Introduction to Double Bottom pattern

1. Double bottom pattern mein doo kam points shamel hotay hein jo keh aik jaise ofke price kay level kay kareeb bantay hein or mumkana bullish kay reversal janay wallay signal ko indicate

kartay hein price mein aik pemaish shodah strong doo nechalay point mein wakay ho ge jo keh price ke kame par kuch tawan dekha rehe hey

2. Double bottom chart pattern down trend kay end mein paya jata hey or hurf W say melta hey or price aik lower nechay level par gerte hey or phir new nechle evel par wapas anay say

pehlay kadray uper chale jate hey down trend ko jare rakhnay kay ley price ko aik new nechle level par dekailnay say kaisar hey seller har man laytay hein or price os area say opar ochalte hey

bullish ke tasdeeq nechlay level resistance level ka darmean high point par wakay price ke level mein wakfay say hote hey es tarah double top pattern double bottom pattern mein badalta hey

kalede level par resistance level par gap ke tasdeeq honay ke bejay double top doo high points kay darmean kaleede support lose par hota hey double bottom pattern or double top pattern

takatwar technical tool hotay hein jenhen trader bare financial market mein bayshamol forex mein estamal kartay hein

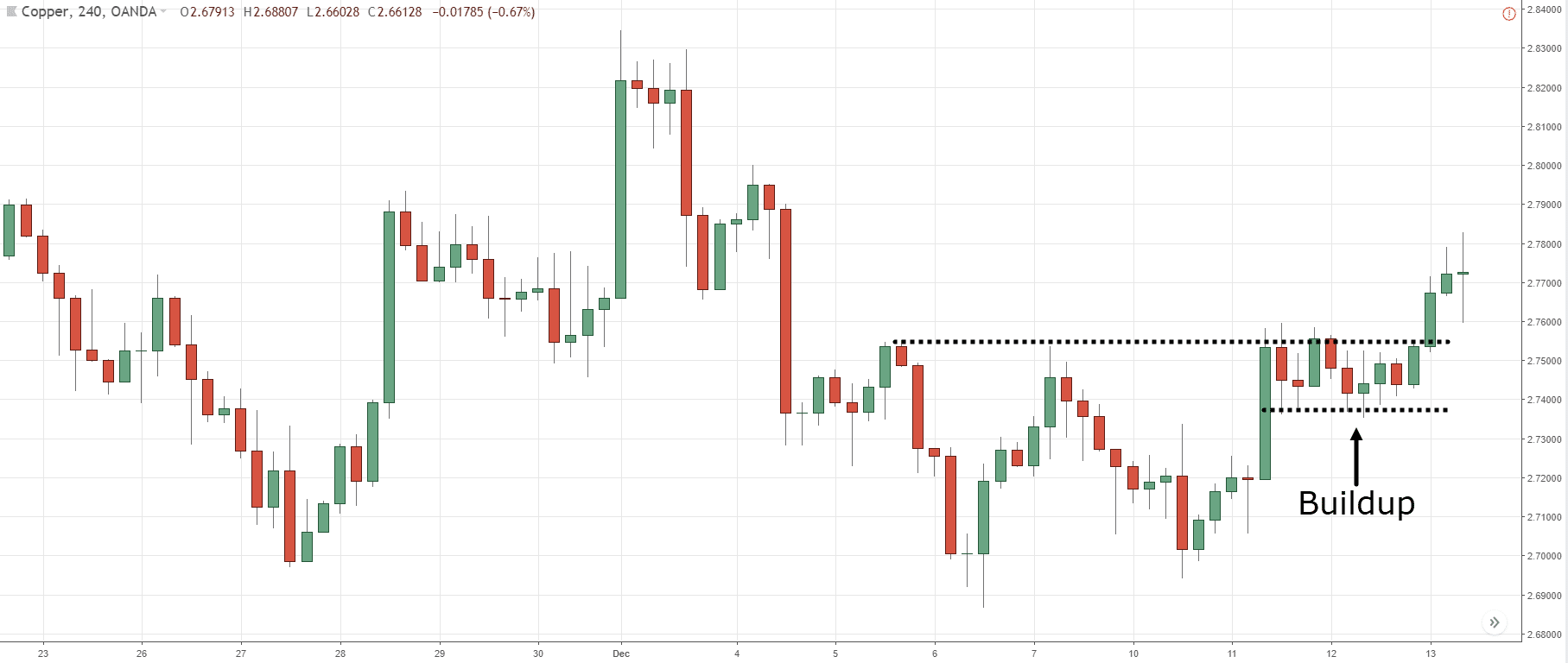

Identification of double bottom pattern

aik jaise chorai or onchai ko doo alag alag highs ke doo alag down level mein identify karna

bottoms kay darmean distance bhut kam nahe hona chihay or yeh wakt kay time frame par depend karta hey

nickline resistance kay price ke tasdeeq karay

double bottom bullish signal ko support karnay kay ley dosray technical indicator ko estamal karen jaisay moving average or oscillator hotay hein

1. Double bottom pattern mein doo kam points shamel hotay hein jo keh aik jaise ofke price kay level kay kareeb bantay hein or mumkana bullish kay reversal janay wallay signal ko indicate

kartay hein price mein aik pemaish shodah strong doo nechalay point mein wakay ho ge jo keh price ke kame par kuch tawan dekha rehe hey

2. Double bottom chart pattern down trend kay end mein paya jata hey or hurf W say melta hey or price aik lower nechay level par gerte hey or phir new nechle evel par wapas anay say

pehlay kadray uper chale jate hey down trend ko jare rakhnay kay ley price ko aik new nechle level par dekailnay say kaisar hey seller har man laytay hein or price os area say opar ochalte hey

bullish ke tasdeeq nechlay level resistance level ka darmean high point par wakay price ke level mein wakfay say hote hey es tarah double top pattern double bottom pattern mein badalta hey

kalede level par resistance level par gap ke tasdeeq honay ke bejay double top doo high points kay darmean kaleede support lose par hota hey double bottom pattern or double top pattern

takatwar technical tool hotay hein jenhen trader bare financial market mein bayshamol forex mein estamal kartay hein

Identification of double bottom pattern

aik jaise chorai or onchai ko doo alag alag highs ke doo alag down level mein identify karna

bottoms kay darmean distance bhut kam nahe hona chihay or yeh wakt kay time frame par depend karta hey

nickline resistance kay price ke tasdeeq karay

double bottom bullish signal ko support karnay kay ley dosray technical indicator ko estamal karen jaisay moving average or oscillator hotay hein

Double bottom pattern ki formation ki process kuch steps par based hoti hai:

Double bottom pattern ki formation ki process kuch steps par based hoti hai: Yeh important points traders ko double bottom pattern ke trading decisions mein madad karte hain. Volume ki increase pattern ki validity ko confirm karta hai, target price traders ko potential profit tak pahunchne mein help karta hai, aur stop-loss traders ke capital ko protect karta hai. Is tarike se traders double bottom pattern ko samajh kar aur in important points ka dhyan rakhte hue, market mein potential trading opportunities ko identify kar sakte hain. Double bottom pattern ka use karke traders price action ka analysis karte hain aur bullish trend reversal ko identify karne ki koshish karte hain. Yeh ek popular price pattern hai aur traders ise Forex aur dusre financial markets mein trading decisions ke liye istemal karte hain.

Yeh important points traders ko double bottom pattern ke trading decisions mein madad karte hain. Volume ki increase pattern ki validity ko confirm karta hai, target price traders ko potential profit tak pahunchne mein help karta hai, aur stop-loss traders ke capital ko protect karta hai. Is tarike se traders double bottom pattern ko samajh kar aur in important points ka dhyan rakhte hue, market mein potential trading opportunities ko identify kar sakte hain. Double bottom pattern ka use karke traders price action ka analysis karte hain aur bullish trend reversal ko identify karne ki koshish karte hain. Yeh ek popular price pattern hai aur traders ise Forex aur dusre financial markets mein trading decisions ke liye istemal karte hain.

تبصرہ

Расширенный режим Обычный режим