introduction Forex mein candlestick patterns ko samajhna aur unka istemal karna traders ke liye bahut zaroori hai. Candlestick charts mein har ek candle ek time frame ko darshata hai aur iske through traders ko market ki movement aur trend ki samajh mil jati hai. Ek bahut important candlestick pattern Descending Hawk Candlestick Pattern hai, jo market mein bearish trend ke samay dikhta hai. Is mein hum aapko Descending Hawk Candlestick Pattern ke bare mein batayenge aur iske bare mein details mein samjhayenge. 1: what is Descending Hawk Candlestick Pattern Descending Hawk Candlestick Pattern, bearish trend ke samay dekha jata hai aur ismein ek bearish candle kaafi chota hota hai, jiske baad doji candle aati hai aur phir ek aur bearish candle aata hai, jo pehle se bhi chota hota hai. Is pattern mein, doji candle bullish ya bearish dono ho sakti hai. Lekin, agar doji candle bullish hoti hai, to iska effect kam hota hai aur market mein koi major trend nahi dekha jata hai. Agar doji candle bearish hoti hai, to iska effect jyada hota hai aur market mein bearish trend jari rehta hai. Is pattern mein, doji candle ke beech mein ek gap hota hai, jo bearish trend ki weakness darshata hai. 2: How to use Descending Hawk Candlestick Pattern Descending Hawk Candlestick Pattern ko use karne ke liye, traders ko sabse pehle trend ka pata hona chahiye. Agar market mein bearish trend jari hai, to traders ko is pattern ki taraf dhyan dena chahiye. Agar descending hawk pattern dikhta hai, to traders ko sell karne ke liye ready hona chahiye aur bearish trend ko capture karna chahiye. 3: strategy of Descending Hawk Candlestick Pattern Descending Hawk Candlestick Pattern ke trading strategies bahut sari hai aur traders inhe use karke apne trading performance ko improve kar sakte hai. Kuch strategies niche di gayi hai: Short Entry: Jab market mein descending hawk pattern dikhta hai, to traders ko sell karne ke liye ready hona chahiye. Traders ko short entry ka use karna chahiye aur stop loss ko doji candle ke high par set karna chahiye. Agar market trend bearish rehta hai, to traders profit earn kar sakte hai. Trend Following: Agar market mein bearish trend jari hai, to traders ko descending hawk pattern ki taraf dhyan dena chahiye. Traders ko sell karne ke liye ready hona chahiye aur bearish trend ko follow karna chahiye. Risk Management: Risk management bahut important hai aur traders ko apne trades ko control karna chahiye. Descending hawk pattern ke time mein, traders ko stop loss ko doji candle ke high par set karna chahiye. Agar market mein trend bullish ho jata hai, to traders ko stop loss ko adjust karna chahea.

`

X

new posts

-

#31 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#32 Collapse

Dropping bird of prey plan two days candles standard mushtamil aik negative model inversion plan hai, jo k costs k top standard ya bullish model k akhtetam standard banta hai. Plan ki pehli aur dosri flame same bullish candles hoti hai jis head dosri fire pehli candle k andar open aur close hoti hai. Sliding flying hunter plan ki dosri light ki game-plan same "Negative Harami Model" aur "Negative Harami Cross Model" jaisi hai lekin aik to iss fire ka combination white hoti hai, jo k "Negative Harami Model" k fire head dull hoti, dosra ye candle negligible genuine body ki hoti hai, jo k "Negative Harami Cross Model" ki flame doji candle hoti hai, jiss ka open aur close same hota hai. Dropping flying hunter plan aik negative model inversion plan hai, jo k costs k top standard ya bullish model head banta hai. Ye plan bullish k kamzori ki nishan dahi karta hai. Dosree light aik insignificant authentic body wali bullish candle hoti hai jo rise ka ikhtetaam karti hai, jiss k baad costs negative model inversion ka sabab banti hai. What is Dropping Bird of prey plan? Forex market fundamental slipping flying hunter plan 2 days candles standard moshtamil aek negative model inversion setup feed. Jo key costs key upr yah bullish model k end standard banta feed. Plan ki first aur second fire same bullish candles hoti roughage. Aur jis mein second fire first flame key andar open our bnd hoti feed. Plunging flying hunter plan ki 2osri light ki indistinguishable negative harami plan or negative harami Cross Patter jesi feed. In any case, aek to is fire ka tone sufeed hoti roughage. Ju key negative harami Model key fire mein kali hoti. 2osri no inquiry light choti authentic body ki hoti feed. Ju key negative harami Cross Model ki fire doji light hoti feed. Jis ka open or close same hota feed. Bouncing flying hunter plan ek negative model inversion plan haey. Yh costs key upper yah bullish model maein banta feed. More likely than not plan bullish key week ki alamat dati karta hai. second candle aek choti l ensured body vali bullish fire hoti feed. Jo rise ka end karti feed. Working structure key awful costs negative model inversion ka bais banti feed. Es ko hm sliding model ka nam dety hain. Exchanging ka amal, Hopping falcon fire arrangement Slipping flying tracker configuration "Negative Harami Model" aur "Negative Harami Cross Model" se melta julta plan hai, jo same bullish model ko negative model me change kia jata hai. Slipping falcon fire arrangement Dropping flying tracker plan two days candles standard mushtamil plan hai, jis me pehlee aik long certifiable body wali bullish light hote hai, jis k baad dosree aik long real body wali immaterial bullish fire banti hai. Pehli light costs k ascent ki nishan-dahi kartti hai, ye fire size aur procedure me standard long authentic body wali bullish fire hotti hai. Plunging bird of prey candle plan Lekin dosre disturbance ki fire aik unimportant valid body wali bullish fire hotee hai, jo k open aur close pehli light k certified body Sliding flying hunter candle plan crucial hoti hai. Plan ki dono light bullish hone k bawajood bhi negative model reversal plan ka kaam hy.... -

#33 Collapse

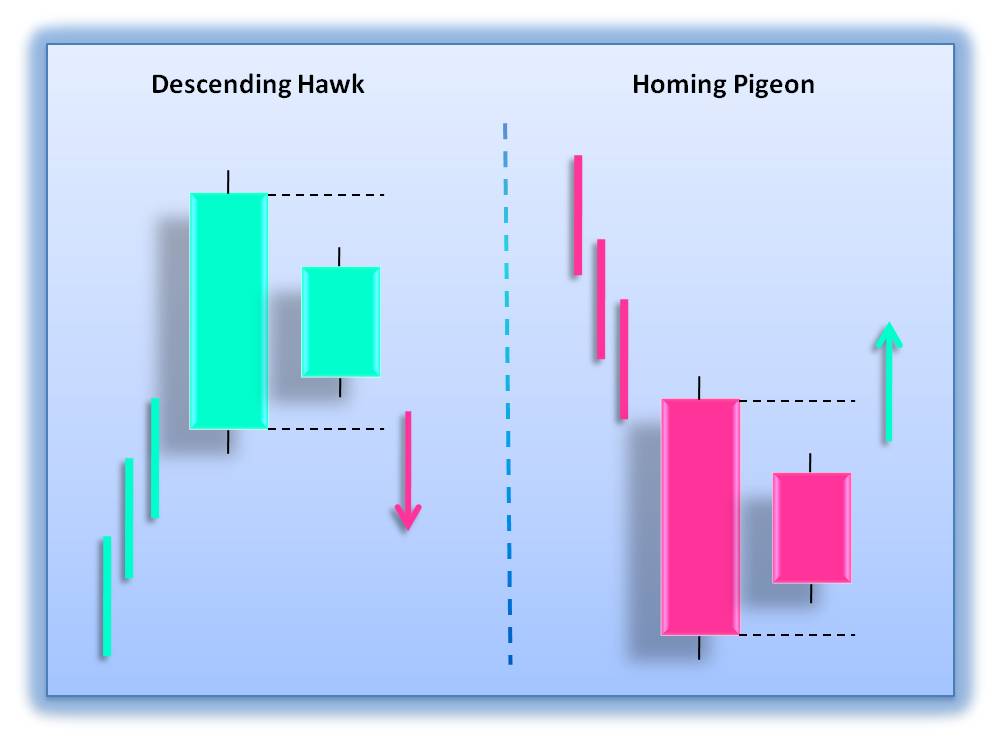

DESCENDING HAWK PATTERN INTRODUCTION: Descending hawk candlestick pattern price chart par do candles se mel kar bana hai, jo k bearish trend reversal k leye istemal hote hen. Pattern ki 1st candle aik white candle hoti hai, jab k 2nd candle aik small white candle hoti hai. Descending hawk candlestick pattern price chart k top ya bullish trend me bearish trend reversal k kaam karta hai, jis ki 1st candle 2nd candle ki nisbat size me bari hoti hai. Descending hawk pattern is a BEARISH reversal pattern, which forms in an uptrend. On the first day a long white candle evolves in the direction of the trend. On the second day, again a white body appears. The body of the first day candle completely engulfs the second candle. Shadows are not important in regard to both candles. SIMILARITIES IN DESCENDING HAWK PATTERN : DESCENDING HAWK may be any candle with a white body, appearing as a longe line, however doji or spinning top are not permitted. The second candle of the pattern must appear as a short line and again doji or spinning top is not permitted. The descending hawk resembles the harami pattern, except for the colors of the body. Here both candles are white. It is the bearish version of the homing pigeon. HAWK REVERSAL CANDLESTICK PATTERN: Hawk reversal Pattern 2 Candlestick per mushtamil hota hai Isko analyse karna bahut Aasan hai is Mein sabse pahle is downtrend aur uptrend Ka progress Mein Hona bahut jaruri hai dusre number per pettren per mushtamil hona zaruri hai aur Teesra second candle ka first candle ke ke andar Banna zaroori hai number aur chauthe number per second candle k higher low r lower high hona chahiye r ye market trend k color ko red (down trend) ko green(uptrend) me tabdail kr deta hai is me dono candle k size me ziada fraq ni hota, ya ye green(uptrend) ko red(downtrend) man tabdeel ker deta ha. SIMILAR PATTERNS: 1. Bearish harami. 2. Bullish homing pigeon. 3. Bearish harami cross. The Descending Hawk is a two-line bearish reversal pattern belonging to the harami patterns family. The candle's body of the first line engulfs the second line's body. Shadows do not matter in regard to both candles. The first line of the Pattern may be any candle with a white body, appearing as a long line. Following candles are allowed: White Candle, Long White Candle, White Marubozu, Opening White Marubozu, Closing White Marubozu. Hawk reversal pattren Bullish or Bearish dono ho sakty hain. Lekin Bullish Bearish hook reversal pettern similar Hota Hai Lekin Pettern ki formation Mein opposite hota han. Is pattern man trader ko "Stop loss aur Take profit" k liye technical indicators ko use kerna chaheye, q k "Hook Reversal Pattern" sirf trend reversal k bara man batata ha lakin kitna move kara ga ye nahe batata. -

#34 Collapse

Descending Hawk Candlestick Pattern kisi share ke chart mein aik candlestick pattern hai jo bearish trend ko signal karta hai. Yeh bearish pattern aik zor daar uptrend ke baad shuru hota hai aur stock price mein giravat ka andaza deta hai. Is mein hum descending hawk candlestick pattern ke bare mein baat kareinge aur isay headings mein batayenge: Descending Hawk Candlestick Pattern ki Tareef kya hai? Descending hawk candlestick pattern bearish trend ke shuruat mein aik zor daar signal hai. Is pattern mein market trend up hai aur phir aik aisi candle banti hai jis mein opening price, high price, low price aur closing price upar neeche aa jate hain. Is se matlab hai ke buyers ke zor mein giravat aati hai aur phir price girne lagta hai. Descending hawk candlestick pattern bearish trend ke indication ke sath sath aik powerful reversal signal bhi hota hai. Descending Hawk Candlestick Pattern ke Types kya hain? Descending hawk candlestick pattern ke do types hotay hain: simple descending hawk aur modified descending hawk. Simple descending hawk candlestick pattern mein market uptrend mein hai aur phir aik aisa candle banta hai jis mein opening price, high price, low price aur closing price upar neeche aa jate hain. Is pattern ko confirm karne ke liye aik doosra bearish candlestick bhi zaroori hai. Modified descending hawk candlestick pattern mein bhi market uptrend mein hota hai, lekin is mein bearish candle ke baad ek doji bhi hota hai. Agar doji ke baad price girti hai to yeh descending hawk candlestick pattern confirm ho jata hai.

Descending Hawk Candlestick Pattern ke Types kya hain? Descending hawk candlestick pattern ke do types hotay hain: simple descending hawk aur modified descending hawk. Simple descending hawk candlestick pattern mein market uptrend mein hai aur phir aik aisa candle banta hai jis mein opening price, high price, low price aur closing price upar neeche aa jate hain. Is pattern ko confirm karne ke liye aik doosra bearish candlestick bhi zaroori hai. Modified descending hawk candlestick pattern mein bhi market uptrend mein hota hai, lekin is mein bearish candle ke baad ek doji bhi hota hai. Agar doji ke baad price girti hai to yeh descending hawk candlestick pattern confirm ho jata hai. Descending Hawk Candlestick Pattern ki Formation kaise hoti hai? Descending hawk candlestick pattern ka formation aik uptrend ke baad hota hai. Is pattern mein aik aisi candle banti hai jis mein opening price, high price, low price aur closing price upar neeche aa jate hain. Yeh bearish candle bullish trend ke zor mein aati hai aur is se pata chalta hai ke buyers ke zor mein giravat aane wali hai. Is pattern ko confirm karne ke liye aik doosra bearish candle bhi zaroori hai.

Descending Hawk Candlestick Pattern ki Formation kaise hoti hai? Descending hawk candlestick pattern ka formation aik uptrend ke baad hota hai. Is pattern mein aik aisi candle banti hai jis mein opening price, high price, low price aur closing price upar neeche aa jate hain. Yeh bearish candle bullish trend ke zor mein aati hai aur is se pata chalta hai ke buyers ke zor mein giravat aane wali hai. Is pattern ko confirm karne ke liye aik doosra bearish candle bhi zaroori hai. Descending Hawk Candlestick Pattern ke Signals kya hote hain? Descending hawk candlestick pattern ke signals bearish trend aur reversal signals hote hain. Jab market uptrend mein hota hai aur phir descending hawk candlestick pattern ban jata hai, to is se pata chalta hai ke bearish trend shuru hone wala hai. Is pattern ko confirm karne ke liye aik doosra bearish candle bhi zaroori hai. Agar price doosri candle se bhi nichay aa jaye to is se pata chalta hai ke bearish trend confirm ho chuka hai aur sellers ke zor mein market hai. Is pattern ke reversal signals bhi hote hain, jo bullish trend ke indication dete hain. Jab market bearish trend mein hota hai aur descending hawk candlestick pattern ban jata hai aur doosra candle bullish trend ke upar close karta hai to is se pata chalta hai ke bullish reversal shuru hone wala hai.

Descending Hawk Candlestick Pattern ke Signals kya hote hain? Descending hawk candlestick pattern ke signals bearish trend aur reversal signals hote hain. Jab market uptrend mein hota hai aur phir descending hawk candlestick pattern ban jata hai, to is se pata chalta hai ke bearish trend shuru hone wala hai. Is pattern ko confirm karne ke liye aik doosra bearish candle bhi zaroori hai. Agar price doosri candle se bhi nichay aa jaye to is se pata chalta hai ke bearish trend confirm ho chuka hai aur sellers ke zor mein market hai. Is pattern ke reversal signals bhi hote hain, jo bullish trend ke indication dete hain. Jab market bearish trend mein hota hai aur descending hawk candlestick pattern ban jata hai aur doosra candle bullish trend ke upar close karta hai to is se pata chalta hai ke bullish reversal shuru hone wala hai.

-

#35 Collapse

Plunging flying hunter fire design cost frame standard do candles se mel kar bana hai, jo k negative model inversion k leye istemal hote hen. Plan the main light to seem to be a white fire, and jab the second flame to seem to be a little white candle. Falling hawk candle configuration cost chart: top: bullish example; negative example reversal; first fire; second light; nisbat size; bari hoti hai. Name: pictures (170).jpg Perspectives: 75 Size: 5.2 KBDesign ki Pehchan k Principles Jumping flying hunter light arrangement aik negative model inversion sharpen ki waja se qeematon ka pehle se bullish model ya excessive cost locale me hona chaheye. Plan ki first fire aik bari guaranteed body wali white light hoti hai, jo k negative model ki alamat hoti hai. Plan ki second candle aik insignificant genuine body wali white light hoti hai, jo k model inversion ka kaam karti hai. Plan ki first light second candle se size me ziada ya bari hoti hai. The plan includes a subsequent white fire and a first white candle with an open and shut inside. Planning certified body candles with shadows is equivalent to stirring things up around town candle with veritable body, and lazmi is equivalent to raising a ruckus around town fire with real body. Plan ki Tafseel Plunging flying hunter light arrangement aik aisa plan hai, jo costs ko rise se lower size standard tabdeel karti hai, punch bhi qeematen low locale me exchange kar rahi hoti hai. Arrangement do candles se mel kar bana hai, jis me first candle aik genuine body wali white light hoti hai, hit k second candle aik insignificant legitimate body wali white fire hoti hai, jo k first fire k authentic body k inside open aur close hoti hai. Try not to utilize candles to counterfeit the body; all things considered, punch the principal candle and the second fire to counterfeit the body. Dropping flying predator candle configuration: second candle first light is andar banti hai; yanni is open and shut, and the main fire is inside me hoti hai; jis se ziada tar design reversal hota hai. Plan standard purchase ki region ki ja sakti hai, jo k aik third dull verification fire k baad ho sakti hai. The third dull light is the genuine body, and the subsequent white fire is the nechay band. -

#36 Collapse

DESCENDING HAWK CANDLESTICK PATTERN DEFINITION Descending hawk Ek Bearish reversal pattern hai Pehle Day Ke candle Ka body dusri candle ko Puri Tarah lapet leta hai jo up trend Mein banta hai first day Ek long white candle Trends ki direction main taiyar Hota Hai donon candles ke Hawale se Shadow important nahi hai Ek long line ke Taur per Zeher hoti hai Ta Ham doji ya spinning Top ki Ijazat nahi hai body ke color ko chhor kar utarne wala baz harami pattern se resemble Rakhta hai yah homing pigeon ka bearish version bhi ho sakta hai candlestick model Har Waqt frames Mein reliable hain kuch patterns Jaisa ke morning star, intraday, shooting star, descending Hawk Mein Shamil Hai Kyunki ismein midpoint ki zarurat hoti hai electronic currency ki Tijarat karna profit ke liye best hai aur ismein loss bhi Bach sakte hain next candle ka Khula hua Pichhle candle ke close ke barabar nahi hota haiDESCENDING HAWK WITH FOR OF HOMING PIGEON Misali tahashkil se deviation Aksar price Mein tabdili ki vajah se Hota Hai aur iska determine homing pigeon Se Kiya jata hai chart ko ek hi time mein date Kiya jata hai candlestick alerts ka istemal profit ke liye bahut fayda Paida karta hai yah chart indicators ke sath Milkar models ke liye Apne entry and exit fraham Karte Hain aur descending hwak ki trading karne se pahle market ke rules ko follow karna chahie aur uski zyada Se zyada confirmation bhi karna chahie Agar uski movement niche ki taraf ja rahi hai to usse analysis karna chahie Uske bad apni trade ko open karna chahie Jaise se aap trading mein risk se Bach sakte hain aur success Hasil kar sakte hain descending Hawk ki predicting bhi kar sakte hain

DESCENDING HWAK TWEEZER BOTTOM AND TWEEZE TOP Matching candles ke sath tweezer bottom mein bhi ho sakte hain ya real body wicks Shadow per most Mel ho sakte hain\ per mushtamil ho sakte hain aur ismein bull and bears bhi Hote Hain bearish tweezer tops ke kareeb Mein Hote Hain jismein Bull and bear move Karte Hain

DESCENDING HWAK TWEEZER BOTTOM AND TWEEZE TOP Matching candles ke sath tweezer bottom mein bhi ho sakte hain ya real body wicks Shadow per most Mel ho sakte hain\ per mushtamil ho sakte hain aur ismein bull and bears bhi Hote Hain bearish tweezer tops ke kareeb Mein Hote Hain jismein Bull and bear move Karte Hain

-

#37 Collapse

Hawk Candlestick Pattern Descending hawk candlestick pattern aik aisa pattern hai, jo prices ko uptrend se lower size par tabdeel karti hai, jab bhi qeematen low area me trade kar rahi hoti hai. Pattern do candles se mel kar bana hai, jis me 1st candle aik real body wali white candle hoti hai, jab k 2nd candle aik small real body wali white candle hoti hai, jo k 1st candle k real body k inside open aur close hoti hai. Dono candles ka lazmi real body me hona chaheye, jab k 1nd candle ka 2st candle se real body me ziada hona chaheye. Plunging bird of prey candle design aik aisa design hai, jo costs ko upswing se lower size standard tabdeel karti hai, poke bhi qeematen low region me exchange kar rahi hoti hai. Design do candles se mel kar bana hai, jis me first light aik genuine body wali white candle hoti hai, punch k second flame aik little genuine body wali white candle hoti hai, jo k first candle k genuine body k inside open aur close hoti hai. Dono candles ka lazmi genuine body me hona chaheye, hit k 1nd light ka 2st candle se genuine body me ziada hona chaheye. Descending hawk patterns two days Candle's par mushtamil aik bearish trend reversal pattern hai, jo k prices k top par ya bullish trend k akhtetam par banta ha... Pattern ki pehli aur dosri candle same bullish candles hoti hai jis main dosri candle pehli candle k andar open aur close hoti ha... Descending hawk pattern ki dosri candle ki formation same "Bearish Harami Pattern" aur "Bearish Harami Cross Pattern" jaisi hai lekin aik to iss candle ka color white hoti hai, jo k "Bearish Harami Pattern" k candle main black hoti, dosra ye candle small real body ki hoti hai, jo k "Bearish Harami Cross Pattern" ki candle doji candle hoti hai, jiss ka open aur close same hota ha... Descending hawk pattern aik bearish trend reversal pattern hai, jo k prices k top par ya bullish trend main banta hai. Ye pattern bullish k kamzori ki nishan dahi karta karta hai. Dosree candle aik aik small real body wali bullish candle hoti hai jo uptrend ka ikhtetaam karti hai, jiss k baad prices bearish trend reversal ka sabab banti ha. -

#38 Collapse

Dropping Falcon Model Dropping falcon plan two days candles standard mushtamil aik negative model inversion plan hai, jo k costs k top standard ya bullish model k akhtetam standard banta hai. Plan ki pehli aur dosri candle same bullish candles hoti hai jis head dosri fire pehli light k andar open aur close hoti hai. Sliding flying hunter plan ki dosri light ki strategy same "Negative Harami Model" aur "Negative Harami Cross Model" jaisi hai lekin aik to iss fire ka arrangement white hoti hai, jo k "Negative Harami Model" k fire head dull hoti, dosra ye candle negligible genuine body ki hoti hai, jo k "Negative Harami Cross Model" ki flame doji candle hoti hai, jiss ka open aur close same hota hai. Dropping flying hunter plan aik negative model inversion plan hai, jo k costs k top standard ya bullish model head banta hai. Ye plan bullish k kamzori ki nishan dahi karta hai. Dosree flame aik insignificant authentic body wali bullish light hoti hai jo rise ka ikhtetaam karti hai, jiss k baad costs negative model inversion ka sabab banti hai. What is Dropping Falcon plan? Forex market fundamental slipping flying hunter plan 2 days candles standard moshtamil aek negative model inversion arrangement feed. Jo key costs key upr yah bullish model k end standard banta feed. Plan ki first aur second fire same bullish candles hoti roughage. Aur jis mein second fire first light key andar open our bnd hoti feed. Plunging flying hunter plan ki 2osri light ki indistinguishable negative harami plan or negative harami Cross Patter jesi feed. Regardless, aek to is fire ka tone sufeed hoti roughage. Ju key negative harami Model key fire mein kali hoti. 2osri no inquiry light choti authentic body ki hoti feed. Ju key negative harami Cross Model ki fire doji light hoti feed. Jis ka open or close same hota feed. Hopping flying hunter plan ek negative model inversion plan haey. Yh costs key upper yah bullish model maein banta feed. More than likely arrangement bullish key week ki alamat dati karta hai. second candle aek choti l ensured body vali bullish fire hoti feed. Jo rise ka end karti feed. Working structure key horrendous costs negative model inversion ka bais banti feed. Es ko hm sliding model ka nam dety hain. Exchanging ka amal, Bouncing bird of prey fire arrangement Slipping flying tracker configuration "Negative Harami Model" aur "Negative Harami Cross Model" se melta julta plan hai, jo same bullish model ko negative model me change kia jata hai. Slipping falcon fire setup Dropping flying tracker plan two days candles standard mushtamil plan hai, jis me pehlee aik long veritable body wali bullish light hote hai, jis k baad dosree aik long certified body wali irrelevant bullish fire banti hai. Pehli flame costs k ascent ki nishan-dahi kartti hai, ye fire size aur procedure me standard long authentic body wali bullish fire hotti hai. Plunging falcon candle plan Lekin dosre disturbance ki fire aik inconsequential true body wali bullish fire hotee hai, jo k open aur close pehli light k veritable body Sliding flying hunter flame plan basic hoti hai. Plan ki dono light bullish hone k bawajood bhi negative model reversal plan ka kaam hy.... -

#39 Collapse

Aslamoalekum members kesay hain ap sab. Mujhay umed hay sah thek thak hon gay. Aj ka hamara disscussion ka jo topic hay wh descending Hawk Candlestick pattern kay bary hain. Isy dekhty hain kay yeh kia hay r hamen kia information deta hay. Descending Hawk Candlestick pattern Descending Hawk Candlestick Pattern forex trading mein ek chart pattern hai jo bearish trend ko zahir karta hai. Is pattern mein candlestick kay jisam top se wesy neechay ki taraf hoti hai aur iska oper wala jo saya hay woh bohat chota hota hai jab ke iska jo nichla wala saya hay woh lamba hota hai. Yeh pattern aksar selling pressure ki numaindgi leta hai aur traders isko choti bechnay ke mwaaqay ke liye istemal karte hain.isaky bohat say faiday hain jinhain istemal kar kay traders apna take profit set kr kay bht se faidamand trade hasil kar sakty hain. importance of pattern Descending Hawk Candlestick Pattern forex trading mein bohat ahmiyat rakhta hai kyunky yeh bearish trend ke ishara deta hai. Agar traders is pattern ko samajhy jaate hain to unhe selling kay bohat numayan mawaqay ke baare mein aik mashwara ho jaata hai aur wo iske zariye woh faidamand e trades kar sakte hain.is liye Is pattern ke zariye traders ko market ki onch nech aur simat ka pata chalta hai. Jab candlestick ka jisam top se neechay ki taraf hoti hai to iska matlab hota hai ke market mein selling pressure hai aur price downward trend ke perwi kar rahi hai. Iske alawa, traders is pattern ki madad se stop loss aur take profit levels js ko bhi set kar sakte hain. Stop loss ko set karke traders apne losses ko control kar sakte hain aur take profit level set karke wo apne faiday ko zeda say zeada kar saktey hain.Isliye forex trading mein Descending Hawk Candlestick Pattern ka ilam hona bohat zaroori hai aur traders is pattern ke zariye apne tejarat main honay wali bh sari harkato ko jesy ko behtar kar sakte hain. -

#40 Collapse

Dropping Bird of prey Model Dropping bird of prey plan two days candles standard mushtamil aik negative model inversion plan hai, jo k costs k top standard ya bullish model k akhtetam standard banta hai. Plan ki pehli and dosri light are similar bullish candles, and their opening and it are something very similar to close times. Sliding flying predator plan with dosri light and course of action that are indistinguishable from "Negative Harami Model" and "Negative Harami Cross Model" lekin aik to iss fire ka assortment white hoti hai, jo k flame head dim hoti, dosra ye candle minimal certified body ki hoti hai, jo k candle doji candle hoti hai, jiss ka open and close same hota Dropping flying predator configuration is a negative example reversal configuration; costs are the top norm, and the head banta is a bullish example. Ye plan bullish k kamzori ki nishan dahi karta hai. Dosree light aik negligible true body wali bullish flame hoti hai jo rise ka ikhtetaam karti hai, jiss k baad costs negative model inversion ka sabab banti hai. What is Dropping Flying predator plan? Forex market essential slipping flying predator configuration feed standard moshtamil aek negative example reversal The bullish example toward the finish of the standard banta feed is jo key costs key upr. The first and second blazes of the plan are indistinguishable bullish candles. Our bnd hoti feed can be gotten to utilizing our subsequent fire, first candle key andar. Plunging flying predator plan ki 2osri flame plan or negative harami Cross Patter jesi feed is a same. Nevertheless, aek to is fire ka tone sufeed hoti roughage. Ju key negative harami Model key fire mein kali hoti. 2osri is beyond question a certifiable body with a hot feed. Cross Model ju key negative harami ki flame doji light hoti feed The equivalent hota feed can be opened or shut. Hopping flying hunter plan ek negative model inversion plan haey. The bullish example maein banta feed yh costs key upper yah Without a doubt plan bullish key week ki alamat dati karta hai. Aek choti l real body vali bullish candle hoti feed is the subsequent candle. Jo rise ka end karti feed. Framework key awful costs terrible example reversal ka bais banti feed. An illustration of a sliding entryway can be viewed as here. "Negative Harami Model" and "Negative Harami Cross Model" melta julta plan hai, jo same bullish model ko negative model me change kia jata hai, trading ka amal, jumping hawk candle configuration Slipping flying hunter setup Dropping flying hunter plan two days candles standard mushtamil plan hai, jis me pehlee aik long authentic body wali bullish light hote hai, jis k baad dosree aik long genuine body wali negligible bullish fire banti hai The cost of a pehli candle on the rise is a nishan-dahi kartti hai, and the fire size and game-plan are both common long veritable bodies with bullish flares. Bouncing falcon fire plan Lekin dosre commotion ki fire aik inconsequential true body wali bullish candle hotee hai, jo k open aur close pehli light k authentic body Sliding flying hunter candle plan key hoti hai. Plan ki dono light bullish sharpen k bawajood bhi negative model inversion plan kaam hy -

#41 Collapse

Re: Slipping Falcon Candle ExampleDropping Falcon Model Dropping falcon plan two days candles standard mushtamil aik negative model inversion plan hai, jo k costs k top standard ya bullish model k akhtetam standard banta hai. Plan ki pehli aur dosri candle same bullish candles hoti hai jis head dosri fire pehli flame k andar open aur close hoti hai. Sliding flying hunter plan ki dosri light ki strategy same "Negative Harami Model" aur "Negative Harami Cross Model" jaisi hai lekin aik to iss fire ka collection white hoti hai, jo k "Negative Harami Model" k fire head dull hoti, dosra ye candle negligible genuine body ki hoti hai, jo k "Negative Harami Cross Model" ki flame doji candle hoti hai, jiss ka open aur close same hota hai. Dropping flying hunter plan aik negative model inversion plan hai, jo k costs k top standard ya bullish model head banta hai. Ye plan bullish k kamzori ki nishan dahi karta hai. Dosree candle aik negligible genuine body wali bullish flame hoti hai jo rise ka ikhtetaam karti hai, jiss k baad costs negative model inversion ka sabab banti hai. What is Dropping Falcon plan? Forex market fundamental slipping flying hunter plan 2 days candles standard moshtamil aek negative model inversion design feed. Jo key costs key upr yah bullish model k end standard banta feed. Plan ki first aur second fire same bullish candles hoti roughage. Aur jis mein second fire first flame key andar open our bnd hoti feed. Plunging flying hunter plan ki 2osri light ki indistinguishable negative harami plan or negative harami Cross Patter jesi feed. Regardless, aek to is fire ka tone sufeed hoti roughage. Ju key negative harami Model key fire mein kali hoti. 2osri no inquiry light choti authentic body ki hoti feed. Ju key negative harami Cross Model ki fire doji light hoti feed. Jis ka open or close same hota feed. Bouncing flying hunter plan ek negative model inversion plan haey. Yh costs key upper yah bullish model maein banta feed. More than likely arrangement bullish key week ki alamat dati karta hai. second candle aek choti l confirmed body vali bullish fire hoti feed. Jo rise ka end karti feed. Working system key awful costs negative model inversion ka bais banti feed. Es ko hm sliding model ka nam dety hain. Exchanging ka amal, Bouncing falcon fire arrangement Slipping flying tracker configuration "Negative Harami Model" aur "Negative Harami Cross Model" se melta julta plan hai, jo same bullish model ko negative model me change kia jata hai. Slipping falcon fire setup Dropping flying tracker plan two days candles standard mushtamil plan hai, jis me pehlee aik long authentic body wali bullish light hote hai, jis k baad dosree aik long certifiable body wali inconsequential bullish fire banti hai. Pehli light costs k ascent ki nishan-dahi kartti hai, ye fire size aur system me standard long real body wali bullish fire hotti hai. Plunging bird of prey candle plan Lekin dosre upheaval ki fire aik irrelevant credible body wali bullish fire hotee hai, jo k open aur close pehli light k certifiable body Sliding flying hunter flame plan central hoti hai. Plan ki dono light bullish hone k bawajood bhi negative model reversal plan ka kaam hy....

-

#42 Collapse

Introduction:Descending hawk pattern" aik technical trading term hai jo stock market aur financial markets mein istemal hota hai. Is pattern ka istemal trend analysis aur price movement prediction ke liye kiya jata hai. Ye pattern bearish (downward) trend ko represent karta hai aur traders ko market mein price decline ki possibility ke bare mein suchit karta hai. What is Descending Hawk Candlestick Pattern?Features: Descending hawk pattern mein kuch key features shamil hote hain:Descending hawk pattern ko samajhne ke liye, pehle humein "hawk" aur "descending" dono terms ki samajh honi chahiye. "Hawk" market mein bullish ya uptrend ko indicate karta hai jabke "descending" kam hota hai ya giraawat ko indicate karta hai. Is tarah, descending hawk pattern bearish trend ke liye use hota hai.Descending hawk pattern ko graphically dekha jaye to yeh ek specific price pattern hota hai jisme kuch key elements hote hain. Ye elements candlestick charts ke through observe kiye jate hain. Descending hawk pattern mein normally teen candles involve hoti hain.How to trade descending hawk patternSabse pehle, pehli candle bullish candle hoti hai jiske baad price decline karta hai. Doosri candle bearish candle hoti hai jiske open price pehli candle ke close price se above hoti hai aur close price pehli candle ke open price se below hoti hai. Ye bearish candle market sentiment ki weakning ko represent karti hai aur price decline ki possibility ko indicate karti hai.Teesri candle bullish candle hoti hai jiske open price doosri candle ke close price se above hoti hai aur close price doosri candle ke open price se below hoti hai. Ye bullish candle price decline ki sambhavna ke baad ko indicate karti hai aur market mein price recovery ki possibility ko represent karti hai.Descending hawk pattern ki pehchan karne ke liye, traders ko iske key features aur confirmatory signals ko dekhna hota hai. Ye features aur signals aapko price action aur candlestick patterns ke through samajhne mein madad karte hain.1: Pehli bullish candle ka size bada hota hai aur bullish momentum ko indicate karta hai. 2: Doosri bearish candle ka size pehli bullish candle se chota hota hai, isse selling pressure aur price decline ki indication hoti hai. 3: Teesri bullish candle ka size doosri bearish candle se bada hota hai, isse buying pressure aur price recovery ki indication hoti hai. 4: Doosri bearish candle ke close price pehli bullish candle ke open price ke niche hota hai. 5: Teesri bullish candle ke close price doosri bearish candle ke open price ke niche hota hai. Conclusion:Descending hawk pattern ko confirm karne ke liye, traders aur analysts doosre technical indicators aur tools ka istemal karte hain. Ye indicators RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), aur volume analysis jaise ho sakte hain.Traders descending hawk pattern ko identify karne ke baad price decline ki expectation rakhte hain aur isko trading strategies mein incorporate karte hain. Is pattern ki mukhtalif variations aur interpretations bhi ho sakti hain, jaise ki ascending hawk pattern aur descending broadening wedge pattern. Thanks -

#43 Collapse

Introduction of the post. A.o.A The Dropping bird of prey plan two days candles standard mushtamil aik negative model inversion plan hai, jo k costs k top standard ya bullish model k akhtetam standard banta hai. Plan ki pehli aur dosri flame same bullish candles hoti hai jis head dosri fire pehli candle k andar open aur close hoti hai. Sliding flying hunter plan ki dosri light ki game-plan same "Negative Harami Model" aur "Negative Harami Cross Model" jaisi hai lekin aik to iss fire ka combination white hoti hai, jo k "Negative Harami Model" k fire head dull hoti, dosra ye candle negligible genuine body ki hoti hai, jo k "Negative Harami Cross Model" ki flame doji candle hoti hai, jiss ka open aur close same hota hai. Dropping flying hunter plan aik negative model inversion plan hai, jo k costs k top standard ya bullish model head banta hai. Ye plan bullish k kamzori ki nishan dahi karta hai. Dosree light aik insignificant authentic body wali bullish candle hoti hai jo rise ka ikhtetaam karti hai, jiss k baad costs negative model inversion ka sabab banti hai. What is Stopping Bird of prey plane Forex market fundamental slipping flying hunter plan 2 days candles standard moshtamil aek negative model inversion setup feed. Jo key costs key upr yah bullish model k end standard banta feed. Plan ki first aur second fire same bullish candles hoti roughage. Aur jis mein second fire first flame key andar open our bnd hoti feed. Plunging flying hunter plan ki 2osri light ki indistinguishable negative harami plan or negative harami Cross Patter jesi feed. In any case, aek to is fire ka tone sufeed hoti roughage. Ju key negative harami Model key fire mein kali hoti. 2osri no inquiry light choti authentic body ki hoti feed. Ju key negative harami Cross Model ki fire doji light hoti feed. Jis ka open or close same hota feed. Bouncing flying hunter plan ek negative model inversion plan haey. Yh costs key upper yah bullish model maein banta feed. More likely than not plan bullish key week ki alamat dati karta hai. second candle aek choti l ensured body vali bullish fire hoti feed. Jo rise ka end karti feed. Working structure key awful costs negative model inversion ka bais banti feed. Es ko hm sliding model ka nam dety hain. Exchanging ka Amal Hopping falcon fire arrangement Slipping flying tracker configuration "Negative Harami Model" aur "Negative Harami Cross Model" se melta julta plan hai, jo same bullish model ko negative model me change kia jata hai. Slipping falcon fire arrangement Dropping flying tracker plan two days candles standard mushtamil plan hai, jis me pehlee aik long certifiable body wali bullish light hote hai, jis k baad dosree aik long real body wali immaterial bullish fire banti hai. Pehli light costs k ascent ki nishan-dahi kartti hai, ye fire size aur procedure me standard long authentic body wali bullish fire hotti hay -

#44 Collapse

Dropping Falcon Candle Example Sliding bird of prey candle design cost outline standard do candles se mel kar bana hai, jo k negative pattern inversion k leye istemal hote hen. Design ki first candle aik white light hoti hai, poke k second flame aik little white candle hoti hai. Plummeting falcon candle design cost diagram k top ya bullish pattern me negative pattern inversion k kaam karta hai, jis ki first candle second candle ki nisbat size me bari hoti hai.Pattern ki Pehchan k Standards Dropping falcon candle design aik negative pattern inversion sharpen ki waja se qeematon ka pehle se bullish pattern ya exorbitant cost region me hona chaheye.Design ki first flame aik bari genuine body wali white candle hoti hai, jo k negative pattern ki alamat hoti hai.Design ki second light aik little genuine body wali white flame hoti hai, jo k pattern inversion ka kaam karti hai.Design ki first candle second light se size me ziada ya bari hoti hai.Design ki second white light first white candle k inside open aur close hoti hai.Design ki dono candles genuine body aur shadow samet ho sakti hai, poke k second candle ki genuine body first light ki genuine body se lazmi kam hona chaheye. Design ki Tafseel Sliding bird of prey candle design aik aisa design hai, jo costs ko upturn se lower size standard tabdeel karti hai, poke bhi qeematen low region me exchange kar rahi hoti hai. Design do candles se mel kar bana hai, jis me first flame aik genuine body wali white candle hoti hai, hit k second candle aik little genuine body wali white light hoti hai, jo k first candle k genuine body k inside open aur close hoti hai. Dono candles ka lazmi genuine body me hona chaheye, poke k 1nd candle ka 2st candle se genuine body me ziada hona chaheye. Design standard Exchanging ka Amal Dropping bird of prey candle design ki second candle first candle k andar banti hai, yanni is ka open aur close dono first candle k inside me hoti hai, jis se ziada tar pattern inversion hota hai. Design standard purchase ki passage ki ja sakti hai, jo k aik third dark affirmation flame k baad ho sakti hai. third dark flame ka genuine body me hona aham hai, jo k second white candle k nechay band honi chaheye. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#45 Collapse

Descending Hawk Candlestick Pattern kia ha??Assalamualaikum dear forex members Descending Hawk Candlestick PatternDescending hawk candlestick pattern price chart par do candles se mel kar bana hai, jo k bearish trend reversal k leye istemal hote hen. Pattern ki 1st candle aik white candle hoti hai, jab k 2nd candle aik small white candle hoti hai. Descending hawk candlestick pattern price chart k top ya bullish trend me bearish trend reversal k kaam karta hai, jis ki 1st candle 2nd candle ki nisbat size me bari hoti hai.Pattern ki Pehchan k Rules- Descending hawk candlestick pattern aik bearish trend reversal hone ki waja se qeematon ka pehle se bullish trend ya high price area me hona chaheye.

- Pattern ki 1st candle aik bari real body wali white candle hoti hai, jo k bearish trend ki alamat hoti hai.

- Pattern ki 2nd candle aik small real body wali white candle hoti hai, jo k trend reversal ka kaam karti hai.

- Pattern ki 1st candle 2nd candle se size me ziada ya bari hoti hai.

- Pattern ki 2nd white candle 1st white candle k inside open aur close hoti hai.

- Pattern ki dono candles real body aur shadow samet ho sakti hai, jab k 2nd candle ki real body 1st candle ki real body se lazmi kam hona chaheye.

Pattern ki TafseelDescending hawk candlestick pattern aik aisa pattern hai, jo prices ko uptrend se lower size par tabdeel karti hai, jab bhi qeematen low area me trade kar rahi hoti hai. Pattern do candles se mel kar bana hai, jis me 1st candle aik real body wali white candle hoti hai, jab k 2nd candle aik small real body wali white candle hoti hai, jo k 1st candle k real body k inside open aur close hoti hai. Dono candles ka lazmi real body me hona chaheye, jab k 1nd candle ka 2st candle se real body me ziada hona chaheye.Pattern par Trading ka AmalDescending hawk candlestick pattern ki 2nd candle 1st candle k andar banti hai, yanni is ka open aur close dono 1st candle k inside me hoti hai, jis se ziada tar trend reversal hota hai. Pattern par buy ki entry ki ja sakti hai, jo k aik 3rd black confirmation candle k baad ho sakti hai. 3rd black candle ka real body me hona aham hai, jo k 2nd white candle k nechay band honi chaheye.

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 11:34 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим