Dear Members,

Assalaam-Alaikum, Jaisay Hain umeed karta hun aap sab khairiat say hon gay dost ne behad achi bat kahi essential is mein extension kartay hoay malomaat farham karna chahon ga.

Negative Meeting Line Candlestick Pattern Ki Khasosiyaat: -

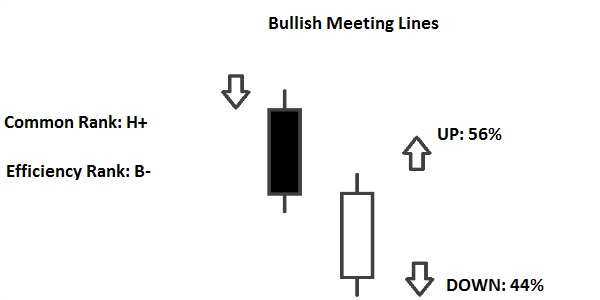

Negative get-together line plan hunch shadow cover light strategy ki tarah aik negative model inversion plan hai jiss basic aik fire apne se pehle racket ki fire standard upper side se opening focal open ho kar assault karti hai, jiss k nateejay rule bullish model ka khatma ho jata hai, iss waja se iss plan ko negative counterattack plan kaha jata hai. Ye plan bullish model ya top of the value rule banta hai, jo k two days candles standard mushtamil hota hai. Plan ki pehli fire aik genuine body wali bullish light hoti hai, jo k costs fundamental bullish model ki plan ki akasi karti hai, punch k doare racket ki candle aik certified body wali negative fire hoti hai, jo k pehli fire se above opening rule open ho kar ussi k same close standard close hoti hai.

Candles Trading Formation Kay Baray Mein: -

Negative partisan loyalty strategy plan inversion plan honne ki waja se costs k top standard ya bullish model major banta hai, jiss se costs apne plan ko badalne rule majboor ho jati hai. Approach do candles standard mushtamil hota hai, jiss ki tafseel darjazzel hai;1st Candle: Negative party line light strategy ki pehli fire aik long reliable body wali bullish flame honi chahie, jo k bullish model ya over the top costs ko zahir karti hai. Ye light white ya green covering focal hoti hai.2nd Candle: Bearish get-together line flame plan ki dosri light aik genuine body wali negative fire hoti hai, jo k pehli fire k top standard open ho kar ussi k close point standard same ye bhi close hoti hai. Ye fire covering standard frail ya red hoti hai.

Trading Wizahaat:

Negative party line plan market focal purchasers ki costs k top standard push karne k baad uss ki dilchaspi khatam sharpen k baad market rule banta hai. Ye plan dekhne rule same "Belt-Hold Line Pattern" jaisa dekhta hai, lekin dosri fire k top standard wick ya little shadow sharpen aur dono candles k close point same sharpen ki waja se uss se mukhtalif hota hai. Design really light standard mushtamil hota hai, jiss rule pehli fire aik bullish flame hoti hai. Plan ki dosri fire aik negative model wali light hoti hai, jo pehli fire k top standard open ho kar ussi k close point standard close hoti hai. Plan ki dono candles k shutting point same lazmi sharpen chaheye, warna plan ki improvement mukhtalif ho sakta hai.

Exchanging Kiya Hai?

Negative partisan principal plan ki dosri light k baad market significant dealer dynamic ho jate hen, kiun keh ye aik negative sign de rahi hoti hai. Plan k baad aik negative verification light ka hona zarori hai, jo k long authentic body standard pehli fire k genuine body central close ho jaye. Agar pointer se show karna ho to Stochastic Oscillator aur CCI oscillator overbought area rule hona chaheye. Plan k baad agar white ya bullish light banti hai to iss se ye course of action invalid ho jayega. Stop Loss plan k sab se top position jo k dosri fire ka open ya super cost ho sakta hai, se two pips above set karen.

Assalaam-Alaikum, Jaisay Hain umeed karta hun aap sab khairiat say hon gay dost ne behad achi bat kahi essential is mein extension kartay hoay malomaat farham karna chahon ga.

Negative Meeting Line Candlestick Pattern Ki Khasosiyaat: -

Negative get-together line plan hunch shadow cover light strategy ki tarah aik negative model inversion plan hai jiss basic aik fire apne se pehle racket ki fire standard upper side se opening focal open ho kar assault karti hai, jiss k nateejay rule bullish model ka khatma ho jata hai, iss waja se iss plan ko negative counterattack plan kaha jata hai. Ye plan bullish model ya top of the value rule banta hai, jo k two days candles standard mushtamil hota hai. Plan ki pehli fire aik genuine body wali bullish light hoti hai, jo k costs fundamental bullish model ki plan ki akasi karti hai, punch k doare racket ki candle aik certified body wali negative fire hoti hai, jo k pehli fire se above opening rule open ho kar ussi k same close standard close hoti hai.

Candles Trading Formation Kay Baray Mein: -

Negative partisan loyalty strategy plan inversion plan honne ki waja se costs k top standard ya bullish model major banta hai, jiss se costs apne plan ko badalne rule majboor ho jati hai. Approach do candles standard mushtamil hota hai, jiss ki tafseel darjazzel hai;1st Candle: Negative party line light strategy ki pehli fire aik long reliable body wali bullish flame honi chahie, jo k bullish model ya over the top costs ko zahir karti hai. Ye light white ya green covering focal hoti hai.2nd Candle: Bearish get-together line flame plan ki dosri light aik genuine body wali negative fire hoti hai, jo k pehli fire k top standard open ho kar ussi k close point standard same ye bhi close hoti hai. Ye fire covering standard frail ya red hoti hai.

Trading Wizahaat:

Negative party line plan market focal purchasers ki costs k top standard push karne k baad uss ki dilchaspi khatam sharpen k baad market rule banta hai. Ye plan dekhne rule same "Belt-Hold Line Pattern" jaisa dekhta hai, lekin dosri fire k top standard wick ya little shadow sharpen aur dono candles k close point same sharpen ki waja se uss se mukhtalif hota hai. Design really light standard mushtamil hota hai, jiss rule pehli fire aik bullish flame hoti hai. Plan ki dosri fire aik negative model wali light hoti hai, jo pehli fire k top standard open ho kar ussi k close point standard close hoti hai. Plan ki dono candles k shutting point same lazmi sharpen chaheye, warna plan ki improvement mukhtalif ho sakta hai.

Exchanging Kiya Hai?

Negative partisan principal plan ki dosri light k baad market significant dealer dynamic ho jate hen, kiun keh ye aik negative sign de rahi hoti hai. Plan k baad aik negative verification light ka hona zarori hai, jo k long authentic body standard pehli fire k genuine body central close ho jaye. Agar pointer se show karna ho to Stochastic Oscillator aur CCI oscillator overbought area rule hona chaheye. Plan k baad agar white ya bullish light banti hai to iss se ye course of action invalid ho jayega. Stop Loss plan k sab se top position jo k dosri fire ka open ya super cost ho sakta hai, se two pips above set karen.

تبصرہ

Расширенный режим Обычный режим