Assalam alaikum dear forum members umeed hai aap sb khair khairiat se hn gy or apka last trading week bahut acha gaya ho ga.

or dua hai k aapka naya any wala week bhi bahut acha jaye.

dear members forex market k chart main different pattrens hoty hain or unko trade karny ka alag style hota hai or in main se aik channel pattern hai aj jsko hum detail se study kren gy or isko trade karny ka tareeka bhi janen gy.

What is a channel in fx market?

Dear members jb market aik trend main move karti ha to seedha opr ya seedha nechy ni jati bl k marke highs or lows bnati ha q k marlet thora opr ya nechy jany k bad retrace karti ha js se markey main lows or highs banty hain.

or in lows or highs ko mila k trendlines bnti hain jo k channel ki shakal dyti hain.

How it is formed?

Dear members jb market up trend main hoti ha to market aik wave ki shakal ki higher highs or higher lows bnati hovi jati ha.

estrha market k lows ko apas main milaya jay to aik trend line bnti ha.

or agr market k highs ko apas main milaya jay to aik trend lines bnti ha.

or market 2 trendlines k darmyan move kar rhi hoti ha or esko channel kaha jata ha.

forex market main channels ki 2 types hoti hain

ascending channel

decending channel

in dono types ko nechy detail se dscs kia gaya ha.

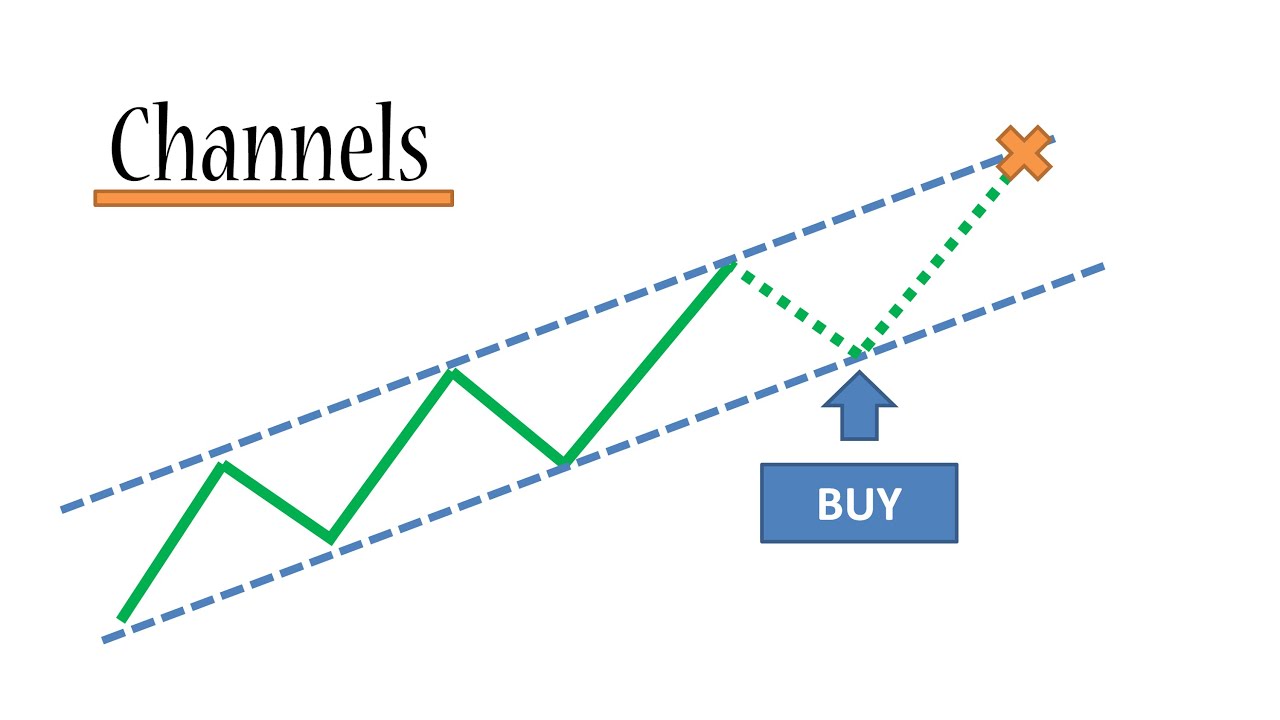

es main jb market nechy wali supporing trendline ko touch karti ha to hum yahan se buy kar skty hain or hmara stop loss es trendline k nechy ho ga.

jb k hmara take profit resisting trendline tk ho ga.

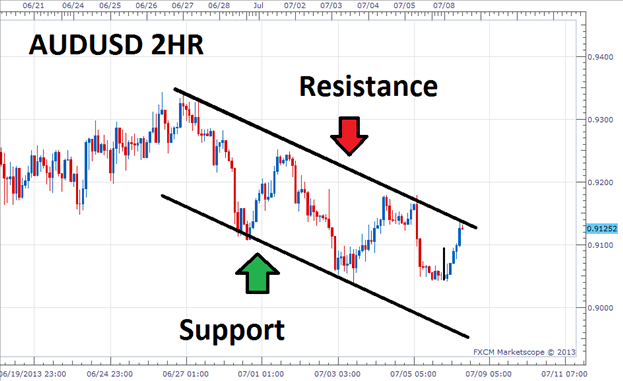

es channel main jb market resisting trendline k ps ati ha to hum yahan se sell kr skty hain or hmara stop loss resisting trendline se opr ho ga jb k take profit hmara supporting trend line tk ho ga.

Breakout of channel:

dear members channel ka breakout tb hota ha jb market downtrend main ya uptrend main channel se bhr nkl jati ha.

breakout ki confirmation ye hoti ha k market js time frame main channel bnati ha usi main channel k bhr candle close kary .

breakout ki confirmation k bad hum es main trade lyty hain.

agr resisting trend line ka breakout ho to hum buy ki trade lyty hain.

jb k supportinh trendline k breakout py hum sell ki trade lyty hain.

jesa k tasweer main supporting trendline ka breakout dkhaya gaya ha or es main hum sell kintrade lyty hain hmara stop loss supporting trendline se opr hota ha.

or dua hai k aapka naya any wala week bhi bahut acha jaye.

dear members forex market k chart main different pattrens hoty hain or unko trade karny ka alag style hota hai or in main se aik channel pattern hai aj jsko hum detail se study kren gy or isko trade karny ka tareeka bhi janen gy.

What is a channel in fx market?

Dear members jb market aik trend main move karti ha to seedha opr ya seedha nechy ni jati bl k marke highs or lows bnati ha q k marlet thora opr ya nechy jany k bad retrace karti ha js se markey main lows or highs banty hain.

or in lows or highs ko mila k trendlines bnti hain jo k channel ki shakal dyti hain.

How it is formed?

Dear members jb market up trend main hoti ha to market aik wave ki shakal ki higher highs or higher lows bnati hovi jati ha.

estrha market k lows ko apas main milaya jay to aik trend line bnti ha.

or agr market k highs ko apas main milaya jay to aik trend lines bnti ha.

or market 2 trendlines k darmyan move kar rhi hoti ha or esko channel kaha jata ha.

forex market main channels ki 2 types hoti hain

ascending channel

decending channel

in dono types ko nechy detail se dscs kia gaya ha.

Ascending Channel:

Dear members ye channel up trend main banta ha or es main market higher highs or higher lows bnaty hovy opr ki trf move karti ha.es main jb market nechy wali supporing trendline ko touch karti ha to hum yahan se buy kar skty hain or hmara stop loss es trendline k nechy ho ga.

jb k hmara take profit resisting trendline tk ho ga.

Decending Channel:

dear members ye channel downward trend main bnta ha or es main market lower highs or lower lows bnaty hovy nechy ki trf jati ha.es channel main jb market resisting trendline k ps ati ha to hum yahan se sell kr skty hain or hmara stop loss resisting trendline se opr ho ga jb k take profit hmara supporting trend line tk ho ga.

Breakout of channel:

dear members channel ka breakout tb hota ha jb market downtrend main ya uptrend main channel se bhr nkl jati ha.

breakout ki confirmation ye hoti ha k market js time frame main channel bnati ha usi main channel k bhr candle close kary .

breakout ki confirmation k bad hum es main trade lyty hain.

agr resisting trend line ka breakout ho to hum buy ki trade lyty hain.

jb k supportinh trendline k breakout py hum sell ki trade lyty hain.

jesa k tasweer main supporting trendline ka breakout dkhaya gaya ha or es main hum sell kintrade lyty hain hmara stop loss supporting trendline se opr hota ha.

تبصرہ

Расширенный режим Обычный режим