Introduction:

Assalamu Alaikum ummid hai aap sab theek Honge aur farak market ko acche se enjoy kar rahe Honge aaj main aapke sath Apna knowledge aur experience share karne Ja Rahe Ho Jo Ek bahut important topic hai jo ke gapping and tytypes ke bare mein hai Is Tarah jaise ki aapko pata hai KSK Kafi sari types Hain jab tak hamare pas gapping ke related knowledge nahi hoga Hum Kabhi Bhi iski types ko understand nahin kar sakte hain isiliye sabse pahle Humne gapping go understand karna chahiye isko study karna chahie Iske bad Hamen iski types already samajh a jaayengi so main aapko Iske bare mein detail se batati hun Agar Ham Chahte Hain ke Forex trading mein successful ho sake to uske liye Hamen bahut mehnat Karni Hogi Taki Hamen Achcha profit Hasil ho sake..

Gapping:

Jab Kisi bhi pair ki price without bagair Kisi activity ke close De aur above below open the tab use situation ko bi hum gapping Kahate Hain Iske important Baat market ke closing hours hai Jo hamari market ka phr pairs ko ashar andaz Karte Hain isiliye is Sare process ko ham gapping Kahate Hain..

Types Of Gapping:

Jaise ki aap ko pata hai k gapping ki Kafi sari types Hain Jo ke har type Mein Kuchh important things kya bataya gaya hai jo ki Hamare liye Kafi important hai Is Tarah main aapko Iske bare mein batati hun ki gapping ki Kitni types bane aur Har type kya important roll play kar rahi hai..

1:Common Gap's.

2: Breakaway Gap's.

3:Runaway Gap's.

4: Exhaustion Gap's.

5:Filled Gap's.

Common And breakaway Gap's:

Market mein common gap's To Ham normal gap consider kar sakte kar sakte hain aur yah gap market mein pervious close day med Mein banta hai iski hardline vajah se ismein opening or closing price different Hote Hain or common gap's Main seling Aur buying pressure Jyada Hota Hai.

Agr break away ki baat ki Jaaye to gap ki price significant area se above ya below move karti hai aur yah gap first time B active or kafi strong Hota Hai Jab trading Rang tight main move karne ke bad chat pattern se out move karti hai aur use gap strong trading ko indicate krti hai..

Runaway And Exchanged Gap's:

Runaway Ek Aisa gap hai yah use time banta hai Jab market strong move kar rahi hoti hai aur current Trend ki decoration main market feature strong show Karte Hain aur yah runway gap large Hota Hai aur is time price trend Inko follow Karte Hain aur rate Trend ke mid Mein banta hai aur yah gap strong buyer pressure up trend mein strong seller pressure down trend mein show Karte Hain isiliye tab ham isase filled ki expect nahin kar sakte.

Exchanged gaps main market Trend ke change hone ki confirmation Deti Hai Is Tarah yah ais lahaz sy best hai isase Ham Trend ke change hone ki confirmation clear Ho Jaati Hai..

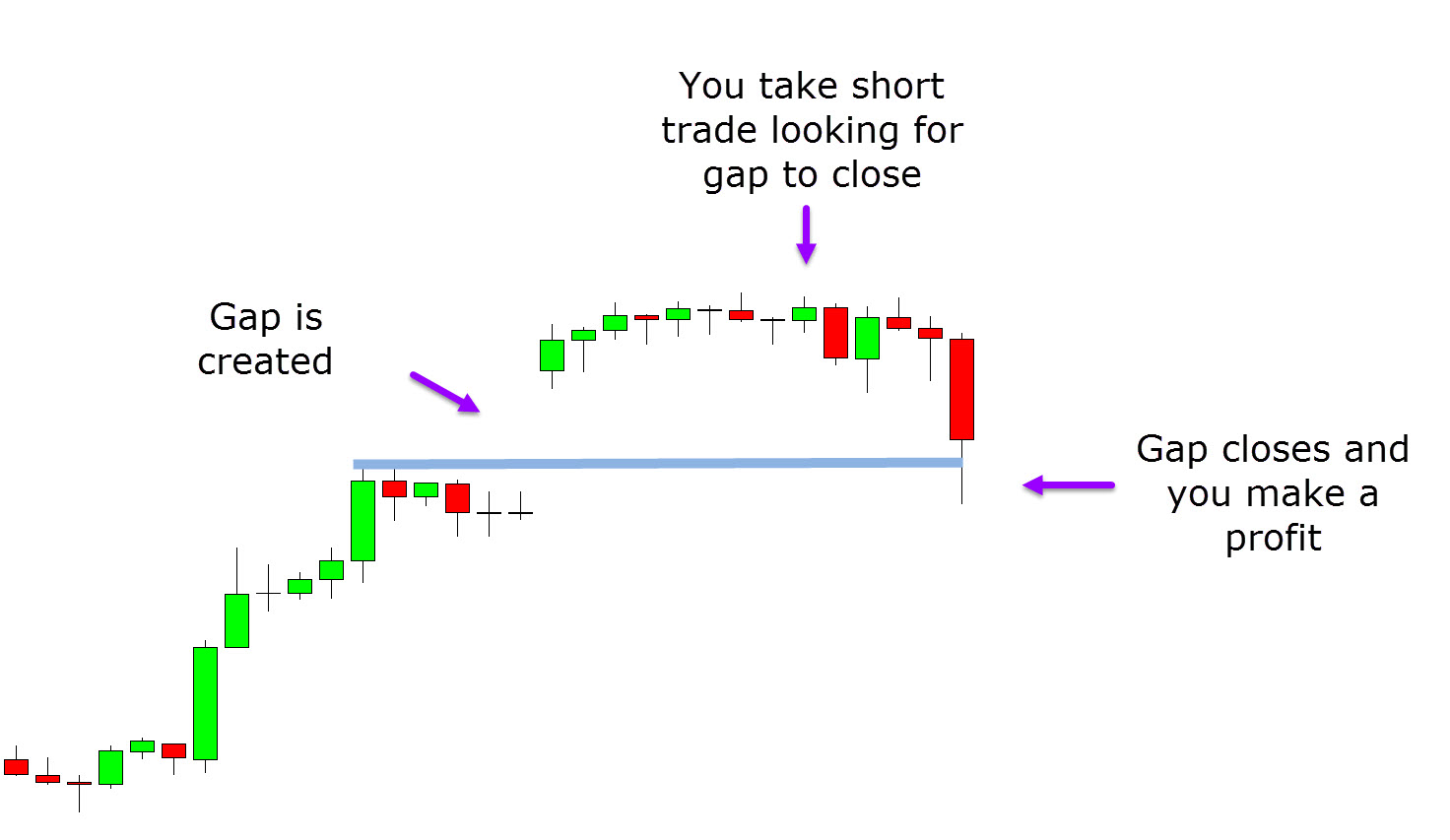

Filled Gap's:

To filled gaps Main Jab market ke gaps fill hote hain Agar Ham aapko Ek Chhoti Si example Jaise ke common gap's main gap bary or famous hain or ye goas jyadatar fail ho Jaate Hain aur FIR unko Ham trading Mein use karte hain aur system ko develop karne mein madad Karte Hain..

Assalamu Alaikum ummid hai aap sab theek Honge aur farak market ko acche se enjoy kar rahe Honge aaj main aapke sath Apna knowledge aur experience share karne Ja Rahe Ho Jo Ek bahut important topic hai jo ke gapping and tytypes ke bare mein hai Is Tarah jaise ki aapko pata hai KSK Kafi sari types Hain jab tak hamare pas gapping ke related knowledge nahi hoga Hum Kabhi Bhi iski types ko understand nahin kar sakte hain isiliye sabse pahle Humne gapping go understand karna chahiye isko study karna chahie Iske bad Hamen iski types already samajh a jaayengi so main aapko Iske bare mein detail se batati hun Agar Ham Chahte Hain ke Forex trading mein successful ho sake to uske liye Hamen bahut mehnat Karni Hogi Taki Hamen Achcha profit Hasil ho sake..

Gapping:

Jab Kisi bhi pair ki price without bagair Kisi activity ke close De aur above below open the tab use situation ko bi hum gapping Kahate Hain Iske important Baat market ke closing hours hai Jo hamari market ka phr pairs ko ashar andaz Karte Hain isiliye is Sare process ko ham gapping Kahate Hain..

Types Of Gapping:

Jaise ki aap ko pata hai k gapping ki Kafi sari types Hain Jo ke har type Mein Kuchh important things kya bataya gaya hai jo ki Hamare liye Kafi important hai Is Tarah main aapko Iske bare mein batati hun ki gapping ki Kitni types bane aur Har type kya important roll play kar rahi hai..

1:Common Gap's.

2: Breakaway Gap's.

3:Runaway Gap's.

4: Exhaustion Gap's.

5:Filled Gap's.

Common And breakaway Gap's:

Market mein common gap's To Ham normal gap consider kar sakte kar sakte hain aur yah gap market mein pervious close day med Mein banta hai iski hardline vajah se ismein opening or closing price different Hote Hain or common gap's Main seling Aur buying pressure Jyada Hota Hai.

Agr break away ki baat ki Jaaye to gap ki price significant area se above ya below move karti hai aur yah gap first time B active or kafi strong Hota Hai Jab trading Rang tight main move karne ke bad chat pattern se out move karti hai aur use gap strong trading ko indicate krti hai..

Runaway And Exchanged Gap's:

Runaway Ek Aisa gap hai yah use time banta hai Jab market strong move kar rahi hoti hai aur current Trend ki decoration main market feature strong show Karte Hain aur yah runway gap large Hota Hai aur is time price trend Inko follow Karte Hain aur rate Trend ke mid Mein banta hai aur yah gap strong buyer pressure up trend mein strong seller pressure down trend mein show Karte Hain isiliye tab ham isase filled ki expect nahin kar sakte.

Exchanged gaps main market Trend ke change hone ki confirmation Deti Hai Is Tarah yah ais lahaz sy best hai isase Ham Trend ke change hone ki confirmation clear Ho Jaati Hai..

Filled Gap's:

To filled gaps Main Jab market ke gaps fill hote hain Agar Ham aapko Ek Chhoti Si example Jaise ke common gap's main gap bary or famous hain or ye goas jyadatar fail ho Jaate Hain aur FIR unko Ham trading Mein use karte hain aur system ko develop karne mein madad Karte Hain..

Ab hum gap kay causes kay baray main baat karain gay. Gaping ki wajah say market kay prices unexpected levels par pohanch jatay hain. Yeh koi bhi wajah ho sakti hai jaisay economic data release, unexpected news, ya phir geopolitical events. Neechay diye gaye causes kay baray main thora detail main baat kiya gaya hai. 1- Economic data release: Jab koi economic data release hota hai to is say market kay prices par asar parta hai. Agar koi data release unexpected hota hai to is say market main gap create ho sakta hai. 2- Unexpected news: Jab koi unexpected news market main aati hai jaisay koi natural disaster, terrorist attack ya phir political crisis to is say market kay prices par asar parta hai. Agar yeh news unexpected ho to is say gap create ho sakta hai. 3- Geopolitical events: Jab koi geopolitical event hota hai jaisay koi war, election ya phir international conflict to is say market kay prices par asar parta hai. Agar yeh event unexpected ho to is say gap create ho sakta hai.

Ab hum gap kay causes kay baray main baat karain gay. Gaping ki wajah say market kay prices unexpected levels par pohanch jatay hain. Yeh koi bhi wajah ho sakti hai jaisay economic data release, unexpected news, ya phir geopolitical events. Neechay diye gaye causes kay baray main thora detail main baat kiya gaya hai. 1- Economic data release: Jab koi economic data release hota hai to is say market kay prices par asar parta hai. Agar koi data release unexpected hota hai to is say market main gap create ho sakta hai. 2- Unexpected news: Jab koi unexpected news market main aati hai jaisay koi natural disaster, terrorist attack ya phir political crisis to is say market kay prices par asar parta hai. Agar yeh news unexpected ho to is say gap create ho sakta hai. 3- Geopolitical events: Jab koi geopolitical event hota hai jaisay koi war, election ya phir international conflict to is say market kay prices par asar parta hai. Agar yeh event unexpected ho to is say gap create ho sakta hai.

تبصرہ

Расширенный режим Обычный режим