Aslam o alaikum,

Dear members, Umeed hai sab theak hain aur achy sy apny tasks complete kar rhy hain. Forex trading main learning, knowledge aur experience ka hona bohat zarori hai. Dear members, forex trading me loss say bachny k liye, aur aik profitable trade krny k liye, candlesticks ka knowledge, aur technical analysis skills ka hona bohat zarori hai. Aj main ap sy jis candlestick pattern k bary main discuss karna chahta hu, wo hai “Inverted Hammer candlestick pattern”. Agar hum risky trade aur loss sy avoid karna chahty hain to is pattern ki understanding bohat zarori hai. Isi tra hum blind trading sy avoid kar k profit earn kar sakty hain aur risk management kr k loss sy bach sakty hain.

Definition “Inverted Hammer candlestick pattern”:

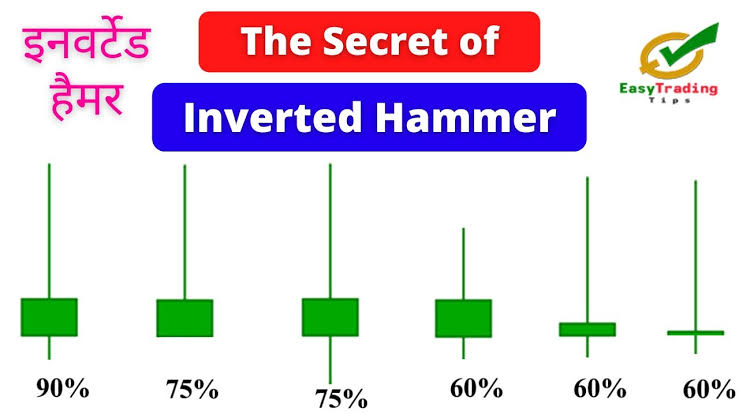

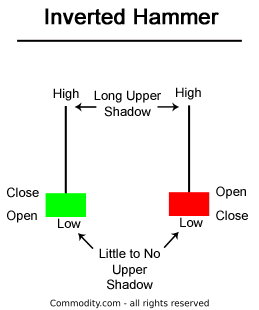

Inverted Hammer candlestick aik bearish trading pattern hai. Jo is bat ki identification karta hai k, aik stock apny bottom tk pohanch gya hai. Aur ab reversal trend k lye ready hai.

Inverted Hammer candlestick charting main, aik price pattern hai, jo us waqt hota hai, jab security us k open hony sy numaya tor p nechy trade karti hai. Lakin opening price k qareeb k period main band hoti hai. Ye pattern aik hammer-shaped candlestick bnata hai. Jis main nichla shadow real body sy double hota hai. Candlestick ki body, open aur closing prices k difference ko represent karta hai. Jab k shadow us period ki high aur low prices ko dikhata hai.

Understanding of Inverted Hammer Candlesticks:

Inverted Hammer tb occur karta hai, jab security ki price decline hoti hai, jo k ye tajwez karti hai k market bottom ko identify karny ki koshish kar rhi hai. Hammer sellers ki traf sy aik nichly hisy ki tashkeel ka ishara deta hai. Aur price main azafa k sath, price ki direction ki potential reversal ko bhi identify karta hai. Ye sab aik he period k doran hota hai, jahan price opening k bad girti hai, lakin phir dubara open hony wali qeemat k qareb close ho jati hai.

Chart ki madad sy “Inverted Hammer candlestick” ka use:

Jasa k chart main dikhaya gya hai k, price main decline hua hai, jis k bad Inverted hammer pattern hai. Ye pattern ka nichla lamba saya tha, jo real body sy multiple times lamba hai. Aur is chart main hammer sy possible price main increase ka signal dia hai. Is ki confirmation agli candle per hui, jis ny higher gap lia aur phir dekha k price, hammer ki closing price sy uper close hui. Is confirmation k doran, traders buying k lye steps laty hain.

Advantages of understanding of Inverted Hammer candlestick pattern:

Dear members, agar ap is candlestick pattern ko understand kar laty hain, to ap is pattern k bad achi opportunity avail kar sakty hain. Aur right time p, right decision ly, achi trade kar sakty hain. Aur loss sy bach k acha profit gain kar sakty hain

Definition “Inverted Hammer candlestick pattern”:

Inverted Hammer candlestick aik bearish trading pattern hai. Jo is bat ki identification karta hai k, aik stock apny bottom tk pohanch gya hai. Aur ab reversal trend k lye ready hai.

Inverted Hammer candlestick charting main, aik price pattern hai, jo us waqt hota hai, jab security us k open hony sy numaya tor p nechy trade karti hai. Lakin opening price k qareeb k period main band hoti hai. Ye pattern aik hammer-shaped candlestick bnata hai. Jis main nichla shadow real body sy double hota hai. Candlestick ki body, open aur closing prices k difference ko represent karta hai. Jab k shadow us period ki high aur low prices ko dikhata hai.

Understanding of Inverted Hammer Candlesticks:

Inverted Hammer tb occur karta hai, jab security ki price decline hoti hai, jo k ye tajwez karti hai k market bottom ko identify karny ki koshish kar rhi hai. Hammer sellers ki traf sy aik nichly hisy ki tashkeel ka ishara deta hai. Aur price main azafa k sath, price ki direction ki potential reversal ko bhi identify karta hai. Ye sab aik he period k doran hota hai, jahan price opening k bad girti hai, lakin phir dubara open hony wali qeemat k qareb close ho jati hai.

Chart ki madad sy “Inverted Hammer candlestick” ka use:

Jasa k chart main dikhaya gya hai k, price main decline hua hai, jis k bad Inverted hammer pattern hai. Ye pattern ka nichla lamba saya tha, jo real body sy multiple times lamba hai. Aur is chart main hammer sy possible price main increase ka signal dia hai. Is ki confirmation agli candle per hui, jis ny higher gap lia aur phir dekha k price, hammer ki closing price sy uper close hui. Is confirmation k doran, traders buying k lye steps laty hain.

Advantages of understanding of Inverted Hammer candlestick pattern:

Dear members, agar ap is candlestick pattern ko understand kar laty hain, to ap is pattern k bad achi opportunity avail kar sakty hain. Aur right time p, right decision ly, achi trade kar sakty hain. Aur loss sy bach k acha profit gain kar sakty hain

تبصرہ

Расширенный режим Обычный режим