Assalamu alaikum dear Pakistan Forex forum members dear forex market mein hum jab kaam kar rahe hote Hain to ismein Ham dekhte hain ki hamen bahut hi acche tarike se hard work karna hote hain aur market mein Apne experience ka istemal Karna hota hai to dear ismein hamen learning karne ke liye different indicators ko bhi study karna hota hai jismein Ham Apne indicators ko study Karke iske bare mein apna knowledge hasil Karke ine per trading Karke profit Le sakte hain ismein hamare pass different technical indicators hote hain jinka Ham trading mein istemal kar sakte hain.

WHAT IS FIBONACCI RETRACEMENT: Dear member for ex trading Mein fibonac number 1 mathematic Leonardo fibonac ne daryaft kiya tha yah number udharti paimane ka use Hua Ek Khas tatib ke sath badhate Jaate Hain fibonac level ka use sabse pahle kudarti Asia ke number mein izaafe ke liye taiyar kiye Gaya Hai Jiska juice 20 sadi financial market Mein Hone Laga shivnesi reshon Ke Piche basic maksad hai ki iska use price ke support aur resister level ke Maloom karne ke liye kiya jaaye fibonac ratio ke jarie se UN level ya position Ke Nishan Dahi ki Jaaye Jo traders ke liye profit ka bahish Banti Hai Jab market Mein price Ek Trend ke hisab se chal rahi Hoti Hai To fibonac ratio bi market Ka Sath de rahi ho to use condition Mein price Ka Tashan Shuru se chalne Diya Jaaye trader trading platform software ho jata hai ki usko kis level per Apna profit kamane ki jarurat hai mein jyadatar traders Apne technical analysis Mein retressment level per insar karti hai.

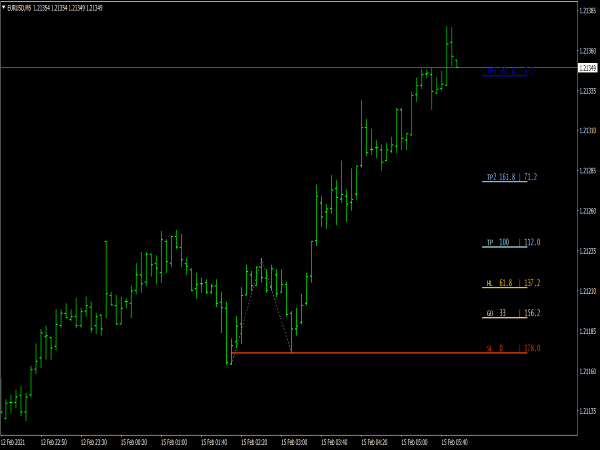

IMPORTANCE OF FIBONACCI RETRACEMENT: Dear member for a trading may fibonac retrustment Har Tarah Ke time frame Mein use Kiya Ja sakta hai short term traders be same fayda Hasil kar sakte hain Jo long term ke traders lete hain fibonac address analysis Mein Hamen price ke support aur register ko Maloom Karke trading ke dauran take profit aur stop loss ki entry aasani se kar sakte hain samajhna aur is per trading karna sabse Aasan hai Kyunki is pattern ki value ki calculation pahle se ho chuki Hoti Hai Bus traders ko ek technic per lines price ke top se bottom ya bottom se top Tak draw karna hoti hai.

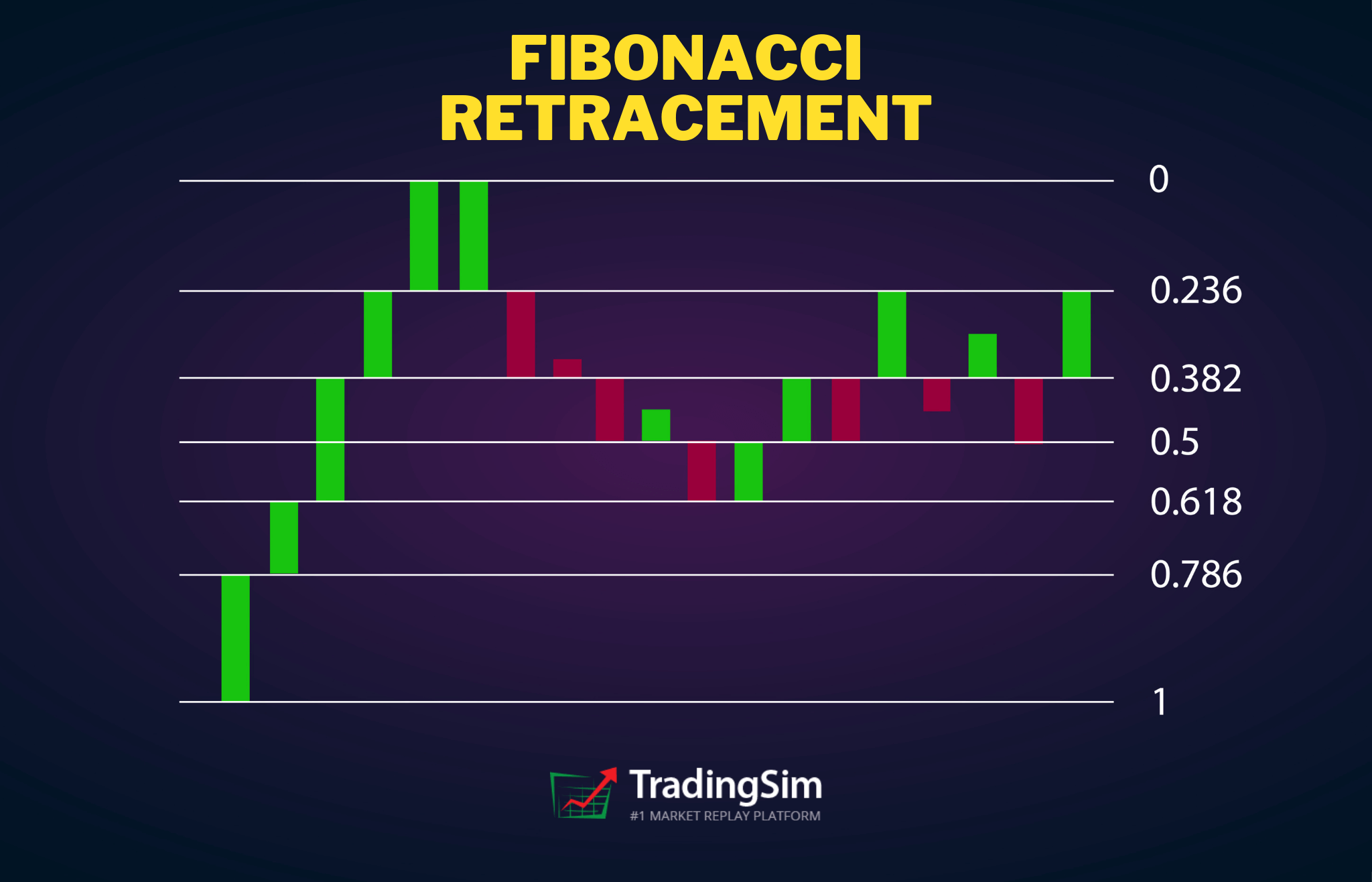

EXPLANATION OF FIBONACCI RETRACEMENT: Fibonac numbers ki Masjid mathematics calculation se vibhinn Aisi sequence level banae Jaate Hain fibonac number 1,2,3,5,8,13,21.... etceterasatraje number hai yani jitni chahie aapko apni Marji ki calculation ke liye use kar sakte hain fibonac number mein izaafe ki psychology Kuchh Yun Hai Ki Har Aane Wala number jo ke proceeding number hota hai Pichhle do numbers Ka majma Hota Hai Jaise Van ko Van ke sath Jama karne per Tu aata hai FIR Van Ko Tu ke sath add karne per 3 Aata Hai ISI Tarah Chalte jaen aur add ko 13 ke sath Jama karne per 21 aata hai yah number banana Itna Mushkil Nahin Hai Bus math ki calculation aani chahie fibonac number Maloom karne ke bad uski calculation karne se fibonac us level create kiye Jaate Hain Jay Shri Krishna level trading mein bahut jyada important hai Kyunki price mostly ine level ko Apne support aur resistance ke liye use karte hain.

WHAT IS FIBONACCI RETRACEMENT: Dear member for ex trading Mein fibonac number 1 mathematic Leonardo fibonac ne daryaft kiya tha yah number udharti paimane ka use Hua Ek Khas tatib ke sath badhate Jaate Hain fibonac level ka use sabse pahle kudarti Asia ke number mein izaafe ke liye taiyar kiye Gaya Hai Jiska juice 20 sadi financial market Mein Hone Laga shivnesi reshon Ke Piche basic maksad hai ki iska use price ke support aur resister level ke Maloom karne ke liye kiya jaaye fibonac ratio ke jarie se UN level ya position Ke Nishan Dahi ki Jaaye Jo traders ke liye profit ka bahish Banti Hai Jab market Mein price Ek Trend ke hisab se chal rahi Hoti Hai To fibonac ratio bi market Ka Sath de rahi ho to use condition Mein price Ka Tashan Shuru se chalne Diya Jaaye trader trading platform software ho jata hai ki usko kis level per Apna profit kamane ki jarurat hai mein jyadatar traders Apne technical analysis Mein retressment level per insar karti hai.

IMPORTANCE OF FIBONACCI RETRACEMENT: Dear member for a trading may fibonac retrustment Har Tarah Ke time frame Mein use Kiya Ja sakta hai short term traders be same fayda Hasil kar sakte hain Jo long term ke traders lete hain fibonac address analysis Mein Hamen price ke support aur register ko Maloom Karke trading ke dauran take profit aur stop loss ki entry aasani se kar sakte hain samajhna aur is per trading karna sabse Aasan hai Kyunki is pattern ki value ki calculation pahle se ho chuki Hoti Hai Bus traders ko ek technic per lines price ke top se bottom ya bottom se top Tak draw karna hoti hai.

EXPLANATION OF FIBONACCI RETRACEMENT: Fibonac numbers ki Masjid mathematics calculation se vibhinn Aisi sequence level banae Jaate Hain fibonac number 1,2,3,5,8,13,21.... etceterasatraje number hai yani jitni chahie aapko apni Marji ki calculation ke liye use kar sakte hain fibonac number mein izaafe ki psychology Kuchh Yun Hai Ki Har Aane Wala number jo ke proceeding number hota hai Pichhle do numbers Ka majma Hota Hai Jaise Van ko Van ke sath Jama karne per Tu aata hai FIR Van Ko Tu ke sath add karne per 3 Aata Hai ISI Tarah Chalte jaen aur add ko 13 ke sath Jama karne per 21 aata hai yah number banana Itna Mushkil Nahin Hai Bus math ki calculation aani chahie fibonac number Maloom karne ke bad uski calculation karne se fibonac us level create kiye Jaate Hain Jay Shri Krishna level trading mein bahut jyada important hai Kyunki price mostly ine level ko Apne support aur resistance ke liye use karte hain.

تبصرہ

Расширенный режим Обычный режим