Introduction with Formation of Envelope channel.

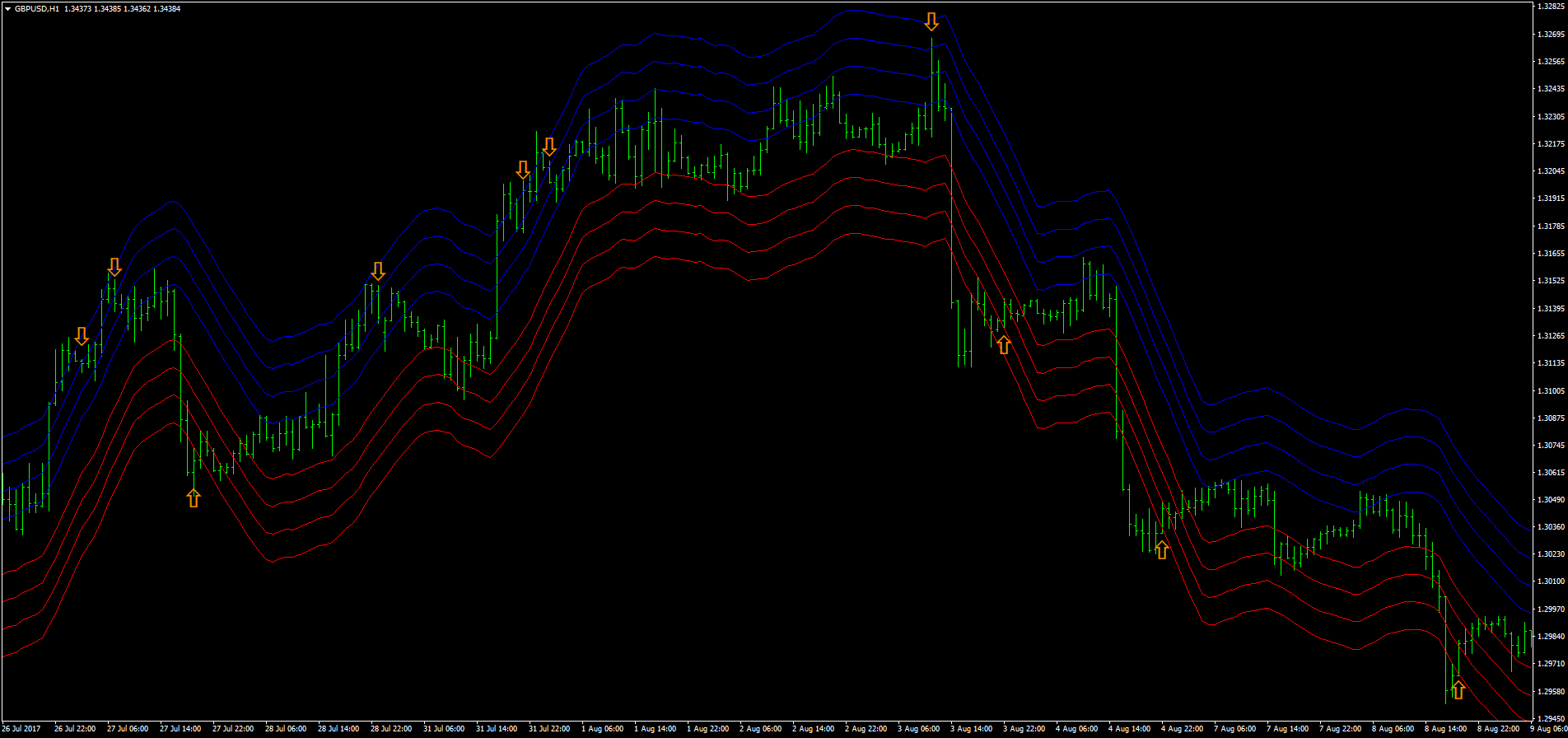

My dear friends ye technical indicators hotay hain jo price chart bars k around upper and lower bands par plotted hotay hain in envelope channels kehtay hain, ye simple moving average sa generate hotay hain aur moving average k above aur below aik predetermined distance sa show hotay hain, envelopes traders aur investors ko extreme overbought aur oversold conditions k sath sath trading ranges ko identify karnay ma help provide kartay hain, is ma jb prices upper band ko cross karti hain ya us k kareeb hoti hain to sell signals generate hotay hain aur jb prices lower band ko cross karti hain ya us k kareeb hoti hain to buy signals generate hotay hain.

Trading With envelope channels.

Dear friends Envelope channels kay bands say ager trader achi tarah understanding lainy kay bad timely trading main order place kary aur over bought and oversold conditions main running trading order ko close kar kay exit ho jaye to usko achi earning ho sakti hay. Lehaza trader ko chahiye keh agar woh envelop channels kay use per trading kar raha hay to trend kay mutabiq kisi aik direction main trading kary aur is tarah isko proper entry and exit point mil jate hain.

Types Of Channels In Trading.

Dear friends trading main Envelope channels kay four channels hai in ko use kar ka hum log fyda hasil kar sakte hain ya basically indicators hota hain jo huma trading mai madad data hain ya indicators huma batata hai ka hum log kis point sy trade ko open kare or kis taraf trade lagain tu huma fyda hasil ho is lia huma in indicators ko lazmi use karna chahiye ta ka hum acchi trade kar sakain trading channels jo mt4 mai use hota hai wo different hota hai in trading channels sy huma maloom hai ka trend serf three types ka hain ascending descending or horizontal channels hota hain or jub ka agr hum bat karain mt4 mai trading channels ka bara mai tu ya indicators hota hain is lia huma channels ka bara mai lazmi sekhna chahiye ta ka hum log is sy kamyabi hasil kar sakain or accha traders ban sakain.

My dear friends ye technical indicators hotay hain jo price chart bars k around upper and lower bands par plotted hotay hain in envelope channels kehtay hain, ye simple moving average sa generate hotay hain aur moving average k above aur below aik predetermined distance sa show hotay hain, envelopes traders aur investors ko extreme overbought aur oversold conditions k sath sath trading ranges ko identify karnay ma help provide kartay hain, is ma jb prices upper band ko cross karti hain ya us k kareeb hoti hain to sell signals generate hotay hain aur jb prices lower band ko cross karti hain ya us k kareeb hoti hain to buy signals generate hotay hain.

Trading With envelope channels.

Dear friends Envelope channels kay bands say ager trader achi tarah understanding lainy kay bad timely trading main order place kary aur over bought and oversold conditions main running trading order ko close kar kay exit ho jaye to usko achi earning ho sakti hay. Lehaza trader ko chahiye keh agar woh envelop channels kay use per trading kar raha hay to trend kay mutabiq kisi aik direction main trading kary aur is tarah isko proper entry and exit point mil jate hain.

Types Of Channels In Trading.

Dear friends trading main Envelope channels kay four channels hai in ko use kar ka hum log fyda hasil kar sakte hain ya basically indicators hota hain jo huma trading mai madad data hain ya indicators huma batata hai ka hum log kis point sy trade ko open kare or kis taraf trade lagain tu huma fyda hasil ho is lia huma in indicators ko lazmi use karna chahiye ta ka hum acchi trade kar sakain trading channels jo mt4 mai use hota hai wo different hota hai in trading channels sy huma maloom hai ka trend serf three types ka hain ascending descending or horizontal channels hota hain or jub ka agr hum bat karain mt4 mai trading channels ka bara mai tu ya indicators hota hain is lia huma channels ka bara mai lazmi sekhna chahiye ta ka hum log is sy kamyabi hasil kar sakain or accha traders ban sakain.

تبصرہ

Расширенный режим Обычный режим