bhi signal deta hai isliye isko Auron indicator oscillator Kaha jata hai ...

TRADING STRATEGY WITH OSCILLATOR:

dear members for X market mein yah oscillator moving every se difference Mein Sel aur boy ki indication Hasil Karke trade open karna Hota Hai yah FIR humko bhi indicator jo ki moving average best hote hain unke Sath milakar use karne se hi acchi indication Hasil hoti hai aur ham is per trade open kar lete hain jisse Hamari trade Mein profit wasil hone ke chances increase Ho Jaate Hain lihaza Hamen pahle yah Pata Hona chahie ki yah oscillator ko delete Kis Tarah karna hai aur best trading ke liye indication Kis Tarah Hasil karni hai ki Ham is per trade open Karen aur successful trade ho isliye is oscillator ko negative ya positive zero ki taraf se hundred ki taraf Jata Hai To yah is Baat ke Ishara hota hai k ab price uptrwnd jany wli ha..

WORKING FOE AROON OSCILLATOR:

dear member forex market Mein yah accelerator indicator tarikh ke 25 period ko use karte hue kaam karta hai aur yah batata hai Ke Kitni period high aur Lo the in 25 period Mein Se Jab Arun up Arun down se upar ho to yah police behaviour show karta hai aur jab Arun down Arun ab se upar Hai To yah Don World Signal show karta hai Jab donon line Mein cross over hota hai to yah trend change Hone Ko show karta hai UP Board down line zero se hundred Ke Darmiyan Mein Chalti rahti Hain oscillator high aur Lo Ke Darmiyan mein time inform karta hai aur strong ab friend Ki Surat Mein yah new high ko show karta hai iske sath yah strong down trend ko new Lo se share karta hai...

:max_bytes(150000):strip_icc():format(webp)/Aroon-c3f5520ca8e14e91a10b8424b3719a11.png)

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Aroon_Indicator_Definition_and_Uses_Jun_2020-01-21a9f177013d4cb999f8f68c26a59f46.jpg) Aroon Oscillator Formula and Calculation

Aroon Oscillator Formula and Calculation

تبصرہ

Расширенный режим Обычный режим