INTRODUCTION:

Dear forex members ummid karta hun ki aap sab khairiyat se honge aur Forex aderi ke vishesh per acchi arning acchi arning kar. Forex risky business hai jismein hamen profit ke sath sath loss bhi ho jata hai isliye important hai ki ham Forex ke bare Forex ke bare mein knowledge experience Taki hamen jyada loss na ho aur ham market se achcha profit gain karTaki hamen jyada loss na ho aur ham market se achcha profit gain kar saken.

HIGH WAVES CANDLESTICK PATTERN:

Dear forex members market mein high waves chemistry pattern essay pattern ko kaha jata hai jinki weeks ya Shadow long hoti hain aur unke unki body short hoti hai. Pattern status ko Pattern status ko market friend ke change hone ke bhi information deta hai. Trader ko market mein aisa pattern dekhne ko Mile to unko phone se apne Trader ko market mein aisa pattern dekhne ko Mile to unko phone se apne trade open. Market ke chart ko acchi tarike se discuss Karke uske bad Apne trade ka entry Le Taki jyada loss na ho Market ke chart ko acchi tarike se discuss Karke uske bad Apne trade ka entry Le Taki jyada loss na ho aur wo market sy acha profit earn kr sakty hain.

FORMATION OF HIGH WAVES CANDLESTICK PATTERN:

Dear forex members Fox market mein market ek train mein move kar rahi hoti hai. And ho raha hota hai to tab hamen highway ke rustic pattern najar aata hai. Jab yah friend abhyar hota hai to trader ko is baat ki confirmation mil jaati hai ki ab train down chalne wala hai. Hi waves chemistry pattern uske baad Barish mein jaati hai. Information trader ko police aur Barish ya FIR tag ya war ki surat mein milati hai. Market Apne entry point per close ho jaati hai. Apna close dekar apna dusra train Shuru kar leti hai.

USES OF HIGH WAVES CANDLESTICK PATTERN:

Dear forex members jab high waves can I see pattern market mein appear hota hai to traders ko different information mil rahi hoti hai. Market katra change hone lagta hai to trader ko is baat ki confirmation milati hai ki vah trade ki entry lene ka vate Karen jab yah pattern complete ho jaaye to uske bad apni new set ki entry Le Is Tarah karne se hamen market bahut jyada profit de sakti hai Nahin to hamen loss ka samna karna pad sakta hai.

Hamen is pattern ka jyada trust nahi karna chahiye kyunki yeh कभी-कभी aisi jagah pair hota hai Jahan hamen yakin Nahin hota hai. Isko dekhkar apni trade ki entry le lenge to vah mujhmein mein jakar fas jaenge. Trader ko bahut jyada loss ho sakta hai isliye trader ko chahie ki vah pahle market ko acchi Tarah dekh le Taki jyada loss na ho. For trader ko kabhi bhi train Lene mein jaldbaji Nahin Karni chahie Varna bahut jyada loss ho sakta hai. Hamari trade bhi profit profitable Nahin ho sakti aur hamare account ke vivah hone ki chances bahut jyada ho jaate Hain isliye trader ko chahie ki pahle vah market ko acche se samjhe aur uske bad apni chat ki entry le.

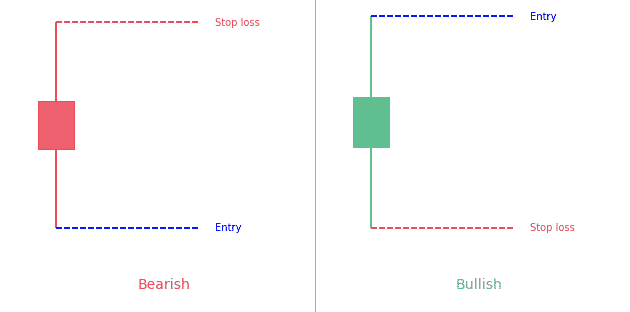

STOP LOSS TAKE PROFIT:

Dear forex members Kisi bhi trade ki entry Lene se pahle important hai ki ham falak ke bare mein acche se knowledge hasil kar len aur uske bad apni trade ki entry len aur trade ki latest hath ya main stop loss aur take profit ko bhi jarur set Karen kyunki isase hamen bahut jyada profit ho Gaya aur hamen loss Nahin hoga aur iska sabse bada advantage yah hai ki hamara time bhi West Nahin hota kyunki Jahan humne trade lagai Hoti hai vahan per jakar hamare trade khud bahut close ho jaati hai aur hamara time West jata hai aur Market mein bahut jyada achcha isliye important hai ki koi bhi trade lagane se pahle hamen stop loss aur take profit ko use Karen.

Dear forex members ummid karta hun ki aap sab khairiyat se honge aur Forex aderi ke vishesh per acchi arning acchi arning kar. Forex risky business hai jismein hamen profit ke sath sath loss bhi ho jata hai isliye important hai ki ham Forex ke bare Forex ke bare mein knowledge experience Taki hamen jyada loss na ho aur ham market se achcha profit gain karTaki hamen jyada loss na ho aur ham market se achcha profit gain kar saken.

HIGH WAVES CANDLESTICK PATTERN:

Dear forex members market mein high waves chemistry pattern essay pattern ko kaha jata hai jinki weeks ya Shadow long hoti hain aur unke unki body short hoti hai. Pattern status ko Pattern status ko market friend ke change hone ke bhi information deta hai. Trader ko market mein aisa pattern dekhne ko Mile to unko phone se apne Trader ko market mein aisa pattern dekhne ko Mile to unko phone se apne trade open. Market ke chart ko acchi tarike se discuss Karke uske bad Apne trade ka entry Le Taki jyada loss na ho Market ke chart ko acchi tarike se discuss Karke uske bad Apne trade ka entry Le Taki jyada loss na ho aur wo market sy acha profit earn kr sakty hain.

FORMATION OF HIGH WAVES CANDLESTICK PATTERN:

Dear forex members Fox market mein market ek train mein move kar rahi hoti hai. And ho raha hota hai to tab hamen highway ke rustic pattern najar aata hai. Jab yah friend abhyar hota hai to trader ko is baat ki confirmation mil jaati hai ki ab train down chalne wala hai. Hi waves chemistry pattern uske baad Barish mein jaati hai. Information trader ko police aur Barish ya FIR tag ya war ki surat mein milati hai. Market Apne entry point per close ho jaati hai. Apna close dekar apna dusra train Shuru kar leti hai.

USES OF HIGH WAVES CANDLESTICK PATTERN:

Dear forex members jab high waves can I see pattern market mein appear hota hai to traders ko different information mil rahi hoti hai. Market katra change hone lagta hai to trader ko is baat ki confirmation milati hai ki vah trade ki entry lene ka vate Karen jab yah pattern complete ho jaaye to uske bad apni new set ki entry Le Is Tarah karne se hamen market bahut jyada profit de sakti hai Nahin to hamen loss ka samna karna pad sakta hai.

Hamen is pattern ka jyada trust nahi karna chahiye kyunki yeh कभी-कभी aisi jagah pair hota hai Jahan hamen yakin Nahin hota hai. Isko dekhkar apni trade ki entry le lenge to vah mujhmein mein jakar fas jaenge. Trader ko bahut jyada loss ho sakta hai isliye trader ko chahie ki vah pahle market ko acchi Tarah dekh le Taki jyada loss na ho. For trader ko kabhi bhi train Lene mein jaldbaji Nahin Karni chahie Varna bahut jyada loss ho sakta hai. Hamari trade bhi profit profitable Nahin ho sakti aur hamare account ke vivah hone ki chances bahut jyada ho jaate Hain isliye trader ko chahie ki pahle vah market ko acche se samjhe aur uske bad apni chat ki entry le.

STOP LOSS TAKE PROFIT:

Dear forex members Kisi bhi trade ki entry Lene se pahle important hai ki ham falak ke bare mein acche se knowledge hasil kar len aur uske bad apni trade ki entry len aur trade ki latest hath ya main stop loss aur take profit ko bhi jarur set Karen kyunki isase hamen bahut jyada profit ho Gaya aur hamen loss Nahin hoga aur iska sabse bada advantage yah hai ki hamara time bhi West Nahin hota kyunki Jahan humne trade lagai Hoti hai vahan per jakar hamare trade khud bahut close ho jaati hai aur hamara time West jata hai aur Market mein bahut jyada achcha isliye important hai ki koi bhi trade lagane se pahle hamen stop loss aur take profit ko use Karen.

تبصرہ

Расширенный режим Обычный режим