Assalam alaikum dear members umeed ha ap sb khairiat se hn gy or apka trading week bhht acha gia ho ga.

aj ki post main hum smart money concept ko study karen gy or dekhen gy ye kia hota ha or forex main esy kaisy istmal kia jata ha.

What is Smart Money?

Dear members aisa capital hota ha jo k institutional banks or financial experts ki trf se trade kia jata ha.smart money us Qowat ko bhi kaha jata ha jo baz oqat market ko lead karti ha or move karati ha.

Smart money retail traders k hujam se kahen ziada ka hota ha.

Smart money traders retail traders se acha perform karty hain or wo es se acha revenue bhi generate karty hain.

Central banks bhi smart money main involve hoty hain es lye retail traders ko bht zada compitition ka samna hota ha q k wo choty se capital se itny bary traders or institutions k sth trade karta ha.

ye institute market ko influence bhi kar skty hain es lye jo traders smart money ko smjhty hain or follow karty hain wo kamyab hoty hain.

Identifying Smart Money:

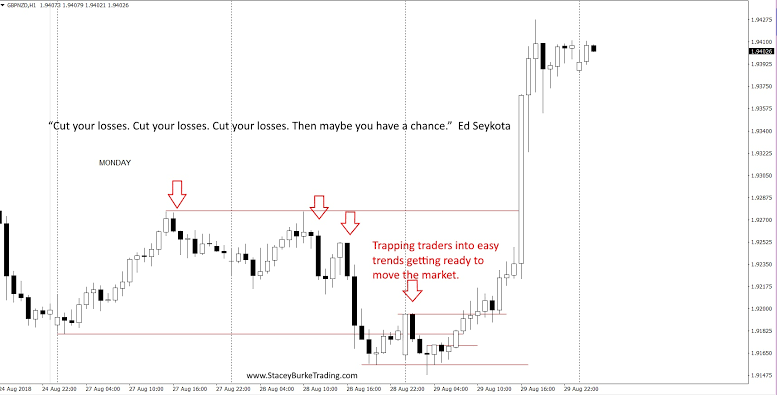

Dear members kabhi kabhar hum dkhty hain k market main koe fundametal data na hony k bawajood bhi market main trading volume kafi ziada ho jata or market main bari bari moves hoti hain to ye smart money ki phchan hoti ha.

es time py institutional traders market main smart money se speculate karty hain.

Smart money ko identify karny k lye sirf chart reading ka sahar lena kafi ni ha bl k hamen kch fundamental indicators se bhi es mamly main kafi madam mil skti ha.

jesa k sentiment indicators jo k hamen btaty hain k ks time py kis position k traders zada hain or side ka trading volume zada ha to es se hamen smart money ko identify karny main madad ml skti ha.

How to trade using Smart money?

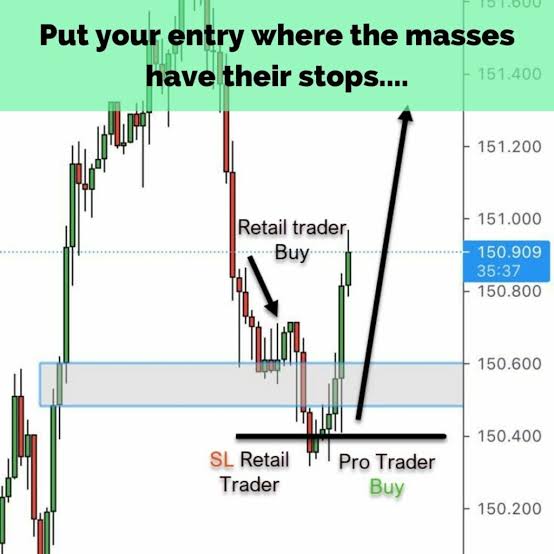

Dear members ham aksr chart main dkhty hain k market apny kisi trend mian jaty hovy for example downtrend main achanak se fly kr k buy main kafi opr chli jati ha or aksr hamen candle wicks dkhny ko milti hain ye spots smart money ki nishani hoty hain.

estrha market aik lambi c candle bna k kafi gap chor jati ha market main jsko fill krny k lye market us area ko test karti ha or hamen es test oy trade leni chahye jahan se market phly reverse ho chuki hoti ha wo support area bn jata ha or wahan se dobara reversal k chanves hoty hain or hum entry le skt hain.

es main hmara stop loss us spike ya reversal candel k nechy ho ga jb k take profit market k previous high kbequal ho ga.

aj ki post main hum smart money concept ko study karen gy or dekhen gy ye kia hota ha or forex main esy kaisy istmal kia jata ha.

What is Smart Money?

Dear members aisa capital hota ha jo k institutional banks or financial experts ki trf se trade kia jata ha.smart money us Qowat ko bhi kaha jata ha jo baz oqat market ko lead karti ha or move karati ha.

Smart money retail traders k hujam se kahen ziada ka hota ha.

Smart money traders retail traders se acha perform karty hain or wo es se acha revenue bhi generate karty hain.

Central banks bhi smart money main involve hoty hain es lye retail traders ko bht zada compitition ka samna hota ha q k wo choty se capital se itny bary traders or institutions k sth trade karta ha.

ye institute market ko influence bhi kar skty hain es lye jo traders smart money ko smjhty hain or follow karty hain wo kamyab hoty hain.

Identifying Smart Money:

Dear members kabhi kabhar hum dkhty hain k market main koe fundametal data na hony k bawajood bhi market main trading volume kafi ziada ho jata or market main bari bari moves hoti hain to ye smart money ki phchan hoti ha.

es time py institutional traders market main smart money se speculate karty hain.

Smart money ko identify karny k lye sirf chart reading ka sahar lena kafi ni ha bl k hamen kch fundamental indicators se bhi es mamly main kafi madam mil skti ha.

jesa k sentiment indicators jo k hamen btaty hain k ks time py kis position k traders zada hain or side ka trading volume zada ha to es se hamen smart money ko identify karny main madad ml skti ha.

How to trade using Smart money?

Dear members ham aksr chart main dkhty hain k market apny kisi trend mian jaty hovy for example downtrend main achanak se fly kr k buy main kafi opr chli jati ha or aksr hamen candle wicks dkhny ko milti hain ye spots smart money ki nishani hoty hain.

estrha market aik lambi c candle bna k kafi gap chor jati ha market main jsko fill krny k lye market us area ko test karti ha or hamen es test oy trade leni chahye jahan se market phly reverse ho chuki hoti ha wo support area bn jata ha or wahan se dobara reversal k chanves hoty hain or hum entry le skt hain.

es main hmara stop loss us spike ya reversal candel k nechy ho ga jb k take profit market k previous high kbequal ho ga.

تبصرہ

Расширенный режим Обычный режим