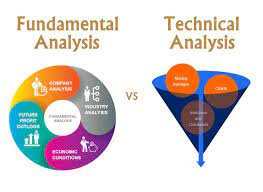

Analysis Types:

foreign exchange market principal buying and selling ky liay evaluation bahot zaruri hoty hain warna agar ham marketplace ki movement dekh ker agar exchange open ker dety hain tou yeh hamari success hoti hai ky hamain kisi exchange main earnings hasil ho jaey warna market principal alternate kerna bahot bara chance hota hai different buyers foreign exchange marketplace major trading ky liay analysis kerty hain ky apny alternate stability ko comfy ker sakain tou evaluation types ky hoty hain jin principal technical analysis aur essential analysis shamil hain ky agar ham dono terha ky analysis ker lety hain tou phir hamari trading main risk issue kam sy kam ho jata hai isliay ham following paras essential technical aur fundamental analysis ko discuss kerain gy.

Fundamental analysis:

fundamental analysis predominant aesy simple factors shamil hoty hain tou without delay economic system industry and business enterprise ky hobby ko effect kerty hain fundamental evaluation ka maqsad business enterprise ki intrinsic fee ko perceive kerna hota hai is ky liay comparatively cheap financial aur different factors ki nice aur quantity ka jaeza lia jata hai aur aesy factors ko pick out kia jata hai ky jin ki waja sy shares ki real charge aur marketplace fee most important difference create ho sakta hai

essential evaluation important in tamam elements ko investigate kia jata hai jo security ki cost ko have an impact on ker sakty hain jin fundamental macroeconomics factors aur organization precise factors jin ko fundamentals kaha jata hai jo aur kuch nehi hoti sirf statements managements competitions aur commercial enterprise principles waghera hoty hian jin ka maqsad kisi bhi industry ki as an entire economy ko analysis kerna hota hai.

Technical analysis:

technical analysis kisi bhi organization ky stocks ki forecast ky liay kiay jaty hain jo rely kerti hai ky enterprise ki call for kia hai aur supply kia hai aur future principal is in keeping with kia impact hony ja raha hai jis ky liay past ki performace aur records jo use kia jata hai tou sab sy pehly stock marketplace main hony wali change ko perceive kia jata hai ky future most important marketplace rate most important hony wali trade ka pata lagaya ja saky. Woh price jis consistent with purchaser aur supplier contract ko finalize kerty hain woh aesi cost hoti hai jo combine kerti hai weight kerti hai aur check kerti hai in tamam elements ko aur wohi wahid price hai jo important hoti hai dusry alfaz predominant technical analysis safety ki rate principal trade ka clean aur complete view pesh kerta hai.

Technical analysis vs fundamental analysis:

Market mein trading ke liye technical aur fundamental analysis donon hi hamare liye important hai kyunki jab tak ham donon analysis ko acchi tarike se nahin kar lete hain tab tak trading kamyab Nahin Hoti Hai kyunki hamare liye technical analysis bhi bahut important hai aur ISI Tarah se hamare liye fundamental analysis bhi bahut important hai hamen donon analysis ko Sahi tarike se karna chahie taki ham kamyab ho jaaye agar ham Sahi tarike se analysis Nahin karenge to kamyabi hamen bilkul bhi nahin hogi isliye hamen chahie ki ham donon analysis behtar tarike se karenge unke jitne behtar tarike se hamen analysis karenge utna hi hamen perfect results milenge hamen koshish Karni chahie ki hamare analysis perfect honi chahie tabhi hamare liye kamyabi Hai jiske dar ke jitne analysis behtar hote hain utani hi unko kamyabi hasil hoti hai technical analysis hamen previous market ki movement ko dekhkar Karne padte hain aur fundamental analysis ham market mein economic data ko dekh kar karte Hain Is Tarah se hamari trading behtar hoti hai.

foreign exchange market principal buying and selling ky liay evaluation bahot zaruri hoty hain warna agar ham marketplace ki movement dekh ker agar exchange open ker dety hain tou yeh hamari success hoti hai ky hamain kisi exchange main earnings hasil ho jaey warna market principal alternate kerna bahot bara chance hota hai different buyers foreign exchange marketplace major trading ky liay analysis kerty hain ky apny alternate stability ko comfy ker sakain tou evaluation types ky hoty hain jin principal technical analysis aur essential analysis shamil hain ky agar ham dono terha ky analysis ker lety hain tou phir hamari trading main risk issue kam sy kam ho jata hai isliay ham following paras essential technical aur fundamental analysis ko discuss kerain gy.

Fundamental analysis:

fundamental analysis predominant aesy simple factors shamil hoty hain tou without delay economic system industry and business enterprise ky hobby ko effect kerty hain fundamental evaluation ka maqsad business enterprise ki intrinsic fee ko perceive kerna hota hai is ky liay comparatively cheap financial aur different factors ki nice aur quantity ka jaeza lia jata hai aur aesy factors ko pick out kia jata hai ky jin ki waja sy shares ki real charge aur marketplace fee most important difference create ho sakta hai

essential evaluation important in tamam elements ko investigate kia jata hai jo security ki cost ko have an impact on ker sakty hain jin fundamental macroeconomics factors aur organization precise factors jin ko fundamentals kaha jata hai jo aur kuch nehi hoti sirf statements managements competitions aur commercial enterprise principles waghera hoty hian jin ka maqsad kisi bhi industry ki as an entire economy ko analysis kerna hota hai.

Technical analysis:

technical analysis kisi bhi organization ky stocks ki forecast ky liay kiay jaty hain jo rely kerti hai ky enterprise ki call for kia hai aur supply kia hai aur future principal is in keeping with kia impact hony ja raha hai jis ky liay past ki performace aur records jo use kia jata hai tou sab sy pehly stock marketplace main hony wali change ko perceive kia jata hai ky future most important marketplace rate most important hony wali trade ka pata lagaya ja saky. Woh price jis consistent with purchaser aur supplier contract ko finalize kerty hain woh aesi cost hoti hai jo combine kerti hai weight kerti hai aur check kerti hai in tamam elements ko aur wohi wahid price hai jo important hoti hai dusry alfaz predominant technical analysis safety ki rate principal trade ka clean aur complete view pesh kerta hai.

Technical analysis vs fundamental analysis:

Market mein trading ke liye technical aur fundamental analysis donon hi hamare liye important hai kyunki jab tak ham donon analysis ko acchi tarike se nahin kar lete hain tab tak trading kamyab Nahin Hoti Hai kyunki hamare liye technical analysis bhi bahut important hai aur ISI Tarah se hamare liye fundamental analysis bhi bahut important hai hamen donon analysis ko Sahi tarike se karna chahie taki ham kamyab ho jaaye agar ham Sahi tarike se analysis Nahin karenge to kamyabi hamen bilkul bhi nahin hogi isliye hamen chahie ki ham donon analysis behtar tarike se karenge unke jitne behtar tarike se hamen analysis karenge utna hi hamen perfect results milenge hamen koshish Karni chahie ki hamare analysis perfect honi chahie tabhi hamare liye kamyabi Hai jiske dar ke jitne analysis behtar hote hain utani hi unko kamyabi hasil hoti hai technical analysis hamen previous market ki movement ko dekhkar Karne padte hain aur fundamental analysis ham market mein economic data ko dekh kar karte Hain Is Tarah se hamari trading behtar hoti hai.

تبصرہ

Расширенный режим Обычный режим