Aslam o alaikum,

Dear forex trading market main successful trading krny kay liye seller's pressure aur buyer's pressure ki completely understanding krna most important ho sakhta hai. Iski kuch details aap sa share krna chahta hun.

Selling and Buying Pressure

Dear member Jab aap market mein candlestick ko individually focus krty Hain, tu ismein aapko market mein seller's or buyer's pressure ko find out kr sakhty Hain. Agar Ap Market mein hamesha seller's Pressure or buyer's pressure ko find krny Kay liye kisi bhi aik specific time frame main kisi candlestick Ko find out kr Kay idea lga sakhty Hain, Kay us specific time period main ks ka zyda pressure tha.

Identifying Pressure

Dear member Basically forex trading market main buyer's or seller's ki apis main fight chal rahi hoti hai. Jab aik candlestick close hoti hai, dear tu ap us particular sessions main easily Buyer's or seller's Pressure ko find out kr sakhty Hain.

Definition of Seller's Pressure

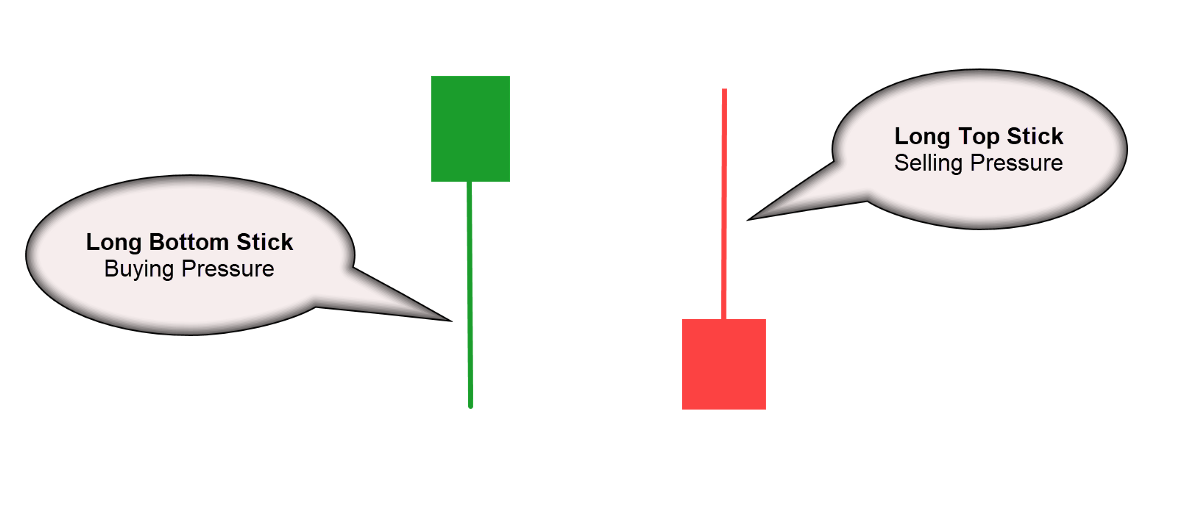

Sellers pressure ki explanation bahut important hoti hai. Jab market mein eik candlestick without wick downtrend main close hoti hai, tu aap isko idea lga Lena cheye ka currently situation main strong seller's Pressure hai. Jab market mein aik candlestick kafi lambi upper Shadow Kay sath closing krti hai, us time per bhi aapko selling pressure milta hai.

Definition of Buyer's Pressure

Dear forex members Jab market mein aik particular sessions main uptrend main candlestick ki closing hoti hai or uski wick bhi na hony Kay baraber hoti hai, tu us time main strong buyer's pressure hota hai. Forex member Agr kei candlestick down shadow / wick main apni closing krti hai, tu ya bhi buyers pressure ko indicate kr rahi hoti hai.

Identifying Pressure

Dear forex traders members Some time market mein seller's or buyer's ka equal pressure bhi ho sakta hai. Jab aik eisi closing hoti hai, jis main candlesticks ki body center main hoti hai or uski wick 2no side per hoti hai, tu us time per seller's or buyer's equal pressure hota hai.

Further Explaination

Above-mentioned details kay bad Seller's Pressure or buyer's pressure ko futher explain krny Kay liye following images apk concept ko mazeed clear krin gay.

Main apni post kay 2nd part main risk and regard ratio ko discuss krny ja raha hun, kunk is per ghoor krna bahi zaroori hota hai.

Definition of Risk and Reward Ratio

Forex trading market mein Jab bhi aap Koi trade open karte hain aur agar aap ismein trade open karne se pahle ek specific limit specified nahin karte hain. Aur apne mind mein yah decide nahin karte Hain ki aap is trade main profit kitna aur kitna nuksan karna chahte hain, aur kitna profit hasil karna chahte hain to iska matlab yah hota hai ki aap risk and reward ratio ke mutabik apni trading nahin kar rahe hain. Basically risk and reward ratio ka matlab yah hota hai ki market mein inter hone se pahle aap aap market mein apne profit Aur nuksan Ko properly calculate Karen aur iski basis per apni decision-making Karen.

Understanding of Risk Reward Ratio

Dear members jab risk and reward ratio ko samjna chaty hain, For example Jab aap market mein inter hona chahte hain aur ismein aap yah decide karte Hain ki Jab aap market mein ek trade open karna hai ja rahe hain, to ismein aap hundred US Dollars profit hasil karna chahte hain aur iske against aap $100 hi nuksan karna chahte hain. Aur Agar aapka account 1000 US dollars ka hai to ismein aapko $100 nuksan aur 100 US Dollars profit ho sakta hai is main apki risk reward ratio 1 : 1 ho ge. Lekin Jab aap ek trade open karte hain aur ismein aap profit 100 US Dollars rakhte hain aur ismein aap apne nuksan ki ratio 50 US dollars rakhte Hain to aisi condition mein aapki risk and reward ratio different hogi aur aisi condition mein of risk and reward ratio co aise mention kar sakte hain 1 : 2.

Value of Risk Reward Ratio

Dear members Forex trading market me jo members risk and reward ratio ki basis per trading nahin kar rahe hote Hain vah kabhi bhi successful trading nahin kar sakte hain. Jab aap market mein risk and reward ratio ki basis per apni decision-making karte Hain, to aap definitely bahut jyada successful trading kar sakte hain aur aapko is platform per hamesha maximum advantages mil sakte hain aur bahut sary faiday hasil kar sakhty hain.

Selling and Buying Pressure

Dear member Jab aap market mein candlestick ko individually focus krty Hain, tu ismein aapko market mein seller's or buyer's pressure ko find out kr sakhty Hain. Agar Ap Market mein hamesha seller's Pressure or buyer's pressure ko find krny Kay liye kisi bhi aik specific time frame main kisi candlestick Ko find out kr Kay idea lga sakhty Hain, Kay us specific time period main ks ka zyda pressure tha.

Identifying Pressure

Dear member Basically forex trading market main buyer's or seller's ki apis main fight chal rahi hoti hai. Jab aik candlestick close hoti hai, dear tu ap us particular sessions main easily Buyer's or seller's Pressure ko find out kr sakhty Hain.

Definition of Seller's Pressure

Sellers pressure ki explanation bahut important hoti hai. Jab market mein eik candlestick without wick downtrend main close hoti hai, tu aap isko idea lga Lena cheye ka currently situation main strong seller's Pressure hai. Jab market mein aik candlestick kafi lambi upper Shadow Kay sath closing krti hai, us time per bhi aapko selling pressure milta hai.

Definition of Buyer's Pressure

Dear forex members Jab market mein aik particular sessions main uptrend main candlestick ki closing hoti hai or uski wick bhi na hony Kay baraber hoti hai, tu us time main strong buyer's pressure hota hai. Forex member Agr kei candlestick down shadow / wick main apni closing krti hai, tu ya bhi buyers pressure ko indicate kr rahi hoti hai.

Identifying Pressure

Dear forex traders members Some time market mein seller's or buyer's ka equal pressure bhi ho sakta hai. Jab aik eisi closing hoti hai, jis main candlesticks ki body center main hoti hai or uski wick 2no side per hoti hai, tu us time per seller's or buyer's equal pressure hota hai.

Further Explaination

Above-mentioned details kay bad Seller's Pressure or buyer's pressure ko futher explain krny Kay liye following images apk concept ko mazeed clear krin gay.

Main apni post kay 2nd part main risk and regard ratio ko discuss krny ja raha hun, kunk is per ghoor krna bahi zaroori hota hai.

Definition of Risk and Reward Ratio

Forex trading market mein Jab bhi aap Koi trade open karte hain aur agar aap ismein trade open karne se pahle ek specific limit specified nahin karte hain. Aur apne mind mein yah decide nahin karte Hain ki aap is trade main profit kitna aur kitna nuksan karna chahte hain, aur kitna profit hasil karna chahte hain to iska matlab yah hota hai ki aap risk and reward ratio ke mutabik apni trading nahin kar rahe hain. Basically risk and reward ratio ka matlab yah hota hai ki market mein inter hone se pahle aap aap market mein apne profit Aur nuksan Ko properly calculate Karen aur iski basis per apni decision-making Karen.

Understanding of Risk Reward Ratio

Dear members jab risk and reward ratio ko samjna chaty hain, For example Jab aap market mein inter hona chahte hain aur ismein aap yah decide karte Hain ki Jab aap market mein ek trade open karna hai ja rahe hain, to ismein aap hundred US Dollars profit hasil karna chahte hain aur iske against aap $100 hi nuksan karna chahte hain. Aur Agar aapka account 1000 US dollars ka hai to ismein aapko $100 nuksan aur 100 US Dollars profit ho sakta hai is main apki risk reward ratio 1 : 1 ho ge. Lekin Jab aap ek trade open karte hain aur ismein aap profit 100 US Dollars rakhte hain aur ismein aap apne nuksan ki ratio 50 US dollars rakhte Hain to aisi condition mein aapki risk and reward ratio different hogi aur aisi condition mein of risk and reward ratio co aise mention kar sakte hain 1 : 2.

Value of Risk Reward Ratio

Dear members Forex trading market me jo members risk and reward ratio ki basis per trading nahin kar rahe hote Hain vah kabhi bhi successful trading nahin kar sakte hain. Jab aap market mein risk and reward ratio ki basis per apni decision-making karte Hain, to aap definitely bahut jyada successful trading kar sakte hain aur aapko is platform per hamesha maximum advantages mil sakte hain aur bahut sary faiday hasil kar sakhty hain.