assalium o alekum

dear forex member umed krti hun ap sb kharyt s hun gy friend hm daily 3 topic discuss krty h js s hm sb ka knowladge zrur gain hota aj k topic s b hm Sb ka knowladge zrur gain hoga chlty h hm apmy topic p study krny

pending types

client terminal darkhwasten tayyar karne aur brokr se tijarti karwaiyon ko injaam dainay ki darkhwast karne ki ijazat deta hai. is ke ilawa, terminal khuli pozishnon ko control aur un ka intizam karne ki ijazat deta hai. un maqasid ke liye, kayi qisam ke tijarti orders istemaal kiye jatay hain. order aik client ka brokrij company ke sath tijarti operation karne ka azm hai. terminal mein darj zail orders istemaal kiye jatay hain : market order, pending order, stap las aur take praft .

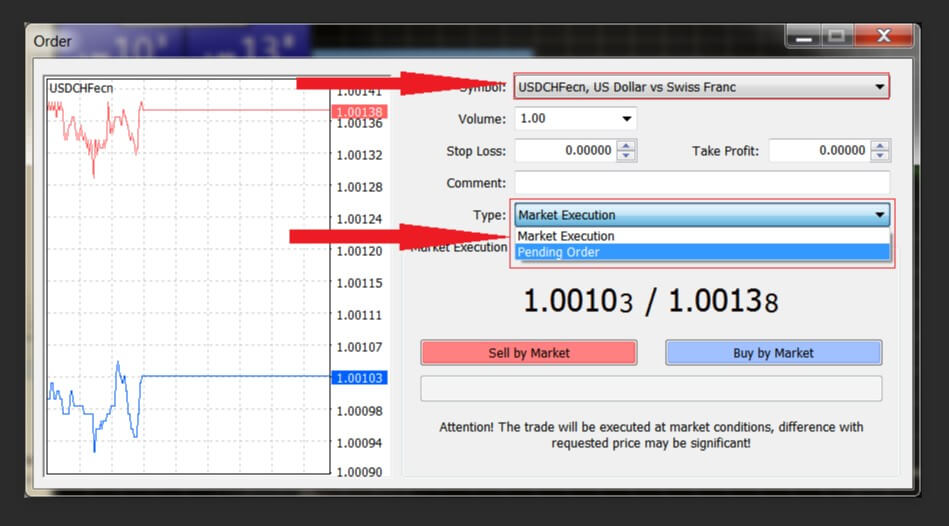

market order

market order brokrij company se mojooda qeemat par security kharidne ya farokht karne ka ehad hai. is order par amal daraamad ke nateejay mein tijarti position khil jati hai. sikyortiz ask qeemat par kharidi jati hain aur bid qeemat par farokht ki jati hain. stap las aur take praft orders ( zail mein bayan kya gaya hai ) ko market order ke sath munsalik kya ja sakta hai. market orders par amal-dar-aamad ka tareeqa tijarat par munhasir hai .

pending order

zair iltiwa order client ki brokrij company se mustaqbil mein pehlay se tay shuda qeemat par security kharidne ya farokht karne ka azm hai. is qisam ke orders tijarti position ko kholnay ke liye istemaal kiye jatay hain bashart e kay mustaqbil ki qeematein pehlay se tay shuda satah tak pahonch jayen. terminal mein chaar qisam ke zair iltiwa order dastyab hain :

buy limit

khareedain bashart e kay mustaqbil ki" ask" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se ziyada hai. is qisam ke orders aam tor par is umeed par lagaye jatay hain ke security ki qeemat, aik khaas satah tak girnay se, barh jaye gi .

buy stop -

khareedain bashart e kay mustaqbil ki" ask" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se kam hai. is qisam ke orders aam tor par is umeed par lagaye jatay hain ke security ki qeemat, aik khaas satah tak pounchanay ke baad, barhti rahay gi

sell limit -

farokht karen bashart e kay mustaqbil ki" bid" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se kam hai. is qisam ke orders aam tor par is umeed par lagaye jatay hain ke hifazati qeemat, aik khaas satah tak bherne ke baad, gir jaye gi .

sell stop -

farokht karen bashart e kay mustaqbil ki" bid" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se ziyada hai. is qisam ke orders aam tor par is umeed ke sath lagaye jatay hain ke security ki qeemat, aik khaas satah tak pounchanay ke baad, girty rahay gi .

zair iltiwa orders ki tarteeb

stap las aur take praft ke orders zair iltiwa order ke sath munsalik kiye ja satke hain. zair iltiwa order ke mutharrak honay ke baad, is ke stap las aur take praft ki sthin khud bakhud open position ke sath munsalik ho jayen gi .

stop loss

is order ko nuqsanaat ko kam karne ke liye istemaal kya jata hai agar security ki qeemat ghair munafe bakhash simt mein barhna shuru ho gayi ho. agar hifazati qeemat is satah tak pahonch jati hai, to position khud bakhud band ho jaye gi. aisay orders hamesha khuli position ya zair iltiwa order se jurey hotay hain. brokrij company inhen sirf market ya zair iltiwa order ke sath rakh sakti hai. terminal is order ki daf-aat ko poora karne ke liye bid qeemat ke sath lambi pozishnon ki jaanch karta hai ( order hamesha mojooda bid qeemat se neechay set kya jata hai ), aur yeh mukhtasir pozishnon ke liye ask qeemat ke sath karta hai ( order hamesha mojooda ask qeemat se oopar set kya jata hai ) .

qeemat ke baad stap las order ko khudkaar karne ke liye, koi tarling stap istemaal kar sakta hai .

take profit

take praft order ka maqsad munafe haasil karna hai jab security ki qeemat aik khaas satah par pahonch jaye. is order par amal daraamad ke nateejay mein position band ho jati hai. yeh hamesha khuli position ya zair iltiwa order se munsalik hota hai. order ki darkhwast sirf market ya zair iltiwa order ke sath ki ja sakti hai. terminal is order ki daf-aat ko poora karne ke liye bid qeemat ke sath lambi pozishnon ki jaanch karta hai ( order hamesha mojooda bid qeemat se oopar set kya jata hai ), aur yeh mukhtasir pozishnon ke liye ask qeemat ke sath karta hai ( order hamesha mojooda ask qeemat se neechay set kya jata hai )

dear forex member umed krti hun ap sb kharyt s hun gy friend hm daily 3 topic discuss krty h js s hm sb ka knowladge zrur gain hota aj k topic s b hm Sb ka knowladge zrur gain hoga chlty h hm apmy topic p study krny

pending types

client terminal darkhwasten tayyar karne aur brokr se tijarti karwaiyon ko injaam dainay ki darkhwast karne ki ijazat deta hai. is ke ilawa, terminal khuli pozishnon ko control aur un ka intizam karne ki ijazat deta hai. un maqasid ke liye, kayi qisam ke tijarti orders istemaal kiye jatay hain. order aik client ka brokrij company ke sath tijarti operation karne ka azm hai. terminal mein darj zail orders istemaal kiye jatay hain : market order, pending order, stap las aur take praft .

market order

market order brokrij company se mojooda qeemat par security kharidne ya farokht karne ka ehad hai. is order par amal daraamad ke nateejay mein tijarti position khil jati hai. sikyortiz ask qeemat par kharidi jati hain aur bid qeemat par farokht ki jati hain. stap las aur take praft orders ( zail mein bayan kya gaya hai ) ko market order ke sath munsalik kya ja sakta hai. market orders par amal-dar-aamad ka tareeqa tijarat par munhasir hai .

pending order

zair iltiwa order client ki brokrij company se mustaqbil mein pehlay se tay shuda qeemat par security kharidne ya farokht karne ka azm hai. is qisam ke orders tijarti position ko kholnay ke liye istemaal kiye jatay hain bashart e kay mustaqbil ki qeematein pehlay se tay shuda satah tak pahonch jayen. terminal mein chaar qisam ke zair iltiwa order dastyab hain :

buy limit

khareedain bashart e kay mustaqbil ki" ask" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se ziyada hai. is qisam ke orders aam tor par is umeed par lagaye jatay hain ke security ki qeemat, aik khaas satah tak girnay se, barh jaye gi .

buy stop -

khareedain bashart e kay mustaqbil ki" ask" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se kam hai. is qisam ke orders aam tor par is umeed par lagaye jatay hain ke security ki qeemat, aik khaas satah tak pounchanay ke baad, barhti rahay gi

sell limit -

farokht karen bashart e kay mustaqbil ki" bid" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se kam hai. is qisam ke orders aam tor par is umeed par lagaye jatay hain ke hifazati qeemat, aik khaas satah tak bherne ke baad, gir jaye gi .

sell stop -

farokht karen bashart e kay mustaqbil ki" bid" qeemat pehlay se tay shuda qeemat ke barabar ho. mojooda qeemat ki satah order ki qeemat se ziyada hai. is qisam ke orders aam tor par is umeed ke sath lagaye jatay hain ke security ki qeemat, aik khaas satah tak pounchanay ke baad, girty rahay gi .

zair iltiwa orders ki tarteeb

stap las aur take praft ke orders zair iltiwa order ke sath munsalik kiye ja satke hain. zair iltiwa order ke mutharrak honay ke baad, is ke stap las aur take praft ki sthin khud bakhud open position ke sath munsalik ho jayen gi .

stop loss

is order ko nuqsanaat ko kam karne ke liye istemaal kya jata hai agar security ki qeemat ghair munafe bakhash simt mein barhna shuru ho gayi ho. agar hifazati qeemat is satah tak pahonch jati hai, to position khud bakhud band ho jaye gi. aisay orders hamesha khuli position ya zair iltiwa order se jurey hotay hain. brokrij company inhen sirf market ya zair iltiwa order ke sath rakh sakti hai. terminal is order ki daf-aat ko poora karne ke liye bid qeemat ke sath lambi pozishnon ki jaanch karta hai ( order hamesha mojooda bid qeemat se neechay set kya jata hai ), aur yeh mukhtasir pozishnon ke liye ask qeemat ke sath karta hai ( order hamesha mojooda ask qeemat se oopar set kya jata hai ) .

qeemat ke baad stap las order ko khudkaar karne ke liye, koi tarling stap istemaal kar sakta hai .

take profit

take praft order ka maqsad munafe haasil karna hai jab security ki qeemat aik khaas satah par pahonch jaye. is order par amal daraamad ke nateejay mein position band ho jati hai. yeh hamesha khuli position ya zair iltiwa order se munsalik hota hai. order ki darkhwast sirf market ya zair iltiwa order ke sath ki ja sakti hai. terminal is order ki daf-aat ko poora karne ke liye bid qeemat ke sath lambi pozishnon ki jaanch karta hai ( order hamesha mojooda bid qeemat se oopar set kya jata hai ), aur yeh mukhtasir pozishnon ke liye ask qeemat ke sath karta hai ( order hamesha mojooda ask qeemat se neechay set kya jata hai )

تبصرہ

Расширенный режим Обычный режим