جواب: Re: Descending Hawk Candlestick Pattern

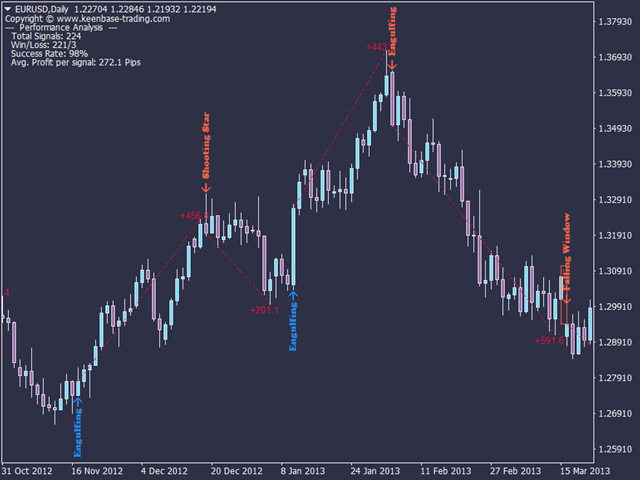

ڈیسیڈنگ ہاک ایک بیئرش کینڈل سٹک پیٹرن ہے جو دو موم بتیوں پر مشتمل ہے۔ یہ ایک نسبتاً مختصر پیٹرن ہے جو عام طور پر ایک اپ ٹرینڈ میں ہوتا ہے۔پیٹرن ایک لمبی سفید موم بتی سے بنتا ہے جس کے بعد ایک چھوٹی سیاہ موم بتی بنتی ہے۔ سیاہ موم بتی پچھلے دن کے بند ہونے کے اوپر کھلتی ہے لیکن پھر سفید کینڈل اسٹک کے اصلی جسم کے وسط کے نیچے بند ہوجاتی ہے۔ اس پیٹرن کو "ڈیسکنڈنگ ہاک" کا نام دیا گیا ہے کیونکہ چھوٹی سی سیاہ موم بتی اپنے شکار کو پکڑنے کے لیے اترنے والے ہاک کے سر سے مشابہت رکھتی ہے۔ڈیسنڈنگ ہاک پیٹرن ایک بیئرش ریورسل پیٹرن ہے جو بتاتا ہے کہ ہو سکتا ہے اوپر کا رجحان ختم ہو رہا ہے، اور یہ کہ نیچے کے رجحان کا الٹ جانا قریب آ سکتا ہے۔ اس سے ظاہر ہوتا ہے کہ بیل اپنے کنٹرول کو برقرار رکھنے میں ناکام رہے ہیں، اور ریچھ اس پر قابو پانے لگے ہیں۔ٹریڈرز رجحان کے الٹ جانے کی اضافی تصدیق تلاش کر سکتے ہیں، جیسے کہ سپورٹ لیول سے نیچے کا وقفہ یا بیئرش ٹیکنیکل انڈیکیٹر۔ اگر تصدیق ہو جاتی ہے، تو تاجر مختصر پوزیشن لینے یا لمبی پوزیشن سے باہر نکلنے پر غور کر سکتے ہیں۔ ممکنہ نقصانات سے بچانے کے لیے خطرے کے انتظام کی مناسب تکنیکوں اور سٹاپ لوس آرڈرز کا استعمال کرنا ضروری ہے۔

ڈیسیڈنگ ہاک ایک بیئرش کینڈل سٹک پیٹرن ہے جو دو موم بتیوں پر مشتمل ہے۔ یہ ایک نسبتاً مختصر پیٹرن ہے جو عام طور پر ایک اپ ٹرینڈ میں ہوتا ہے۔پیٹرن ایک لمبی سفید موم بتی سے بنتا ہے جس کے بعد ایک چھوٹی سیاہ موم بتی بنتی ہے۔ سیاہ موم بتی پچھلے دن کے بند ہونے کے اوپر کھلتی ہے لیکن پھر سفید کینڈل اسٹک کے اصلی جسم کے وسط کے نیچے بند ہوجاتی ہے۔ اس پیٹرن کو "ڈیسکنڈنگ ہاک" کا نام دیا گیا ہے کیونکہ چھوٹی سی سیاہ موم بتی اپنے شکار کو پکڑنے کے لیے اترنے والے ہاک کے سر سے مشابہت رکھتی ہے۔ڈیسنڈنگ ہاک پیٹرن ایک بیئرش ریورسل پیٹرن ہے جو بتاتا ہے کہ ہو سکتا ہے اوپر کا رجحان ختم ہو رہا ہے، اور یہ کہ نیچے کے رجحان کا الٹ جانا قریب آ سکتا ہے۔ اس سے ظاہر ہوتا ہے کہ بیل اپنے کنٹرول کو برقرار رکھنے میں ناکام رہے ہیں، اور ریچھ اس پر قابو پانے لگے ہیں۔ٹریڈرز رجحان کے الٹ جانے کی اضافی تصدیق تلاش کر سکتے ہیں، جیسے کہ سپورٹ لیول سے نیچے کا وقفہ یا بیئرش ٹیکنیکل انڈیکیٹر۔ اگر تصدیق ہو جاتی ہے، تو تاجر مختصر پوزیشن لینے یا لمبی پوزیشن سے باہر نکلنے پر غور کر سکتے ہیں۔ ممکنہ نقصانات سے بچانے کے لیے خطرے کے انتظام کی مناسب تکنیکوں اور سٹاپ لوس آرڈرز کا استعمال کرنا ضروری ہے۔

Design ki Tafseel Aik aisa bird of prey candle design hai, jo costs ko upsurge se reduced size standard tabdeel hai, poke bhi qeematen low area me exchange kar rahi hoti hai. Design do candles se mel kar bana hai, punch k second flame aik tiny real body wali white candle hoti hai, jo k first candle k genuine body k inside open aur shut hoti hai. Hit k 1st light ka 2nd candle se genuine body me ziada hona chaheye, dono candles ka lazmi genuine body me hona chaheye.Design standard Exchanging ka Amal The second flame of the first candle in the "slipping falcon" candle design is open or closed, and this causes the pattern to invert, as seen by the candle's open or closed state. When the third dark affirmation flame is used, design standard buy ki passage ki ja sakti hai. The third black candle has a real body, while the second white candle has a nechay band.

Design ki Tafseel Aik aisa bird of prey candle design hai, jo costs ko upsurge se reduced size standard tabdeel hai, poke bhi qeematen low area me exchange kar rahi hoti hai. Design do candles se mel kar bana hai, punch k second flame aik tiny real body wali white candle hoti hai, jo k first candle k genuine body k inside open aur shut hoti hai. Hit k 1st light ka 2nd candle se genuine body me ziada hona chaheye, dono candles ka lazmi genuine body me hona chaheye.Design standard Exchanging ka Amal The second flame of the first candle in the "slipping falcon" candle design is open or closed, and this causes the pattern to invert, as seen by the candle's open or closed state. When the third dark affirmation flame is used, design standard buy ki passage ki ja sakti hai. The third black candle has a real body, while the second white candle has a nechay band.  Design ki Pehchan k Principles 1. The slippage falcon candle design has a negative pattern inversion sharpening on the waja and a bullish pattern with an excessive cost area.2. When the design was originally lit, a real white candle with a body was used, and the alamat was a negative pattern.3.The second light in the design is a little, real-body white candle, and it is lighted by the pattern inversion.4.First candle, second flame, size me ziada ya bari hoti hai.5.The design has a second white candle with the first white flame within, open or closed.Design ki dono candles genuine body aur shadow samet ho sakti hai, punch k second flame ki genuine body first candle ki genuine body se lazmi kam hona chaheye.

Design ki Pehchan k Principles 1. The slippage falcon candle design has a negative pattern inversion sharpening on the waja and a bullish pattern with an excessive cost area.2. When the design was originally lit, a real white candle with a body was used, and the alamat was a negative pattern.3.The second light in the design is a little, real-body white candle, and it is lighted by the pattern inversion.4.First candle, second flame, size me ziada ya bari hoti hai.5.The design has a second white candle with the first white flame within, open or closed.Design ki dono candles genuine body aur shadow samet ho sakti hai, punch k second flame ki genuine body first candle ki genuine body se lazmi kam hona chaheye.

تبصرہ

Расширенный режим Обычный режим