Dear jub market ki movement bullish trend main ho ya bearish trend main ya phir market sideways trend main movement kar rehi ho hamesha market ki movement in four channels main hi hoti hai jo ky equidistant channel standard deviation channel regression channel aur Andrew's pitchfork channels hain ky jab ham in channels main market ki movement ko read kerty hain tou hamain market ki future movement ka pata chal jata hai kyun ky market hamesha kisi aik channel main long time ke liye apni movement ko continue rakhti hai tou agar ham same channel main market ki current channel main movement ko read karty hain toa hamein same movement per market ki prediction kerny main bhi aur market main trade enter kerny main bhi koi pareshani nahi hoti ham channels main market ki hone wali movement ki continuation per trade enter kar lete hain aur market jab tak same channel main apni movement ko continue rakhti hai tab tak hamain profit hasil hota rehta.

Types of Channels.

Trading In Channel Index.

Dear trading main channel ko kabhi bhi avoid nahin karna chahie trading channel ko acchi Tarah Se Learn karna chahiye Iske bare mein apne pass Achcha Se Achcha knowledge Rakhna bahut se trader Aise Hote Hain Jo trading channel ko ignore karte hai Jiski vajah se unhen apni trading mn profit Hasil Nahi Hota forex market Ky yah channel market ki uptrend downtrend sideway movement or retracement ko show Karte rahte hain channel ki madad Se Jab Ham market Mein Apni trade open Karte Hain To Hamen trading mein bahut hi accha profit Hasil hota.

Equidistant channel.

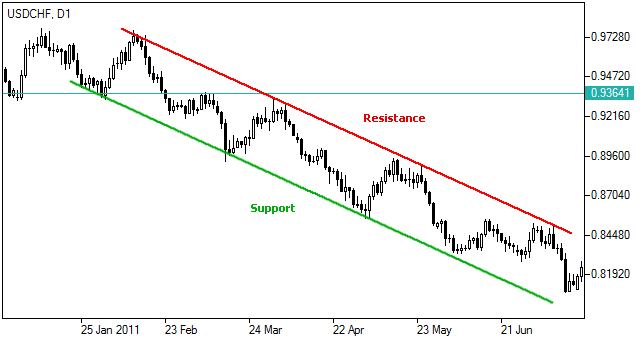

Dear Equidistant channel main teen lines hoti hain aur upper line ko resistance level aur nicha wali line resistance level kehta han.

Regression Channel.

Dear Regression Channel main high swing line ko aur dosri swing line low ko le ker banai jati ha jab k ak middle line b hoti ha.

Andrews Pitchfork Channel.

Dear Andrews Pitchfork Channel man teen trend lines draw karta hain aur is man main three point 1, 2 aur 3 draw kia jata han.

Importance of Chennal.

Dear channel main apni movement ko continue rakhti hai tab tak hamain profit hasil hota rehta hai jab ham kisi bhi aik channel ky start hony per confirm kar lety hain ky yeh konsa channel hai tou hamain phir same channel ko follow kerty huey hi market main trade enter karni chahiye kay hamein trading main bahut achi earning bhi hasil ho jati hai jab market same channel main apni movement ko continue rakhti hai aur trading channel ki madad Se Jab Ham market Mein Apni trade open Karte Hain To Hamen trading mein bahut hi accha profit Hasil hota hai isliye Hamen trading channel ko kabhi bhi avoid nahin karna chahie.

Types of Channels.

- Equidistant channel.

- Regression Channel.

Trading In Channel Index.

Dear trading main channel ko kabhi bhi avoid nahin karna chahie trading channel ko acchi Tarah Se Learn karna chahiye Iske bare mein apne pass Achcha Se Achcha knowledge Rakhna bahut se trader Aise Hote Hain Jo trading channel ko ignore karte hai Jiski vajah se unhen apni trading mn profit Hasil Nahi Hota forex market Ky yah channel market ki uptrend downtrend sideway movement or retracement ko show Karte rahte hain channel ki madad Se Jab Ham market Mein Apni trade open Karte Hain To Hamen trading mein bahut hi accha profit Hasil hota.

Equidistant channel.

Dear Equidistant channel main teen lines hoti hain aur upper line ko resistance level aur nicha wali line resistance level kehta han.

Regression Channel.

Dear Regression Channel main high swing line ko aur dosri swing line low ko le ker banai jati ha jab k ak middle line b hoti ha.

Andrews Pitchfork Channel.

Dear Andrews Pitchfork Channel man teen trend lines draw karta hain aur is man main three point 1, 2 aur 3 draw kia jata han.

Importance of Chennal.

Dear channel main apni movement ko continue rakhti hai tab tak hamain profit hasil hota rehta hai jab ham kisi bhi aik channel ky start hony per confirm kar lety hain ky yeh konsa channel hai tou hamain phir same channel ko follow kerty huey hi market main trade enter karni chahiye kay hamein trading main bahut achi earning bhi hasil ho jati hai jab market same channel main apni movement ko continue rakhti hai aur trading channel ki madad Se Jab Ham market Mein Apni trade open Karte Hain To Hamen trading mein bahut hi accha profit Hasil hota hai isliye Hamen trading channel ko kabhi bhi avoid nahin karna chahie.

Channel trading mein, traders ke liye kuch main points hote hain jo dhyan mein rakhne ki zaroorat hoti hai. Pehla point hai channel ki validity ko confirm karna. Channel ki validity ko confirm karne ke liye, traders ko price movement ko closely monitor karna hota hai. Agar price channel ke andar consistent movement show kar rahi hai, toh channel ki validity strong hai aur traders isko follow kar sakte hain. Lekin agar price channel se bahar ja rahi hai, toh channel invalid ho jata hai aur traders ko uski validity ko dubara confirm karna chahiye. Dusra point hai entry aur exit points ko identify karna. Channel trading mein, traders ko channel ke andar hi trade karna hota hai. Agar price upper trend line ke near ja rahi hai, toh traders channel ke upar mein buy entry point ko dhundhte hain. Jab price lower trend line ke near ja rahi hai, toh traders channel ke neeche mein sell entry point ko dhundhte hain. Exit point ko decide karne ke liye, traders channel ke opposite trend line ko ya support-resistance levels ko istemal karte hain. Agar price channel ke opposite trend line ko touch karti hai, toh traders apne trade ko close kar sakte hain.

Channel trading mein, traders ke liye kuch main points hote hain jo dhyan mein rakhne ki zaroorat hoti hai. Pehla point hai channel ki validity ko confirm karna. Channel ki validity ko confirm karne ke liye, traders ko price movement ko closely monitor karna hota hai. Agar price channel ke andar consistent movement show kar rahi hai, toh channel ki validity strong hai aur traders isko follow kar sakte hain. Lekin agar price channel se bahar ja rahi hai, toh channel invalid ho jata hai aur traders ko uski validity ko dubara confirm karna chahiye. Dusra point hai entry aur exit points ko identify karna. Channel trading mein, traders ko channel ke andar hi trade karna hota hai. Agar price upper trend line ke near ja rahi hai, toh traders channel ke upar mein buy entry point ko dhundhte hain. Jab price lower trend line ke near ja rahi hai, toh traders channel ke neeche mein sell entry point ko dhundhte hain. Exit point ko decide karne ke liye, traders channel ke opposite trend line ko ya support-resistance levels ko istemal karte hain. Agar price channel ke opposite trend line ko touch karti hai, toh traders apne trade ko close kar sakte hain.  Channel trading strategy mein, stop loss aur profit target levels ko bhi carefully decide karna zaroori hai. Stop loss level ko traders channel ke opposite side ke bahar ya channel ke opposite trend line ke neeche rakhte hain. Jabki profit target level ko traders channel ke opposite side ke near ya channel ke opposite trend line ke pass set karte hain. Channel trading strategy ka istemal karne se traders ko trend ke andar price movement ka acchi tarah se pata chalta hai. Is strategy mein traders price action ko observe karte hain aur support-resistance levels ko identify karte hain. Channel trading mein trend lines ka istemal karke traders entry aur exit points ko sahi tarike se dhundh sakte hain. Lekin, jaise har trading strategy mein hota hai, channel trading mein bhi risk management ko samjhna aur follow karna zaroori hai. Traders ko price movement ko closely monitor karna chahiye aur channel ki validity ko confirm karne ke liye confirmatory indicators ka istemal kar sakte hain.

Channel trading strategy mein, stop loss aur profit target levels ko bhi carefully decide karna zaroori hai. Stop loss level ko traders channel ke opposite side ke bahar ya channel ke opposite trend line ke neeche rakhte hain. Jabki profit target level ko traders channel ke opposite side ke near ya channel ke opposite trend line ke pass set karte hain. Channel trading strategy ka istemal karne se traders ko trend ke andar price movement ka acchi tarah se pata chalta hai. Is strategy mein traders price action ko observe karte hain aur support-resistance levels ko identify karte hain. Channel trading mein trend lines ka istemal karke traders entry aur exit points ko sahi tarike se dhundh sakte hain. Lekin, jaise har trading strategy mein hota hai, channel trading mein bhi risk management ko samjhna aur follow karna zaroori hai. Traders ko price movement ko closely monitor karna chahiye aur channel ki validity ko confirm karne ke liye confirmatory indicators ka istemal kar sakte hain.

تبصرہ

Расширенный режим Обычный режим