Introduction

Hello assalamu alaikum, kaise hain forex form ki member, main bilkul theek hun ummid hai aap bhi theek honge,

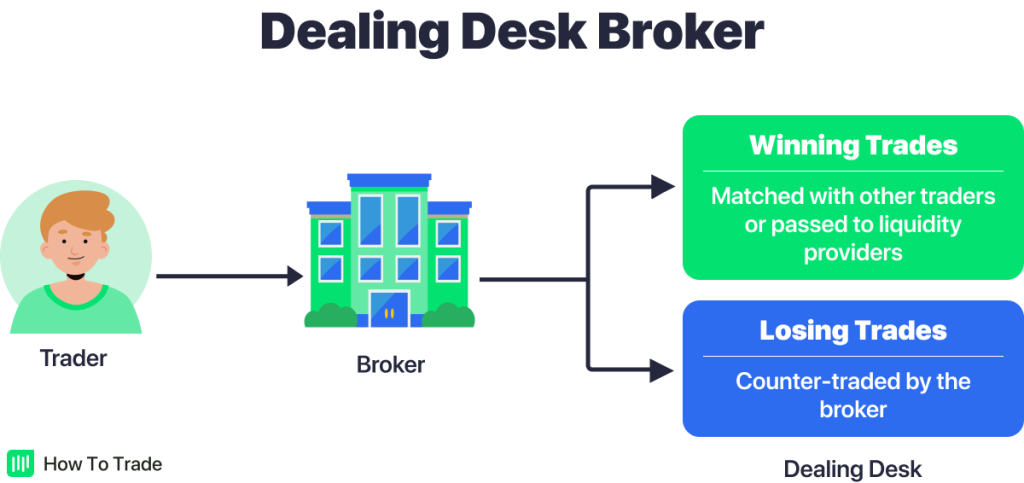

Dealing Desk keya hai, takriban dealing desk ke bare mein Kisi Ko Nahin pata, iske bare mein bahut khubsurat se aapko bataunga,

Aur iske bare mein aapko mukmmal samajh a jayegi.

Definition

Friends,aik working desk woh hai jahan market bananay walay maliyati alaat jaisay ke forex, aykoyti, options, commodities aur deegar maliyati asasay banatay aur tijarat karte hain.

Key Takeaways

A:Dear friends, interaction desk woh jagah hai jahan market bananay walay maliyati alaat jaisay ke forex, aykoyti, options, commodities aur deegar maliyati asasay banatay aur tijarat karte hain.

B:Dear friends,tajir apne gahkon ki janib se mazeed tijarat karne ke liye mojood hain aur woh bator principal ya agent kaam kar satke hain.

C:Dear friends, principal ke tor par kaam karte waqt sales person customer ke kaarobar ka dosra rukh ikhtiyar karta hai.

D:Dear friends ,aik agent ke tor par kaam karte waqt, tajir sanwi market mein dastyab raqam kama kar client ke order ka intizam kere ga aur client ko wohi qeematein masool hon gi jo baichnay walay ne jari ki hain.

Understanding Dealing Desk

Dear friends,ghair mulki currency ki mandiyon mein, tranzikshn desk woh jagah hai jahan bank ya maliyati idaray mein forex traders rehtay hain. forex market din raat khulay rehne ke sath, bohat se idaron ke paas desk mojood hain jo poori duniya mein kaam karte hain. sikyortiz aur deegar maliyati masnoaat ki tijarat ke liye taawun par mabni desk ghair mulki zar e mubadla ki mandiyon, jaisay bankon aur maliyati idaron se bahar mil satke hain. Dealing desk forex tak mehdood nahi hain. woh bohat se maliyati asasay istemaal karte hain jaisay equity, etfs, ikhtiyarat, aur asasay .

Dear friends,lafz" desk" aik ghalat naam ho sakta hai, is ki tareef kuch dukandaron ko tafweez kardah table ke paish e nazar. barray maliyati idaron ke paas aksar aisay wasail hotay hain jo bohat se brokrz aur market bananay walay istemaal karte hain. aik barri tanzeem mein, barri krnsyon, jaisay euro aur yan, mein mutadid trading desk ho satke hain jin mein chand tajir khaas tor par un krnsyon par kaam karte hain .

Hello assalamu alaikum, kaise hain forex form ki member, main bilkul theek hun ummid hai aap bhi theek honge,

Dealing Desk keya hai, takriban dealing desk ke bare mein Kisi Ko Nahin pata, iske bare mein bahut khubsurat se aapko bataunga,

Aur iske bare mein aapko mukmmal samajh a jayegi.

Definition

Friends,aik working desk woh hai jahan market bananay walay maliyati alaat jaisay ke forex, aykoyti, options, commodities aur deegar maliyati asasay banatay aur tijarat karte hain.

Key Takeaways

A:Dear friends, interaction desk woh jagah hai jahan market bananay walay maliyati alaat jaisay ke forex, aykoyti, options, commodities aur deegar maliyati asasay banatay aur tijarat karte hain.

B:Dear friends,tajir apne gahkon ki janib se mazeed tijarat karne ke liye mojood hain aur woh bator principal ya agent kaam kar satke hain.

C:Dear friends, principal ke tor par kaam karte waqt sales person customer ke kaarobar ka dosra rukh ikhtiyar karta hai.

D:Dear friends ,aik agent ke tor par kaam karte waqt, tajir sanwi market mein dastyab raqam kama kar client ke order ka intizam kere ga aur client ko wohi qeematein masool hon gi jo baichnay walay ne jari ki hain.

Understanding Dealing Desk

Dear friends,ghair mulki currency ki mandiyon mein, tranzikshn desk woh jagah hai jahan bank ya maliyati idaray mein forex traders rehtay hain. forex market din raat khulay rehne ke sath, bohat se idaron ke paas desk mojood hain jo poori duniya mein kaam karte hain. sikyortiz aur deegar maliyati masnoaat ki tijarat ke liye taawun par mabni desk ghair mulki zar e mubadla ki mandiyon, jaisay bankon aur maliyati idaron se bahar mil satke hain. Dealing desk forex tak mehdood nahi hain. woh bohat se maliyati asasay istemaal karte hain jaisay equity, etfs, ikhtiyarat, aur asasay .

Dear friends,lafz" desk" aik ghalat naam ho sakta hai, is ki tareef kuch dukandaron ko tafweez kardah table ke paish e nazar. barray maliyati idaron ke paas aksar aisay wasail hotay hain jo bohat se brokrz aur market bananay walay istemaal karte hain. aik barri tanzeem mein, barri krnsyon, jaisay euro aur yan, mein mutadid trading desk ho satke hain jin mein chand tajir khaas tor par un krnsyon par kaam karte hain .

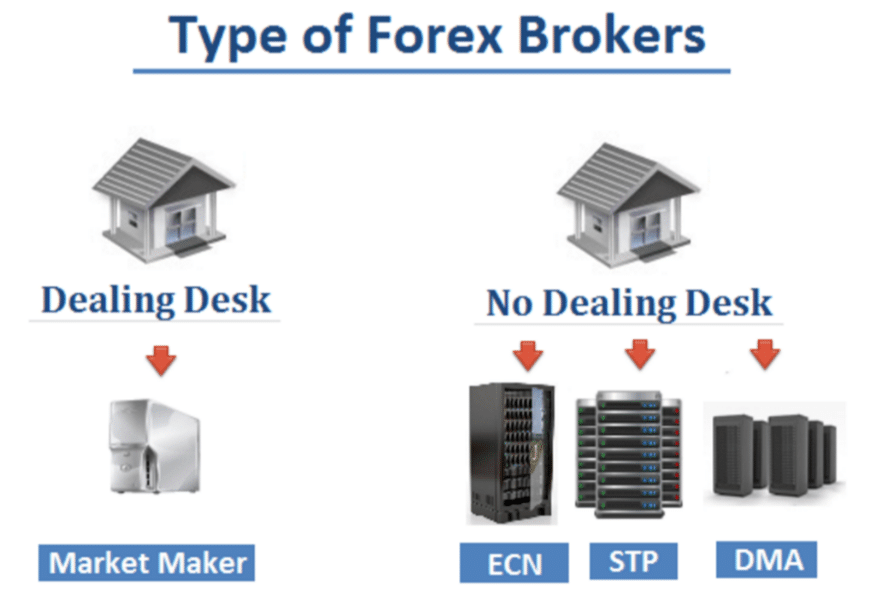

Ek aur trade execution method hai straight-through processing (STP). Is method mein, DD traders ke orders ko straight-through process karta hai, yani bina interference ke. DD traders ke orders ko market mein directly transmit karta hai aur unko market mein execute karne ke liye ECN (Electronic Communication Network) ya dusre liquidity providers ke pass forward karta hai. STP method mein, DD ka role sirf trade execution hai aur woh market maker ki tarah act nahi karta. Dealing Desk ki presence aur functioning traders ke liye kuch advantages aur challenges bhi lay kar aati hai. DD ke presence se traders ko instant execution aur liquidity milta hai. DD market mein available liquidity provide karta hai, jis se traders apni trades execute kar sakte hain. DD brokers ki through traders ko spreads aur transaction costs control karne ki flexibility milti hai. Lekin DD ke sath kuch challenges bhi hote hain. Kuch traders ko lagta hai ke DD conflict of interest create karta hai. Kyun ke DD apne khud ke bid aur ask prices set karta hai, toh woh spreads ko widen kar sakta hai aur traders ke favor mein execute hone wali trades ko reject kar sakta hai. Is tarah, kuch traders ko lagta hai ke DD unki trading strategies ko manipulate kar sakta hai. Iske Ilawa DD ke through traders ke orders ke execution speed pe bhi asar hota hai. DD ke internal processes aur procedures ki wajah se traders ke orders ko execute hone mein thora waqt lag sakta hai. Market volatility ke dauran yeh delay aur zyada noticeable hojata hai. Isliye, kuch traders prefer karte hain ke unka broker STP method ka istemal kare jahan orders ko straight-through process kiya jata hai.

Ek aur trade execution method hai straight-through processing (STP). Is method mein, DD traders ke orders ko straight-through process karta hai, yani bina interference ke. DD traders ke orders ko market mein directly transmit karta hai aur unko market mein execute karne ke liye ECN (Electronic Communication Network) ya dusre liquidity providers ke pass forward karta hai. STP method mein, DD ka role sirf trade execution hai aur woh market maker ki tarah act nahi karta. Dealing Desk ki presence aur functioning traders ke liye kuch advantages aur challenges bhi lay kar aati hai. DD ke presence se traders ko instant execution aur liquidity milta hai. DD market mein available liquidity provide karta hai, jis se traders apni trades execute kar sakte hain. DD brokers ki through traders ko spreads aur transaction costs control karne ki flexibility milti hai. Lekin DD ke sath kuch challenges bhi hote hain. Kuch traders ko lagta hai ke DD conflict of interest create karta hai. Kyun ke DD apne khud ke bid aur ask prices set karta hai, toh woh spreads ko widen kar sakta hai aur traders ke favor mein execute hone wali trades ko reject kar sakta hai. Is tarah, kuch traders ko lagta hai ke DD unki trading strategies ko manipulate kar sakta hai. Iske Ilawa DD ke through traders ke orders ke execution speed pe bhi asar hota hai. DD ke internal processes aur procedures ki wajah se traders ke orders ko execute hone mein thora waqt lag sakta hai. Market volatility ke dauran yeh delay aur zyada noticeable hojata hai. Isliye, kuch traders prefer karte hain ke unka broker STP method ka istemal kare jahan orders ko straight-through process kiya jata hai.

تبصرہ

Расширенный режим Обычный режим