Assalam alaikum dear members umeed ha ap sb thk hn gy.Dear members aj hum chart patterns ki list main agy barhty hovy triangle pattern ko discuss karny lagy hain hum dekhen gy k ye pattern kesy bnta ha or eski direction kia hoti ha or esy kesy trade kia jata ha.

What is triangle pattern?

Dear members triangel pattern 1 continuation chart pary pattern ha mtlb k price jis direction main move kar ri hoti ha ye us trend ya direction ki continuation ki indication ha.

Jb price 2 convergin lines k darmiyan estrha highs kr lows bnati ha k highs upper line ko touch karty hain kr lows lower line ko touch karty hain to 1 triangle shape structure bnta ha.

Commonly triangle pattern ki 3 different types hoti hain jo k hum aj bari bari discuss karen gy.

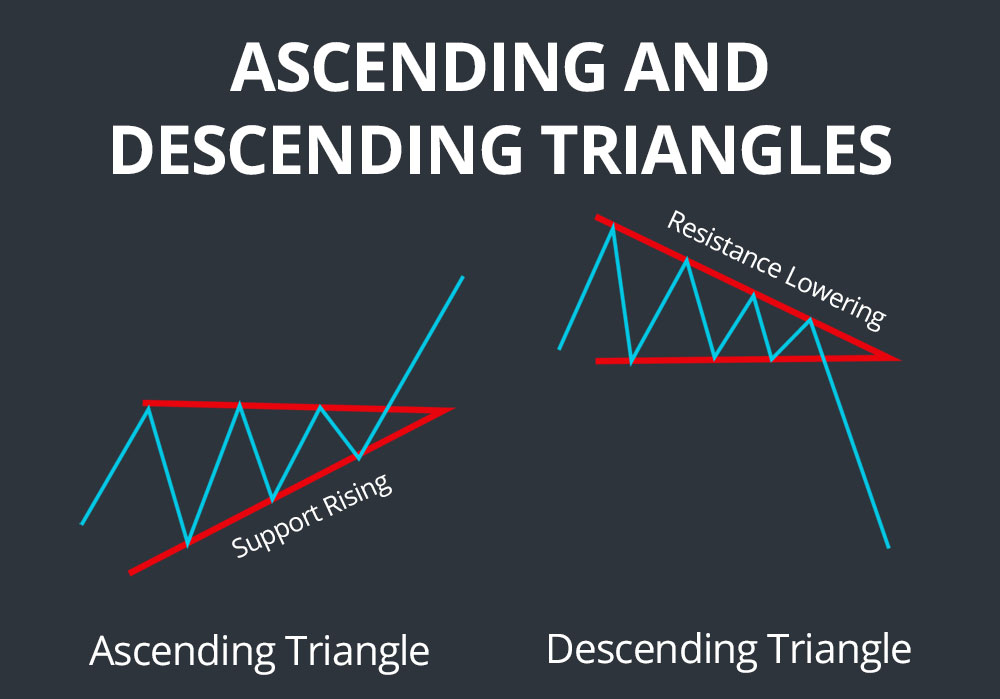

1) Ascending triangle:

Ascending triangle 1 breakout pattern hota ha or ye tb bnt ha jb market opr ki trf 1 horizontal trendline se bar bar resist hoti ha estrha es triangel ki oper ki trend line horizontal hoti ha or nechy ki trend line upward direction main hoti ha mtlb k market higher lows bnati ha.q k buyer apni bids barhaty jaty hain jiski waja se higher lows bnty hain or 1 wqt ata ha k buyers momentum pakarty hain or triangle ka breakout hota ha.

Es pattern main ap triangel ki lower trend line se trade le skty hain or stop loss lower trend line k nechy ho jb k take profit apka triangle ki length k equal ho.

ya phr ap breakout py bhi trade le skty hain.

2) Descending triangle:

Decending triangel inverted type ha ascending triangle ki. Es main triangle ki nechy wali trend line horizontal hoti ha jo k support k tor py kaam krti ha jb k oper wali trend line downward sloping hoti ha jiska mtlb ha market lower lows bnati ha or sellers dominate kye hoty hain market ko or at the end market breakdown ho k mazeed nechy jati ha.

Es main ap breakdown py bhi trade le skty hain ya us se phly triangle ki upper trend line py trade le skty hain or stop loss trend line se thora opr rkh skty hain.

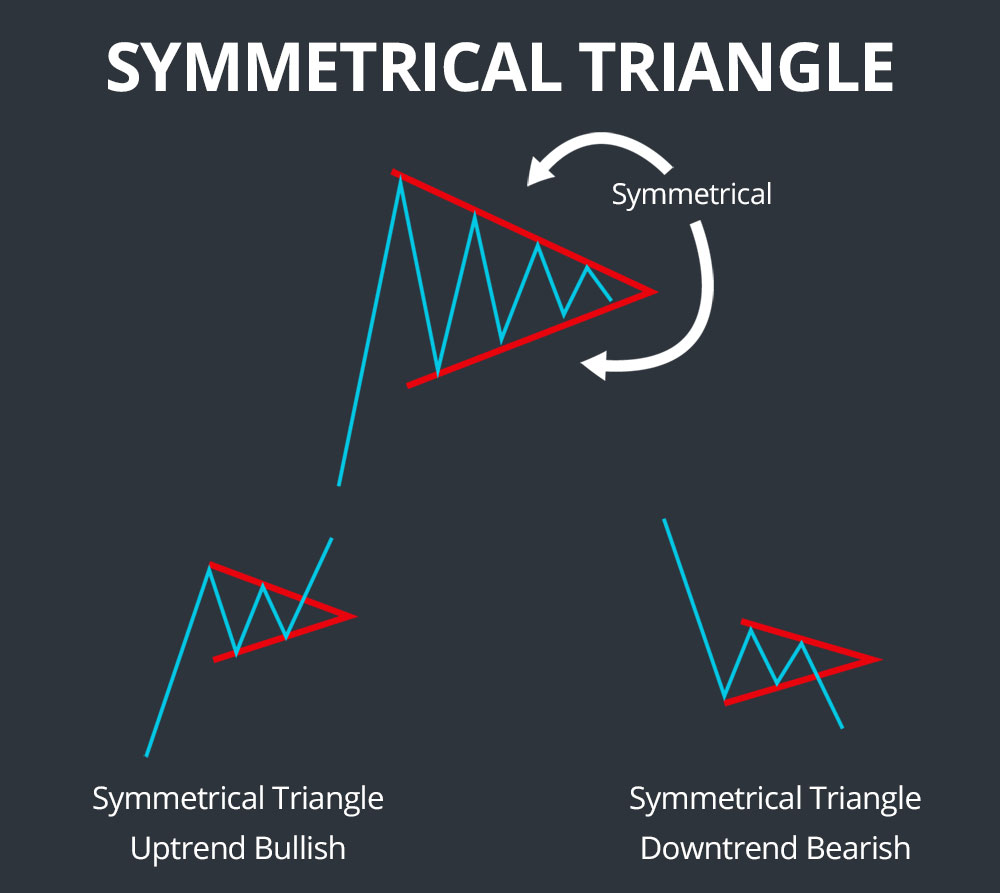

3) Symmetrical triangle:

Symmetrical triangle ki upper trend line downward sloping hoti ha or lower trend line upward sloping hoti ha mtlb k market converge hoti jati ha or jesy hi range short hoti ha to market breakout ya bteakdown ho k bullish ya bearish ho jati ha.

Es main sirf or sirf breakout ya breakdown py hi apko trade karni chahye.

What is triangle pattern?

Dear members triangel pattern 1 continuation chart pary pattern ha mtlb k price jis direction main move kar ri hoti ha ye us trend ya direction ki continuation ki indication ha.

Jb price 2 convergin lines k darmiyan estrha highs kr lows bnati ha k highs upper line ko touch karty hain kr lows lower line ko touch karty hain to 1 triangle shape structure bnta ha.

Commonly triangle pattern ki 3 different types hoti hain jo k hum aj bari bari discuss karen gy.

1) Ascending triangle:

Ascending triangle 1 breakout pattern hota ha or ye tb bnt ha jb market opr ki trf 1 horizontal trendline se bar bar resist hoti ha estrha es triangel ki oper ki trend line horizontal hoti ha or nechy ki trend line upward direction main hoti ha mtlb k market higher lows bnati ha.q k buyer apni bids barhaty jaty hain jiski waja se higher lows bnty hain or 1 wqt ata ha k buyers momentum pakarty hain or triangle ka breakout hota ha.

Es pattern main ap triangel ki lower trend line se trade le skty hain or stop loss lower trend line k nechy ho jb k take profit apka triangle ki length k equal ho.

ya phr ap breakout py bhi trade le skty hain.

2) Descending triangle:

Decending triangel inverted type ha ascending triangle ki. Es main triangle ki nechy wali trend line horizontal hoti ha jo k support k tor py kaam krti ha jb k oper wali trend line downward sloping hoti ha jiska mtlb ha market lower lows bnati ha or sellers dominate kye hoty hain market ko or at the end market breakdown ho k mazeed nechy jati ha.

Es main ap breakdown py bhi trade le skty hain ya us se phly triangle ki upper trend line py trade le skty hain or stop loss trend line se thora opr rkh skty hain.

3) Symmetrical triangle:

Symmetrical triangle ki upper trend line downward sloping hoti ha or lower trend line upward sloping hoti ha mtlb k market converge hoti jati ha or jesy hi range short hoti ha to market breakout ya bteakdown ho k bullish ya bearish ho jati ha.

Es main sirf or sirf breakout ya breakdown py hi apko trade karni chahye.

تبصرہ

Расширенный режим Обычный режим