Assalam u Alaikum dear members umeed karta hon keh ap sab thek hon gy. Jaisa keh ap janty hain keh ham hamaisha ki tarah he ap ky liye bahut he informative topics laty hain jo keh ap ki trading ko bahut he strong bana sakty hain. Ham ap ki khidmat me aisy topics per bat karty hain jin ko agar ap follow karen to ap loss sy bach sakty hain aur safely trading kar ky bahut acha profit hasil kar sakty hain. Aj ka hamara topic hai Bearish Harami kia hota hai aur yeh kaisy kam karta hai ham is per mukamal tafseel sy bat karen gy. To aeye shoro karty hain aur is par roshni dalny ki koshish kart hain.

What Is a Bearish Harami?

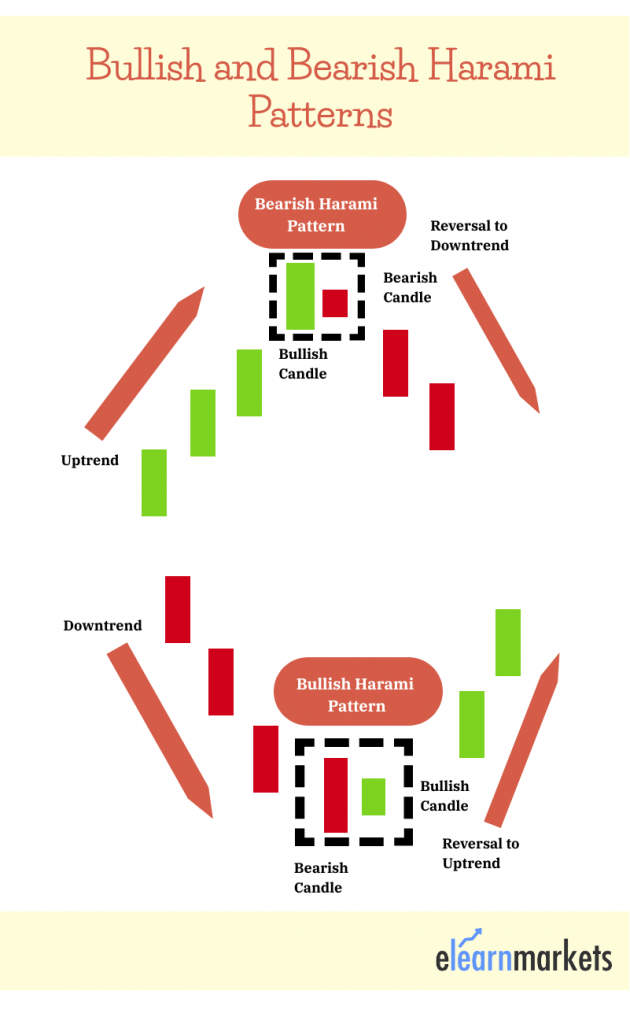

Bearish harami do baar wala japani candle stIck pattern hai jo qeemat mein kami ki nishandahi karta hai. lambi safaid mom batii ke baad choti siyah mom batii. doosri mom batii ki khilnay aur band honay wali qeematein pehli ke andar foot honi chahiye. up trindz ke douran Bearish Harami bantay hain.

Bearish Harami Explained

Doosri candlestick jitni choti hogi, palatnay ka imkaan itna hi ziyada hoga. aik taizi harami, neechay ke rujhan se pehlay, tajweez karti hai ke qeematein barh sakti hain .Deegar takneeki asharion ke sath mil kar bearish harami ko tijarti signal ke tor par istemaal kya jata hai. aik tridr 200 din ki moving average istemaal kar sakta hai taakay taweel mudti kami ke rujhan ki tasdeeq ki ja sakay aur jab ke douran bearish harami ban jaye.

Trading a Bearish Harami

Jab qeemat doosri harami Candlestick se neechay ajati hai to mukhtasir position li ja sakti hai. yeh harami candle ke kam se neechay stap lmit order day kar ya waqfay par market order day kar kya ja sakta hai. tajir ki khatray ki bhook par munhasir hai, harami candle ya lambi safaid mom batii ke oopar stap loss order diya ja sakta hai. himayat aur muzahmat ka istemaal karte hue munafe ka hadaf muqarrar karen .

What Is a Bearish Harami?

Bearish harami do baar wala japani candle stIck pattern hai jo qeemat mein kami ki nishandahi karta hai. lambi safaid mom batii ke baad choti siyah mom batii. doosri mom batii ki khilnay aur band honay wali qeematein pehli ke andar foot honi chahiye. up trindz ke douran Bearish Harami bantay hain.

Bearish Harami Explained

Doosri candlestick jitni choti hogi, palatnay ka imkaan itna hi ziyada hoga. aik taizi harami, neechay ke rujhan se pehlay, tajweez karti hai ke qeematein barh sakti hain .Deegar takneeki asharion ke sath mil kar bearish harami ko tijarti signal ke tor par istemaal kya jata hai. aik tridr 200 din ki moving average istemaal kar sakta hai taakay taweel mudti kami ke rujhan ki tasdeeq ki ja sakay aur jab ke douran bearish harami ban jaye.

Trading a Bearish Harami

Jab qeemat doosri harami Candlestick se neechay ajati hai to mukhtasir position li ja sakti hai. yeh harami candle ke kam se neechay stap lmit order day kar ya waqfay par market order day kar kya ja sakta hai. tajir ki khatray ki bhook par munhasir hai, harami candle ya lambi safaid mom batii ke oopar stap loss order diya ja sakta hai. himayat aur muzahmat ka istemaal karte hue munafe ka hadaf muqarrar karen .

:max_bytes(150000):strip_icc():format(webp)/BearishHarami-2e18c487b93a462586bda2d0c196aeb9.png)

تبصرہ

Расширенный режим Обычный режим