Assalamu Alaikum Dosto!

High Wave Candlestick

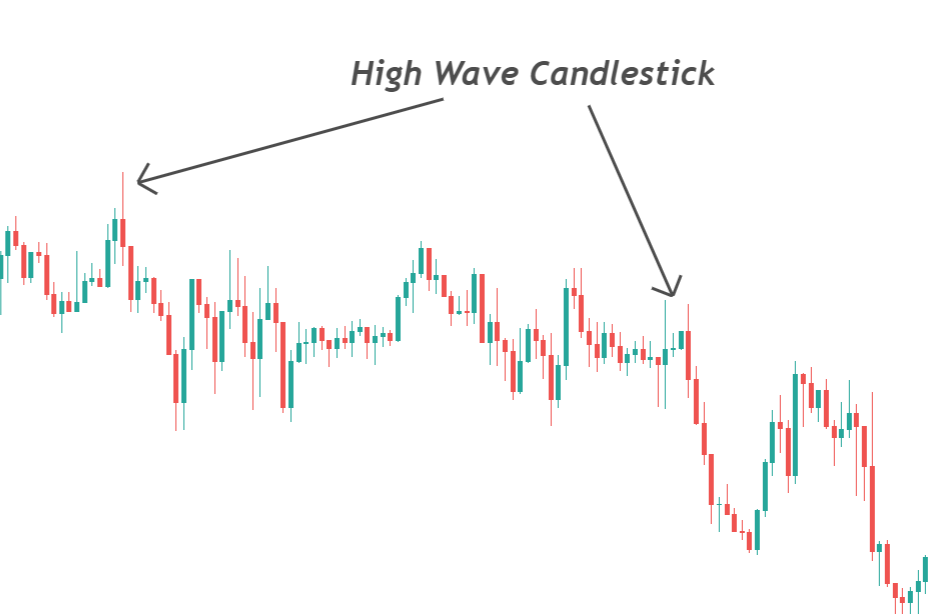

High wave candlestick aik single small real body candle hone ki waja se analysis main bohut ziada istemal hoti hai. Japanese candles ko is wajah se trading ke dauran analysis mein zyada pasand kiya jata hai, kyunki ye candles single candle hone k bawajood bhi aik complete pattern tashkeel deti hai. Jab bhi ye single candlesticks prices k top ya bottom main paye jaati hai, to uss waqt ye trend reversal ka kaam karti hai. Single candle mein doji candles aur small real body wali candles akele ya dusre candles ke sath prices main leading indicator ka kaam karti hai. High wave candlestick prices ke top ya bottom mein trend reversal pattern ka kaam karti hai, jab ki yahi candle sideways market mein neutral candle tasawar ki ki jati hai.

Candles Formation

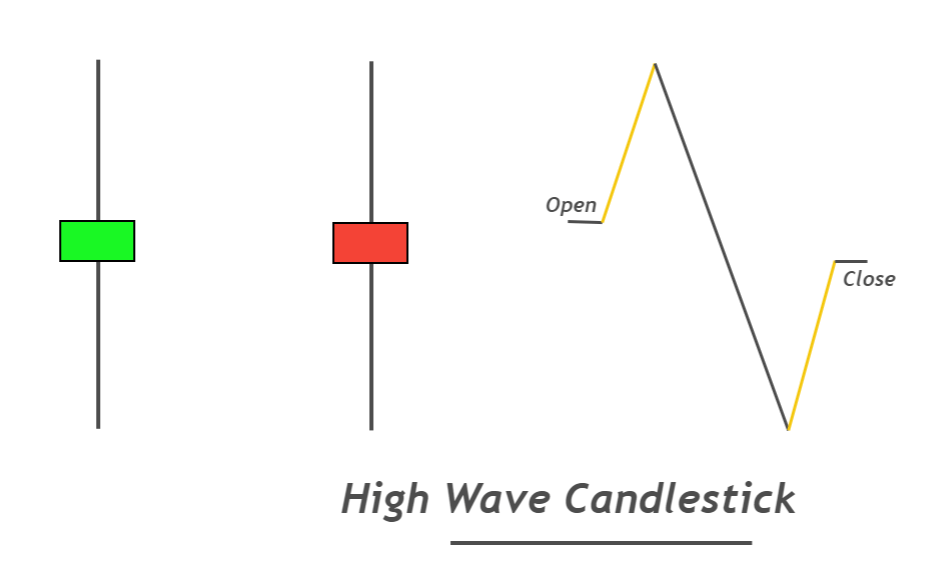

High wave candlestick prices k top par akele hi trend reversal ka kaam karti hai. Ye candle small real body bhi aik strong position rakhti hai, jiss ki technical analysis main bohut ziada ahmeyat hai. High wave candlestick ki formation darjazzel tarah se hoti hai:

High Wave Candle:

High wave candlestick small real body k hone ki waja se ye candle bullish aur bearish dono tarah se hoti hai. Ye candle prices k bottom main bullish trend reversal jab k prices k top par bearish trend reversal ka kaam karti hai. Ye candle aik small green ya red real body rakhti hai, jiss k upper aur lower sides par aik long shadow ya saya hota hai. Explanation

High wave candlestick k banne ki pechahay ki psychology ka inhisar traders par munhasir hoti hai, jab bhi buyers ya sellers prices ko kisi khas semat main move karne k baad wapis dosri semat main same pressure se push karte hen. Lekin kahani yahan khatam nahi hoti, bulke din k ikhtetam tak prices wapis apne aghaz wali position k qareeb a kar close ho jati hai. Iss soratehal main jo candle banti hai, wo High wave candle hoti hai. Ye candle small real body ki hoti hai, jiss main prices ka open aur close same point par nahi hota hai, jab k upper aur lower sides par long shadows hota hen. Shadow length main taqreeban dono sides par same hota hen, jo buyers aur sellers ki barabari ko dekhati hai.

Trading

High wave candlestick prices k top par ya bottom main ziada behtar tawar par kaam karti hai. Normal ye candle neutral tasawar ki jati hai, q k iss ki aik to small real body hoti hai aur dosra iss ka shadow kisi aik side par size ziada nahi hota hai. Bearish market main bullish trend reversal k leye buy ki entry ki ja sakti hai, jab k bullish trend main bearish trend reversal k leye sell ki entry k trades open keye ja sakte hen. Candle par trading se pehle long timeframe ka hona zarori hota hai, jab k trend reversal k leye confirmation candle ki bhi zarorat hoti hai. CCI indicator aur stochastic oscillator par trading k dowran support aur resistance levels ya overbought aur over-sold zone hona chaheye. Stop Loss candle k low ya high prices se two pips below ya above set kia ja sakta hai.

تبصرہ

Расширенный режим Обычный режим