Explanation.

Friends humy trading experience ko increase karna chahiye aur market mein indicator ki madad se market men divergence pe bhi trading kar sakte hain jab ham price chart ke analysis karte hain to tab ham market men opportunity find krte hain.Trading main ap apni Strategy main indicator istemal karin bahot zyada help milti hy. Different types k indicator aap ko market main bahut zyada help dety hain jis sy apko trade krny main asani hoti hy.

What is divergence

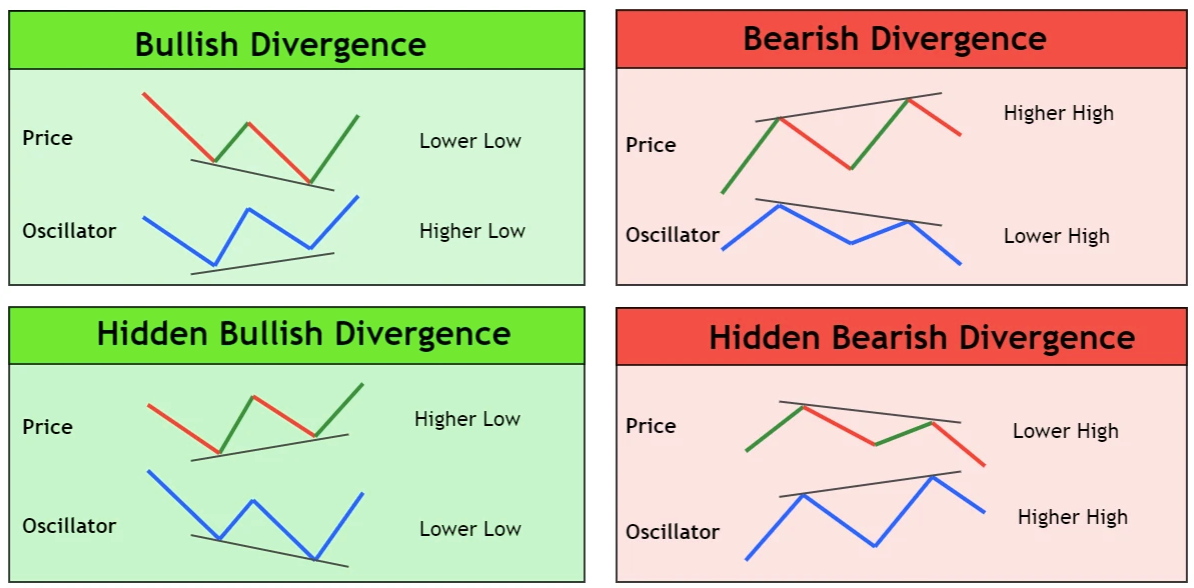

Friends Divergence ki agar defination ki jaaye to kuch yoon ho gi kay hain k jab market kisi bhi trend main move kar rahe hoti hai chahe wo bullish ho ya bearish apka Indicators ya Oscillator apko usk against trend show kar raha hota hy. Jesa k market Uptrend main cover kar rahe hu aur Indicators apko downtrend show kar rahy hoty hain. Inko hidden divergence kehty hain jok Indicators ke madat sy find krty hain. Iski madat sy apko market k trend ka change hony ka idea ho jata hai aur aik achi trades milti hain.

Divergence Types

Bullish divergence.

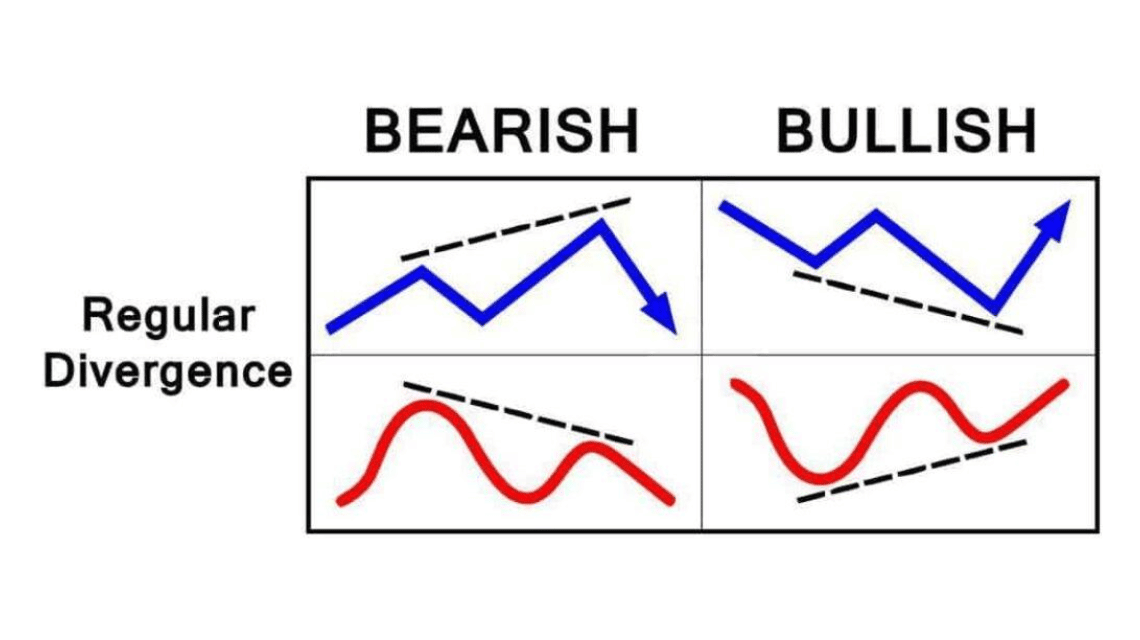

Dear jab ap analysis ko perform kar rahy hoty hain to jab bhe market ka trend down hoga aur market down side move kar rahe hoge to apka Indicators apko bullish trend show kar raha hoga. Ap agr chart par trend line lgain to market ka trend down nazar aye ga aur agr Indicators pa trend line lgain to wo Uptrend show kary ga. Bullish Divergence ko delhny k liay ap apko chart par market Lower Lows bnati dikhai dy ge jab k Indicators ya Oscillator main apko market lower high bnati hue dikhai dy ge. Is chez ko bullish Divergence kaha jata hy. Bullish divergence main apko market k uptrend ka idea ho jata hy jis main candlestick pattern aur chart patterns ko dekh kar trade kar sakty hain.

Bearish Divergence

Friends bearish divergence ko find krny k liay aapko different indicator ka istemal karna hoty hean aur Indicators apko downtrend show karty hain aur market Uptrend mainove kar rahe hoti hai Jaise k agr ap dekhain to market chart par Higher High bana rahe hoti hy aur Indicators main apk pass latest high break nahi hota. Isko bearish hidden divergence kaha jata hy. Bearish trend ko finds kia jata hy aur market main sell ke trade find indicator ke madat sy kia jata hy.ma asa hota ha ka market high trend wale side par movement kar rahe hoti ha to agr ap market ko samajhna chata ha ap Indicators ka istemal kar na ho ga. Divergence ko find krnay ka liya apko different types ka indicator ke madad lane hoga.Indicators ap ko market ka low trend show karay ga magar market high ptrend ke traf move kar rahe ho ge. Or agar dekhe to market apna high trend ma move kar rahe ho ge Indicators main market ap ko high trend break nahi kara ga. Isliye is ko bearish hidden divergence bhi kaha jata ha. Bearish trend ko finds kar ka is pattern ma sell ke trade ko lagaya jata ha jis ka liya huma indicator ke madat chaia hote ha jab bhi market Uptrend main movement kar rhe Hoti hy to agr ap market ka swing karna chahte hain to isk liye aapko Indicators ka istemal karna hota hy.

Friends humy trading experience ko increase karna chahiye aur market mein indicator ki madad se market men divergence pe bhi trading kar sakte hain jab ham price chart ke analysis karte hain to tab ham market men opportunity find krte hain.Trading main ap apni Strategy main indicator istemal karin bahot zyada help milti hy. Different types k indicator aap ko market main bahut zyada help dety hain jis sy apko trade krny main asani hoti hy.

What is divergence

Friends Divergence ki agar defination ki jaaye to kuch yoon ho gi kay hain k jab market kisi bhi trend main move kar rahe hoti hai chahe wo bullish ho ya bearish apka Indicators ya Oscillator apko usk against trend show kar raha hota hy. Jesa k market Uptrend main cover kar rahe hu aur Indicators apko downtrend show kar rahy hoty hain. Inko hidden divergence kehty hain jok Indicators ke madat sy find krty hain. Iski madat sy apko market k trend ka change hony ka idea ho jata hai aur aik achi trades milti hain.

Divergence Types

- Bullish Divergence

- Bearish Divergence

Bullish divergence.

Dear jab ap analysis ko perform kar rahy hoty hain to jab bhe market ka trend down hoga aur market down side move kar rahe hoge to apka Indicators apko bullish trend show kar raha hoga. Ap agr chart par trend line lgain to market ka trend down nazar aye ga aur agr Indicators pa trend line lgain to wo Uptrend show kary ga. Bullish Divergence ko delhny k liay ap apko chart par market Lower Lows bnati dikhai dy ge jab k Indicators ya Oscillator main apko market lower high bnati hue dikhai dy ge. Is chez ko bullish Divergence kaha jata hy. Bullish divergence main apko market k uptrend ka idea ho jata hy jis main candlestick pattern aur chart patterns ko dekh kar trade kar sakty hain.

Bearish Divergence

Friends bearish divergence ko find krny k liay aapko different indicator ka istemal karna hoty hean aur Indicators apko downtrend show karty hain aur market Uptrend mainove kar rahe hoti hai Jaise k agr ap dekhain to market chart par Higher High bana rahe hoti hy aur Indicators main apk pass latest high break nahi hota. Isko bearish hidden divergence kaha jata hy. Bearish trend ko finds kia jata hy aur market main sell ke trade find indicator ke madat sy kia jata hy.ma asa hota ha ka market high trend wale side par movement kar rahe hoti ha to agr ap market ko samajhna chata ha ap Indicators ka istemal kar na ho ga. Divergence ko find krnay ka liya apko different types ka indicator ke madad lane hoga.Indicators ap ko market ka low trend show karay ga magar market high ptrend ke traf move kar rahe ho ge. Or agar dekhe to market apna high trend ma move kar rahe ho ge Indicators main market ap ko high trend break nahi kara ga. Isliye is ko bearish hidden divergence bhi kaha jata ha. Bearish trend ko finds kar ka is pattern ma sell ke trade ko lagaya jata ha jis ka liya huma indicator ke madat chaia hote ha jab bhi market Uptrend main movement kar rhe Hoti hy to agr ap market ka swing karna chahte hain to isk liye aapko Indicators ka istemal karna hota hy.

Types Of Divergence: Positive divergence & Negative Divergence Positive divergence tab hoti hai jab price chart mein lower lows bante hain lekin oscillator chart mein higher lows nazar aate hain. Yeh tab hota hai jab market ki halat aur kimat mein ek namwar giravat hone ki ashanka hoti hai. Positive divergence, traders ko batati hai ke bearish trend kamzor ho raha hai aur upar ki taraf jane ka mauka ban sakta hai. Yeh ek bullish signal hai jo ki traders ko yeh dikhata hai ke samay sahi hai kharidne ke liye ya kisi bearish position se exit karne ke liye. Negative divergence tab hoti hai jab price chart mein higher highs bante hain lekin oscillator chart mein lower highs dikhte hain. Yeh tab hota hai jab market ki halat aur kimat mein ek namwar badhne ki ashanka hoti hai. Negative divergence, traders ko batati hai ke bullish trend kamzor ho raha hai aur niche jane ka mauka ban sakta hai. Yeh ek bearish signal hai jo ki traders ko yeh dikhata hai ke samay sahi hai bechne ke liye ya kisi bullish position se exit karne ke liye. Divergence trading ki ahamiyat kuch mukhtalif wajahon se samajh mein aati hai. Pehle toh yeh traders ko market ke reversals aur trend changes ke bare mein agah kar deti hai. Divergence signals, price action ke andar chipe huye hidden shifts ko ujagar karne mein madad karte hain aur traders ko unko pehle se hi dekhne ka mauka dete hain. Dusra divergence trading risk management mein bhi ahem hai. Jab traders divergence ka istemal karte hain, toh woh stop loss orders aur risk management strategies ko tajweez karte hain taaki woh nuqsan se bach saken. Divergence signals ko samajhne aur uspar amal karne se traders ko market ki gehraiyon aur wajihaat ka behtar andaza hota hai. Teesra divergence trading ki madad se traders apne entry aur exit points ko sahi tareeke se samajh sakte hain. Divergence signals, unko trading ke sahi waqt par dastak dena sikhati hain. Yeh traders ko yeh batati hai ke jab market mein koi trend change hone wala hai, tab unko apne positions ko adjust karna chahiye. Is tarah, divergence trading traders ko better timing aur profitable trades ki kamyaabi pradaan kar sakti hai. Divergence trading, jaise har tarah ka trading, apne risks aur challenges ke saath aata hai. Isliye, traders ko divergence ki sahi samajh, pratibha aur tajarbe ki zaroorat hoti hai. Sahi tareeke se divergence ko samajhne ke liye, traders ko regular market analysis, price aur oscillator indicators ka istemal, aur tajarbat se bharpur hona zaroori hota hai.

Types Of Divergence: Positive divergence & Negative Divergence Positive divergence tab hoti hai jab price chart mein lower lows bante hain lekin oscillator chart mein higher lows nazar aate hain. Yeh tab hota hai jab market ki halat aur kimat mein ek namwar giravat hone ki ashanka hoti hai. Positive divergence, traders ko batati hai ke bearish trend kamzor ho raha hai aur upar ki taraf jane ka mauka ban sakta hai. Yeh ek bullish signal hai jo ki traders ko yeh dikhata hai ke samay sahi hai kharidne ke liye ya kisi bearish position se exit karne ke liye. Negative divergence tab hoti hai jab price chart mein higher highs bante hain lekin oscillator chart mein lower highs dikhte hain. Yeh tab hota hai jab market ki halat aur kimat mein ek namwar badhne ki ashanka hoti hai. Negative divergence, traders ko batati hai ke bullish trend kamzor ho raha hai aur niche jane ka mauka ban sakta hai. Yeh ek bearish signal hai jo ki traders ko yeh dikhata hai ke samay sahi hai bechne ke liye ya kisi bullish position se exit karne ke liye. Divergence trading ki ahamiyat kuch mukhtalif wajahon se samajh mein aati hai. Pehle toh yeh traders ko market ke reversals aur trend changes ke bare mein agah kar deti hai. Divergence signals, price action ke andar chipe huye hidden shifts ko ujagar karne mein madad karte hain aur traders ko unko pehle se hi dekhne ka mauka dete hain. Dusra divergence trading risk management mein bhi ahem hai. Jab traders divergence ka istemal karte hain, toh woh stop loss orders aur risk management strategies ko tajweez karte hain taaki woh nuqsan se bach saken. Divergence signals ko samajhne aur uspar amal karne se traders ko market ki gehraiyon aur wajihaat ka behtar andaza hota hai. Teesra divergence trading ki madad se traders apne entry aur exit points ko sahi tareeke se samajh sakte hain. Divergence signals, unko trading ke sahi waqt par dastak dena sikhati hain. Yeh traders ko yeh batati hai ke jab market mein koi trend change hone wala hai, tab unko apne positions ko adjust karna chahiye. Is tarah, divergence trading traders ko better timing aur profitable trades ki kamyaabi pradaan kar sakti hai. Divergence trading, jaise har tarah ka trading, apne risks aur challenges ke saath aata hai. Isliye, traders ko divergence ki sahi samajh, pratibha aur tajarbe ki zaroorat hoti hai. Sahi tareeke se divergence ko samajhne ke liye, traders ko regular market analysis, price aur oscillator indicators ka istemal, aur tajarbat se bharpur hona zaroori hota hai.

تبصرہ

Расширенный режим Обычный режим