Bearish Engulfing Pattern Kia Hai?

Financial market main kisi stock ya assets ki prices same barqarar nahi rehti hai. Jab bhi supply ya demand main kami beshi hoti hai, to stock ki prices par bhi uss ka impact parta hai. Supply main izzafay se hamesha assets ki qeematen gerti hai, jab k demand main izzafay se qeematen main izzafa hota hai. Supply aur demand ka ye sisela chalta rehta hai, jiss se assets ki prices bhi up and down hoti rehti hai. Forex trading main supply aur demand ka andaza humen price chart par candles ki pattern ki shape main melta hai, jiss main long real body wali candles humesha aik strong indication dete hen. Jab bhi kisi assets ki stock main bohut ziada izzafa waqea hota hai, to uss waqat demand main kami k chances ziada ho jate hen. Aksar long candlestick jaise bearish engulfing pattern main dosri bearish candle hoti hai, bohut ziada strong reaction deti hai, jo k trend reversal ka sabab banti hai.

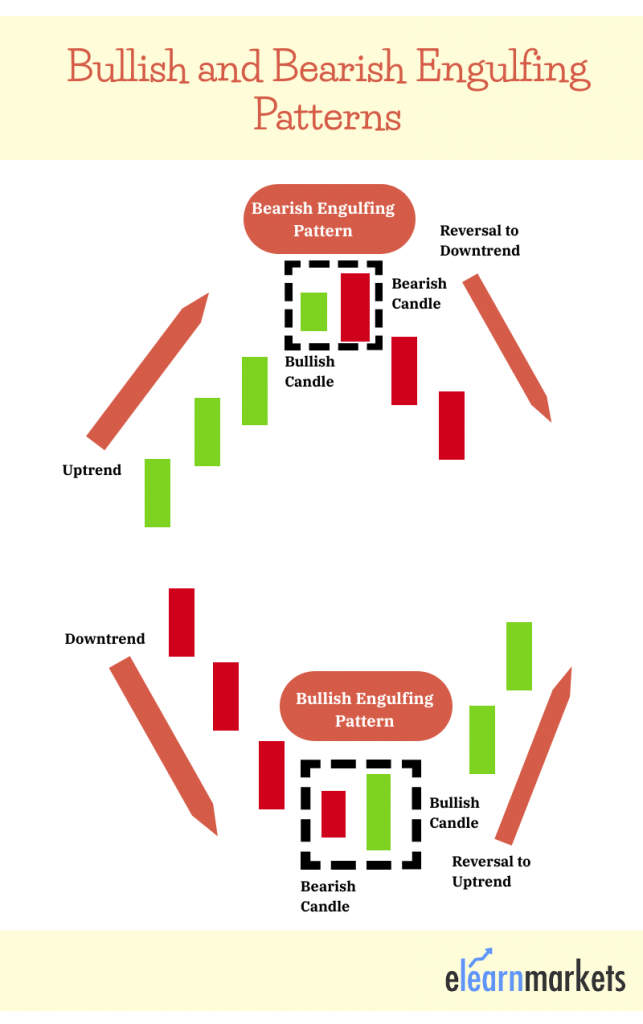

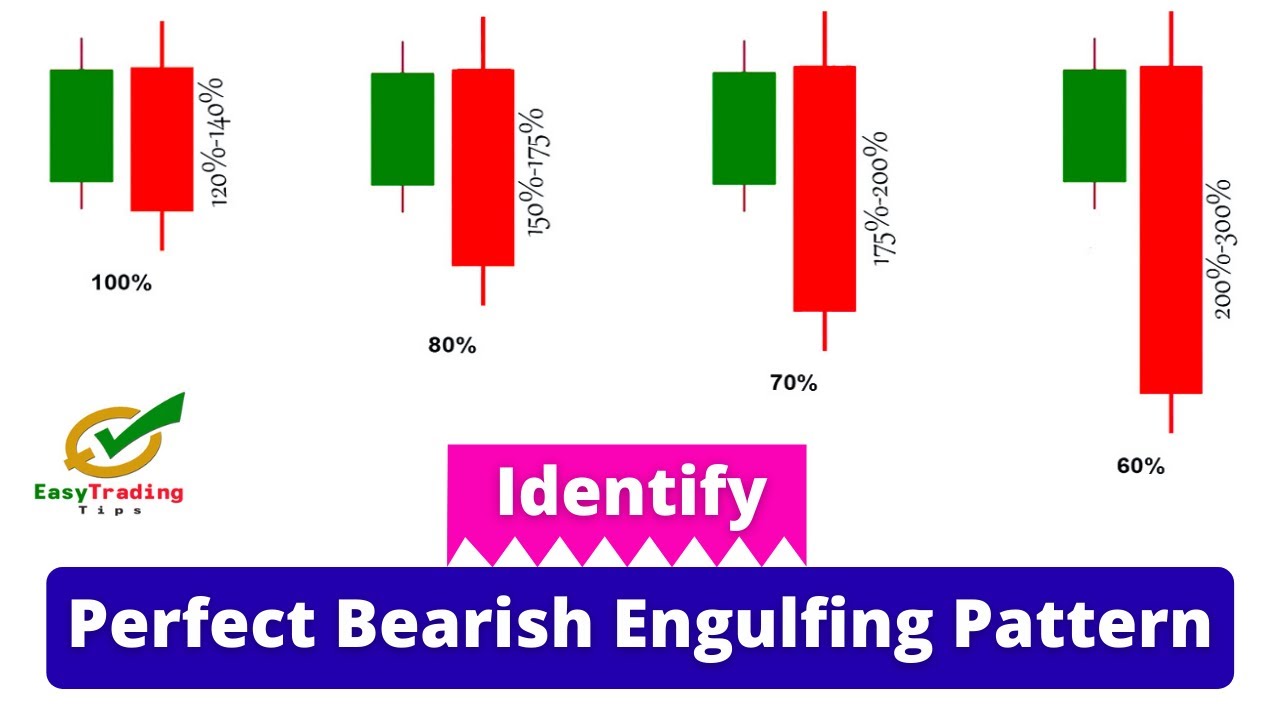

Bearish engulfing candlestick pattern prices chart par do candles ka aik bearish trend reversal pattern hai, jo k high prices ya uptrend main banta hai, jahan se prices k downtrend main badalne k chances hote hen. Pattern strong bearish signlas deta hai, q k dosri bearish candle pehli candle ko mukamal hazaf kar deta hai. Bearish engulfing candlestick pattern ki pehli candle bullish trend k mutabiq hoti hai, q k ye bullish trend main akhari candle hoti hai, iss waja se ye aik real body wali white candle hoti hai. Ye candle upper side par close hoti hai, jiss ka close price open price se ooper hota hai. Ye candle shadow samet ya shadow k bagher bhi ho sakti hai. Bearish engulfing candlestick pattern ki dosri candle aik long real body wali bearish candle hoti hai, jo k market main low demand ki waja se banti hai. Ye candle pehli candle k top gap main open ho kar ussi k bottom se below close hoti hai. Bearish candle bhi shadow samet ya shadow k bagher ho sakti hai, lekin real body main ziada honi chaheye, jiss se ye candle pehli candle ko mukamal apne andar engulf kar deti hai.

Bearish Engulfing Pattern Kaam Kese Karta Hai?

Bearish engulfing candlestick pattern candles k opposite direction main same aik bullish harami candlestick pattern jaisa dekhaye deta hai. Ye pattern prices k top ya bullish trend main banne par bearish trend reversal ka kaam karta hai. Ye pattern do candles par mushtamil hota hai, jiss ki pehli candle aik bullish candle hoti hai, jo k prices main bullish trend continuation ka kaam karti hai, lekin ye candle pattern ki last candle hoti hai, q k iss baad pattern ki dosri candle aik long real body wali bearish candle hoti hai, jo k pehli candle k upper gap main open ho kar ussi k bottom se below close hoti hai. Dosri candle pehli candle ko apne andar mukamal jazap kar leti hai, aur price chart par maojoda trend ka khatema kar deti hai.

Bearish Engulfing Pattern Ka Istemal Kese Kia Jata Hai?

Bearish trend reversal pattern asal main aik single candle pattern hai, q k pehli candle to normal bullish teend k mutabiq hoti hai, lekin dosri candle long real body aur strong banne se prices par hawi bhi ho jati hai, jo k trend reversal ka sabab banti hai. Pattern par trading se pehli prices ka top area ya bullish trend main lazmi honi chaheye, jab k pattern k baad aik confirmation candle ki bhi zarrorat hoti hai. Confirmation candle aik to bearish candle honi chaheye aur dosra ye candle dosri bearish candle k bottom par close honi chaheye, jo k real body main hoti hai. CCI indicator aur stochastic oscillator par value overbought zone main honi chaheye, jab k pattern ka stop loss sab se upper position ya dosri candle k open price se two pips above set karen.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Bearish_Engulfing_Pattern_Definition_and_Tactics_Nov_2020-01-e5c7ca848ee14466bc981e29e8e63087.jpg)

تبصرہ

Расширенный режим Обычный режим