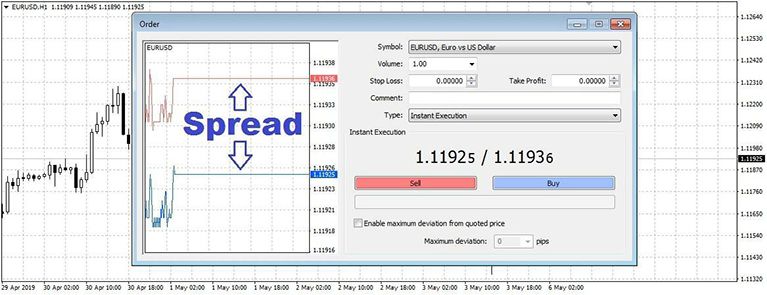

Spread

Bid price (Buy) aur ask price (Sell) k darmeyan faraq ko Spread kaha jata hai. Spreads ko financial market me pips me count kia jata hai. Agar aik currency jore USD/JPY ki bid qeemat 110.50 aur ask qeemat 110.75 hai to ye 50 aur 75 k darmeyan faraq (pips) ko spread kehte hen. Spreads dar-asal brokers ki commission hoti hai, jo wo apne clients se trading k sahulat k badle le rahe hote hen. Aam tawar par brokers apne clients ko pehle teen digits me radu-badal nahi karte. Bulke wo sirf last 2 digits ka hi hawala pesh karte hen k 50 aur 75, yani bid price 50 hai aur ask price 75. Aaj kal forex market me 5 digits ki sahulat bhi muhaya ki jati hai. Is waja se market me bid aur ask ki trade lagane se pehle is ko baghawar tajzeya zarori hai.

Financial markets me brokers apne clients ko spreads k lehaz se do tarah ki accounts ki sahulat muhaya karte hen;

- Fixed Spread

- Variable Spread

1. Fixed Spread

Foxed spread wale account me bid aur ask k darmeyan spread aik mustehkam (fixed) value hoti hai. Fixed spread me brokers (kuch brokers) ziada tar apne clients se kuch percentage bhi osool karte hen. Fixed spread accounts k aksar rules aur regulations bhi ziada hote hen, jaise; account me maojood balance ziada hona chaheye, baaz items pe commission bhi rakha jata hai. Lekin in sab k bawajood fixed spread account ziada behtar hote hen, q k is me spread kam hota hai, aur hota bhi mustehkam, to na to traders ko slippage ka darr hota hai aur na hi kam munafa k chances.

2. Variable Spread

Variable spreads me bid aur ask price k darmeyan faraq har waqat aik jaisa nahi rehta, yani market ki teezi k sath ye faraq barh jata hai aur slow market me ye kam ho jata hai. Variable spread kam volume wale account pe hote hen, jis me brokers ko ziada munafa melta hai. Variable spread wale account me kuch major currency pairs pe spread to kam hota hai, lekin minor ya cross currency pairs ka spread ziada hota hai.

' x='0' y='0' height='100%25' width='100%25' xlink%3Ahref='data%3Aimage/png;base64,iVBORw0KGgoAAAANSUhEUgAAAAkAAAAGCAYAAAARx7TFAAAAiklEQVQImXWOUQvCMBCD ///mTBQUWGgg7mhFTvsbLdutsPPdg/TFwPhuEtCThDxjmxNj 2HZT47R5imJCN8mPA oE2HUg8OpxqpNCbuIWqJwsREa3uyfUG Ws BbV6yyXYY60i64BchgH BczC45Tyb0g9FdaO6KmrZcDxLysudzo1f0z802sx1Hwxz0CRECV ZAAAAAElFTkSuQmCC'%3E%3C/image%3E%3C/svg%3E)

> the definition and its role in Forex trading">

> the definition and its role in Forex trading">

تبصرہ

Расширенный режим Обычный режим