Aslam u Alaikum!

Dear members i hope ap sab kehriyat sy hon gay, or market main achi earning kar rhy hon gy. Dear agr ap market main kamyabi Hasil karna chahty hain to aapko Hamesha experience k satg kam karna hota hai aur apni learning ko perfect banana hota hai. Tab hi ap kamyabi hasil kar sakte hain.Forex trading mein agar aap successful trading karna chahte hain. To ap ko different factor par study karty hain to ap ko bhot zyda advantages available hoty hain. To dear jesy k ap sb janty hain. k forex mein humy bht carefully km krna chahiye, q k mmarket kbi b inverse move kr skti hai, to is ly humy apni mind ko hazir rkhna chahiye, or trading k doran stoploss r take profit lazmi lagaynYe pattern five candlestick per mabni hota hay jis main first air fifth same direction main hoti hain laikin fifth candlestick last four candlesticks say large and green hoti hay jis waja sag ye tamam candlesticks ko khud main engulf kar rahi hoti hay, jab keh central three candlesticks in kay against hoti hain. Yeh pattern bullish aur bearish donon surton main hota hay.

HIKKAKE CANDLESTICK PATTERN IN FOREX:

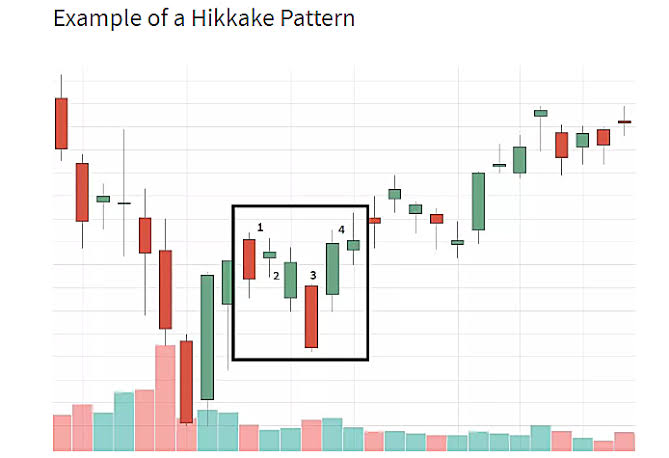

Dear members forex market me hikkake candlestick pattern five 5 candles pr mushtamil hoti ha. Ye bullish r bearish 2no trah appear hota ha. Is pattern se hum direction of market me short teem move ko detect krty hn. Ye pattern market continuation r turnning point ko show krta ha. Isky two setups hpty hn. Jis me se forst price action ki short term dpwn moment ko indicate krta ha. R second short term upward moment ka signal deta ha. Pattern ki first candle second candle ki body ko completely over shadow kr leti ha. 3rd candle first candle k below se low r 2nd candle k high se above end hoti ha. Next candle privous se drift below hoti ha. R last wali candle second candle k hogh se above end hoti hai. Es mein 2 tarah k pattern hoty hain. forex market me Hikkake Candlestick pattern five 5 Candlesticks pr mushtamil hota ha r ye bullish r bearish dono trah appear hota ha. Is pattern se hum market li direction me short term move ko detect krty hn. Ye pattern market me market Continuation r turning point ko show krta ha. Is pattern k 2 step hoty hn jin se hum market ki prices sction r short term down movement ko indicate krta ha. R secondly short term up movement ka signal deta hs. Is pattern ki first candle 2nd ki body ko. Completely over shadow kr leti ha. R third candle first candle k below se low r second candle k high se above ki end krti ha. Next candle drift se below hoti ha r r last wli second candle se qbove end hoti ha.

THERE ARE TWO HIKKAKE CANDLESTICK PATTERN..

1: BULLISH HIKKAKE PATTERN .

2:BEARISH HIKKAKE PATTERN .

1. BULLISH HIKKAKE CANDLESTICK PATTERN IN FOREX:

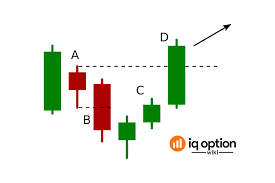

Dear members forex market me bullish pattern three inside down Candlestick ki trah hota ha. Isko prices ko rise krny ki zarurt ni hoti. Is pattern me 5 candles hoti hn. Jin me first candle bullish r next three besrish r last wli b large bullish hoti ha. Ye patteen running trend k ly either reversel ya continuation k ly use hota ha. Confirmation k ly humy next candle pr depend krna prhta ha.Yeh pattern bullish aur bearish donon surton main nazar ata hay, is liye hamain short time frames main more careful rehna parta hay keh kahi ye fake to nai. Is liye hamain iskay sath RSI indicator ko use karna chahiye ta keh hamain is main momentum ka bhi pata chal saky. Iskay bad hamain apni trade ko safe rakhny kay liye stop loss ka bhi use karna chahiye ta keh hamari trade arzi movement main bhi safe reh saky.Isko prices ko rise krny ki zarurt nihoti. Is pattern me 5 candles hoti hn. Jin me first bullish next three bearish hoti hn r last wali phr se bullish hoti ha.ye pattern running trendk ly either reversal ya continuation k ly use hota ha. Confirmation k ly humy next candle pe depend rehna prhta ha..

2. BEARISH HIKKAKE CANDLESTICK PATTERN IN FOREX:

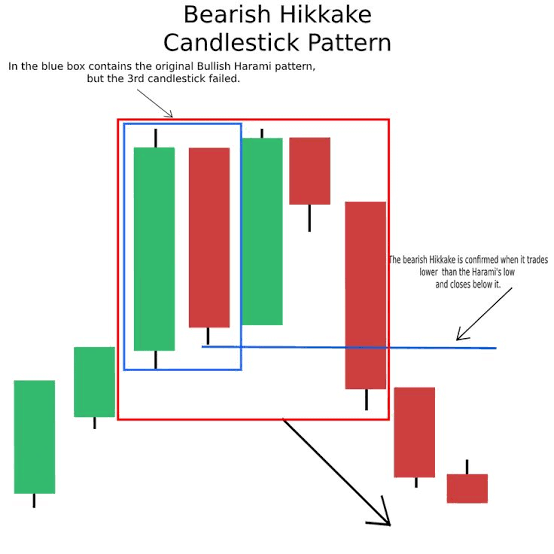

Dear members ye pattern thee inside up pattern ki trah hota ha. Pattern k ly price trend ki falling zaruri ni . is pattern me b five candles hoti hn. Jin me first r last wli besrish hoti hn. R midd wali three candles bullish hoti hn. Ye pattern b reversal r continuation dono ko predict krta ha. Trend confirmation humy next candle se confirm hota ha..

TRADING STRATEGY:

Dear members forex market me according to trading stratgy humy market k break hony ka wait krns chshiye. Wo break chshy supprt ko kry ya resistance ko kry humy wait krna chahiye. Iski confirmation is surst me hoti ha k msrket break krny wali direction me hi complte kr ly. Is me trsders ko same direction me hi open kr leni chahiye trade. R wohi achi earning hasil kar skty hain.first confirmation krni chshiye Confirmation is surat me ho skti thi k market break krny wli direction me ek candle ko complete kry. Esi situation me traders ko same dorection me trade open krni chahiye. R taky ap acha profit hasil kr sken...

FALSE BREAK IN HIKKAKE CANDLESTICK PATTERN IN FOREX:

Dear members forex market me traders ko ye bt mind me rlhni chahiye k msrket me false Breakout b krti ha r agr trader ghlt Breakout me phas jae to niklna mushkil ho jta ha to humy bht carefully hendle krna chahiye trading ko. Jo trader false breakout stratgy ko ise lrty hn wohi kren r tbhi wo is me successful ho skty hn agr wo money management r risk management se km kren.Market main continuation trend main aik reversal aur phir achanak long continuation ati hay. Yani jab market bullish main hoti hay aur phir is main down trend ata hay jiska volume and momentum donon slow hoty hain. Laikin phir achanak aik reversal long bullish candlestick banti hay jo keh short term move ka signal daiti hay. Yeh pattern amooman tab banta hay jab market main koi news any wali ho aur kuch traders market ki reversal main trade lagaty hain laikin momentum slow hota hay. Laikin jab news announcement ho jati hay to market again same trend main taizi say barhti hay aur youn achanak market main aik bahao a jata hay.

CHART IN ANALYSIS:

Dear members market main successful Hona Chahte Hain. To aapko different candlestick k related proper information honi chahie ta k ap successful trading kar sakyn, es ki explanation ap sy chart main share karn gi. Dear members Jab market ka trend aik khaas direction sy dosri direction mein change hota hy hum is hony wali changing ko Reversal kehty hen. Dosto Reversal ky ban'ny sy pehly market jis taraf move kar rahi hoti hy usi he same direction mein barrhti chali jati hy.agr ap market main kamyabi Hasil karna chahte hain to ismein ap ko bhot acha profit milta hai. market mein koi trend temporary toor par Reversal hota hy to ham isy Retracement ka naam dety hen. Matlab ye ky market ka trend completely toor par change nahin ho raha hota balky market thory time k liye Reversal hoti hy. Es ki tafseel main ap sy chart main share karun gi.

Dear members i hope ap sab kehriyat sy hon gay, or market main achi earning kar rhy hon gy. Dear agr ap market main kamyabi Hasil karna chahty hain to aapko Hamesha experience k satg kam karna hota hai aur apni learning ko perfect banana hota hai. Tab hi ap kamyabi hasil kar sakte hain.Forex trading mein agar aap successful trading karna chahte hain. To ap ko different factor par study karty hain to ap ko bhot zyda advantages available hoty hain. To dear jesy k ap sb janty hain. k forex mein humy bht carefully km krna chahiye, q k mmarket kbi b inverse move kr skti hai, to is ly humy apni mind ko hazir rkhna chahiye, or trading k doran stoploss r take profit lazmi lagaynYe pattern five candlestick per mabni hota hay jis main first air fifth same direction main hoti hain laikin fifth candlestick last four candlesticks say large and green hoti hay jis waja sag ye tamam candlesticks ko khud main engulf kar rahi hoti hay, jab keh central three candlesticks in kay against hoti hain. Yeh pattern bullish aur bearish donon surton main hota hay.

HIKKAKE CANDLESTICK PATTERN IN FOREX:

Dear members forex market me hikkake candlestick pattern five 5 candles pr mushtamil hoti ha. Ye bullish r bearish 2no trah appear hota ha. Is pattern se hum direction of market me short teem move ko detect krty hn. Ye pattern market continuation r turnning point ko show krta ha. Isky two setups hpty hn. Jis me se forst price action ki short term dpwn moment ko indicate krta ha. R second short term upward moment ka signal deta ha. Pattern ki first candle second candle ki body ko completely over shadow kr leti ha. 3rd candle first candle k below se low r 2nd candle k high se above end hoti ha. Next candle privous se drift below hoti ha. R last wali candle second candle k hogh se above end hoti hai. Es mein 2 tarah k pattern hoty hain. forex market me Hikkake Candlestick pattern five 5 Candlesticks pr mushtamil hota ha r ye bullish r bearish dono trah appear hota ha. Is pattern se hum market li direction me short term move ko detect krty hn. Ye pattern market me market Continuation r turning point ko show krta ha. Is pattern k 2 step hoty hn jin se hum market ki prices sction r short term down movement ko indicate krta ha. R secondly short term up movement ka signal deta hs. Is pattern ki first candle 2nd ki body ko. Completely over shadow kr leti ha. R third candle first candle k below se low r second candle k high se above ki end krti ha. Next candle drift se below hoti ha r r last wli second candle se qbove end hoti ha.

THERE ARE TWO HIKKAKE CANDLESTICK PATTERN..

1: BULLISH HIKKAKE PATTERN .

2:BEARISH HIKKAKE PATTERN .

1. BULLISH HIKKAKE CANDLESTICK PATTERN IN FOREX:

Dear members forex market me bullish pattern three inside down Candlestick ki trah hota ha. Isko prices ko rise krny ki zarurt ni hoti. Is pattern me 5 candles hoti hn. Jin me first candle bullish r next three besrish r last wli b large bullish hoti ha. Ye patteen running trend k ly either reversel ya continuation k ly use hota ha. Confirmation k ly humy next candle pr depend krna prhta ha.Yeh pattern bullish aur bearish donon surton main nazar ata hay, is liye hamain short time frames main more careful rehna parta hay keh kahi ye fake to nai. Is liye hamain iskay sath RSI indicator ko use karna chahiye ta keh hamain is main momentum ka bhi pata chal saky. Iskay bad hamain apni trade ko safe rakhny kay liye stop loss ka bhi use karna chahiye ta keh hamari trade arzi movement main bhi safe reh saky.Isko prices ko rise krny ki zarurt nihoti. Is pattern me 5 candles hoti hn. Jin me first bullish next three bearish hoti hn r last wali phr se bullish hoti ha.ye pattern running trendk ly either reversal ya continuation k ly use hota ha. Confirmation k ly humy next candle pe depend rehna prhta ha..

2. BEARISH HIKKAKE CANDLESTICK PATTERN IN FOREX:

Dear members ye pattern thee inside up pattern ki trah hota ha. Pattern k ly price trend ki falling zaruri ni . is pattern me b five candles hoti hn. Jin me first r last wli besrish hoti hn. R midd wali three candles bullish hoti hn. Ye pattern b reversal r continuation dono ko predict krta ha. Trend confirmation humy next candle se confirm hota ha..

TRADING STRATEGY:

Dear members forex market me according to trading stratgy humy market k break hony ka wait krns chshiye. Wo break chshy supprt ko kry ya resistance ko kry humy wait krna chahiye. Iski confirmation is surst me hoti ha k msrket break krny wali direction me hi complte kr ly. Is me trsders ko same direction me hi open kr leni chahiye trade. R wohi achi earning hasil kar skty hain.first confirmation krni chshiye Confirmation is surat me ho skti thi k market break krny wli direction me ek candle ko complete kry. Esi situation me traders ko same dorection me trade open krni chahiye. R taky ap acha profit hasil kr sken...

FALSE BREAK IN HIKKAKE CANDLESTICK PATTERN IN FOREX:

Dear members forex market me traders ko ye bt mind me rlhni chahiye k msrket me false Breakout b krti ha r agr trader ghlt Breakout me phas jae to niklna mushkil ho jta ha to humy bht carefully hendle krna chahiye trading ko. Jo trader false breakout stratgy ko ise lrty hn wohi kren r tbhi wo is me successful ho skty hn agr wo money management r risk management se km kren.Market main continuation trend main aik reversal aur phir achanak long continuation ati hay. Yani jab market bullish main hoti hay aur phir is main down trend ata hay jiska volume and momentum donon slow hoty hain. Laikin phir achanak aik reversal long bullish candlestick banti hay jo keh short term move ka signal daiti hay. Yeh pattern amooman tab banta hay jab market main koi news any wali ho aur kuch traders market ki reversal main trade lagaty hain laikin momentum slow hota hay. Laikin jab news announcement ho jati hay to market again same trend main taizi say barhti hay aur youn achanak market main aik bahao a jata hay.

CHART IN ANALYSIS:

Dear members market main successful Hona Chahte Hain. To aapko different candlestick k related proper information honi chahie ta k ap successful trading kar sakyn, es ki explanation ap sy chart main share karn gi. Dear members Jab market ka trend aik khaas direction sy dosri direction mein change hota hy hum is hony wali changing ko Reversal kehty hen. Dosto Reversal ky ban'ny sy pehly market jis taraf move kar rahi hoti hy usi he same direction mein barrhti chali jati hy.agr ap market main kamyabi Hasil karna chahte hain to ismein ap ko bhot acha profit milta hai. market mein koi trend temporary toor par Reversal hota hy to ham isy Retracement ka naam dety hen. Matlab ye ky market ka trend completely toor par change nahin ho raha hota balky market thory time k liye Reversal hoti hy. Es ki tafseel main ap sy chart main share karun gi.

تبصرہ

Расширенный режим Обычный режим