Aslam o alaikum,

Dear forex members Indicators trading platforms par aik aisay tool ke hasiyatt rakhtay hain jo apki trading ka mazid wazeh aur toyhe point bnaaty hain aur aapki trading main nikhar laty hain. Indicators long term aur short term forecast aapko btaaty hain, market ke current state aapky samny laaty hain ya historical data apko analysis kay lieey provide karty hain. apko kaaafi sary aisey indicators milll sakte hain jinnko aap use kar sakte hain lekin chand indicators main aap kay satth share karta hu.

Market main kaam karny walon kay apny aony pasandida technical indicators hoty hain aur ye indicators traders apni strategy main istemal karte hain. Lekin aik baaat jiss main koi do raay nahi hai kay koi ayesa indicator nahi hai joi sab sy best hoo, Kun kay harr trader ka apnna trading style hota hai aur har trader ke strategy mukhtalif hoti hai jiss main mukhtalif indicators usko suit karte hain.

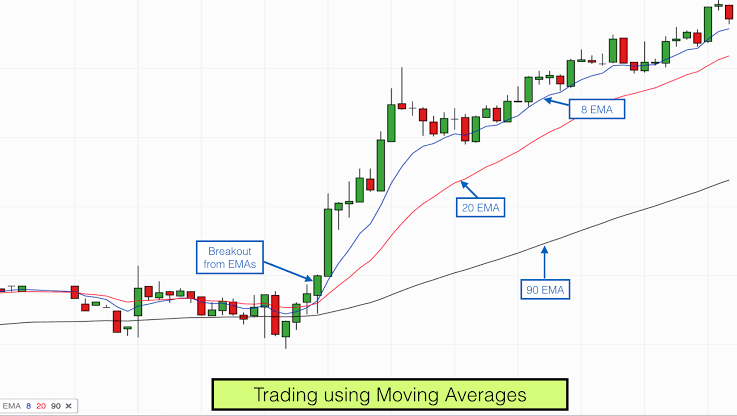

Moving Averages

Yeh indicators leading technical indicator hay joo kay price action main breakout ke nishaandehi kartey hai, aur iss kay sath sath market ke amomi simat bhe btaty hain. Moving averages indicators chart par aik line ke soorat main hoty hain aur jo time ke mikdaar apne set ke hoti hai jesa kay 20 days ya 200 days, uss hisaab sy average price btaty hain. Es say trader ko marrket ka shoort term ya long terms trend ka andaazaa hota hai. Lekin esss baat ko zehan main rakhna chahey kay choty period wali Moving averages price change hony par bary time period wali moving averages sy taiz amal karti hain.

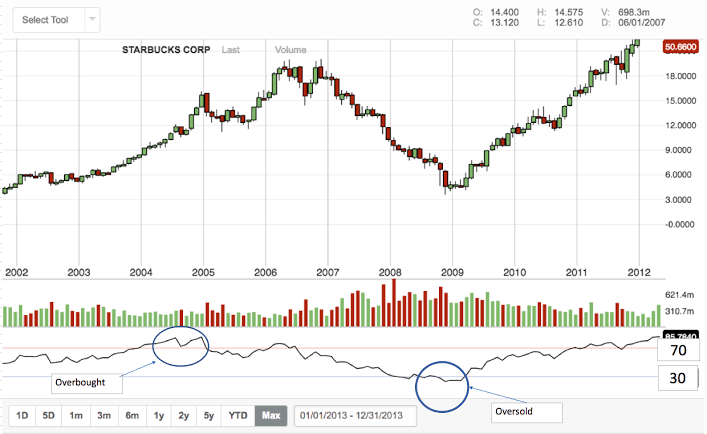

RSI

Relative Strength Index yaA RSI oversold yaa overbought conditions koo dekhany main madaad karta hai. Relative strength index un trader kay lieey zaidaa bhetr saabit hota hai jo low buy aur high sell karte hain. Rsi ke value 0 sy 100 kay darmiyaan hoti hai jis main traders 70 sy above overbought consider kartey hain aur 30 sy neechy oversold considering hoti hai. Traders oversold ko buy aur overbought ko sell karte hain. Lekin RSI ko dekhty huy aik baat ko miind main rakhnna parta hai kay market selling ya buying zone main ho tub market main order lagana behtar rehta hai.

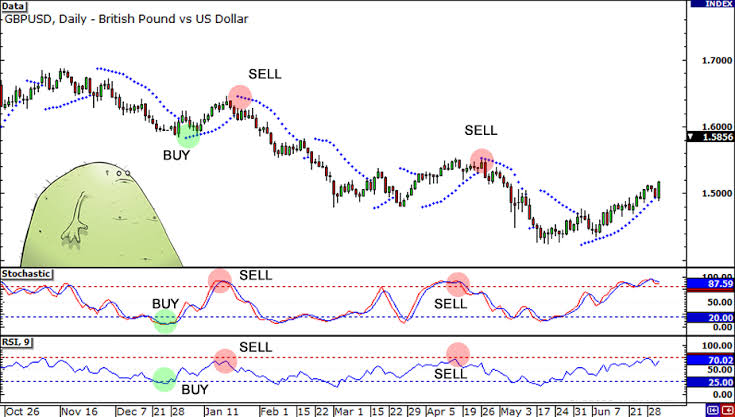

Oscillators

Oscillators market jabb ik limit par pohnnch jaati hai aur wahan say trend ke mukhalif directionss main correction yakeni nazzar aar rahi hoti hai. For example agar market main up trend chal raha hai aur market kafi zaidaa upmove karti hai, Aur aik bulandi pe jaa kar rukti hai to to wo over bought condition main hoti hai our wahan sy market correction kay liey aany kay kafi imkanaat s ban jaaty hain. Ise kay baraakkas market jb oversold conditions main hoti hai to correction kay liey up jaany kay imkanaat hoty hain. Aur ye baat ko zehann main rakha jaay kay jab market oversold ho to buy kiya jaay aur jab overbought ho too sell kiya jay.

Stochastics

Stochastics koo khassosi torr par market ke overbought aur oversold conditions kay zone e taraf ishara karney kay liey istemal kiya jaata hai. Lekin Stochastic mummkina price reversal ko bhe pointout kartey hain. Stochastic kay aik sy zaida versions hain lekin slow Stochastic sab sy zaida aur kable aiitebaar indicator samjha jaata hai. Stochastic indicator aapko chart kay bottom main milta hai jo kay do moving averages par mushtamil hota hai jo 0 sy hundrad kay darmmiyaan hoti hain. Stochastic traders ke first choice hota hai kun kay esski ke darustagi kafi zaida hai aur inexperienced traders kay liey zaida mozun hai.

Market main kaam karny walon kay apny aony pasandida technical indicators hoty hain aur ye indicators traders apni strategy main istemal karte hain. Lekin aik baaat jiss main koi do raay nahi hai kay koi ayesa indicator nahi hai joi sab sy best hoo, Kun kay harr trader ka apnna trading style hota hai aur har trader ke strategy mukhtalif hoti hai jiss main mukhtalif indicators usko suit karte hain.

Moving Averages

Yeh indicators leading technical indicator hay joo kay price action main breakout ke nishaandehi kartey hai, aur iss kay sath sath market ke amomi simat bhe btaty hain. Moving averages indicators chart par aik line ke soorat main hoty hain aur jo time ke mikdaar apne set ke hoti hai jesa kay 20 days ya 200 days, uss hisaab sy average price btaty hain. Es say trader ko marrket ka shoort term ya long terms trend ka andaazaa hota hai. Lekin esss baat ko zehan main rakhna chahey kay choty period wali Moving averages price change hony par bary time period wali moving averages sy taiz amal karti hain.

RSI

Relative Strength Index yaA RSI oversold yaa overbought conditions koo dekhany main madaad karta hai. Relative strength index un trader kay lieey zaidaa bhetr saabit hota hai jo low buy aur high sell karte hain. Rsi ke value 0 sy 100 kay darmiyaan hoti hai jis main traders 70 sy above overbought consider kartey hain aur 30 sy neechy oversold considering hoti hai. Traders oversold ko buy aur overbought ko sell karte hain. Lekin RSI ko dekhty huy aik baat ko miind main rakhnna parta hai kay market selling ya buying zone main ho tub market main order lagana behtar rehta hai.

Oscillators

Oscillators market jabb ik limit par pohnnch jaati hai aur wahan say trend ke mukhalif directionss main correction yakeni nazzar aar rahi hoti hai. For example agar market main up trend chal raha hai aur market kafi zaidaa upmove karti hai, Aur aik bulandi pe jaa kar rukti hai to to wo over bought condition main hoti hai our wahan sy market correction kay liey aany kay kafi imkanaat s ban jaaty hain. Ise kay baraakkas market jb oversold conditions main hoti hai to correction kay liey up jaany kay imkanaat hoty hain. Aur ye baat ko zehann main rakha jaay kay jab market oversold ho to buy kiya jaay aur jab overbought ho too sell kiya jay.

Stochastics

Stochastics koo khassosi torr par market ke overbought aur oversold conditions kay zone e taraf ishara karney kay liey istemal kiya jaata hai. Lekin Stochastic mummkina price reversal ko bhe pointout kartey hain. Stochastic kay aik sy zaida versions hain lekin slow Stochastic sab sy zaida aur kable aiitebaar indicator samjha jaata hai. Stochastic indicator aapko chart kay bottom main milta hai jo kay do moving averages par mushtamil hota hai jo 0 sy hundrad kay darmmiyaan hoti hain. Stochastic traders ke first choice hota hai kun kay esski ke darustagi kafi zaida hai aur inexperienced traders kay liey zaida mozun hai.