Technical analysis gbpusd updates

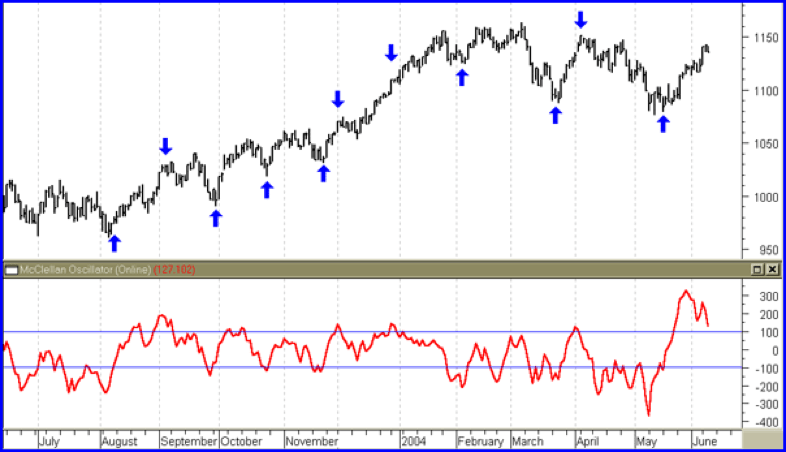

daily time frame chart

Hello guys good afternoon my dear traders kisy Ho ummid krta hon theek aur khairiyat se hongy aur aj gbpusd 1. 3020 ke ird gird mandala raha hai, jis se yeh zahir hota hai ke baichnay walay 50% fibonacci retracement level cross over ke sath qeemat ko mazeed 1. 2949 tak barha rahay hain. is soorat mein, aik taweel mudti mandi ka istehkaam zahir ho sakta hai kyunkay 1. 3200 ka multi time mustard honay se qeemat 200 day sma se 1. 2900 tak taizi se gir jaye gi. you s index exchange rate pichlle session mein barhta rahay ga aur 100. 70 par decorations trained line mid day par wapas aajay ga, jo ke nai muzahmat se guzarte hue 1. 2849 ke aas paas gbpusd mein mutawaqqa kami hai. haliya uuchaal 1. 2990 ki satah se qadray oopar mandlana aik mazboot baichnay walay ka inqilab ho ga jis se qeemat ko 40 aur 50 din ki saada harkat pazeeri ost se 1. 2970 par laya jaye ga. is rukawat ki mazboot khilaaf warzi mandi ke taasub ko barqarar rakhay gi, aur yeh shaam ke session mein 38. 8 % fibonacci retracement ki satah tak pahonch gayi. takneeki nuqta nazar se, bolungar baind ke isharay aur asketars aik wazeh manfi raftaar ko barqarar rakhtay hain aur ab bhi ziyada farokht honay walay kndishng area se kuch faaslay par hain, jab ke macd aahista aahista apni mid line se neechay ki taraf barh raha hai jaisay ke phislan ko neechay kar raha ho. yeh jora 1. 3150 par fori muzahmati rukawat ko rivers kar sakta hai aur kharidaron ke liye pichlle haftay ki buland 1. 3290 par dobarah daawa karne ka darwaaza khol sakta hai,

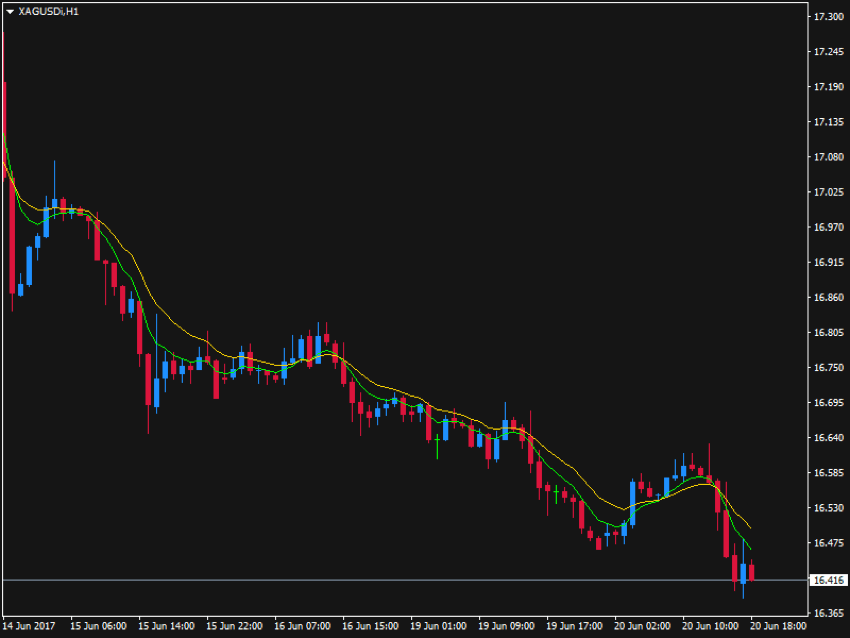

Gbpusd h4 chart

my dear friend gbpusd h4 ke time frame par, aakhri band honay wali mom batii aur sir aur kandhay ka ulta patteren qaim karne se kharidaron ki tawajah hatt jaye gi aur qeemat 1. 3000 se neechay rahay gi. is manzar naame mein, 200 din ke saada moving everest ke sath mazeed tasdeeq aur tasfia ke muntazir baichnay walay 1. 2870 ke qareeb reechh ko challenge karen ge. is ke bar aks, agar kharidaron ki taaqat manfi pehlu se palat jati hai aur qeemat 1. 3120 par 38. 3 % fibonacci retracement ki satah se oopar jati hai, to Amrici session mein 1. 3190 par izafi numoo dekhi ja sakti hai. taajiron ko anay wali range par nazar rakhnay aur aala assar walay khabron ke adaad o shumaar ko dekhnay ki zaroorat hai, jo taweel mudti ulat jane ki simt ko bhi badal day ga aur market se پپس haasil karne ke liye tijarat ka intizam kere ga. is haftay ahem awamil kharidaron ki tawajah mabzol kar den ge, aur baichnay walay ka dabao 1. 2760 ke ird gird aglay manfi pehlu par mukammal control kar le ga

daily time frame chart

Hello guys good afternoon my dear traders kisy Ho ummid krta hon theek aur khairiyat se hongy aur aj gbpusd 1. 3020 ke ird gird mandala raha hai, jis se yeh zahir hota hai ke baichnay walay 50% fibonacci retracement level cross over ke sath qeemat ko mazeed 1. 2949 tak barha rahay hain. is soorat mein, aik taweel mudti mandi ka istehkaam zahir ho sakta hai kyunkay 1. 3200 ka multi time mustard honay se qeemat 200 day sma se 1. 2900 tak taizi se gir jaye gi. you s index exchange rate pichlle session mein barhta rahay ga aur 100. 70 par decorations trained line mid day par wapas aajay ga, jo ke nai muzahmat se guzarte hue 1. 2849 ke aas paas gbpusd mein mutawaqqa kami hai. haliya uuchaal 1. 2990 ki satah se qadray oopar mandlana aik mazboot baichnay walay ka inqilab ho ga jis se qeemat ko 40 aur 50 din ki saada harkat pazeeri ost se 1. 2970 par laya jaye ga. is rukawat ki mazboot khilaaf warzi mandi ke taasub ko barqarar rakhay gi, aur yeh shaam ke session mein 38. 8 % fibonacci retracement ki satah tak pahonch gayi. takneeki nuqta nazar se, bolungar baind ke isharay aur asketars aik wazeh manfi raftaar ko barqarar rakhtay hain aur ab bhi ziyada farokht honay walay kndishng area se kuch faaslay par hain, jab ke macd aahista aahista apni mid line se neechay ki taraf barh raha hai jaisay ke phislan ko neechay kar raha ho. yeh jora 1. 3150 par fori muzahmati rukawat ko rivers kar sakta hai aur kharidaron ke liye pichlle haftay ki buland 1. 3290 par dobarah daawa karne ka darwaaza khol sakta hai,

Gbpusd h4 chart

my dear friend gbpusd h4 ke time frame par, aakhri band honay wali mom batii aur sir aur kandhay ka ulta patteren qaim karne se kharidaron ki tawajah hatt jaye gi aur qeemat 1. 3000 se neechay rahay gi. is manzar naame mein, 200 din ke saada moving everest ke sath mazeed tasdeeq aur tasfia ke muntazir baichnay walay 1. 2870 ke qareeb reechh ko challenge karen ge. is ke bar aks, agar kharidaron ki taaqat manfi pehlu se palat jati hai aur qeemat 1. 3120 par 38. 3 % fibonacci retracement ki satah se oopar jati hai, to Amrici session mein 1. 3190 par izafi numoo dekhi ja sakti hai. taajiron ko anay wali range par nazar rakhnay aur aala assar walay khabron ke adaad o shumaar ko dekhnay ki zaroorat hai, jo taweel mudti ulat jane ki simt ko bhi badal day ga aur market se پپس haasil karne ke liye tijarat ka intizam kere ga. is haftay ahem awamil kharidaron ki tawajah mabzol kar den ge, aur baichnay walay ka dabao 1. 2760 ke ird gird aglay manfi pehlu par mukammal control kar le ga

تبصرہ

Расширенный режим Обычный режим