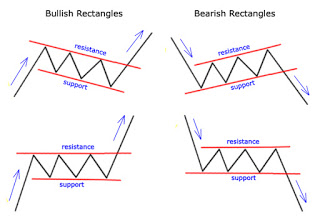

Bullish Rectangles

Bullish rectangles key mutabiq trades ko open karny key ley traders ko resistance level ko key level samjna ho ga aur esi key level/resistance level par agar market ki movement ki measurement ki jaye to market agar bullish trend key bad some time tak resistance level par stay kary aur sideways trend key sath na to zeyda up move kary aur na hi zeyda down move to ye market ka bullish rectangles ho sakta hay es key bad market strong bullish move per se kar sakti hay, es satiation me market ki moving average zaror calculate karni chahiye.

Forex market main different kisam pattern banty rehty hay aur en patterns pka market main bohat acha result hota hay aur en say humay pata chalta hay keh en main kaisy entry lay sakty hay aur kaisy hum es say exit ho sakty hay es liye humay chahiye keh eskay bary main bhi apny knowledge ko enhance karen kyun keh agar hum esko bhi use karen gay to acha profit bna sakty hay es pattern main market ka chance hota hay keh aik trend line ko brake kar kay upward move kary aur agar hum upward move ko follow karty huay esmain trade place karen gay to market main us trade say acha profit hasil kea ja sakta hay aur esmain humay aik target bohat acha achive ho jata hay es business main humay har chance ko avail karna chahiye esi main humara faida hota ha.

Market ki swing movement ko profitable banany key ley bullish ya bearish rectangles ko samjna bahot zarori hay, market kabi support level ko aur kabi resistance level tak ja ponchti hay ye level kab break hoty hey es key ley bullish and bearish rectangles traders key ley helpful ho sakty hey,

bullish rectangles ki agar bat ki jaye to bullish ki major trend agar support level ko beak na kary to ye major trend continue rak sakti hay aur 3 time support level ko touch kar key ye trend again strong resistance level ko break kar sakti hay, esi tarha bearish rectangles be agar strong resistance level ko break nahi karti aur down to up aur per se up to down move karti hay to strong se strong support level break ho sakta hay.

Bullish rectangles key mutabiq trades ko open karny key ley traders ko resistance level ko key level samjna ho ga aur esi key level/resistance level par agar market ki movement ki measurement ki jaye to market agar bullish trend key bad some time tak resistance level par stay kary aur sideways trend key sath na to zeyda up move kary aur na hi zeyda down move to ye market ka bullish rectangles ho sakta hay es key bad market strong bullish move per se kar sakti hay, es satiation me market ki moving average zaror calculate karni chahiye.

Forex market main different kisam pattern banty rehty hay aur en patterns pka market main bohat acha result hota hay aur en say humay pata chalta hay keh en main kaisy entry lay sakty hay aur kaisy hum es say exit ho sakty hay es liye humay chahiye keh eskay bary main bhi apny knowledge ko enhance karen kyun keh agar hum esko bhi use karen gay to acha profit bna sakty hay es pattern main market ka chance hota hay keh aik trend line ko brake kar kay upward move kary aur agar hum upward move ko follow karty huay esmain trade place karen gay to market main us trade say acha profit hasil kea ja sakta hay aur esmain humay aik target bohat acha achive ho jata hay es business main humay har chance ko avail karna chahiye esi main humara faida hota ha.

Market ki swing movement ko profitable banany key ley bullish ya bearish rectangles ko samjna bahot zarori hay, market kabi support level ko aur kabi resistance level tak ja ponchti hay ye level kab break hoty hey es key ley bullish and bearish rectangles traders key ley helpful ho sakty hey,

bullish rectangles ki agar bat ki jaye to bullish ki major trend agar support level ko beak na kary to ye major trend continue rak sakti hay aur 3 time support level ko touch kar key ye trend again strong resistance level ko break kar sakti hay, esi tarha bearish rectangles be agar strong resistance level ko break nahi karti aur down to up aur per se up to down move karti hay to strong se strong support level break ho sakta hay.

تبصرہ

Расширенный режим Обычный режим