Assalam alaikum dear members!

umeed ha ap sb khairiat se hn gy or apki trading achi jaa rhi ho ge.

dear members aj ki post main hum spinning top candle stick ko study karen gy or dekhen gy ye kb or kaisy banti ha or esko trading main kesy use kia jata ha.

What is Spinning Top candle stick?

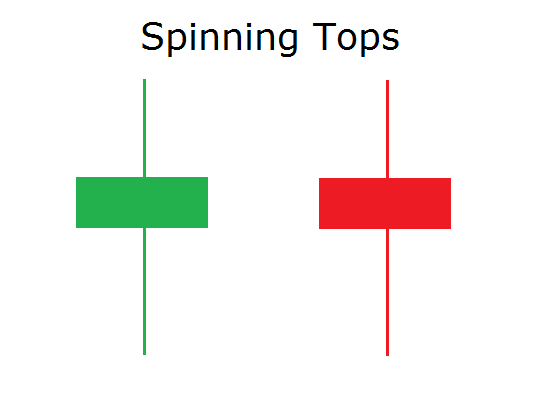

Dear members ye aik choti body wali candle stick hoti ha js k opr or nechy lmbi wich hoti ha or es ka mtlb hota ha k buyers or sellers k drmyan koe decission ni hoa market beech main ha abi.

Ye candle stick tb bnti ha jb buyers price ko opr push karty hain or samen time py sellers price ko nechy push karty hain or estrah es ki opening or closing price blkul kareeb hoti hain.

Spinning top main close open ya nechy se opr ho skta ha laikin inka fasla hmesha bht km hota ha.

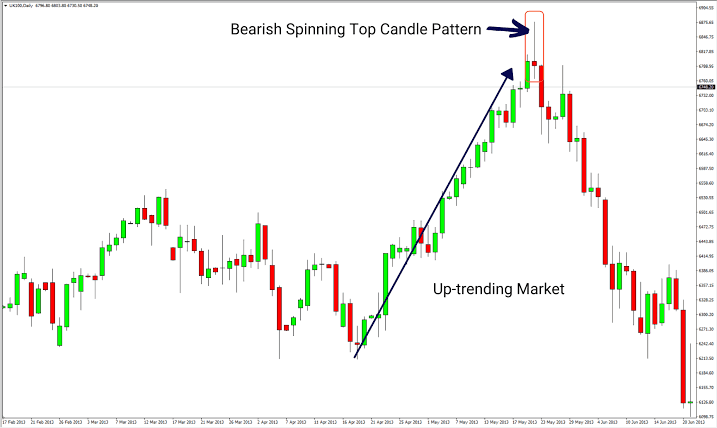

Spinning top k bad market range bhi bna skti ha q k buters or sellers same power main hoty hain.

laikin aksr ye pattern reversal pattern hota ha agr es se agli candle stick eski confirmation kr dy.

spinning top ki body ki base py 2 types hoti hain.

Bearish :

agr spinning top candle ki body bearish ho to ye bearish spinning top pattern khlata ha.

Bullish: agr spinning top candle ki body bullish ho to ye bullish spinning top candle stick pattern khlata ha.

HOW TO TRADE IT?

Dear members agr es pattern k bad market sideways ho jay or range bna ly to hamen es range main trade ni krni chahye or es k breakout ka wait karna chahye.

laiking agr spinning top candle k bad agli candle trend reversal ki confirmation dy to hmen es main trade leni chahye.

jesa k agr ye candle uptrend k end main bny or eski bearish body or es se next candle usi time frame main bearish close ho to hamen yahan se sell ki entry le leni chahye q k ye reversal ki confirmation ha.

umeed ha ap sb khairiat se hn gy or apki trading achi jaa rhi ho ge.

dear members aj ki post main hum spinning top candle stick ko study karen gy or dekhen gy ye kb or kaisy banti ha or esko trading main kesy use kia jata ha.

What is Spinning Top candle stick?

Dear members ye aik choti body wali candle stick hoti ha js k opr or nechy lmbi wich hoti ha or es ka mtlb hota ha k buyers or sellers k drmyan koe decission ni hoa market beech main ha abi.

Ye candle stick tb bnti ha jb buyers price ko opr push karty hain or samen time py sellers price ko nechy push karty hain or estrah es ki opening or closing price blkul kareeb hoti hain.

Spinning top main close open ya nechy se opr ho skta ha laikin inka fasla hmesha bht km hota ha.

Spinning top k bad market range bhi bna skti ha q k buters or sellers same power main hoty hain.

laikin aksr ye pattern reversal pattern hota ha agr es se agli candle stick eski confirmation kr dy.

spinning top ki body ki base py 2 types hoti hain.

Bearish :

agr spinning top candle ki body bearish ho to ye bearish spinning top pattern khlata ha.

Bullish: agr spinning top candle ki body bullish ho to ye bullish spinning top candle stick pattern khlata ha.

HOW TO TRADE IT?

Dear members agr es pattern k bad market sideways ho jay or range bna ly to hamen es range main trade ni krni chahye or es k breakout ka wait karna chahye.

laiking agr spinning top candle k bad agli candle trend reversal ki confirmation dy to hmen es main trade leni chahye.

jesa k agr ye candle uptrend k end main bny or eski bearish body or es se next candle usi time frame main bearish close ho to hamen yahan se sell ki entry le leni chahye q k ye reversal ki confirmation ha.

تبصرہ

Расширенный режим Обычный режим